Introduction

The general influence of globalization has seen increased integration of the global community as well as interdependence. The demand for foreign currency is on the rise. Governments have the demand for foreign exchange reserves to ensure economic stability. For more and more engaged of Australia and US in trade activities and its additional extended international trade between the two nations. The research between the two countries is of significance.AUD represents a driving fluctuation for long period, and has a total increased trend since March of 2001 (Piana, 2001).

But in recent two years, this currency represents an anomalistic change after the influence of international economic crisis of 2008, the value of AUD has complicated and confusing. In order to examine the trend of AUD in future, this writing analyzes exchange rate trends between AUD and USD over the past ten years. It is important to note that USD and AUD are the most traded and the 5th most traded currency in the world (Piana, 2001). The rise of AUD as a global trading currency is largely motivated by the large interest rates in Australia. Factors considering in analysis of these trends include raw materials prices changes, relative domestic price level and import-expert changes, relative interest rate changes, and any other appropriate factors.

Trend analysis

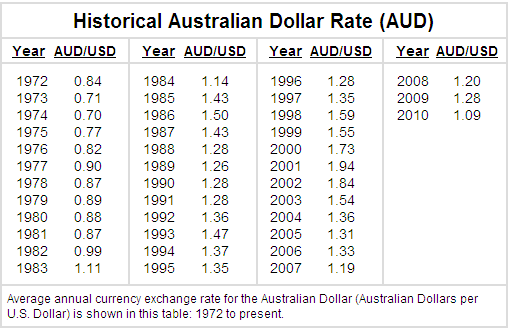

The attached graph below shows an exchange trend between the two currencies over a long period of time (figure 1).

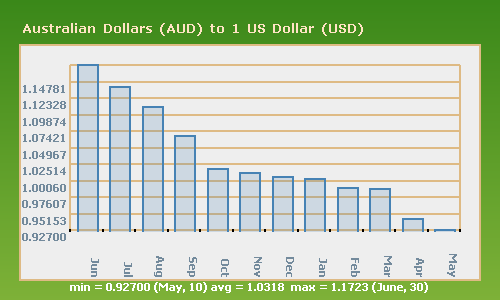

The general picture shows a continuous gain by AUD over the dollar from the period ranging from 2001 to 2007. In 2007, there is a slight decline in decline as the USD slightly appreciates against the USD. However, in 2010, the USD picks up strongly against the USD to retain its positive growth trend (Piana, 2001). The past twelve months results have further seen AUD gain marginally against the USD as illustrated in the graph below:

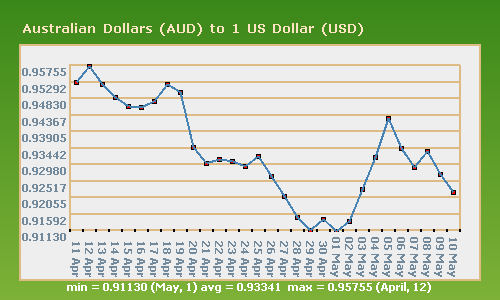

The same trend is replicated by daily trading graph over the last 30 days.

The trend of AUD in ten years indicates Continuous appreciation against the USD as earlier mentioned. However, some mid-times have seen some level of depreciation. An evaluation of the trends however shows a generalized trend in long run evaluations (see figure 1 & 2). This is however not the general scenario presented by short-run evaluation where increased fluctuations are observed see figure 3). Despite these fluctuations though, a best fit line would still indicate that the AUD is gaining over the USD strongly.

In general, short-term yields light-rising similar in trend to middle term. However, long term indicates a summary rise in strength of the AUD over the USD. However, it’s important to note that under the floating exchange rate system, money is volatile and determinants by the law of supply and demand also. There are many factors inducing the changes of supply and demand of money, so the market equilibrium of money can be influenced. These influences are so complex, any factors which change the money supply and demand, can be going some way affect the exchange rate, but some are strong, some are weak.

