Financial markets are viable areas that investors need to focus on in contemporary times. They are typical marketplaces that provide the platforms for the purchases and sales of financial assets such as foreign exchange, stocks, derivatives, and bonds (Adambekova and Andekina, 2013). The financial markets play a pivotal role in economic growth and development because they ensure a stable flow of financial resources between parties willing to save and those aiming to make various investments (Adam, 2009). There are numerous financial institutions around the world, and each of them has unique names. For example, the capital market and Wall Street are some of the well-known ones by investors in the United States and worldwide (“Financial Markets – Overview, Types, and Functions”, 2021). Over the past two decades, they have intensely illuminated the high rate of globalization compared to any other field. The markets have shown that globally, the trade capacity is on a sharp rise proportional to the financial investments. Thus, it is accurate to report that finance has been the engine responsible for steering international trade growth and development.

Moreover, it is crucial to understand the origin and development of the financial industry to make the right investment decisions today and in the future. The original global markets date back to the late 19th and early 20th century between 1871 and 1914 (Chambers and Dimson, 2016, p. 99). The global financial markets emerged before the First World War, with the investors in the currently developed economies taking center stage in the stock exchange. Before World War I, the German investors had 16% of the global stock of securities compared to 18%, 21%, and 24% held by French, American, and British investors, respectively (Chambers and Dimson, 2016, p. 99). Their growth has been imminent and marked by a substantial increase in investments within the markets. Thus, it is clear that financial markets are ensuring global economic development, and they are significant for investors across the globe.

However, although they have encountered remarkable growth and have been highly instrumental to investors globally, they have experienced problems. Some of the difficulties directly linked to them across the world are risks and uncertainty (Chambers and Dimson, 2016). They flourish under challenging circumstances where the investors have a close prediction of the possible outcomes depending on the world’s state. However, uncertainty becomes a severe challenge when it bars the investors and other stakeholders involved from predicting the distribution of the possible results in the markets (Chiang, 2019). Uncertainty most occurs when there are shocks that affect the entire market or when organizations face specific difficulties that disturb their activities (Chambers and Dimson, 2016). Therefore, uncertainty and risk are the challenges that make it difficult for the markets to operate smoothly.

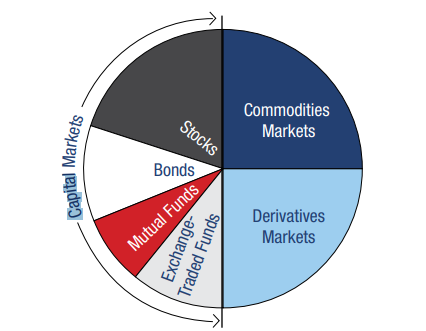

Having understood the industry’s history and development, it is essential to know the types of financial markets available in various regions. There are four main types of financial markets: the stock, bond, commodity, and derivatives. However, generally, the financial market is considered to consist of the commodities, derivatives and the capital markets. The latter is divided into subsections, including stocks, bonds, mutual funds, and the exchange-traded funds. The capital markets are lucrative, and most of the people who have invested in them have recorded gains. As shown in Figure 1 below, the capital market holds the most considerable fraction of the market.

The stock market deals with company shares, which are linked to the company’s ownership. Investors in the stock trade earn a profit when they invest in organizations that record good performance. Buying the stock is not a problem for most investors. However, understanding the risks and uncertainties and predicting the possible distribution of outcomes is a challenge that hinders their ability to choose the right stock that will give profits (Chambers and Dimson, 2016). The bond market enables governments and companies to finance their investments and projects. It also allows investors to purchase bonds from the governments or the companies for a particular duration upon which they are paid back with interest (Asian Development Bank, 2019). Commodity markets make it possible for investors and traders to purchase and sell natural resources. Understanding these markets is essential because it enables potential traders to make investment decisions.

Additionally, an example is the commodities futures market that privileges traders to set the prices of the resources to be sold in the future at the current time. The derivative markets deal with forwards, options, swaps, and futures contracts, which are financial instruments obtained from other forms of assets (Sundaram, 2012). It is essential to know the types of financial markets because they greatly help investors make the right decisions.

Capital Allocation within the Domestic Economy

Interestingly, financial markets are leading both domestic and international growth and development. They play a critical role in capital allocation within the domestic economies. The financial markets help provide private capital that helps finance developments domestically (United Nations [UN], 2016). The markets enable individual organizations to have the ability to lend local currencies in the domestic markets. They aid in lowering the currency mismatch for the borrowing parties hence reducing some risks within the market. The government bond is also significant in availing critical pricing benchmarks and tools vital in fiscal and macroeconomic risk. The domestic environment’s financial markets act as a stable source of sustainable finance to the economies (Stošić Mihajlović, 2016). The capital market also forms part of the financial market, supporting and creating employment within the economy hence steering economic growth (UN, 2016). Therefore, the financial market’s capital allocation in the domestic market is critical in improving local economies’ status.

