Introduction, Definition, History and Importance

Accounting standards are founded on the institutional theory of governance that de-emphasizes the self-interests of individuals in favor of institutional interests. The theory holds that organizations operate within established norms, values, and assumptions that determine what is acceptable and what is not (Carpenter et al., 2018). The establishment of Generally Accepted Accounting Principles (GAAP) is among the accounting standards established to make sure entities pursue institutional interests as opposed to individual self-interests. This report defines GAAP and highlights its history, importance, principles, benefits, limitations, and alternatives.

Definition

By definition, GAAP is a recognized set of procedures and rules governing financial reporting and corporate accounting. GAAP comprises comprehensive accounting practices jointly developed by the Governmental Accounting Standards Board (GASB) and the Financial Accounting Standards Board (FASB). The joint efforts in the composition of GAAP make the rules applicable to both not-for-profit and governmental accounting (CFI, 2020). GAAP may vary from region to region, industry to industry, and even from country to country. The objective, however, remains to streamline corporate accounting for the interests of key stakeholders.

History of GAAP

The history of GAAP can be traced back to the 1930s when the public interest in accounting standards was expanding and business combinations and other market practices created the need for accounting standards. The evolution of GAAP since the 1930s has reflected the changes in accounting practice and incidences that prompted the changes. GAAP was initially established as a response to the 1929 stock market crash as the government sought to regulate the actions of publicly traded companies (eFinance Management, 2020).

The Securities Exchange Commission (SEC) that set the standards delegated the responsibility to the private sector auditors. The creation of the Accounting Principles Board (APB) in 1939 saw the institution start issuing opinions regarding accounting practices, some of which later were imposed on the public limited corporations.

A chronological historical account of the GAAP shows the evolution of GAAP to both the stock market crash of 1929 and the legislations that followed the event. For example, the Securities Act of 1934 created the Securities Exchange Commission (SEC) that prescribed the methods to be used in preparing companies’ financial reports (Zeff, n.d.). The formal introduction of GAAP was done in 1936 with the publication of Examinations of Financial Statements. Following the publication, SEC has continually updated GAAP in response to the dynamics of the accounting practice. In the 1960s, the securities market in the United States became more competitive and conglomerates and multinational mergers started to emerge. SEC continued to release updates (specifically the Accounting Series Releases) that continued to address the changing business environment. SEC has been keen to correct the abuses of the GAAP with companies finding unusual or extraordinary items within their accounts.

Importance of GAAP

GAAP is seen as an international convention for best practices in accounting. The main purpose of GAAP is to make sure companies engage in responsible actions in accounting and decision-making to prevent similar incidences to the 1929 stock market crash. The growth and development of an economy are made possible by thriving enterprises and can be hurt when they collapse. GAAP makes sure the investment decisions by businesses are reasonable and that the firms can account for their expenditures and other activities involving their finances.

GAAP offers uniformity for people examining the financial statements and provides them with a foundation from which they can compare performance and make other decisions tied to the liquidity of a company. From a regulatory perspective, however, GAAP’s importance is manifested by the ability to provide a regulatory framework that streamlines accounting practices to avoid market crashes and other consequences of irresponsible behaviors.

GAAP Principles

GAAP comprises a set of 10 key principles regulating the courses of action of the accountants and in financial reporting. The principles, as discussed in this report, focus on key accountancy areas and are the basis on which entities carry out their financial reporting. Besides the 10 principles, other key concepts essential for the application of GAAPs will be outlined (CFI, 2020). The various principles and their interpretations are discussed in detail below.

The Principle of Materiality

The principle of materiality holds that all acts of reporting should correctly disclose the genuine financial position of the corporation. It is a requirement for all bookkeepers to reveal all financial material data relating to the specific accounting period. Following the GAAP, accountants have to reveal all details that have an impact on the financial statement. Such details are critical in making decisions and failure to report material data can mislead the readers of the financial statements.

The Principle of Permanent Methods

The principle of permanent methods obligates organizations to use the same financial reporting procedures throughout to make it possible to compare the financial information of a company across the accounting periods. In other words, the principle calls for consistency in the application of reporting methods. The permanent methods principle is closely related to the principle of consistency which also requires adherence to the same standards.

The Principle of Regularity

The accountants are required by the principle of regularity to abide by the GAAP rules throughout the accounting activities.

The Principle of Non-Compensation

Businesses abiding by the GAAP rules and providing full and accurate disclosure of the businesses’ financial accounting should not expect any form of compensation for doing so. The non-compensation principle is a statement clarifying that adherence to GAAP rules does not result in any monetary benefit by the company from the regulatory bodies.

The Principle of Sincerity

Since SEC delegated the responsibilities to private sector auditors, the regulatory body expects that those responsible for complying with the GAAP rules do so with sincerity. The principle of sincerity, therefore, obligates the companies to report all financial data with basic accuracy and honesty.

