Introduction

The financial and strategic management of Amazon Company will be analyzed from a variety of aspects throughout this study. Much emphasis will be placed on various parts of the firm. There will be an analysis of some of the dangers the company faces, and some suggestions will be offered on how those dangers might be mitigated in some cases. As part of the analysis that will be conducted, the company’s stock will be valued, and the financial condition will be assessed.

Case Background

The industry under which the Amazon.com, Inc. company operates in the past five years is cloud computing and online retail. Its operations are in every part of the world, including Seattle, Washington, where its headquarters are. Jeff Bezos started Amazon.com as an online bookstore on July 5, 1994. Amazon was initially planned to be an online marketplace (Ruiz-Mafe et al., 2020, p.478). The company made its IPO on May 15, 1997, right in the thick of the dot-com bubble, and went public shortly after (Hu and Tracogna, 2020, p.102022). On April 27, 1998, less than a year after going public, Amazon successfully made its first three acquisitions (Al Ahbabi and Nobanee, 2019, p. 24). This was a key milestone for the company.

Financial Strategy

Several companies in which Amazon had invested terminated their contracts with the company after the dot-com bubble burst on March 11, 2000 (Ruiz-Mafe et al., 2020, p.486). This caused Amazon to lose money on its investments. In 2005, the company resumed making multiple acquisitions each year, focusing on online media websites and online shops (Ruiz-Mafe et al., 2020, p.468). This change came about due to the company’s desire to grow its market share. Beginning in 2011, Amazon focused on establishing and improving Amazon Echo while expanding its Amazon Web Services segment through acquisitions.

