Introduction

Recent decades have seen the transition of government structures from totalitarian regimes to democratic regimes. In the Middle East, this transition is ongoing because there is a political wave of reforms that has swept through North Africa and some regions of the Middle Eastern continent. This political wave has manifested itself in political reforms and demands for democracy. Already, three Middle Eastern rulers have been deposed from power as calls for democratic reforms continue to grow. Democratic reforms have brought a new wave of economic reforms which border along free market systems. In the Middle East, this economic reform has completely changed the role of the state from controlling natural resources to playing a facilitative role in economic development. Other parts of the world such as central Asia and Europe underwent the same transition in the 90s (The World Bank, 2007, p. 1). With the entrenchment of these governance changes, there has been a new attitude in public spending which several governments have adopted. Conversely, there has been a complete change of the tax policy administration. The change in tax policy administration encompasses fiscal policy governance.

In the fields of economics and political science, fiscal policy is the combination of government expenditure and tax collection methods to influence the economy. From a broader point of view, fiscal policy is contrasted to macroeconomic policies or monetary policies. Often, economists recommend the use of fiscal and monetary policies to influence the economic performance of a country (The World Bank, 2007, p. 1). The control of interest rates and public or government spending is one example of the power of fiscal policies on an economy. Fiscal controls ordinarily utilize two main tools: taxation and government spending. Often, various aspects of a country’s economy are impacted by fiscal policies. Some of these economic components include aggregate demand, economic level performance, resource allocation strategies and income distribution strategies.

This paper analyzes the influence of fiscal policies on the Saudi Arabian Economy. Saudi Arabia has witnessed tremendous changes in economic growth over the past few years, after the liberalization and diversification of its economy (Al-Jarrah, 2005, p. 1). Predominantly, Saudi Arabia’s economy is characterized by oil exports. In fact, among all OPEC countries, Saudi Arabia is the biggest oil exporter in the world (Al-Jarrah, 2005, p. 1). In addition, Saudi Arabia’s economy is among the leading economies of the Middle East. The country is an active member of the GCC and a global participant in economic and fiscal policy formulation. Saudi Arabia’s economic boom has largely been characterized by fiscal and monetary decisions made by its government. The question of whether fiscal policies directly influence the economic performance of a country is especially important in the Saudi Arabian case because it will be interesting to analyze the importance of fiscal policy changes on the growth of the oil and non-oil economic sectors. For instance, during 1969-2005, the Saudi Arabian government adopted several fiscal reforms that saw the contraction and expansion of the non-oil industry (Al-Jarrah, 2005, p. 1). These economic changes were coupled by changes in government spending and governance structures. These changes enable this study to track the alterations in fiscal and economic variables to assess the economic output of the Saudi Arabian economy in the short-run and the long run.

Motivation

During the early 90s, Saudi Arabia was perceived to be a poorly performing economy in the Middle East and indeed, the rest of the world (Library of Congress, 2006, p. 9). However, the country’s fortunes changed in the early 2000s. According to a United Nation’s (UN) report, it was noted that,

“Among developing nations, Saudi Arabia ranks 32nd out of 103 countries on the Human Poverty Index (an assessment of standard of living), ahead of most of its Middle East neighbors, and 77th out of 177 nations on the Human Development Index (a comparative measure of well-being and child” (Library of Congress, 2006, p. 10).

Before the 2000s period, a royal decree to establish the Supreme Economic Council of Saudi Arabia was established to transition the country’s economy from a traditional oil-reliant state to a modern economy of the 21st century (Library of Congress, 2006, p. 9).. Concisely, the Supreme Economic Council formulated and exercised different fiscal controls to affect the economic growth of the country. Despite increased oil revenues (due to high oil prices and increased oil productivity, from the advancement in production technology); Saudi Arabia still experienced high levels of unemployment and poverty, which were occasioned by the uneven distribution of oil incomes.