The Principle of Prudence

Prudence entails exercising caution in important matters such as those concerning money. In GAAP, the principle of prudence requires the accountants to represent factual data that is not clouded by speculation. The information featured in the statements should also be reasonable. The essence of the prudence principle is to make sure the amounts of revenues and expenses are not underestimated and overestimated respectively. Overstatement of costs and an understatement of income result in the skewed financial position of a company.

The Principle of Periodicity

In the accounting discipline, the concept of periodicity refers to the process of dividing up complex and going activities of an entity so that they can be reported in annual, monthly, or even quarterly financial statements. In GAAP, the principle of periodicity requires that reporting financial statements be done during the accepted reporting periods.

The Principle of Utmost Good Faith

Similar to the principle of sincerity, the principle of good faith requires that the accountants fully disclose the financial data in the financial reports. Utmost good faith is founded on the Latin phrase ‘uberrimae fidei’ commonly used in the insurance sector. The principle holds that all parties to a transaction should remain honest with each other. In GAAP, the requirement applies to the people preparing the records whereby they are required to carry out the exercise honestly and in good faith.

The Principle of Consistency

The same requirement for the principle of permanent methods applies to the principle of consistency. The preparation and presentation of financial records should consistently adhere to the standards. GAAP criteria could differ across different firms, and the principle of consistency requires that a corporation sticks to the same standards throughout the financial reporting periods.

The Principle of Continuity

The last principle is concerned with the continuity of the business whereby the valuation of its assets is supposed to be done under the assumption that the corporation will continue to operate.

Other Key Concepts

Besides the 10 core principles described above, GAAP also describes several other rules and regulations governing accounting practices. The major conceptions in GAAP relate to matters of matching, revenues, costs, and disclosure. The cost concept focuses on how the costs of assets are recorded. GAAP guidelines insist that assets are recorded using the purchase price that also reflects costs of transport, acquisition, and installation. There may be a limitation of this principle in that it fails to show the true work of an asset.

The revenue principle dictates that all incomes are recorded when they are recognized. Proceeds are noted at different times depending on whether the transactions are done on a cash or accrual basis. GAAP simply requires firms to recognize the funds in time. The GAAP matching principle posits that revenues match the expenses. In other words, the expenses associated with an income-generating activity are recorded when an item gets sold as opposed to when its payment is received. Lastly, the disclosure principle insists that all facts are disclosed in the financial statements of a business.

Benefits, Limitations, and Alternatives

Benefits

The benefits of deploying GAAP in corporate accounting and financial reporting as experienced by entities include consistency where firms can implement safeguards and controls to achieve a fair presentation of the financial position of the company. Secondly, GAAP aids in the development of comparable records that allow investors and other stakeholders to compare fiscal information across various corporations and reporting periods. Following GAAP rules, therefore, is likely to instill confidence in the company’s monetary performance. Thirdly, GAAP makes a company more trustworthy in the eyes of stakeholders due to the realization that the records presented are true and have not been manipulated. Lastly, the principles of GAAP make accounting easier by presenting simple yet effective procedures and guidelines.

Other stakeholders like the government and the regulatory bodies can also greatly benefit from the use of GAAP. The government needs to provide insight into the actions of corporations. Ensuring that all businesses follow the guidelines will make the work of the government through its agencies easier. The stock market crash of 1929 and other financial crises can be attributed to wrong decision-making by companies. Such incidents have detrimental implications on the economy, and GAAP can be a means of preventing future crashes through good accounting practices.

Limitations

The limitations of GAAP are varied as various concerns remain unresolved. Firstly, the application of GAAP is incompatible with other standards such as International Financial Reporting Standards (IFRS) meaning multinationals have to prepare further reconciliation reports in a cumbersome and costly process (Doward, 2017). Secondly, GAAP offers specific rules as opposed to generalized guiding principles. The result is the inflexibility of GAAP making it difficult to accommodate any market changes. Thirdly, the valuation on assets based on historical prices fails to reflect their fair value which could have greater accuracy in depicting the true value of the assets. Lastly, GAAP takes care of the complex accounting practices in large enterprises and applies the same to medium and small private and public corporations. However, medium and small companies have fairly simple books and figures making it burdensome to prepare complex GAAP records. In essence, GAAP has not fully addressed all issues in accounting as some remain unsolved.

Alternatives to GAAP

GAAP serves the same purposes as other financial accounting regulations across the world. The best alternatives to GAAP are those internationally recognized standards such as International Financial Reporting Standards. IFRS is used in most countries across the world and many institutions with a global presence would find it easier to use IFRS across all their branches. IFRS is regulated by the International Accounting Standards Board and, even though the principles differ from those of GAAP, there is work in progress to merge the two.