Economic and financial explanations of the past trends

Trading patterns between US and Australia

The United States plays a major role in the Australian economy. The trade and investment relationship with the US is more dynamic than with any other major trading partner (Kipici & Kesriyeli, 1997). The US supplies one third of all foreign investment. It is the largest single country source. Australia is host to about 4 per cent of US foreign investment, similar to the share of US investment in Mexico and Japan (Kipici & Kesriyeli, 1997). Trade and investment between Australia and the US has accelerated in recent years. Australian exports have experienced strong growth to the US, particularly in elaborately transformed manufactures and wine exports. Over the past five years, merchandise exports to the US grew by more than exports to any other major trading partner.

The US also remains the single most important partner for trade in services, making up almost two thirds of Australia’s services trade. As with goods, services trade with the US has grown more rapidly than with other major trading partners in recent years. Foreign investment from the US has been growing at an annual rate of 25 per cent, compared to 17 per cent for investment from all sources over the last five years (Kipici & Kesriyeli, 1997). The United States is now host to over 50 per cent of Australia’s overseas investment abroad, having surpassed the UK to become the largest destination for Australian foreign direct investment in 1998. Australia ranks eighth among foreign owners of US assets and eleventh among destinations for US foreign investment. Australia, being only 4 per cent the size of the US economy is less important to the US as a trading partner.

Financial exchange rates

Trends in exchange rates between AUD and USD have been motivated by various factors. As already mentioned Australian dollars always maintain high interest rates. High interest rate attract for foreign capital to flow in. When the real exchange rate in Australia higher than that of US, foreign capital is interested to make financial investment, causing a rise in AUD demand, and hence appreciation. Conversely, when USD currency exchange rate rises higher than Australia, AUD depreciate. According to Deustsche bundesbank (2005) supports the view that,

“Exchange rate movements, after all, (and) are likely to be affected by financing and investment decisions taken by international investors. Shifting funds borrowed in a low-interest currency into a higher-interest currency should tend to cause the latter to appreciate (Simpson & Evans, 2004).”

The effect of interest rates in currency changes in relation to AUD and USD cannot be best illustrated by the figure below;

Series one represents financial interest rates in the US while series 2 represent financial interests rates in Australia. The figure offers tool for comparison of the changes in interest rates in Australia against the US and correspondingly the changes in currency exchange rates. It’s important that starting in 2008 to 2009, the interest rates in Australia slightly declined against that in the US and similarly, the USD gained marginally against the AUD. Generally, it can be seen that the exchange rate of AUD against the dollars gained when the financial interest rates rose. Some level of proportionality may be assumed if all the other affecting factors were to be considered constant (Ellis, 2001). In practice, the relationship between financial interest rate differentials and exchange rate variations are more complex as simple models would illustrate.

In year 2000, US adopted a high interest rate policy, resulting into a dramatic rise in USD over AUD resulting into AUD’s depreciation despite the higher financial interest rates (Ellis, 2001). It’s not always that a rise in financial interest rates would result into a gain in currency exchange; other factors also have an influencing power on the currency exchange trends.

Relative domestic price level and import-expert changes

Australian and US export demands vary for a various reasons. Changes in domestic pricing within the respective countries as well as the trading terms largely affect currency exchange rates. These two variations tend to have immediate impact on the AUD and USD (Blystone, 2006). When domestic price increase, or rise rapidly in Australian but remain constant or rise slowly in the United States, Australian consumers need more foreign consumptions because they are cheaper, these cause the imports in Australia to increase, and hence increased for foreign currency, dollar included; in same time, US need less high-priced Goods from Australia, causing exports decline to US from Australia. Based on demand supply theory, AUD’S value will most likely decline against the dollar.

