Introduction

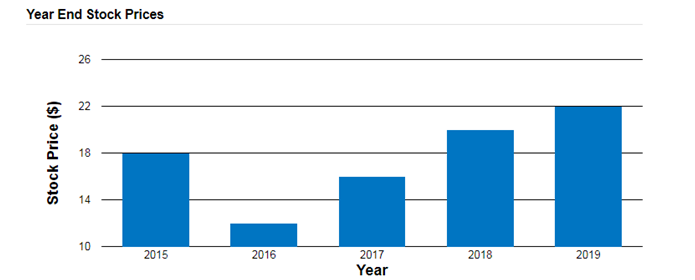

Financial analysts use various models and theories to calculate share prices. Such an exercise is possible since investors are usually expected to act without any form of bias and rationally. Nonetheless, a wide range of aspects will affect share price, including prospects and current organizational performance. Guess’ share prices have been increasing steadily since 2016. This company operates in the fashion industry and it markets its products in different parts of the world. For instance, the average stock price for 2017 stood at 16 USD while the one for 2018 was 20 USD (see Figure 1).

The adjusted price for the year 2019 was 22 USD (see Figure 1). This information reveals that the company has not been performing fairly within the last three years. This is true since Guess was recording a share price of around 50 USD towards the end of the last decade (Novotová 2016). However, there are specific issues or problems that could have been identified and resolved to improve this organization’s performance and make it a leading competitor in the industry.

Factors Affecting Share Price Movements

The apparel industry is characterized by various problems that affect the profitability of different competitors. Since 2016, Guess has faced a number of issues that have been influencing its share prices (Guess 2020). For instance, this company operates in a sector that has many established companies that offer high-quality clothes to different customers across the world, such as Adidas, Hugo Boss, Zara, Nike, and Uniqlo (O’Connell 2019).

The presence of these organizations in the industry has resulted in increased levels of competition within the past four years. Such players can attract more customers using their products, thereby affecting Guess’ performance. The leaders at Guess’ have been keen to consider various strategies to overcome this problem and improve its share price.

The second force or problem that has affected share prices within the past three years is the difficulties recorded in the global credit markets. O’Connell (2019) argues that the conditions recorded in the economy tend to affect business partners, customers, financial institutions, and insurers. When the environment for doing business remains unpredictable, investors tend to avoid shares issued by poorly performing companies. Disruptions in various markets and distribution channels have continued to disorient this organization’s ability to meet the demands of different clients. Such unpredicted changes in financial markets have affected liquidity and operations, thereby affecting the steady growth of share prices. The demand for Guess’ shares has not been growing or increasing as initially predicted.

The effectiveness of managerial tendencies in a given organization will determine the way things are done and how it realizes its business objectives. Within the past five years, leadership struggles and troubles have made it impossible for Guess to make considerable improvements or attract additional investors (Trading basics- factors that influence share prices 2018). Poor management affects brand share price by reducing the morale of both employees and other stakeholders. This kind of development will result in low profitability and demand for shares. Coupled with ever-changing market trends, this challenge has resulted in a situation whereby Guess’ goals have become unattainable.

This problem also explains why poor managerial strategies led to a sharp decline in this company’s overall valuation to stand at 1.4 billion USD in 2019 (Guess 2020). Due to the nature of this predicament, it has been critical for leaders to consider a powerful strategic plan to ensure that the desired level of growth is achieved. Such a move will have a significant impact on share price and make Guess a leading competitor in the global apparel industry.

Recommendations

Guess needs to consider and implement evidence-based strategies in an attempt to improve its share price performance. Based on the current situation, a powerful business model is critical to ensure that this corporation expands its operations, increases its offerings, and engages in continuous research and development (R&D) to deliver high-quality products that resonate with the demands of the targeted customers.

This suggestion means that the leaders at Guess’ can hire competent professionals to improve the way clothes and other products are manufactured, packaged, advertised, and delivered to the buyers. The concept of improved R&D will result in superior clothes and shoes that can satisfy the needs of every potential customer (Taube & Warnaby 2017). This recommendation is critical since it will improve the overall acceptance of this brand and eventually overcome the challenge of competition. With increased profits and earnings, chances are high that the share price will be above 26 USD and increase continuously.

The above section has indicated that Guess has not been performing effectively due to the nature of the global economy. This corporation, therefore, needs to widen its operations and attract more customers in different regions. Since the current operations have been concentrated in North America, Guess can identify emerging markets, such as Asia, Latin America, the European Union, and Africa (Guess 2020). This recommendation will attract more customers and eventually maximize profits. Consequently, the challenges associated with the trends recorded in the economy will be diluted (Cimino 2019). The possible outcome is that the company’s share price will increase significantly.

The final recommendation that can change the current situation revolves around transforming the nature of management at this company. Rastislav and Petra (2016) reveal that the efforts or inputs of a leader in a given organization can have recognizable impacts on the overall performance. The board can consider the need to hire a competent manager who has what it takes to introduce a superior strategic plan that can take Guess’ from one level to the next. Such an individual will transform operations, mentor his or her followers, introduce a better work ethic and eventually improve performance (Singh, Darwish & Potočnik 2016).

The leader will identify potential barriers to growth and the factors influencing share price movements. When the management profile is comprised of professionals with a positive track record, the percentage of share prices will increase (Dangi et al. 2017). These changes or recommendations will ensure that this company becomes a real force in the global apparel industry.

Conclusion

The above discussion has identified Guess as a competitive company in the fashion industry. Although its share price increased slightly from 2017 to 2019, there are various problems that affected its overall performance and profitability during the same period. Identifying professional leaders, implementing a superior business model, and expanding its operations are evidence-based recommendations that will ensure that Guess’ share prices stabilize in the future. These achievements will make it more successful and continue to deliver high-quality products to its customers.

Reference List

Cimino, A 2019, Why Guess? shares might return to style in 2020. Web.

Dangi, MRM, Latif, NEA, Baharum, Z & Noor, RM 2017, ‘Leadership quality and competency towards investor valuation and firm performance’, Journal of Advanced Research in Business and Management Studies, vol. 7, no. 2, pp. 55-68.

Guess 2020. Web.

Guess: investor info 2020. Web.

Novotová, J 2016, ‘Determining the categories of fashion by price and quality from a consumer point of view’, Journal of Interdisciplinary Research, vol. 6, no. 2, pp. 70-77.

O’Connell, L 2019, Number of Guess, Inc. stores worldwide in 2019, by type. Web.

Rastislav, R & Petra, L 2016, ‘Strategic performance management system and corporate sustainability concept – specific parametres in Slovak enterprises’, Journal of Competitiveness, vol. 8, no. 3, pp. 124-124.

Singh, S, Darwish, TK & Potočnik, K 2016, ‘Measuring organizational performance: a case for subjective measures’, British Journal of Management, vol. 27, no. 1, pp. 214-224.

Taube, J & Warnaby, G 2017, ‘How brand interaction in pop-up shops influences consumers’ perceptions of luxury fashion retailers’, Journal of Fashion Marketing and Management, vol. 21, no. 3, pp. 385-399.

Trading basics- factors that influence share prices 2018. Web.