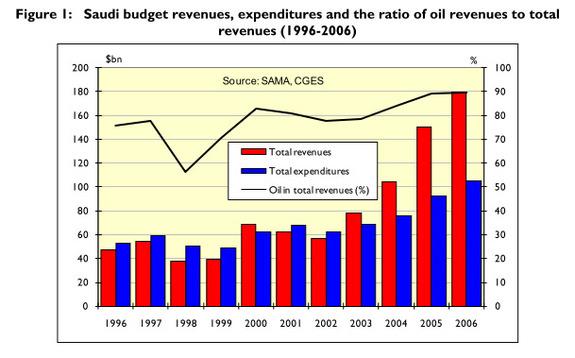

Before 2002, the Saudi Arabian government experienced huge budgetary deficits because of low oil production and low global oil prices. Furthermore, this budgetary deficit was fueled by the huge investments that the government made in offering consumer subsidies and increasing military spending (Library of Congress, 2006, p. 9). However, with increased oil revenues (from the year 2002), Saudi Arabia experienced budget surpluses. The following diagram shows the oil revenues for Saudi Arabia over the years

Consequently, the Saudi Arabian government was able to increase its government spending. For instance, in 2006, the Saudi government spent more than $90 billion in current and capital expenditures (Library of Congress, 2006, p. 10). This amount translated to a 20% increase in government spending, compared to the year 2005. The country’s oil revenues have therefore contributed to the fiscal policy implementation of Saudi Arabia’s economic strategies. Indeed, increased oil revenues have contributed to the improved financing of the country’s economic stimulus plans. However, Saudi Arabia’s spending and fiscal plans have been ambiguous. Precisely, Saudi Arabia’s fiscal policies and government spending have been witnessed in both social and economic sectors of the economy; thereby questioning the influence of social investments on the economic growth of the country. This dilemma prompts a further analysis in understanding the influence of fiscal policies on the economic growth of the country.

Saudi Arabia’s economic case highlights the importance of economic growth as an important component of the overall economic welfare of a country. However, many economists and policy makers still poorly understand the role of fiscal policies in influencing the economic welfare of a country. Partially, this dilemma is explained by the neoclassical growth model, which explains that the economic productivity of a country is determined by its growth in labor supply, technological change and the advancement of human resources (Turnovsky, 2004). Therefore, if a country operates in an environment where its fiscal policies support savings, there will be a positive capital-output relationship, which will further elevate the economic output of the economy. In this regard, changes in taxation policies have a profound impact on the economic performance of a country. With an existing body of knowledge suggesting that fiscal policies have a profound impact on the economic growth of a country, it is almost inevitable to study this relationship to understand the effects of such a relationship and its extent.

Problem Description

Saudi Arabia’s economy has largely been dependent on oil. In fact, Saudi Arabia’s economic boom was witnessed during the 2003 to 2005 period when global oil dependency increased and the price of crude oil soared. Saudi Arabia’s reliance on crude oil is therefore undeniable. The country’s natural oil reserves have been mentioned in previous sections of this study to be largest in the world. Considering the growing dependency on crude oil (especially in developing nations of the world), it is almost natural that Saudi Arabia’s economy is bound to grow due to increased oil revenues. Fiscal policies have been developed to ensure the country does not experience significant economic repercussions from fluctuations in global oil prices. These reforms are part of Saudi Arabia’s government resolutions after the 70s period of economic gloom (Library of Congress, 2006, p. 9).

The Saudi Arabian government continues to experience many challenges as it tries to diversify its economy from being oil dependent. The challenge is mainly experienced by the fact that the oil industry is still very profitable. In fact, oil reliance is expected to increase due to increased oil reliance from growing economies such as China, India and Brazil. However, the main problem observed from this trend is the possible growth of Saudi Arabia’s economy from the global oil boom as opposed to the effectiveness of the country’s fiscal policies plan. Due to this argument, there are suggestions that Saudi Arabia’s economy has grown in leaps and bounds, not because of effective fiscal policy solutions but due to increased global oil demand (Library of Congress, 2006, p. 9). Based on this suggestion, there is increased importance of analyzing Saudi Arabia’s economic growth viz-a-viz its fiscal policy plans.