Examples of Financial Statements Using GAAP

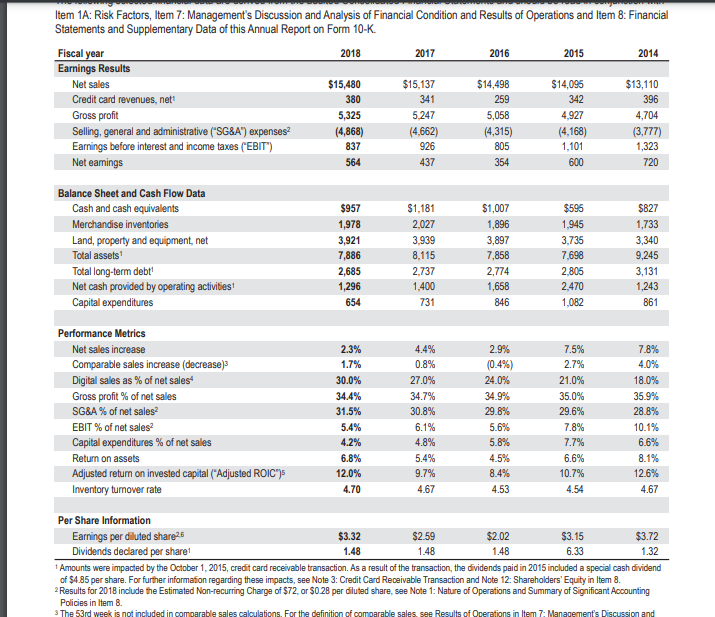

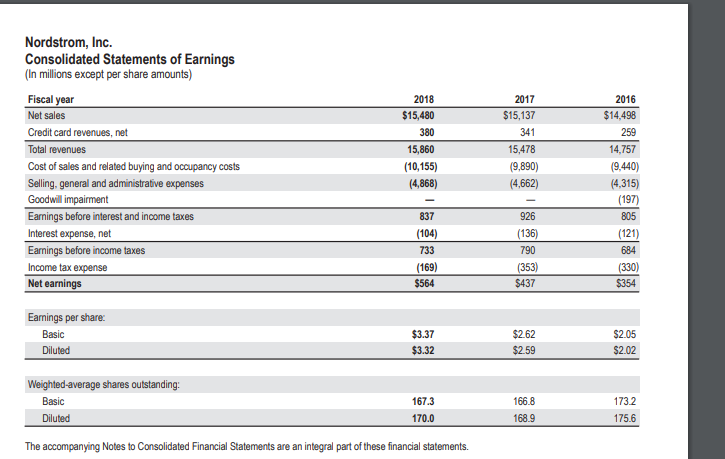

The following screenshot is taken from Nordstrom’s 2018 form 10-K report expressing various financial metrics. The selection of the company is founded on any unique criteria, rather a simple search of companies using GAAP produced a list from which Nordstrom was picked. Publicly traded companies are a better choice due to their size and the potential complexity of their financial reports. Additionally, the appeal of such enterprises is that the financial statements are readily accessible. However, the accessibility of the 2018 annual report explains why the screenshots show financial data for the years 2016, 2017, and 2018.

An income statement is one of the vital financial records that show how companies receive and record incomes and expend on various activities. The screenshot below shows the income statement for Nordstrom for the fiscal years 2016-2017:

These two screenshots reflect how the company prepares and presents its financial statements. The statements show stipulate all the financial figures from assets, expenses, and revenues.

Conclusion

The establishment of GAAP as a result of the stock market crash of 1929 has allowed corporations to streamline their financial reporting activities by allowing greater transparency. GAAP comprises ten core guiding principles that are all founded on the elements of costs, matching, revenues, and disclosure. The principles regulate how companies represent their financial position through fiscal statements. The benefits of GAAP include trust from stakeholders, comparability of reports, and consistency of reporting. The limitations include the complexity of the principles, especially when applied in small enterprises with few records. Additionally, there are still problems that remain unresolved. The best alternative to GAAP is the IFRS due to its global application and the fact that companies using IFRS will not have to prepare reconciliation reports.

References

Carpenter, V., Cheng, R., & Feroz, E. (2018). Towards an empirical institutional governance theory: Analysis of the decisions by the 50 U.S. State Governments to adopt Generally Accepted Accounting Principles. Corporate Ownership & Control, 4(4), 42-59.

CFI. (2020). What is GAAP? Corporate Finance Institute. Web.

Doward, L. (2017). GAAP limitations. Bizfluent. Web.

eFinance Management. (2020). What is GAAP?. eFinance Management. Web.

Zeff, S. (n.d.). Evolution of US Generally Accepted Accounting Principles (GAAP). Rice University. Web.