Conversely, when domestic prices decreased than that in the US, the imports decrease and exports increase, Australia will require reduced foreign currencies but foreigner need more AUD’s, and hence UD will appreciate. Simpson & Evans (2004) in their article used the Cranger causality method combined with error correction modeling and VAR analysis, and their results indicate that the evidence is stronger that “commodity price changes lead AUD exchange rate changes; (and) there is a significant negative short-term relationship between local commodity price changes and exchange rate changes in Australia (Blystone, 2006).”

A best illustration of this is shown by the commodity pricing index of the two countries over the same duration. The US/Australian CPI has been on the decline since 2001. Although fluctuating, the general picture indicates a reducing trend over the years as shown by graph attached below. The graph is based on the CPI figures since 2001 to 2010.

Interestingly in 2008 when the CPI increased, the gain of the AUD over the USD similarly declined that confirming the effect of CPI on AUD/USD exchange rates.

Other factors

Factors affecting exchange rates are however not limited to the above-mentioned, tourism, bank and firm lending, and overseas payments also influence currency change rates across the two nations (Reserve Bank of Australia, n.d). Although often mentioned by various researchers as influencing exchange rates, no clear link exists between the GDP in the US and Australia and the currency exchange rates of similar period of time (Crosby, 2005). Australian tourists going to US or Australian investors investing in the US influence the nations currency demand either positively or negatively.

Vice-versa is true. Government and politics also play a critical role in influencing currency exchange rates in the US and Australia. For instance, the US adoption of high financial interest’s policies in 2001 led to a gain of its currency over the AUD. Similarly, The Reserve Bank of Australia is allowed to intervene Foreign Exchange Market and implement policies designed to influence AUD value with regard to the level of inflation and the nation’s macro-economic economic stabilization. The economic crisis in 2008 saw a decline in value of AUD over the USD.

In general, on basis of the afore-discussed factors, it can be concluded that AUD’s exchange rates against USD has been subject to various fluctuations over the period under study and this has been a result of interplay of various factors. These factors are either competitive or complex. Such include changes in raw material prices, the relative domestic price levels, and the variations in imports and exports. Interest changes also play a critical role in determining currency trend changes. Forecast in currency rate changes between the USD and the AUD should therefore incorporate these factors into forecasting (Crosby, 2005).

According to the driving Australian economic growth, the high interest rate of Australian currency, the increased demand of raw materials worldwide, the lower rate of employment, and any other positive factors, the exchange rate of AUD will steadily but increased slowly.

Forecasting of future paths of the exchange rate

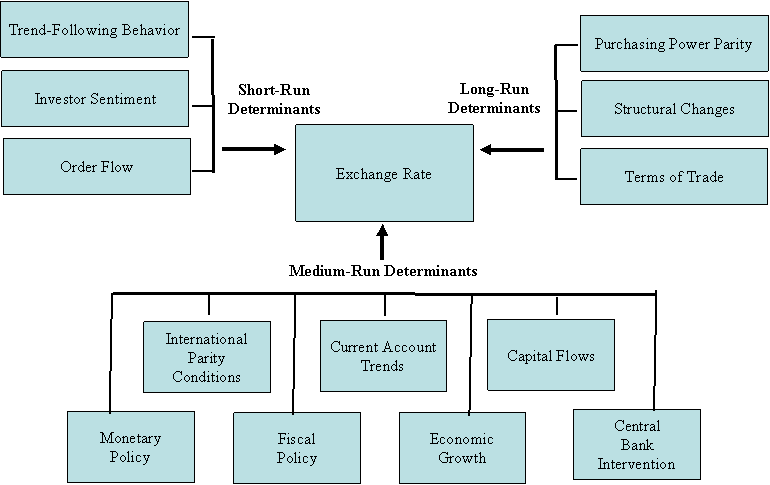

Forecasting future currency exchange rates should always take note of various factors which affect exchange rate (Fung, 2008). Forecasting can be done on short-term, long term and medium term ranges. The figure below indicates factors which mostly affect forecasting of currency exchange rates.

