This paper is an overview of the Emirates Integrated Telecommunications Company (EITC) (DU). The study presents various aspects of the business like the nature, headquarters and management of the organisation. It provides a brief outline of the size of the company and its financial position. The research discusses the performance of the business in the Dubai Financial Market drawing comparisons with its major competitors like the Emirates Telecommunications Corporation and Hit Telecom. The report concludes with an advisory opinion of the future projections of the group, and whether the company’s shares are worth buying.

Du Company

The company’s profile

Overview

Du is the other name of the Emirates Integrated Telecommunications Company (EITC). The organisation deals with telecommunications in Dubai. The business uses the abbreviation “Du” as its commercial brand name. However, its legal name remains the Emirates Integrated Telecommunications Company. The business integrated the Du business concept in February 2006. At the end of March 2011, the Du Company had a profile of about 4.6 million subscribers. In the month of February 2007, the EITC launched mobile telecommunications’ products across the United Arab Emirates region. Results of the year 2008 gave indications that the company had an extra 1.89 million customers within a period of over 11 months. During the same time, the company’s revenue had improved by about 156% from the previous year. The company is the new telecommunications products’ provider for the United Arab Emirates area. It is a semi-government company that operates across the UAE.

The company’s headquarters

The Al Salam Tecom Tower in Dubai houses the headquarters of the Du Company. The company operates from Building 14, Dubai Media City. The organisation started its infrastructure, retail operations and services in the building. The tower accommodates up to 2,000 of Du’s corporate team. The building has 2 floors for training facilities and 1 floor that comprises of a meeting room for the staff and other stakeholders. In addition, it has 1 floor for a cafeteria that caters for food and drinks of Du’s staff. It also has 1 executive and a ground floor for business and retail services.

The company’s chief executive officer

Omar Sultan is Du Company’s Chief Executive Officer. He served as the head of Mobinil Telecommunications SAE. Mr. Sultan served in the role of president and CEO of the Egyptian company of mobile services from 21st of April 1998 until his appointment at DU in 2006. He worked at a senior management position in the France Telecom Group. He served in customer service, marketing and various sales’ capacities in France. Sultan was a participant in the acquisition of a commercial enterprise based in America. He started working with the France Telecom Mobiles International as the deputy head of business programmes in the Middle East and Arab areas. He worked as the CEO of Maltacom PLC and also the Arab Working Group for the private department in the International Telecommunications Association. His rich experiences showed that he had worked as the head of Go Mobile. He holds a degree in engineering. He has given several lectures or talks on electronic information services and telecommunications. He also has exquisite knowledge on mobile telecommunications and internet in the Middle East, the United States, Japan, Europe and Africa.

The company’s chairman and board

The Chairman of Du Company is Mr. Ahmad Bin Byat. Byat is also the executive chairman of Tecom Investments FZ-LLC and Dubai Real Estate Corporation, as well as a member of the board of trustees for both Zayed University and the Dubai School of Government.

His Excellency Younis Al Khoori is the vice chairman of the company. He is the deputy head at Dubai’s Department of Finance and Industry and is on the Committee of Management of the Central Bank of Dubai and Al Hilal Bank PJSC. He is also the vice chairman of the Emirates General Petroleum Corporation.

The Du Company’s board has the overall responsibility of ensuring the application, review and efficiency of the group’s internal control systems. The board delegates certain of those responsibilities to the Audit and Compliance Committee of EITC. The system of internal controls manages risks associated with the conduct of the company’s business. The system also eliminates the risk of failure to achieve the company’s business objectives. It provides reasonable and not absolute assurance against material misstatement or loss. The business, through its training and management standards and procedures, aims at developing a disciplined and constructive control environment in which all employees understand their roles and obligations (Market Watch,2013).

Du Company’s governance model

The sustainability of the governance model at Du Company arises from the complementary interplays between shareholders, supervisors or Board and Standing Committee and management as demonstrated in the chart below:

Foundation of Du Company

The Du Company started business in 2006. The company launched mobile telecommunication services in February 2007 in the United Arab Emirates. It is 41% owned by the UAE Federal Government. Mubadala Development Company owns 21% of the total shares of the organisation while TECOM investments also own 20% of its total worth. The public owns another 20% of the company’s assets. The company has been working to improve and expand its diverse products in the telecommunications industry. The sector remains at the heart of the UAE’s social and economic transformation. The company connects homes and commercial enterprises across the United Arab Emirates. The group serves areas like Abu Dhabi, Ajman, Dubai, Fujairah, Ras al-Khaimah, Sharjah, and Umm al-Quwai.