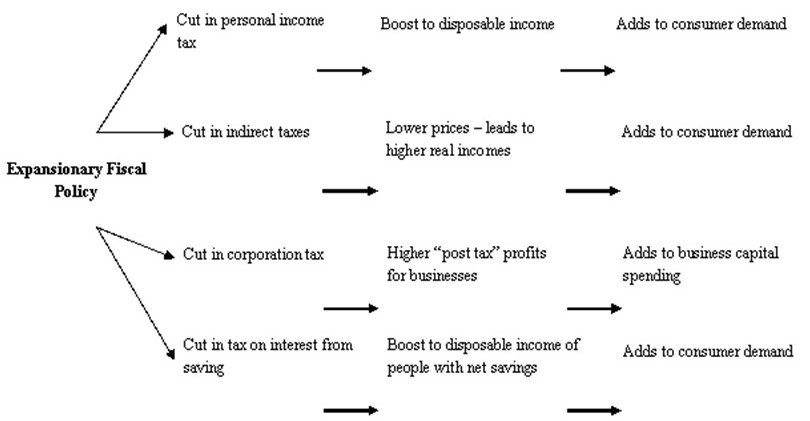

Nonetheless, despite the above arguments, the effects of fiscal policies are known to determine the patterns of our every day economic spending (Riley, 2011, p. 1). The following diagram exposes this relationship

In this regard, the extent of fiscal policy effects determines the way households and businesses spend their money. For a long time, fiscal policies have been associated with taxation, labor productivity, business incentive decisions, and aggregate demand. However, many scholars have contested the relation between fiscal policies and these economic indicators (Turnovsky, 2004, p. 3). For instance, the debate regarding whether taxation influences the incentive to work is controversial. This controversy is mainly fueled by the observation that economic growth is normally subject to a lot of issues. For instance, the common perception that progressive fiscal policies are automatically bound to result in increased economic performance is contested by some economists who identify that this assumption is mainly derived from studies that examine the impact of progressive fiscal policies on developed nations (Turnovsky, 2004). Often, such economists cite the dependence on Organization for Economic Cooperation and development (OECD) countries to do research studies on the impact of fiscal policies and economic growth as a strong weakness for the development of the above assumption. Their main concern emanates from the fact that OECD countries have a developed form of governance system that is characterized by sophisticated technology and highly skilled staff, while less developed countries do not have such types of competencies.

For instance, less developed nations are likely to have an undeveloped tax regime and a less effective fiscal policy outline to realize the same positive outcomes that fiscal policy strategies are said to have on economic growth and performances in developed countries. Therefore, the same positive relation observed between progressive fiscal policy strategies and economic growth may not be true for developing nations. This observation is especially supported by the fact that, developing nations are characterized by ineffective governance systems, corruption, poor policy formulation and such like poor governance vices which may ultimately lead to the realization of undesirable economic outcomes. For instance, corruption is known to lead to the disappearance of national resources, which would have otherwise contributed to progressive economic growth. Consequently, regardless of the effectiveness in policy formulation, a desirable economic outcome may not be realized if ineffective governance is existent. The same observation is also true if the size of government is analyzed because Joharji (2010) explains that the size of government determines the level of economic outcomes for fiscal policy strategies. Through this assertion, Joharji (2010) states that large governments are likely to experience a stronger and more desirable economic outcome from fiscal policy recommendations as opposed to smaller governments. From this understanding, there is a strong distinction between developing and developed countries when fiscal policy effectiveness is analyzed from an economic outcome point of view. Hence, there is a strong need to analyze every country, depending on the economic and governance characteristics of the country.

Certainly, in a world of increased globalization trends, the impact of a country’s fiscal policies may be severely undermined by global forces. These effects may go either way. For instance, if a government formulates fiscal policies to stimulate economic growth, a desirable output may fail to be achieved because of external economic forces, which are independent of the government’s influence. For instance, the ongoing European economic crisis may significantly affect countries that trade with the European Union, despite whatever fiscal policies that may be in place. Based on such observations, the extent that fiscal policies may affect a country’s economic output is debatable.

Some economists have also advanced arguments which purport that, fiscal policies may be ineffective in certain situations where there is a future anticipation of an economic event (Joharji, 2010, p. 4). This view has mainly been advanced by future-oriented consumption theories. For instance. When an economy is characterized by heavy government borrowing, there is a resultant trend that, people may expect increased government taxes thereby adjusting their spending patterns and savings accordingly. Often, in such a case, people tend to increase their savings. This analogy also exposes the ambiguity in determining the extent fiscal policies affect economic performances of different countries.

