FedEx Company, now known as Federal Express Corporation, is an American multinational corporation headquartered in Memphis, Tennessee, specializing in commercial services, e-commerce, and transportation. The company is now well-known for its air delivery services. To counteract its main competitor, it has launched FedEx Ground, Kinkos, and numerous subsidies since then. The company collaborates with the US government to provide postal package transportation services via FedEx SmartPost. Frederick Smith of Yala, a graduate, founded the company in 1971 Federal Corporation (FedEx, 2021). He developed the company’s concept while working on a term paper at university, and he wanted to build a dependable delivery system, so he started in 1973 (Qing et al., 2020).

Smith chose Memphis International Airport for the process because of its favorable weather and proximity to the average population. The company grew gradually and had at least one billion dollars in revenue by 1983. In 1984, it expanded its operations to Asia and Europe and acquired one of its competitors, the Flying Tiger Line, a globally renowned airline cargo. For marketing purposes, the company’s name was shortened to FedEx in 1994 and has been used for several years was adopted. The company reorganized as a holding company on October 2, 1997, and began operations in January 1998 with the inquiry of Caliber System Inc. (Qing et al., 2020). As of May 31st, 2021, the company’s net income is worth US$12.231 billion. Therefore, individuals should invest in the FedEx Company because its dividends are consistently increasing, and it is generally stable in all aspects.

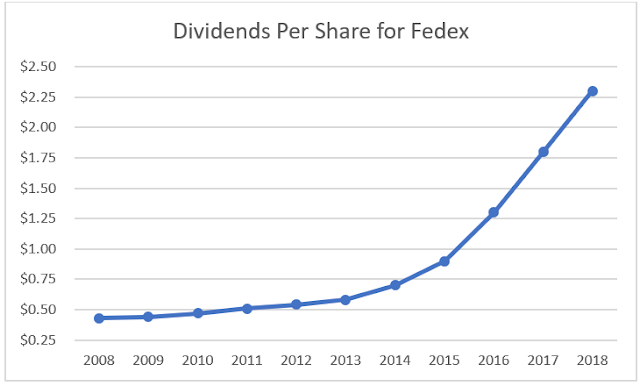

According to analysis, the company has more room to run; its setup is perhaps the best as it has formerly been since 2015. The company has had a consistent rise in price per share over the years and is attributed to some reasons. The company anticipates spending less capital to improve TNT (An international delivery company) to create cash flow and minimal spending over the coming years. This shall ensure that the dividends increase and enable the company to repurchase the stock. The freight services are worth contributing, given that there are relatively few commercial flights taking off. Therefore, the portion of the logistics market is up with the price and operates with freight and passenger luggage. Walmart is expected to establish a prime-like delivery service, and both have had a longstanding relationship. Thus, FedEx can win more than its average share of developing Walmart’s E-commerce volume. On the other hand, FedEx stock has recently begun to perform better. Up to now, shares are up approximately 14%, outperforming the Dow Jones and the S&P. Wall Street seems to prefer FedEx stock compared to the United Parcel Service. About 56 percent of analysts prefer FedEx rate shares to UPS rate shares, while about 40 percent and favor UPS rate shares (Marafona, 2021). In connection, the mean Buy-rating ratio of stock in Dow Jones is average at around 55%. However, the analyst’s mean price target is about $167 per share, below the share’s trade. Dividends paid by FedEx Corporation have remained consistent for more than ten years (Qing et al., 2020). Between the past ten years, the initial annual payment was approximately US$0.5 in 2011, compared to US$3.0 in 2020. From this, it is clear that the annual growth is about 20% each year throughout the period (Marafona, 2021). Over the last five years, earnings per share have rapidly grown, and it has posted an annual increment of 23%. The company has been retaining a majority of the profits, which is an ideal undertaking based on an investment perspective, given that the company reinvests its earnings effectively.

Before investing in a company, it is crucial to analyze the company’s stability and strategies taken upon by the company to respond to uncertainties. In 2018, the company experienced a devastating blow to the world industrial economy. Commercial businesses were adversely affected as the trade disputes escalated. To counter this, the company recognized the slowdown in trade and responded effectively through active management of the costs and switched to necessary, proper investments to ensure long-term success. FedEx has an incredible history of observing what lies on the horizon. With such a capability, the company has been able to position its operation on E-commerce, which has been booming in the market at present. Therefore, the company has successfully operated an integrated SmartPost volume to standard operations. Due to the demand for online orders, such as furniture and equipment, the company has built out capabilities to lever such a considerable increase.

FedEx has developed a business model in which our firms compete jointly, operate independently, and manage cooperatively. This is beneficial in providing a wide range of transportation and E-commerce to its clients worldwide (Ramanathan, 2019). In terms of investment perspective, it increases the company’s sales volume, thus, profitability. As earlier stated, the company has invested well in E-commerce, given that the internet has increased significantly in the recent past. The company has invested in new technologies to ensure efficiency, optimizing deliveries globally through innovative solutions. Therefore, it shall make deliveries to customers more reliable, convenient, efficient, and cost-effective. The company is stable and efficient in business-to-business distribution. It has been unique and most trusted by businesses to supply their goods. With this, it is essential as it is among the massive source of FedEx revenues. The company has strengthened international profitability in its 220 countries and territories through an aircraft fleet modernization program (Marafona, 2021). Economically, globalization drives the volume growth in long-term effect.

FedEx Company is best to invest due to consistent rise in its dividends and stable nature. The company has had an upward trend in the annual revenue despite the technicalities such as the COVID-19 and is worth investing in FedEx Corporation. A company needs to check on costs associated with its operation to curb overspending and ensure profitability. The company has laid good strategies meant to minimize costs and spending. Besides, the world is fond of uncertainties and should always adopt good strategies to predict such delays and react appropriately. As a general rule, it is crucial to analyze the nature of the stability of a company before an investment is made. The analysis should involve all aspects; for instance, a good company to invest in should effectively reinvest part of its earnings. FedEx routes have had a 15% increment yearly as a good and most stable investment. An investor can think on countless occasions regarding the cost of purchasing the FedEx route. Therefore, the time is right and appropriate to start investing in the FedEx route. Since the company is now reputable globally, the sky is always the limit. Its tactical approaches to uncertainties are perfect, timely, and cost-effective.

References

FedEx. (2021). Technology and Innovation Policy Perspectives |Fedex.com. Web.

Marafona, M., C. (2021). The logistic giant emerges amid the pandemic: The value creation of FedEx Corporation. NOVA – School of Business and Economics.

Qing, K. J., Kee, D. M. H., Soon, J. C. T., Hui, C. K., Kelvin, C., Singh, A., Kurniawan, O. E., Alotaibi, A. B., Pandey, R., Quttainah, M. A. & Sin, L. G. (2020). The impact of employee satisfaction, organizational commitment, job performance, and teamwork as the success factors in FedEx: A study of FedEx’s employees in Malaysia. International Journal of Tourism and Hospitality in the Asia Pacific, 3(2), 48-56. Web.

Ramanathan, N. (2019). Quality-based management for future-ready corporations serving society and the planet. Total Quality Management & Business Excellence, 32(5-6), 541-557. Web.