Stock market or the company’s ticker symbol

The Emirates Integrated Telecommunications Company operates in the Dubai Financial Stock Market. The company’s ticker symbol is DFM: Du

The company’s primary business line

The Emirates Integrated Telecommunications Company primary businesses include telecommunications and related accessories. Its motto is “to enhance your life, anytime and anywhere”. The company works under the mission of delighting clients and providing employment opportunities to the best talents. The organisation seeks to create an optimal value for its shareholders. It can achieve this aspect through excellence in business, innovation and contribution to the positive change in the society. The group works to deliver its vision through its pool of talented human resource personnel, skills and synergies to the system. The core values of the Emirates Integrated Telecommunications Company include confidence, friendliness, honesty, and surprise. The company’s values guide its actions in the market.

Size of the company

The Du Company features among Dubai’s biggest telecommunications organizations. It is a cohesive service organisation that provides video, content, data and voice services to mobile and fixed networks in commercial and residential premises. The business has three target sections. These components include the consumer, business and carrier sections. The consumers’ section focuses on households and individuals by offering fixed and mobile voice calling, television, data and internet services. The business segment of the company aims at providing integrated fixed and mobile commercial solutions like content, software applications, voice, data and professional services to international data networks and wholesale operators (Du, 2013).

A preview of the Emirates Integrated Telecommunications Company (DU) indicates that the company has total assets that accumulate to about AED 200,798,362b. This figure includes current and non-current assets. The Du Company recorded revenues of AED 10.15 billion in the year 2012. This figure was a 14.70% increase from the year 2011. The company received about 1, 242, 250 net new mobile subscribers. This number is equivalent to the total market share of about 48.8%. In addition, it is similar to the value share of 33.5% as indicated in the company’s 2012 consolidated financial reports. The 2012 financial figures show that the mobile data revenue rose by 75% over the revenues of 2011. This rise took the total data financial gains to AED 1.75 billion in the year 2012. This aspect was an increase in business gains of about AED 1.02 billion. The business grew by AED 3.98 billion in terms of EBITDA growth. About 35.1% represented an EBITDA margin of 39.38% for the year 2012. The Emirates Integrated Telecommunications Company (DU) had about 5,004 employees. The company doubled the number of Emirati employees in the year 2012 as part of the “emiratisation” efforts. The UAE National Call Centre has about 122 workers (Gulf Base, 2013).

The Du brand

The Du Company directs heavy investments into its brand development to attract high popularity with people. The development of the Du brand helps to build a high affinity for significant stakeholder clusters. Du has undertaken an innovative identity system to make its communications simple. The brand endeavours to achieve easy identification, coherent and consistent imagery across the operating area.

The Emirates Integrated Telecommunications Company has enforced other brand aesthetics in other settings within the UAE. The company markets itself in career fairs, sponsored events, and trade shows. This provides a unique opportunity to sell itself to different clients. These industrial strategies have yielded significant financial gains according to independent assessments. The brand health scores of Du are the highest in UAE according to the Millward Brown Research Company. The economic value of the Du brand is one of the best in the Middle East. Many people in the UAE respect the brand. The brand’s expansive and rapid growth is a result of adoption of innovative strategies, services and special promotions to clients. Du offers services that include a wide range of client choices. It provides services that fit the needs of its clients and to the exact context of different customer groups.

Du’s commercial strategy

Emirates Integrated Telecommunications Company PJSC (Du) currently runs four major industrial segments. These units include mobile, fixed, wholesale and broadcasting segments. The mobile segment provides the area with mobile content, broadband WIFI, voice and data. The fixed department offers landline services to commercial and consumer clients across the UAE. The other services of the fixed segment include telephony, IP or VPN, broadband and IPTV. The wholesale part provides voice and data services to national and international carriers and operators. Services within this segment include international roaming agreements, cancellation of inbound international voice traffic, and point-to-point leased line networks. The broadcasting section of the business provides integrated broadcasting, satellite and media companies. The organisation’s main competitor, Etisalat brand, also has a similar organization. This fact makes it easy for clients to switch between the operators. The two telecommunications’ players got the approval of the UAE Telecommunications Regulatory Authority (TRA) to set market prices without getting approval from the state in the year 2010. This point led to price wars between the companies. The organisations tend to compete on the level of the quality of services they offer. They provide special promotions and offers to attract their clients.

Competition and industrial overview

Two integrated telecommunication operators currently serve the United Arab Emirates region. These businesses comprise Emirates Integrated Telecommunications Company PJSC (Du) and the Emirates Telecommunications Corporation (Etisalat). The Etisalat brand is the United Arab Emirates first big telecommunication operator. The organisation began operations in the year 1976. It enjoyed the monopoly in the region until the government granted the Emirates Integrated Telecommunications Company PJSC (Du) a licence at the end of the year 2005. The region has commitments to liberalise the telecommunications further because of the United Arab Emirates’ association with the World Trade Organization. The UAE has plans of extending commitments to liberalise the sector from 2010 to 2015.