However, there are cases where fiscal spending is highly effective. For instance, it is understood that, in instances where economies experience recessions, fiscal policies are more effective in stimulating growth. The same observation cannot be expected by exercising monetary policies because monetary policies are known to be ineffective during recessions (Joharji, 2010, p 4). However, similar to other fiscal and monetary debates, some economists observe that monetary changes can still be effective in dictating the economic performance of a country through consumer and business spending.

Based on the above analogy, determining the extent of fiscal policy effects on a country’s economy varies depending on the circumstance. Saudi Arabia is not alien to this observation. Considering Saudi Arabia is a prosperous economy of the Middle East, it is crucial to understand the economic impact of fiscal policies on the giant oil producer. From this understanding, this paper intends to analyze the extent fiscal policies have influenced the economy of Saudi Arabia.

Formulation of a Hypothesis and Null Hypothesis

- H1o: Fiscal policy is not very important in stimulating economic growth.

- H1a: Fiscal policy is very important in stimulating economic growth.

Literature Review

“Whether government spending can boost the pace of economic growth is widely debated” (Joharji, 2010, p. 5). This is an assertion from Joharji’s article on fiscal policy and growth in Saudi Arabia. Theoretically, the neo-classical growth model holds the view that fiscal policies facilitate economic growth and determine the level of productivity in the end. Endogenous growth models outline that increased government spending often amount to improved economic projections due to spillover investment opportunities and increased qualities of human capital (Joharji, 2010, p. 5).

Governments that intend to stimulate aggregate demand, induce price stability, reduce unemployment and boost economic growth (depending on the economic objectives of the country) often use fiscal policies. The Keynesian theory supports this view because it explains that increasing government expenditure and reducing tax rates go a long way to stimulate aggregate demand (Joharji, 2010, p. 5). Often, in instances of slow economic growth (or recessions), governments employ appropriate fiscal policies to improve economic growth and boost employment levels. The recovery of increased government spending is often expected to be achieved through increased economic expansion and increased tax collections. However, fiscal policy controls are not only used in times of recessions or slow economic growth. If a country experiences high inflation rates, unstable currencies and similar economic conditions, fiscal policies may be used to stabilize prices by reducing aggregate demand.

Economists have however argued about the effectiveness of fiscal policies because the entire concept of crowding out is often controversial (Al-Jarrah, 2005, p. 1). This concept is controversial because economists observe that high government borrowing often leads to high interest rates, thereby offsetting the gains to be accrued as a result. For example, whenever a government experiences budget deficits, it will usually resort to internal borrowing or external borrowing. Internal borrowing is often realized in treasury bills and bonds. Therefore, if governments issues such bonds, there is likely to be a higher demand for credit in the economy (as people rush to buy these bonds), thereby increasing the cost of credit. Consequently, there is likely to be a lower aggregate demand for goods and services, which will be counterproductive to the ultimate goal of boosting economic growth. Neoclassical economists normally emphasize the crowding out controversy, but proponents of the Keynesian theory (who explain that fiscal policies are especially effective in instances where there is a liquidity trap) often dispute such arguments (Joharji, 2010, p. 5).

A classical point of view also observes that expansionary fiscal policies are likely to decrease the level of exports in a country because increased government borrowing attracts foreign investors due to high interest rates. This observation is factual because expansionary fiscal policies offer a higher return on investments, thereby attracting more foreign investors. Companies that intend to finance business projects are therefore forced to compete with their governments in securing capital because government securities already have a high rate of return. In addition, before foreign investors purchase government bonds from a given country, they must buy the domestic currency and therefore, when a country experiencing increased foreign capital inflows adopts expansionary fiscal policies, the demand for the country’s currency is likely to increase (Joharji, 2010, p. 5). An increased demand for the domestic currency is also bound to cause an appreciation of the domestic currency’s value. With increased currency value appreciation, exports from such countries are likely to cost more than they did before. Consequently, foreigners will have to pay more for such goods and the locals pay less for imports. As a result, the likelihood that exports will decrease and imports will increase is high.