Mergers and Acquisitions Evaluation

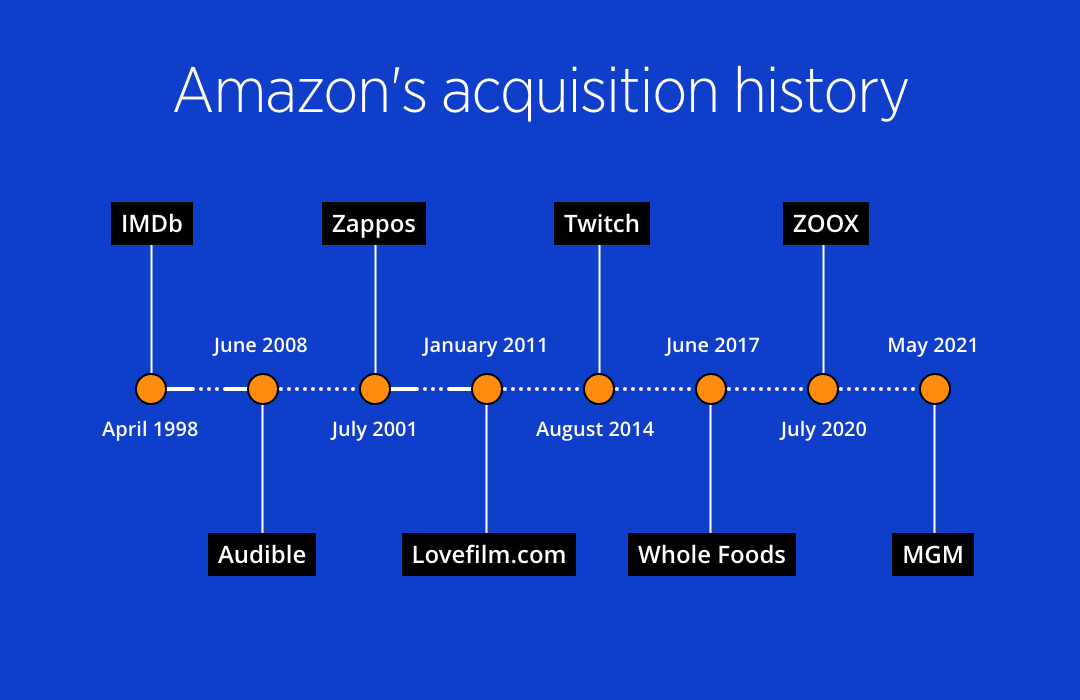

The acquisition of Whole Foods Market by Amazon on June 16, 2017, for $13.7 billion was the most high-profile of Amazon’s assets (Gautier and Lamesch, 2021, p.100890). In recent years, Amazon has acquired companies in various business sectors (Gautier and Lamesch, 2021, p.100890). Amazon has bought 75 pharmaceutical, technical and other companies (such as Whole Foods and PhillPack); significant mergers and acquisitions of Amazon in the past five years include 23 companies (Gautier and Lamesch, 2021, p.100890). Due to private equity firms, five purchases were made. In addition, it sold a holding (Singh and Pathak, 2021, p. 116). Software is the company’s main focus, followed by internet software and services (29%). Figure 1 below shows some of the mergers and acquisitions of the company. According to the concept of shareholder value creation and divestiture, the creation of the shareholder value of an Amazon enterprise is more significant than the current profit.

Financial Performance

According to the net financial loss concept, Amazon’s first-quarter 2022 statistics indicated a net loss of $3.844 billion, compared to $8.107 billion in 2021 (Jindal et al., 2021, p.276). This is a 7 percent raise over the $108.518 billion reported for the first quarter of 2021 (Jindal et al., 2021, p.277). Amazon’s North American revenue will climb 18.4% by 2021 (Jindal et al., 2021, p.273). The specific subsidiaries include Acom and Alexa Internet. The rationale for divestiture was the drop in online retail sales, which estimated online retail sales dropped 3% last year to $51.129 billion (Jindal et al., 2021, p.280). In the first quarter of 2021, demand for online enterprises was bolstered by the COVID-19 outbreak and government stimulus cheques (Jindal et al., 2021, p.280).

Sales Growth

The company’s first three months witnessed a 7% growth in revenue, totaling $116.4 billion (Al Ahbabi and Nobanee, 2019, p. 22). This was a drop from the previous quarter’s 44% rise (Al Ahbabi and Nobanee, 2019, p. 23). Amazon sold the same number of items as before, but its expenditures rose. Investment in Rivian Automotive, an electric truck manufacturer whose shares have fallen this year, contributed $7.6 billion to the company’s $3.8 billion deficit during the quarter (Al Ahbabi and Nobanee, 2019, p. 16). Amazon’s consumer business in North America and abroad contributed to its losses despite its expanding and profitable cloud services segment.

Wall Street expected significantly higher numbers. Therefore, Amazon’s stock dropped more than 10% in after-hours trade (Al Ahbabi and Nobanee, 2019, p. 17). The company expects a 3-7% sales gain for the current quarter, indicating its growth may slow (Al Ahbabi and Nobanee, 2019, p. 28). Amazon will move Prime Day from June to the third quarter this year. Vaccines and the March 8.5% annual inflation rate have impacted behaviors again (Al Ahbabi and Nobanee, 2019, p. 26). According to data issued by the Department of Commerce on Thursday, consumer spending on Amazon nondurables was down 0.6% in the first quarter when inflation was considered (Al Ahbabi and Nobanee, 2019, p. 27). Amazon benefited from the coronavirus outbreak as more people shopped online.

