Introduction

Auditing is one of the major and important parts in accounting and it refers to the evaluation of a company or business entity to check on different functions whether they are working appropriately. Auditing plays an important role in evaluation of business entities as well as other institutions in the society. Auditing is most cases is carried out on local government management and financial operations within different sectors. Different financial systems can be used in auditing financial firms against any financial problems that might arise in the firm.

Escali financial system

This is type of a financial system that is usually practiced and that plays an important role to the financial institutions that practice it. The system helps in controlling all financial activities. The system works in such a way that it automates most of the routines and calculations that are usually carried out in most financial institutions. Also the system can be integrated with other software products, for instance the accounting systems within different financial institutions. It is mostly used by businesses that have loans and invest in financial instruments or make use of derivatives. (Financial systems, 2009)

Escali financials are made to automate and increase the efficiency of financial management in any given financial or non financial organization or firm.

Procedure

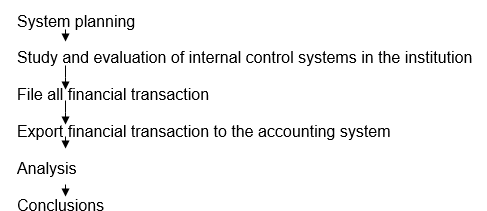

The procedure that is usually followed by Escali financial system is not very much complicated. The steps are as follows;

System planning

The first and major step in Escali financial system is coming up with a plan based on the kind of activity to be carried out and the type of institution under investigation. System planning involves first having the auditing team which is to carry out auditing. To come up with the plan the first thing is for the team to familiarize itself with the auditor’s operations which is usually done by reviewing of the permanent files that are found in headquarters of that given institution. The reason for this is that the team will be in a position of soliciting important information that can be used to carry out the work. (Financial systems, 2009)

Study and evaluation of the internal control

After system planning on how to apply the system in the given institution; study and evaluation of the internal controls that are used by the institution to know exactly the point at which the financial system should be applied. Study and evaluation of the internal controls are very important in the Escali financial system, this is because the internal control systems that are used by the given institution play a great role in implementing the system in the institution. (Financial systems, 2009)

The study and evaluation of the internal controls in the given institution can be done through different ways. The first thing that is used is questionnaires whereby they are applied to the respective people within the given institution. Internal auditing is usually done which involves internal control systems. Internal control refers to a system under which employee duties, records and procedures are developed in a way that makes it easier to exercise effective controls over assets, liabilities, revenues and expenditures within that given institution.

File all financial transactions

All the financial transactions that take place within the institution are filed under one file, this is to enable easy accessibility of the information and retrieval for auditing. The transactions are filed in a certain order such that it is easier to trace each and every transaction that has been recorded. Through orderly filing it becomes easier to track any irregularities and where they might have taken place. (Efficient financial systems, 2009)

Export financial transactions to the accounting system

After the financial transactions have been filed in an orderly manner they are then exported to the accounting system. This is done to ensure that the transactions are in order with the information that is provided by the accounting system. This is very important since when the transactions do not match it becomes easier for the auditing team to start investigations on what may be the reason for that. (Efficient financial systems, 2009)

Exportation of the transactions files can either be done manually or electronically. Where there is an efficient computer system it is easier for the transactions to be exported to the accounting system electronically. This helps in saving time and increasing accuracy and efficiency of the operations taking place. There is also another advantage of using Escali in that it helps in getting rid of paper work as well as carrying out manual calculations.

Analysis

After the information and transactions have been transferred to the accounts department then analysis begins. All the data provided is analyzed carefully then conclusions are made regarding whether the financial transactions are properly carried accurately and efficiently or not.

Conclusions

Based on the outcome of the analysis then conclusions are made regarding whether everything is carried out properly or not. After this then the necessary recommendations are made and actions are taken to correct what might be wrong.