There have been other arguments against the effects of fiscal policies on the economy because it is observed that the time taken to implement fiscal policies and the time taken to detect any desirable returns from the economy create an undesirable time lag (Al-Obaid, 2004). In such type of situation, an inflationary effect may be realized, although in theory, inflation should not be realized if fiscal expansionary policies use idle resources. For example, if expansionary fiscal policies lead to the employment of idle workers, no inflationary pressures should be witnessed. The opposite should be true if expansionary fiscal policies cause the increased demand of workers who are employed because the economy would demand more workers while the supply remains fixed. In this case, wage increases would be witnessed and price inflation would follow.

In the case of Saudi Arabia, Joharji (2010) reports that, government spending has seen increased investments in infrastructure and productive capacities but it has done little to stimulate growth in the Middle Eastern country. Instead, Joharji (2010) holds the view that administrative reforms and increased efficiencies of government entities have a bigger role to play in the prosperity of Saudi Arabia’s economy.

The research to determine the relationship between fiscal policy development and economic growth in the Middle East is not a new area of study. Previous researchers have studied this phenomenon by covering different fiscal measures and employing different time-series regression methods to comprehend the relationship between fiscal policy implementation and economic growth in the Middle East. As expected, many of these researchers reported varied findings. In a meta-analysis studying 41 papers and investigating the influence of fiscal policies on economic growth, it was established that 17% of the papers reported a positive relationship between fiscal policy effectiveness and economic growth (Nijkamp, 2004, p. 1). A further 29% of these papers reported a negative relation between fiscal policy effectiveness and economic growth. In addition, 54% of the papers’ findings reported an inconclusive relationship between the two variables.

The same findings reported a positive relationship between increased educational levels and increased infrastructure development on the economic growth of a country. This unanimity in findings did not reflect on the relationship between fiscal policies and economic growth (Nijkamp, 2004, p. 1). However, this observation is not strange considering different countries adopt different forms of fiscal policy recommendations.

Nonetheless, there was a common observation among these studies explaining that, any form of government spending was likely to have an impact on the economy (in one way or another) (Nijkamp, 2004, p. 1). For instance, infrastructure developments are known to increase a country’s economic performance because it improves the factors of production. The same observation is true for increased investments in education and health sectors because increased margins of human productivity are often experienced from increased investments in these sectors. However, through the same lens of analysis, some types of fiscal policies such as increased military spending and the adoption of subsidies do not have a positive impact on economic growth.

The experiences of Saudi Arabia’s fiscal policies have been evident in its government spending strategies and the balance of its foreign debt obligations with its national revenue. For instance, in 2009, the Saudi Arabian government boosted its national spending to overcome the global financial crisis (Joharji, 2010, p. 5). This objective was realized after the government increased its spending budget by 36%. Most of the spending had been directed to infrastructure and social service investments. Largely, the economic slack created by the 2009 global economic crisis was eliminated in this manner (Joharji, 2010, p. 5). In a recent report, the International Monetary Fund (IMF) hailed the fiscal policy strategies of Saudi Arabia’s government by explaining that they were largely progressive. In relation to this assertion, the IMF reported that, “Saudi Arabia confronts the current global crisis from a position of strength, reflecting a track record of prudent macroeconomic policies and structural reforms that have enhanced the economy’s resilience” (Information Office of the Royal Embassy of Saudi Arabia, 2011, p. 2).

In addition to a strong government response, Saudi Arabia posted a strong economic performance in 2008. This performance was largely attributed to the government’s actions regarding the economic conditions of the country. Concerning this economic boom, the Saudi Arabian non-oil economic sector grew by more than 4% (Information Office of the Royal Embassy of Saudi Arabia, 2011, p. 2). The country’s oil production also grew by another 4.4%. In response to these economic changes, Saudi Arabia’s inflation levels declined and the domestic debt reduced. In addition, the country’s foreign direct investments remained steady by posting figures of $23 billion in 2008 alone (Information Office of the Royal Embassy of Saudi Arabia, 2011, p. 2). A pioneer in Saudi Arabia’s robust economic performance was the country’s banking sector which posted impressive returns, thereby weathering the global economic crisis during the 2008/2009 period (Information Office of the Royal Embassy of Saudi Arabia, 2011, p. 2). Furthermore, the bank’s non-performing loans decreased significantly.