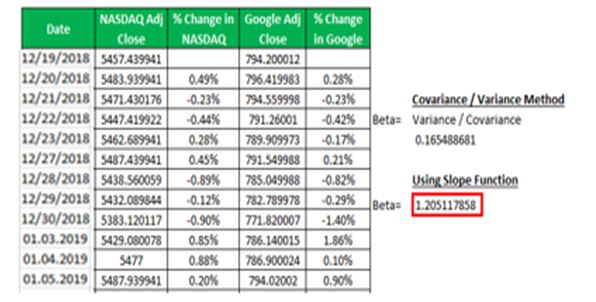

CFO Brian Olsavsky told reporters the company was “extremely thrilled” with how often people shopped on Amazon and that the slowdown reflected the end of pandemic shopping behaviors (Ruiz-Mafe et al., 2020, p.480). He also said Amazon was “delighted” with how much people spent (Ruiz-Mafe et al., 2020, p.473). A year ago, clients made regular, low-priced purchases like masks; today, they are returning to normal (Ruiz-Mafe et al., 2020, p.468). Amazon ranks first on the 2021 Digital Commerce 360 Top 1000 list (Ruiz-Mafe et al., 2020, p.465). It ranks third on Digital Commerce 360 Online Markets’ ranking of the 100 largest online marketplaces (Ruiz-Mafe et al., 2020, p.485). The following excel attached image shows how the risks of the Amazon company can be calculated.

Risk Analysis

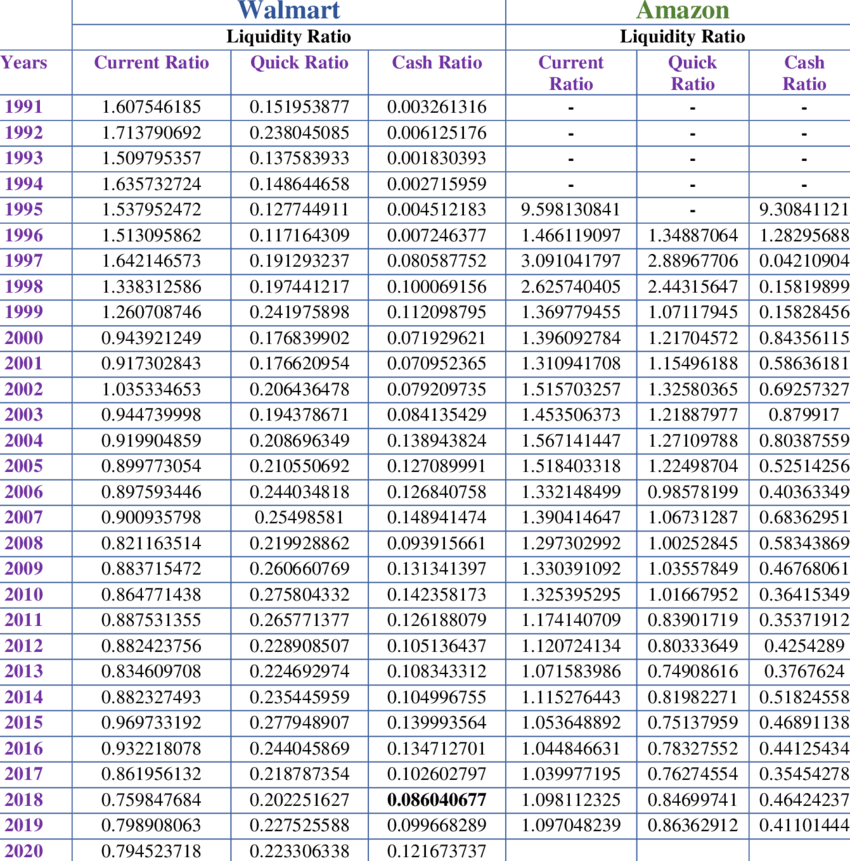

According to the risk association theory, learned in this course, Amazon is evaluating the risks associated with its networking and data infrastructure to provide cloud computing to consumers worldwide. Relevant calculations can be seen in the Figure 2; they were conducted using financial tools of absolute and current liquidity. In this sense, one of the company’s challenges is the competitive pricing method its rivals, Target and Walmart, use. Walmart’s prices are now lower than Amazon’s (Jindal et al., 2021, p.279). This can be concluded by applying calculations may change purchasers’ perceptions of Amazon’s cheaper offerings, which would benefit the company.

Debated and considered Amazon’s cloud computing services are the company’s most basic infrastructure services. These services have security flaws. Offering cloud computing services to clients is risky. Customers can exploit these risks. The number of people using cloud computing services has increased, along with the number of associated threats. Cloud computing’s great danger is caused by easy access to many valuable data. Attackers can exploit this information to hack cloud users’ accounts.