Moreover, one of the tasks of any economy is to ensure the efficient allocation of capital. For this to be achieved, capital has to be drawn from the underperforming sectors and channeled to the vibrant industries at any given time (Di Mauro, Hassan and Ottaviano, 2018). The financial markets help ensure effectiveness, and several theories have been brought forward to support the claims. For instance, the agency theories explain how the financial markets impact the domestic economies. According to the theory, managers are encouraged to create and implement investment policies that maximize value because of the pressure they get from the managerial ownership and external investors. The laws that are put in place to protect the investor’s funds ensure the supply of finance in good projects hence enabling a country to gain adequate capital allocation within the market (Wurgler, 2010). It implies that, naturally, the financial markets dictate the movement of capital within the domestic economies.

Furthermore, at the end of the 20th century, countries with well-developed financial markets had higher elasticity in industrial growth than the economies that were still underdeveloped. Examples of the developed countries included the UK, Japan, Germany, and the US, while some of the underdeveloped economies were Turkey, Panama, and Bangladesh (Wurgler, 2010). Unlike economies with well-developed financial markets, other countries underinvest in the growing industries and overinvest in the underperforming sectors. Thus, it is vivid that the financial markets reflect on the actual economy and play a critical role in capital allocation.

Capital Allocation within International Markets

The global financial system is massive, with various financial organizations and markets. The financial markets have numerous positive contributions to the global financial system. One of these advantages is that it helps companies to raise capital. Through the global financial market’s liquidity and depth, organizations can invest more, improve their access to finances, maintain steady growth, and reduce their capital cost (Thakor, 2015). Therefore, the developed financial markets across the globe spearhead investment, entrepreneurship, increase in Gross Domestic Product (GDP), and the creation of more employment opportunities (Gujrati, 2015). Research reveals that financial markets are responsible for enhancing global trade by mobilizing resources and steering innovation (Thakor, 2015). Innovation is critical for the advancement of the world’s economy.

However, even though innovation is highly instrumental for global growth, it is impeded by some challenges such as inadequate funding and personnel. Financial markets operating across the globe work hard to lower these challenges: inadequate funding and personnel. Through capital and capital gains provided by financial markets, the barriers to global growth are minimized, and innovation is made much possible worldwide. For instance, through the funds made available by the financial markets, regions of the world that tend to have limited local resources are able to achieve inventions (Thakor, 2015). Furthermore, financial capital from the financial markets flows in various regions around the world supporting innovation, it becomes much easier to attract human capital to the respective areas. Thus, it is clear that financial markets play a critical role in allocating both financial and human capital within the international markets (Thakor, 2015). These fundamental capitals allocated by the markets help in economic growth and development.

Evaluation of the United States Economy

The United States economy is one of the most developed economies in the world. The US has well-established financial systems that play a massive role in ensuring the flow of resources. The US financial markets include numerous individual markets for diverse trades provided on various trading platforms (O’Sullivan, 2017). Some of the available products in different trading platforms include derivatives, foreign exchange, equities, and fixed-income securities (“Financial Markets of The United States, 2021). Research reveals that the country has one of the most vibrant capital markets, which is responsible for the existence of small businesses to the largest firms in the country. The markets enable most Americans to achieve their goals and raise their living standards. The notable aspect that allows the markets to be exceptional compared to those of the other economies of the world is that they have transparent, efficient, well-regulated, and modern capital markets (Roe, 2012). These features have surely enabled the economy to remain healthy and highly competitive in the global market.

Some of the key organizations that provide platforms for transactions in the US financial markets include the New York Stock Exchange (NYSE), Midwest Stock Exchange, International Money Market, Pacific Stock Exchange, Cincinnati Stock Exchange. Others are the Boston Stock Exchange, Chicago Mercantile Exchange (CME), National Association of Securities Dealers Automated Quotations System–American Exchange (NASDAQ-AMEX) and the Chicago Board of Trade (CBT) (“What Are All of The Securities Markets in the US”, 2021). These organizations have been highly automated over the years, and they provide cheap and timely services for their clients. The markets differ in size because some are small while others, such as the NYSE, are big and trade trillions daily.