These economic results were the products of fiscal policy initiatives adopted by the Saudi Arabian government to stimulate economic spending. This was witnessed through a government stimulus plan that was designed to promote capital spending. Conversely, the stimulus package facilitated the diversification of the Saudi Arabian economy and the global economic recovery. In a similar report by the IMF, the Saudi Arabian government was lauded for increasing its capacity expansion despite experiencing falling crude oil prices (in the 2008/2009) period, thereby stabilizing the global oil prices (Information Office of the Royal Embassy of Saudi Arabia, 2011, p. 2).

Other fiscal economic reforms have also been witnessed in the education, judicial, environmental and financial sectors because these economic reforms were identified to contribute to the growing economic performance of the Middle Eastern nation. With such fiscal policies in place, Saudi Arabia has been ranked as the best performing Middle Eastern economy and the 16th best performing economy in the world (Information Office of the Royal Embassy of Saudi Arabia, 2011, p. 2).

In a study done by Al-Jarrah (2005), the effects of fiscal policy on the Saudi Arabian government were analyzed. The two variables were defense spending and economic growth for the period starting 1970 and ending 2003. Evidence of bidirectional causalities were established where higher military spending amounted to decreased economic growth. This relationship was not only established in Saudi Arabia but other developing countries as well.

A similar study by Al-Obaid (2004) to assess the impact of total government expenditure and Saudi Arabia’s GDP, it was established that increased public expenditure increases the level of GDP growth. This observation was representative of Wagner’s law, which affirmed the same relationship. However, it was also established that the methodology for measuring the size of government also had a significant impact on the level of measuring economic growth. For instance, if government expenditure were measured in form of size, then size would also be used to determine the economic growth of a country. However, if government expenditure was measured as a ratio of the country’s GDP, a negative correlation would be established.

Studies to assess the level of government expenditure on Saudi Arabia’s non-economic sector have also been done and it was established that there was a positive relationship between government expenditure and increased GDP in the non-oil sector (Al-Obaid, 2004, p. 4). This relationship was established after annual data for 1969-1997 were used. This study also revealed that if the government expenditure were increased by 1%, a 0.5% increase in the non-oil GDP would be witnessed (Al-Obaid, 2004, p. 4). Using vector auto regression, the same relationship showed that increased public investments did not amount to substantial output growth.

Analyzing previous studies to assess the impact of fiscal policies on Saudi Arabia, two shortcomings have been witnessed. First, most of the studies tend to analyze the short-run effects of fiscal policies as opposed to the long-run effects of the same. There is also a strong inclination to show that most of the studies only showed either a long-run or short-run relationship between fiscal policies and economic growth. Secondly, there is a limitation in analyzing the long run budget constraints. This limitation is supported by the fact that government expenditures have to be balanced by government revenues in the end (Al-Obaid, 2004, p. 4). Due to this balance, there is a high likelihood that the effects of fiscal policies on long-term growth of a country are overstated. For instance, Bose (2003) examined the effects of fiscal policies on different economic sectors (education and health) and investment types (consumption and investments) then noted that, government investments on education and health (coupled with overall capital spending) had a positive impact on the economic growth of a country.

The Saudi Arabian experience can be compared to studies done by The World Bank (2007) to investigate the impact of fiscal policies on the economic growth of Eastern Europe and Central Asian states. The early 90s saw the slowdown of economic growth in Europe and central Asia but these economies soon revamped back to a period of economic boom towards the end of the 90s period. The transition from a period of economic gloom to a period of economic boom saw central Asia and Europe uplift more than 58 million people from poverty (The World Bank, 2007, p. 1). Part of this success was largely attributed to the fiscal policy recommendations adopted by most countries in these regions during the 90s period. For instance, there were several public finance reforms and a decline in government spending, in line with the new roles of the state during the same period. Complementarily, tax revenues increased, due to an increase in the efficiency of tax administration strategies. Fiscal deficits have also been rarely experienced because there has been a cap on spending while national revenue have remained steady over the years (The World Bank, 2007, p. 1). Consequently, public debt ratios have significantly decreased. Currently, fiscal deficit reports in most Eastern and central Asia states are lower than the fiscal deficit reports in most western European states (although the level of fiscal policy reforms have lost momentum in some central Asian and eastern European states). Current recommendations explain that if Eastern European and central Asian states are to realize decreased levels of fiscal debts, they need to consolidate their fiscal policies (The World Bank, 2007, p. 10).