Employees and the tools they use to carry out their job tasks and provide consumers with high-quality services are another potential danger or weakness to Amazon’s infrastructure. This vulnerability could prevent Amazon from offering high-quality services. Using tainted or malicious databases and software can impede service delivery to users. Insecure application and programming software interfaces could harm Amazon’s computing services (Jindal et al., 2021, p.272). If a virus or other external incursion causes cloud computing services to malfunction, the application and programming interfaces that allow users to access the company’s online services can be disrupted. This can prohibit users from using the company’s online services.

Financial Risk Models and Theories

When Amazon debuted in 1995, many thought its ranking system was insane (Melacini et al., 2018, p. 22). Consumer empowerment has contributed to the growth of Amazon’s brand. A corporation without online customer reviews is unimaginable today. Growth-focused organizations and CEOs sacrifice creativity. Instead of embracing employees, they push harder and tell them what to do. This prevents people from seeing opportunities in difficulty. The business defines the individual by employment and market. Before creating a risk management plan, one should prioritize risks and hazards. They can achieve this by employing a risk scale.

Analysis of Financial Perspective

The Amazon Company is based on equity capital, which consists of the capital raised through the issuance of stock and the firm’s net profits that can be credited to shareholders. The core of Amazon Company’s capital structure is equity capital. Debt capital is the value of bonds, term loans, and other types of credit used to fund the firm’s activities. Amazon.com’s business structure also includes debt capital. Amazon has relied chiefly on long-term loans, with only a few exceptions turning to short-term debt. Amazon’s overall debt level has not changed significantly since 2015.

Trend Analysis

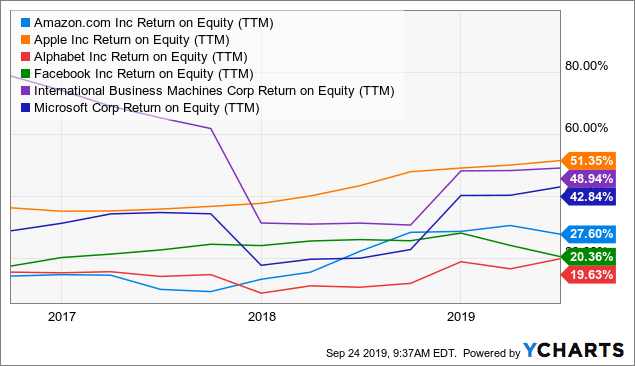

Amazon has now entered the ranks of high-end technology companies like Apple and Cisco. Due to the lack of a consistent profit in the company’s early years, Amazon did not pay dividends to its owners. Amazon has gained a competitive advantage over other companies, such as Netflix, by starting to pay dividends to shareholders. Amazon has been unable to complete a mission that other technology companies, such as Microsoft, have been able to do due to its failure to pay dividends to its stockholders over the years.

Company Cost Structure

The corporation decided to invest 100 percent of its cash flow back into the company, which is often referred to as a personal investment. The owner of Amazon Firm puts money in the company to ensure that it can run efficiently; this is usually done in the company’s early stages and preliminary levels. Amazon can continue operating because of the short-term financing it obtains from numerous financial institutions. Given that Amazon generates a substantial amount of cash through the sale of its products, reinvestment of revenues is one of the company’s other funding sources (Melacini et al., 2018, p. 18).