Historically, the country has made continuous efforts towards strengthening and enhancing its financial sector. Since the early 21st century, the United States has experienced remarkable improvement in technology, and it has gained a significant competitive advantage in the global market (Calomiris and Neal, 2013). These unprecedented changes have made the US market fairer because they give the small and average investors and groups who wish to invest the best prices whenever they buy or sell. The accessibility and liquidity have been essential for all organizations. The paths to public markets in the United States have become less costly for the small and medium companies hence ensuring their growth and sustainability (Jones and Sirri, 2018). The easy access to financial markets in the country has increased the proportion of venture capitalists willing to provide funding.

The financial markets, especially the capital market in the US, is highly automated and liquid. Some of the benefits linked to it include lower costs of trading and retirement savings, greater access to customer credit, and increased opportunities for various types of investors in the country (Stošić Mihajlović, 2016). The United States’ automated markets have helped investors reduce their expenditure during the transactions and save more for their retirement needs. More Americans have high access to credit, enabling them to address their financial costs (Gordon and Judge, 2018). Investors can tailor their investment needs in the country because of the liquidity of the markets. For example, the exchange-traded funds from the financial markets provide varied investment alternatives for investors at a low cost.

Critical Evaluation of Challenges that the US Faces Due to Industrialization and Trade Policies

Even though the US economy has been doing well compared to many other economies, the country encounters several challenges resulting from industrialization and trade policies. Through industrialization, the United States has invested various resources in many other countries of the world. These international investments prompt it to interact with other countries’ trade policies and regional blocks. The United States currently encounters many trade barriers in various regions (“Non-Tariff Barriers and Regulatory Issues”, 2021). Tariffs are continuously becoming a problem for the United States. Some of the tariffs have been imposed as part of the global response to counter the United States’ trade policies to protect its markets. For instance, on March 18, there was an announced decision by President Donald Trump to introduce a 10% import tax on aluminum and a 25% income tax to steal (Salmon, 2018, para. 1). Despite the United States’ motive to safeguard their economy, other economies have considered such policies as unfair, resulting in tensions among countries and fear of potential trade wars.

Additionally, industrialization has also brought with it many challenges within US economy. The United States faces water and air pollution resulting from industrialization (Li et al., 2018). The degradation is devastating because it significantly deteriorates people’s quality of life and brings a challenge to citizens’ life expectancy. The United States has many regulations under the Environmental Protection Agency (EPA) that help control more than 80 toxins that range from chromium to dioxin and asbestos harmful to the environment (Folk, 2017, para. 5). However, despite the measures in place, industries operating in and out of the United States are still the worst air polluters globally. The US factories also pose a threat to the water sources around them (Manisalidis et al., 2020). Soil contamination in the US and the countries where their companies have invested their resources and opened branches have also been a problem linked to industrialization (Folk, 2017, para. 6). Therefore, industrialization has posed environmental challenges to the United States and the world in general.

Additionally, industrialization in the country has widened the gap between the rich and poor. For instance, in the year 2018, the wealthiest top 5% of the United States people owned 23% of all income in the country while the top 20% earned 52% of the income (Amadeo, 2020, para. 5). In the same year, the bottom 20% of the population had only 3.1 % of the national income (Amadeo, 2020, para. 6). These disparities are due to enormous profit gained by individual beneficiaries of industrialization. The automation and liquidity of the financial markets have also privileged the rich to continue making more investments, increasing the financial gap.

The other challenge that the United States faces due to industrialization is deterioration in social well-being in the urban areas. Globalization increased the rate of urbanization in the United States. It led to people’s migration to the cities, resulting in urban challenges, such as crime, and urban lifestyles leading to diseases and conditions (Sadashivam and Tabassu, 2016). Again, the United States’ urbanization has been fueled by investors’ ability to start and expand their activities nationally. The traders’ capability to make investments in the economy has dramatically influenced the US financial markets (Keay and Redish, 2012). However, even though industrialization and trade policies existing in the domestic and international markets have posed some challenges to the United States, it is evident that the financial markets have helped the country to make remarkable developments.

Conclusion

In summary, financial markets are fueling domestic and global economies’ growth and development. They started to establish their existence and operations in the late 19th century, and they have remained highly instrumental to date. They consist of the commodities, derivative, and the capital market. The United States is one of the countries which has embraced the financial markets and has significantly benefited from them. Thus, considering investing in stock and bond trade in the US market can indeed accumulate positive returns.

Recommendations

It is essential to consider the following recommendations to succeed in the US market:

- Assessing the US stock market to make identify the correct stock to trade. Before investing in any stock market there is need to gain good understanding of the trade and the market. Having the knowledge about the market helps in making good decisions that reduce the chances of making loses during the trade.