Nonetheless, fiscal policy reforms have elevated Eastern European and central Asian states to be leaders among their peers because their levels of per capita income are among the highest in the world. Southeast Europe and central Asia now hold some of the largest governments. In fact, their primary public expenditures are about 40% of their GDPs and their public spending is nearly half of their GDPs owing to the huge investments made by these governments in social protection schemes (The World Bank, 2007, p. 1). This observation mirrors the Saudi Arabian experience.

Methodology

This research uses mixed methodology. However, the major mode of research data to be used will be secondary research data. In this regard, there will be extensive research done to ascertain information about the economic growth of Saudi Arabia, viz-a-viz its fiscal policies, through existing documents like textbooks, journals and the likes. Through this research data, there are several advantages that will be derived. For instance, it will be more cost-effective to undertake secondary research data than primary research because it is cheaper to undertake primary research as opposed to secondary research. From this understanding, the sourced data is also easier to obtain, quick to obtain and very useful in accumulating research data relating to understanding democracy in Africa.

Mainly, the secondary research data to be used includes research information from Saudi Arabia and the Middle East. This information will be in the form of directories, databases, country reports and the likes. These data sources may include research data relating to government reports; online research data; academic sources of data and commercial sources of data. To obtain some of these data, frequent visits were made to general and specialist libraries. However, progressively, data analysis tools were used to evaluate historical and current information about Saudi Arabia’s economic growth to predict the effects of fiscal policies on the country’s economy. This section of the research methodology is part of the descriptive research design adopted in the study. Through this research design, a formal, objective, and systematic analysis of information regarding the research question was analyzed to uncover new facts and meaning regarding the research question. Emphasis was therefore made to observe, describe and document important issues regarding how fiscal policies have affected the Saudi Arabian economy. As a statistical application tool, this study categorized research data into descriptive, exploratory and confirmatory research data, so that hypotheses could be developed about the target market, or alternatively, hypotheses can be confirmed.

Results

The total economic gain from an increase in government revenue for the non-oil sector is estimated to be 0.66% for every 1% of government expenditure. This is the statistical relationship, which is significant for this study. A time trend relationship is also significant in analyzing the fiscal policy impact on the Saudi Arabian economy because technological advancements and other exogenous factors have a profound impact on economic development. Though there is evidence suggesting that there is a negative relationship between increased government expenditure and GDP in the long-term, this statistical relationship is insignificant.

The statistical significance level for non-oil GDP growth is slated at 5% to mean that short-run economic gains from increased government expenditure is mainly realized in the non-oil sector (Joharji, 2010, p. 6). This statistical relationship is representative of the effort by the Saudi Arabian government to diversify its economy from a predominantly oil-reliant nation. However, the positive relationship between increased government expenditure and increased GDP outcomes is divisive across different periods. For instance, the GDP growth for the non-oil sector peaks at one year of fiscal policy implementation and grows over the next couple of years to level out thereafter.

Shocks to government expenditure also play a crucial role in explaining the variations to non-oil GDP for the medium and long terms. These shocks tend to be statistically minimal in evaluating GDP variations for the first one year of fiscal policy implementation but its significance tends to increase as time goes by. For instance, during the first year of forecast, there is a 3.7% error of forecast for non-oil GDP but this percentage increases to 71.3% in five years and 81.3% in 10 years (Joharji, 2010). This analysis affirms the earlier observation that increased government spending has a positive relationship with increased GDP in the non-oil sector. This analogy shows that current and capital expenditure are determinants of non-oil GDP.