Ratio Analysis

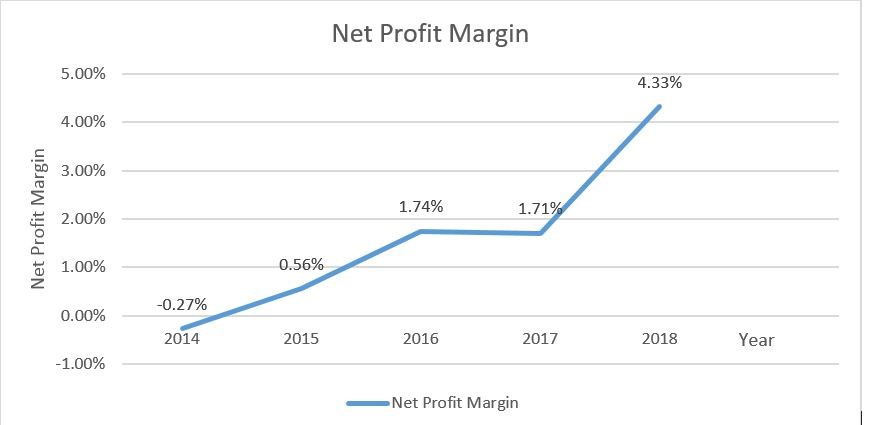

The net profit margin is shown in the Figure 3 below for the years 2014 to 2018 (Almarar and Nobanee, 2020, p. 503)

Leverage Ratios

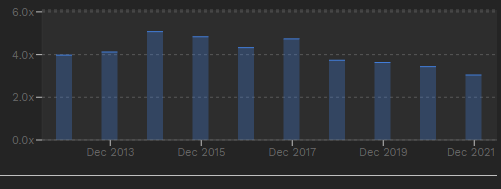

The level of financial leverage maintained by Amazon.com during the most recent quarter was 3.1x and is shown in the Figure 4 below (Almarar and Nobanee, 2020, p. 504). It is shown in the Figure 4 below.

Liquidity Ratios

The average amount of financial liquidity that Amazon.com had throughout its fiscal years that ended in December 2017 to 2021 was 3.7x (Almarar and Nobanee, 2020, p. 506). It is shown in the Figure 5 below. Through the fiscal years ending in December 2017 and continuing through 2021, Amazon.com maintained a median financial liquidity of 3.6x (Almarar and Nobanee, 2020, p. 510).

Efficiency Ratios

The efficiency ratios in different Companies which provide same services as Amazon are shown in the graph below (Purkayastha and Tangirala, 2019, p. 11833). The values put Amazon at a better position. It is shown in the Figure 6 below.

Stock Wealth Analysis

Estimation of Amazon Cost of Capital

Average Yearly Returns

Amazon has become one of the world’s most valuable public firms, reaching $25 million in average yearly return (Melacini et al., 2018, p. 17).

Estimated Cost of Capital

The study can now compute Amazon’s WACC because it has both the cost of debt and the cost of equity to use in our calculations. To accomplish this, the study began by calculating the weights of both components using the Total debt/Market cap ratio. This allowed the study to determine the relative importance of each factor in the calculation.

Market Value Added

After doing the necessary math, the study has determined that Amazon has a WACC of 6.30 percent (Xie et al., 2018, p.375). By consulting different web sources, the analysis can evaluate how our findings compare to those of other analysts. Looking at the Fin box, one can see that it provided three different projections for Amazon’s weighted average cost of capital: a lower, a mid, and an upper.

- Lower WACC, which comes in at 7.90 percent (Xie et al., 2018, p.375);

- WACC Mid — 9.00 percent (Xie et al., 2018, p.364);

- WACC Upper — 10.20 percent (Xie et al., 2018, p.368).

A little more significant than what was predicted by the study. In their estimates, however, they used a risk-free rate range of 3.50 to 4.00 percent, as determined by further examination of their model (Xie et al., 2018, p.366). As previously stated, the yield on 10-year U.S. government bonds has declined to 0.76 percent as of April 2020 due to shifting global conditions (Xie et al., 2018, p.363).

Valuation Perspectives

AMZN provides online shopping and advertising, which are regarded as commercial services. Despite starting as a book vendor, Amazon quickly grew. Amazon first sold books (Ko and McKelvie, 2018, p. 450). Growth fueled this; next, the study will create a DCF model to calculate the company’s intrinsic worth and share price.