The UAE reported in the year 2002 that it had plans to allow the operation of new telecommunications’ players in the sector, because the region had plans to improve public telecommunications’ services through the introduction of fair competition in the market. The United Arab Emirates is the region with the highest mobile, fixed-line and internet penetration levels among Arab states. This aspect is related to the large numbers of commercial investors, tourists and temporary residents that operate in the region, which multiplies the usage of SIM cards in the region. The Du Company is also the property of the Emirates Federal Government. This point implies that it may have significant political influence that may limit the number of competitors in the market. The UAE market business operates under royalty unlike other states that use taxes. The government determines royalties on an annual basis. This factor might explain the limited competition in the telecommunications sector in the UAE.

Du’s competitors

The biggest competitors of the Du Company are Etisalat and Hit Telecom. Hit Telecom is one of the telecommunication companies in the United Arab Emirates. It pursues and creates high development communication prospects through the identification of market needs and demands. The organisation applies sound investment approaches, operational success and experienced management to oversee its operations. The company is one of the main competitors of Emirates Integrated Telecommunications Company. On the other hand, Etisalat is the brand name for the Emirates Telecommunications Corporation. The company operates in about 18 nations across Africa, Middle East and Africa.

EPS, PE of Du Company and competitors

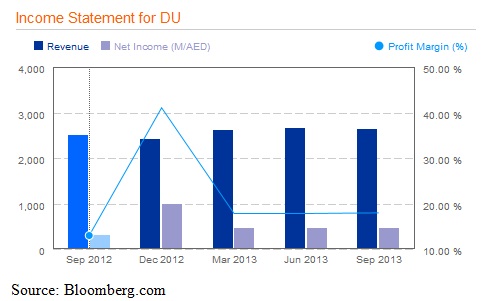

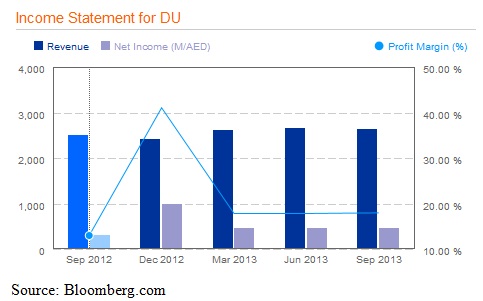

Stock market statistics for Du Company

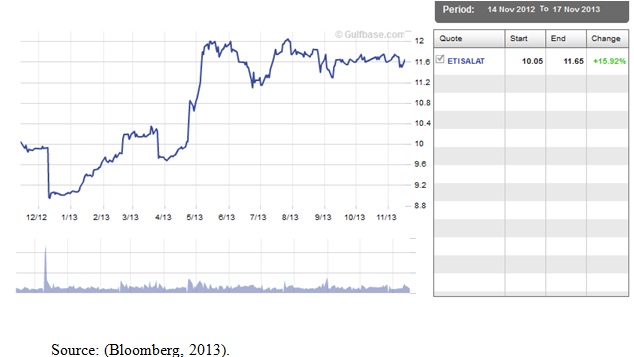

Source: (Bloomberg, 2013).

Stock market statistics for the Emirates Telecommunications Corporation

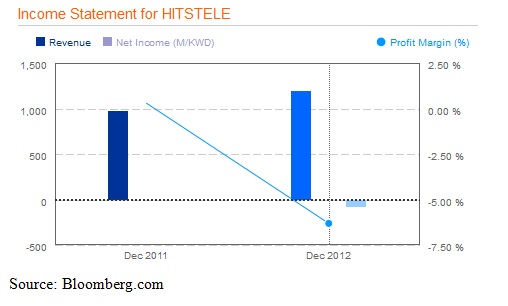

Stock market statistics for HITSTELE

Source: (Bloomberg, 2013).

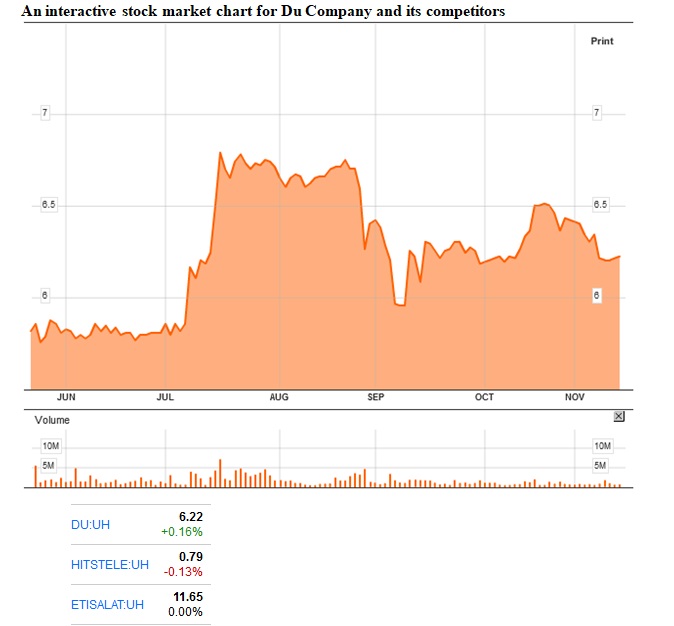

Graph: Comparison of companies over Last 3 years

Du Company’s stock market performance

Comparison with competitors

Essential Du Company’s indicators in the stock market

Source: (Bloomberg, 2013).

