The World Health Organization (WHO) is a corporation that controls the situation in the sphere of healthcare, medicine, and the quality of people’s lives all over the world. It is crucial to mention that it is not a private company; that is why its aim is not to become profitable. It is funded by specific funds and governments of diverse countries. Many humans of different nationalities take part in volunteer programs established by this organization. In this case, the salary of the workers means that the budget covers the expenses of the office managers and leaders of the corporation.

The majority of healthcare workers, nurses, and assistants work for free as they want to enhance the medical situation in third-world countries. The WHO is an international organization with several departments in diverse countries and regions. Its budget structure is complex and requires complete analysis to examine its liquidity and profitability. The purpose of this paper is to investigate the key financial ratios to understand the monetary functioning of the corporation and compare it to the situation in the industry in general.

The WHO is a corporation with a specific financial structure; that is why it is not possible to analyze it using typical methods of examination. Organizations funded by the government have a particular budgetary policy that cannot be compared to monetary measures of the private sector (Nowicki, 2018).

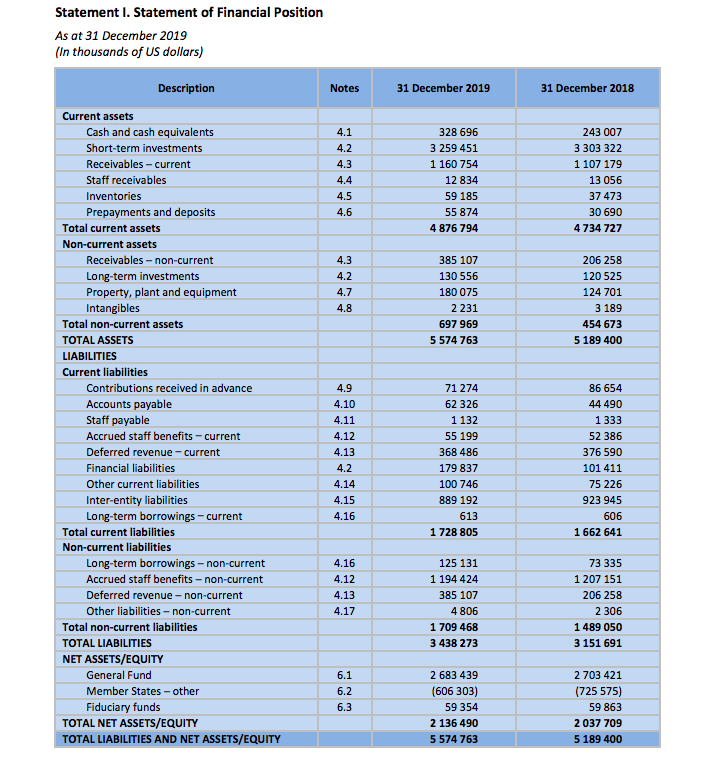

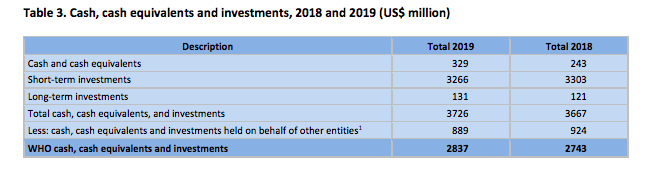

The liquidity of the WHO is counted according to its cash, cash equivalents, and investment management (World Health Organization [WHO], 2019). Cash and cash equivalents are the minor part of the total sum: in 2019, it was 329 million dollars (Appendix A). The primary segment is presented by short-term investments: 3266 million dollars in 2019 (Appendix A). The overall budget in this sector, which includes both cash and diverse types of investments, was 2837 million dollars in 2019.

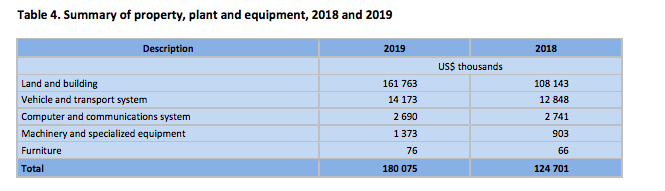

In the analysis of the liquidity of the company, it is crucial to mention property, plants, and equipment. This sector includes furniture, information technology equipment, and other vehicles owned by the corporation (World Health Organization [WHO], 2019). A significant part of the budget in this segment is presented by the cost of lands and facilities. In 2019 its overall sum was 161 763 thousand dollars (Appendix B).

The computer and communications system and machinery are also included in this part of liquid resources and cost approximately 4 000 thousand dollars in 2019 (Appendix B). Another vital part of the budget is staff liability, which includes expenditures on health insurance of more than 40 000 members of the corporation (World Health Organization [WHO], 2019). The WHO is an illustration of a corporation with high liquidity. Even though one of the major parts of the total sum is the real property (lands and buildings), the budget is balanced and distributed evenly.

The WHO is a non-profit company founded voluntarily, excluding the countries-participants that are obliged to pay the membership fee regularly. The organization is focused on grant assistance and amelioration of the current situation in the sphere of medicine. According to these facts, the company does not have any profit, and it is impossible to find the information in its financial documents containing details about the total margin. The only statistic that is freely accessible is the documentation of net assets. The total sum of this rate in 2019 was 2136 million dollars (World Health Organization [WHO], 2019). The leaders of the WHO aim to balance the expenditures on monitoring and supporting the healthcare system worldwide and the income from the membership fees and donations.

There is not enough information to analyze asset efficiency in a detailed way. However, it is possible to assume that owning real property is profitable for the company. For example, the cost of the lands increases significantly for one year. In 2018 it was 108 143 million dollars, and in 2019 it reached the sum of 161 763 million dollars (Appendix B). Total current and non-current assets also increased in 2019 in comparison to the previous year. In 2018 it was 4 734 727 dollars for current assets and 454 673 for non-current assets (Appendix C).

In 2019 the rates rose 100 000 dollars for both indicators (Appendix C). The capital structure includes assets, liabilities, and equities (World Health Organization [WHO], 2019). Even though the WHO annually publishes a detailed financial report, it is necessary to point out that there is a lack of crucial information for the overall analysis of the monetary policy. There is no data about the profitability of the corporation, its debt service coverage, and others. In contrast to other healthcare organizations, the central part of the WHO’s budget is concentrated in the sphere of real property.

It is advisable to make reports not only about the overall incomes and expenditures of the company but also about the diverse parts of it. For example, it can be suggested to provide statistics on the financial structure in different countries, taking into consideration the national currency. What is more, it would be beneficial to pay more attention to the monetary policy concerning the support of healthcare workers in third-world states.

References

Nowicki, M. (2018). Introduction to the Financial Management of Healthcare Organizations. Health Administration Press.

World Health Organization. (2019). Audited Financial Statements. Web.

Appendix A

Liquidity. Cash and Investments

Appendix B

Liquidity. Real Property

Appendix C

Financial position