Equity Spread

The rainforest industry earns $8.2 billion, an excellent economic advantage; these companies collect rubber tree timber and Brazil nuts. This ignores the economic benefits of Amazon’s environmental influence, including weather regulation and carbon storage. Since Amazon company stores CO2, if the forest were taken down, agriculture would lose $422 million annually (Melacini et al., 2018, p. 18). This would reduce farmland’s benefits.

Discounted Cash Flow Valuation

Researchers examined dozens of contributing factors—some contradicting each other—to build a regional map of the Amazon’s economic value. Researchers analyzed dozens of contradictory elements to determine Amazon’s monetary value. Researchers said that these data represent a small percentage of “the Amazon jungle’s incalculable value” (Melacini et al., 2018, p. 17). He pushed Brazil to withdraw from Kyoto to cut emissions. This analysis reveals that preserving the Amazon’s natural state is economically beneficial, even if one does not believe in climate change (Melacini et al., 2018, p. 20). The study’s conclusion that the Amazon should be preserved is significant.

Obtaining Strategy Alignment

To align with strategy, Amazon must do the following. It should clarify the mission, vision, design, and goals. The company and its top executives are good sources if a corporation has a strategic plan, study the mission, vision, strategy, and goals documents. According to the neoclassic financial theory, one should organize one-on-one meetings with influential business leaders to discuss their organization’s goals and how they benefit the firm. Amazon should summarize the combined aims and objectives from the two sources and when measuring learning attempts, record as much information as feasible.

The L&D team should review step 1’s summary. Learning can help with clear procedures or goals, such as introducing new goods or enhancing safety. Education can help clear techniques or plans. Specific learning and development methodologies or goals should not make sense to someone. Involve their employees, so they know the firm’s goals and objectives and buy into the plan they help create (Xie et al., 2018, p.364). Once one has L&D goals and plans, go on to the next step. One must involve their team in this process and also consider critical stakeholders. So long as it’s easily shared, it can be a paper, spreadsheet, or PowerPoint.

Align the business plan with the L&D strategy. After developing the L&D plan, check with the key business stakeholders with whom one discussed it in step 1 for alignment. The final phase is crucial for winning over stakeholders. The study will address any new questions, concerns, or misunderstandings. One should get corporate stakeholders’ agreement and ensure they understand their duties in the L&D plan. When this stage of strategic alignment is complete, one can work with their L&D team to implement the plan.

Cost Allocation Models

There are several cost evaluations models which Amazon can use to achieve the corporate strategy, as stated below. Alignment to design and overall corporate performance can mainly be achieved using the inventory turnover ratio. With the help of this performance theory, it will be possible to monitor the effectiveness of the sale of goods successfully. The financial cost allocation model also plays an important role; the application of a structural model allows to identify of the benefits obtained under different economic conditions.

The Direct Expenses

Considered a direct expense is anything that can be directly associated with a cost object for their business. Direct costs are the only ones that do not need to be assigned and are used in calculating the cost of products sold, as they are directly associated with the production process. Direct labor, direct materials, and manufacturing supplies are the three sorts of direct costs that a business typically encounters (Purkayastha and Tangirala, 2019, p. 11833). On an assembly line, both direct labor and direct expenses can be used to describe an employee’s duties. The same may be stated of the plastic necessary for toy production and the glue used to assemble the various components (Hole et al., 2019, p. 012121). Because they are related to the amount of output produced, direct costs are almost always subject to change. However, if production does not change, there is a chance that direct costs will also not alter.

Indirect Expenditures

Direct costs are expenses incurred as a natural outcome of a company’s daily operations. Indirect expenses cannot be immediately traced to a specific service or good but are nonetheless deemed vital to the production process or the provision of the connected goods and services (Hole et al., 2019, p. 012121). Indirect expenses are necessary for production, such as utilities and line supervisor pay. However, because these expenditures are not directly associated with a particular product or service, they must be allocated wisely.