Reasons for Applying Escali Financial Systems

There are main reasons of applying Escali financial systems in the internal control systems in any given institution that include;

Prevention of fraud and wastage in the system, this is because there may be fraud actions or wastage of resources that take place within the system such that when investigations are carried out they can be revealed. (Baysinger, 2008)

To ensure accuracy of the accounting and other operating data, auditing of control systems plays great role in ensuring that the accounting operations that are carried out in the institution are accurate to ensure financial compliance. (Baysinger, 2008)

Promotes adherence to the stated policies, internal systems are designed in such a way that they adhere to the stated policies within the given institution. Auditing helps to check whether the internal systems follow and adhere to these policies for the institution to function perfectly. (Baysinger, 2008)

Further the efficiency of operations, it ensures that there is high efficiency in the operations that take place within the institutions. This is because it helps in identification of irregularities hence the being in a position to correct and to enhance efficiency. (Baysinger, 2008)

Ensure conformance with the applicable laws, through auditing the different laws and regulations for different areas are identified and investigations are done to check whether they are followed or not. Through this it becomes easier for the laws and regulations to be adhered to since audits are done regularly. (Baysinger, 2008)

Escali Financial System control objectives

First it is aimed at identification of information independently without interference of any other department or sector. This is because it is an independent body that functions to develop a general picture of the given area or issue that is being investigated. This being the major function of the Escali financial system other objectives are carried out which include. (Efficient financial systems, 2009)

Identifying any weaknesses that may come up in the administration or any other department within the institution in regards to the issue under investigation. Other administrative flows are practiced within the institution that may not be right. Some of these issues might not be identified since in most cases management and leaders are not wiling to release any negative information regarding their institution.

The system is also in a way that it can calculate profits and loses that are realized by the financial institutions. Also the system can calculate unrealized loss and profits, brokerage among many others. This helps in identifying and coming up with accurate and sufficient information that can be used by the financial institution to improve on certain operational areas.

Also the information provided is usually very essential since it is essential in identifying strengths and weaknesses of the administrative structures. When strengths and weaknesses are identified it then becomes easier to make informed decisions on ways that can be used to strengthen the institution.

Also applying the Escali financial system in an institution helps in providing the government or any other body that is concerned and the general public with reliable and credible information. This is because it gives out accurate information that can be beneficial for the government in governing the institution. Provision of such information enables the public to have faith and to develop trust with these institutions. At the same time it becomes easier to for the public to embark pressure on the institutions in regards to certain problems that might be realized in the institution. (Efficient financial systems, 2009)

The final objective of the Escali financial system when applied within an institution is to provide baselines on which reforms that have been put have in these institutions can be assessed using. This is because the kind of information that is usually provided can play great role in ensuring that the reforms are adhered to strictly. (Efficient financial systems, 2009)

Control systems

Some systems are developed to help in achievement of the objectives. The systems are divided into two; accounting controls and administrative controls.

Accounting controls

Accounting controls are aimed at achieving the first two objectives of internal control which include prevention of fraud and wastage of any resources within the given institution. Secondly is to ensure accuracy of the accounting and other operating data systems. These are the major areas that are concerned with accounting activities hence the need for having internal control systems in place. The major purpose is to help in keeping track of the resources within the given institution.

Accounting controls follow certain system or procedure that involves the following steps to come up with accurate information. The first thing is the segregation of duties, procedural control which involves documentation and internal auditors. Analysis of physical inventories and accounting to determine whether there is any loophole or problem that is realized. (Audit methods and techniques, 2008)

Administrative controls

Administrative controls are usually highly concerned about how resources are used within that particular department. In the part of internal control systems they play major role in ensuring the achievement of remaining part of objectives that are linked with the use of the resources. These objectives include ensuring there is adherence to the stated policies of the given institution, further the efficiency of the operations and in ensuring conformance with the applicable laws. (Audit methods and techniques, 2008)

List of references

Audit methods and techniques, 2008, introduction to auditing procedures. Web.

Baysinger S. 2008, Management of the audit function. Web.

Efficient financial systems, 2009. Web.

Financial systems, 2009. Web.

Urban governance toolkit series, 2004, independent audit function. Web.