Du Company’s stock performance

A transformation in the price of stocks is one of the significant factors in the computation of a company’s performance in the stock market. The price transformation rate of Emirates Integrated Telecom in the month of October 2013 was about -0.81%. This rate was higher than the median of its market competitors. The organisation’s stock price alteration percentage was lower than the normal of its sector or fixed line telecommunications with about -0.41%. Du Company’s stock performance for the month of October 2013 was below that of market competitors according to this benchmark. In addition, the performance was below its market index.

The company’s risk management

The head of Internal Audit and Risk Management of Du is also responsible for developing, maintaining and implementing the unit’s framework, strategy and policy. In addition, he communicates and reports key risk management issues and provides recommendations for improvement where necessary. The Du Company considers risk management as a core competency throughout the organisation. It focuses on maintaining risk management systems and enhancing the organisation’s ability to manage uncertainty by protecting its assets. It also safeguards shareholders’ interests while ensuring compliance with applicable laws and regulations. The Du Company designed the ERM framework to ensure consistency in the application of the structure in identifying, assessing, monitoring and reporting risks across the organisation.

Conclusion

The management of the Emirates Integrated Telecommunications Company has an impressive track record. This fact is evident in the organisation’s robust growth trajectory and financial gains. The Du Company is growing rapidly. It grew from a customer base of 2.4 million customers in 2008 to about 5.3 million clients in 2011. The business recorded EBITDA of 368 million in 2008 to 2.8 billion in 2013. The organisation’s management recounts that it is working hard to deliver high quality value for stakeholders. It plans to provide superior and innovative services and products to enrich its clients’ experiences, that may give the organisation an advantage over its market competitors. In addition, it may improve productivity and profitability. The approach can improve the performance of the organisation’s workers.

Emirates Integrated Telecommunications Company also invests in creating future leaders through a partnership with INSEAD. The partnership seeks to create an executive leadership initiative that can incorporate aspects of client logistics and financial management. INSEAD is one of the leading business schools across the globe. This fact can improve succession planning of the Du Company. It is one of the approaches that can promote the competitiveness of the organisation.

The Du Company’s corporate governance strategy is consistent with best international practices in the telecommunications sector. It also operates in line with the demands of the Dubai Financial Market and Emirates Securities and Commodities Authority (ESCA). The Du Company has robust mechanisms in place to produce quality performances in the financial market. The S & P Hawkamah places the Du Company in the leading rank of 2011 on the basis of corporate management, social responsibility and environment.

I would buy Du’s shares in the stock market because of the organisation’s continued growth. Du posted net profits of about AED 475m after annual royalty in 2013. The organisation’s revenues rose by about 46% in the year 2012. The company continues to post impressive profit performance in mobile revenue, data and total subscriptions. The Du Company is a rapid expanding business organization. It has over 2,000 personnel who work to improve the company’s products. The organisation’s clients come from over 60 diverse countries with different cultural settings. The business has the capacity to serve its customers in different languages. About 50% of the senior management staff and customer care personnel of Du are citizens of the United Arab Emirates. The business has a strong commitment towards the provision of fundamental prospects for quality talent within the setting of a cosmopolitan environment. The organisation has about 6.6 million mobile subscribers. This aspect translates to about 50% of the market share. In addition, about 556, 000 fixed line clients, 181, 000 home services’ clients and more than 72, 000 commercial premises use the services of the business. Surveys indicate that the Du Company is the best mobile broadband network in the African region and the Middle East. The organisation’s annual revenues exceed AED 11 billion. I predict that the organisation will expand its operations fast within the UAE market. I would recommend one to buy this organisation’s shares because of profit projections that can bring high returns. I also recommend that the company does a comprehensive market research in order to provide services that clients prefer. The organisation may also look for ways of recruiting the most talented employees from around the world to work for it as the key to improved productivity in companies today remains a well compensated workforce. Many companies in the UAE do not incorporate comprehensive human resource policies to cater for their workers.

References

Bloomberg. (2013). Emirates Integrated Telecommunications Company. Web.

Du. (2013). Who we are. Web.

Gulf Base. (2013). Emirates Telecommunications Corporation-ETISALAT. Web.

Market Watch. (2013). Emirates Integrated Telecommunications Co. PJSC. Web.