The only unique situation that completely results in no increase in GDP growth is when the government increases its expenditure in military or white elephant projects. This kind of expenditure is also seen to contribute to the variation in GDP levels after fiscal policies are implemented. From this observation, there is a strong need to differentiate government expenditure into productive and non-productive expenditures.

Discussion and Conclusion

Weighing the findings of this study, we can conclude that progressive fiscal policies amount to increases in GDP for Saudi Arabia. This analysis holds true despite the kind of expenditure (whether it is aggregate, capital or investment). These findings are consistent with other studies done on Saudi Arabia that show there is a positive correlation between progressive policy implementation and increases in GDP. Interestingly, this paper points that that current government expenditure yields a higher GDP output than capital expenditures. Conceivably, this observation may draw the link between public expenditure and non-growth opportunities in the economy. From a growth perspective, it is therefore important to allocate public expenditure to improving and maintaining infrastructure so that this factor of production spurs more growth. This approach would be more appropriate as opposed to allocating public funds to new projects with uncertain returns on investments. However, because procedures for classifying capital expenditure are not broken down to the different categories of spending, it is very difficult to highlight the different components of public expenditure, which do not spur growth for the Saudi Arabian economy. A more categorical distinction of public expenditure would ensure there is a more distinct approach to understanding how fiscal policies influence the economic outcome of Saudi Arabia.

Throughout the entire analysis, the role of the Saudi Arabian government in uplifting the non-oil sectors of the economy should also be acknowledged because the Saudi Arabia is directing many resources to the non-oil sector and shifting its fiscal policies to encourage the growth of the private sector. Acknowledging the need to encourage the growth of the private sector in stimulating growth in the non-oil sectors of the economy, the synchrony between private and public sector participation to achieving long-term economic growth should also be considered. In addition to improving the fiscal policy framework to encourage more private sector participation, the government should ensure its efforts to reform the structural framework of the economy work towards diversifying the economy and deepening the scope of the financial markets. Furthermore, the government should ensure price distortions are eliminated and the efficiency of the public sector is improved. If these actions are implemented, and more foreign investors are allowed to participate in the country’s economy, there is a good probability that the Saudi Arabian economy will grow and diversify. This link between economic growth and the government’s influence shows that fiscal policies play an important role to the economic growth of Saudi Arabia.

Clarification of Concepts and Terms

Fiscal Policies – Fiscal policies are government policies and strategies that influence the macroeconomic conditions or performance of a country. Often such interventions are non-monetary and they usually include tax measures and government spending policies, which are aimed to control the performance of the economy.

Monetary Policies – Monetary policies define the regulation of interest rates and the money supply in the economy. Usually, monetary policies are used to control inflation and stabilize the currency of a given country.

Gross Domestic Product (GDP) – GDP refers to the total value of all goods and services in an economy (measured annually)

References

Al-Jarrah, M. (2005). Defense Spending and Economic Growth in an Oil-Rich Country: The Case of Saudi Arabia. Pakistan Economic and Social Review, 43, 151-166.

Al-Obaid, H. (2004). Rapidly Changing Economic Environments and the Wagner’s Law: The Case of Saudi Arabia. Fort Collins, Colorado: Colorado State University.

Bose, N. (2003). Public Expenditure and Economic Growth: A Disaggregated Analysis for Developing Countries. Manchester, United Kingdom: University of Manchester.

Information Office of the Royal Embassy of Saudi Arabia. (2011). IMF Report Commends Saudi Fiscal Policies. Web.

Joharji, G. (2010). Fiscal Policy and Growth in Saudi Arabia. Web.

Library of Congress. (2006). Country Profile: Saudi Arabia. Web.

Nijkamp, P. (2004). Meta-Analysis of the Effect of Fiscal Policies on Long-Run Growth. European Journal of Political Economy, 20, 91-

124.

Riley, J. (2011). The Microeconomic Effects of Fiscal Policy. Web.

The World Bank. (2007). Fiscal Policy and Economic Growth. Web.

Turnovsky, S. (2004). The Transitional Dynamics of Fiscal Policy: Long-Run Capital Accumulation and Growth. Journal of Money Credit and Banking, 36, 883-910.