Short-Run Forecasting Tools

Short-term variations are often difficult to forecast and are a factor of bandwagon effects, reaction to instantaneous occurrences e.g. news, and technical analysis (Yin-Wong, Menzie, & Ian, 2000). Trend following behavior are often common in exchange rates where a rise is more likely to be followed by another rise until such time that anther factor comes into play. Investment based sentiment in forecasting comes into play when there is some level of consensus within the market. Additionally, some instances evidence a positive correlation between spot exchange rate trends and flow of orders into the dealer’s market (Fan & Richard, 2003).

Long-Run Forecasting Tools

Often a number of techniques are adopted in long-term forecasting. It is often assumed that commodity prices should be similar between two nations and hence the exchange rate between the two should equal the ratio of commodity prices between the two countries (Fan & Richard, 2003). Forecasted commodity prices can therefore be used effectively to forecast future exchange rate trends. This technique is often referred to as Purchasing Power Parity (PPP) (This concept is repeated in the next section). This is mathematically represented below;

The relative changes approach states that the rates of exchange will tend to offset national interest rate differences.

Medium-Run Forecasting Tools

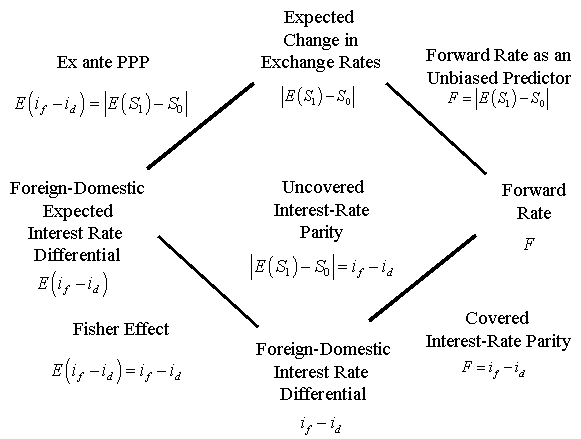

Medium run forecasting also endeavors to take into consideration various parity conditions. These include purchasing power parity, interest rate parity, fisher effects and forward rates of exchange (Fung, 2008). Cross-national parity conditions are best illustrated by the diagram below;

Projected forecast in currency trends are as indicated below

Based on the changing trends between AUD and USD, it would be appropriate to advice intending investors to invest more in AUD given its prospective continued growth against the USD.

References

Australian Bureau of Statistics. n.d., Statistics. Web.

Blystone, D. (2006). The relationship between commodities and the foreign exchange market. Web.

Crosby, M. (2005). Pricing to market and volatile AUD and USD. Australian Journal of Management, 30(1), pp. 456-478.

Deustsche bundesbank. (2005). Exchange rates and interest rate differentials: Recent developments since the introduction of the Euro. Web.

Ellis, L. (2001). Measuring the real exchange rate: Pitfalls and practicalities. Web.

Fan, M. & Richard, K. L. (2003). “Customer Trades and Extreme Events in Foreign Exchange,” in Essays in Honor of Charles Goodhart, Paul Mizen (ed.), Edward Elgar: Northampton, MA, USA, pp. 160-179.

Fung, L. (2008). Large real exchange rate movements, firm dynamics and productivity growth. The Canadian Journal of Economics, 41 (2), 391.

Kipici, A. N. & Kesriyeli, M. (1997). The real exchange rate definitions and calculations. Web.

Piana, V. (2001). Exchange rate. Web.

Reserve Bank of Australia, n.d. Statistics. Web.

Simpson, J. L. & Evans, J. (2004). Commodity exporting countries and exchange rates: Australian evidence. Derivatives Use, Trading & Regulation, 10(1), pp. 231-245.

Yin-Wong C., Menzie, D. C. & Ian, W. M. (2000). “How do UK-Based Foreign Exchange Dealers Think Their Market Operates?” NBER Working paper 7524 cited in Rosenberg, Michael R. (2003) Exchange Rate Determination, p. 8.