Expenses For Administrative Overhead

Overhead costs refer to business expenses that are not directly tied to customer service. Their company will incur overhead expenses regardless of whether it is producing things or providing services since these are necessary expenditures irrespective of how directly or indirectly, they contribute to the output. Instances of overhead costs include rent, insurance, and office supplies, among others. Overhead expenses are expenses incurred regardless of the level of production. In the same manner, as indirect costs, overhead costs must be allocated consistently to calculate the product’s actual worth.

Conclusion

In this paper, discussion on a variety of topics pertaining to the Amazon Company has been done. All of the financial analyses of the firm as well as the dangers that the company confronts or may encounter in the future have been incorporated into this report. It has been suggested that certain actions be taken in order to guarantee that the company’s operations continue to be in accordance with the strategic plans. The risk assessment impacts on the corporate strategy, allowing Amazon to adjust it in order to avoid losses while increasing their probability during the assessment.

References List

Al Ahbabi, A.R. and Nobanee, H. (2019) ‘‘Conceptual building of sustainable financial management & sustainable financial growth’’, SSRN Electronic Journal, 34(1), pp. 16–28. Web.

Almarar, F. and Nobanee, H. (2020) ‘‘Sustainability and risk: A mini-review’’, SSRN Electronic Journal, 11(3), pp. 495–520. Web.

Biswas, T.K. and Das, M.C. (2020) ‘‘Selection of the barriers of supply chain management in Indian manufacturing sectors due to COVID-19 impacts’’, Operational Research in Engineering Sciences: Theory and Applications, 3(3), pp.1-12. Web.

Gautier, A. and Lamesch, J. (2021) ‘‘Mergers in the digital economy’’, Information Economics and Policy, 54, p.100890. Web.

Hole, Y., Pawar, M.S. and Khedkar, E.B. (2019) ‘‘Omni channel retailing: An opportunity and challenges in the Indian market’’, Journal of Physics: Conference Series, 1362(1), pp. 012121. Web.

Hu, T.I. and Tracogna, A. (2020) ‘‘Multichannel customer journeys and their determinants: Evidence from motor insurance’’, Journal of Retailing and Consumer Services, 54, p.102022. Web.

Jindal, R.P., Gauri, D.K., Li, W. and Ma, Y. (2021) ‘‘Omnichannel battle between Amazon and Walmart: Is the focus on delivery the best strategy?’’, Journal of Business Research, 122, pp.270-280. Web.

Ko, E.J. and McKelvie, A. (2018) ‘‘Signaling for more money: The roles of founders’ human capital and investor prominence in resource acquisition across different stages of firm development’’, Journal of Business Venturing, 33(4), pp.438-454. Web.

Melacini, M., Perotti, S., Rasini, M. and Tappia, E. (2018) ‘‘E-fulfilment and distribution in omni-channel retailing: a systematic literature review’’, International Journal of Physical Distribution & Logistics Management, 48(4), pp. 14-25. Web.

Purkayastha, D. and Tangirala, V.K. (2019) ‘‘Dark side case: Amazon. com, Inc. and the Human Cost of Fast Shipping’’, Academy of Management Proceedings, 2019(1), p.11833. Web.

Ruiz-Mafe, C., Bigné-Alcañiz, and Currás-Pérez, R. (2020) ‘‘The effect of emotions, eWOM quality and online review sequence on consumer intention to follow advice obtained from digital services’’, Journal of Service Management, 31(3), pp.465-487. Web.

Singh, A. and Pathak, G.S. (2021) ‘‘Revisiting marketing strategy in emerging markets: A study of Amazon.com’’, International Journal of Economics and Business Research, 22(2-3), pp.113-126. Web.

Xie, J., Zhang, W., Liang, L., Xia, Y., Yin, J. and Yang, G. (2018) ‘‘The revenue and cost sharing contract of pricing and servicing policies in a dual-channel closed-loop supply chain’’, Journal of Cleaner Production, 191, pp.361-383. Web.