- Considering investing in companies with green initiatives. Industrialization has posed the challenge of environmental pollution around the world. It is thus important to invest in companies that are making efforts to address this problem by considering initiatives that help to reduce environmental pollution. By investing in such companies, you do not only make profit but also contribute to the efforts of making the world a better place.

- Understanding regulations regarding investments in the US financial markets. Understanding the regulations in place within the United States is important because it will significantly reduce lawsuits and fines arising due to legal violations. Legal violations can also result to significant waste of time.

- Entrusting the investment company with the research and analysis on the US financial market and the possible investment areas. The organization has the right personnel with the capacity to make good predictions and assess the available stocks in the market.

Reference List

Adam, M. H. M. (2009) ‘Financial markets: the recent experience of a developing economy’, Savings and Development, 33(1) pp. 27-40. Web.

Adambekova, A. A. and Andekina, R. E. (2013) ‘Financial market and its definitions: transformation of scientific concepts’, World Applied Sciences Journal, 27, pp. 12-16. Web.

Amadeo, K. (2020) The true cause of income inequality in America, Web.

Asian Development Bank. (2019) Good practices for developing a local currency bond market lessons from the asean+3 Asian bond markets initiative may 2019. Mandaluyong City: ADB publications.

Calomiris, C. W. and Neal, L. (2013) ‘History of financial globalization, overview’, in Calomiris, C. W. and Neal, L (ed.) Handbook of key global financial markets, institutions and infrastructure. New York: Elsevier Inc. pp. 3-14.

Chambers, D. and Dimson, E. (2016) Financial market history: reflections on the past for investors today. Cambridge: CFA Institute Research Foundation.

Chiang, T. C. (2019) ‘Financial risk, uncertainty and expected returns: evidence from Chinese equity markets’, China Finance Review International, 1, pp. 1-22. Web.

Di Mauro, F., Hassan, F. and Ottaviano, G. I. (2018) ‘Financial markets and the allocation of capital: the role of productivity’, Centre for Economic Performance, 1(1555) pp. 1-31.

Financial markets – overview, types, and functions (2021) Web.

Financial markets of the United States (2021) Web.

Folk, E. (2017) Environmental impacts of industrialization: Web.

Gordon, J. N. and Judge, K. (2018) ‘The origins of a capital market union in the United States’, ECGI Working Paper Series in Law, 2(1), pp. 1-21.

Gujrati, R. (2015) ‘Effects and benefits of financial globalization: challenges of developing countries’, The International Journal of Multidisciplinary Research, 1, pp. 1-16.

Jones, C. M. and Sirri, E. R. (2018) ‘Examining the main street benefits of our modern financial markets’, U.S. Chamber of Commerce, 2(1), pp. 1-28.

Keay, I. and Redish, A. (2012) ‘Financial markets and twentieth century industrialization: evidence from US and Canadian steel producers (No. 1003)’, Queen’s Economics Department Working Paper, 1, pp. 1-13.

Li et al. (2018) ‘Influence of industrialization and environmental protection on environmental pollution: a case study of Taihu Lake, China’, International Journal of Environmental Research and Public Health, 15(12), pp. 1-12.

Manisalidis et al. (2020) ‘Environmental and health impacts of air pollution: a review’, Frontiers in Public Health, 8(1), pp. 1-6.

Non-tariff barriers and regulatory issues | United States trade representative (2021) Web.

O’Sullivan, M. (2017) ‘The expansion of the US stock market, 1885—1930: historical facts and theoretical fashions’, Enterprise & Society, 1, pp. 489-542.

Roe, M. J. (2012) ‘Capital markets and financial politics: preferences and institutions.’ Capitalism and Society, 7(1), pp. 10-19.

Sadashivam, T. and Tabassu, S. (2016) ‘Trends of urbanization in India: issues and challenges in the 21st century’, International Journal of Information Research and Review, 3(5), pp. 2375-2384.

Salmon, B. (2018) US trade barriers: the developing impact and international response | lexology: Web.

Stošić Mihajlović, L. (2016) ‘Functioning of financial and capital markets in modern conditions’, Journal of Process Management New Technologies, 4(4), pp. 1-22.

Sundaram, R. K. (2012) Derivatives in financial market development. London: International Growth Centre London.

Thakor, A. (2015). International financial markets: a diverse system is the key to commerce. Washington DC: Center for Capital Markets Competitiveness

United Nations (2016) ‘Developing domestic capital markets International Finance Corporation (World Bank Group)’ pp. 1-5. Web.

What are all of the securities markets in the US? (2021) Web.

Wurgler, J. (2010) ‘Financial markets and the allocation of capital.’ Journal of Financial Economics, 58(1-2), pp. 187-214.