Introduction

There is a connection between reporting accounting standards adopted by various accounting bodies and the listing of companies in stock exchanges. In the modern world, most companies are listed in more than one stock exchange and they operate in many countries. This calls for the use of uniform standards for easier reporting and comparison of various performances from various countries. The research paper undertakes to find out the best method of reporting for companies listed in Saudi Arabia stock exchange and recommend the best accounting standards for the companies listed in the stock exchange of Saudi Arabia. This is a crucial research question for multinationals operating in many countries as well as students who are taking international finance and accounting because it addresses a problem that affects multinationals.

Statement of the Problem

The research questions affect directly the performance, reporting, and listing of multinationals in the Saudi Arabia stock exchange. In the world today there are Chinese companies listed in the New York stock exchange and other stock exchanges as well as some foreign companies listed in Saudi Arabia stock exchange. The main aim of this paper is to find out how many companies are affected by Saudi Arabia not adapting or converging International Financial Reporting Standards. The reporting standard used determines the future performance of the economy in relation to the world market and achieving inflow and outflow of investments to the country or out of the country.

There is a relationship between the performance of companies and reporting standards adopted in a specific stock exchange. Saudi Arabia’s accounting body is yet to adopt or converge to international accounting standards board recommended reporting standards i.e. IFRS. This has made most multinationals that are operating in this market incur an extra cost in trying to solve the differences that arise due to the reporting standards used in Saudi Arabia and in their home country.

Objectives of the Research

With the competitiveness and expansion of various companies from various countries accounting standards used to play an important role in determining the performance of the economy. This research will provide a great opportunity for the Saudi Arabia stock exchange and accounting standards board to understand the importance of adapting or converging towards international financial reporting standards. The purpose of this research paper is to examine international financial reporting standards used by most country’s stock exchanges and the accounting reporting standards used by Saudi Arabia.

Based on this research Saudi Arabia’s stock exchange will have a better understanding of the importance of adopting international accounting standards to reduce costs associated with reporting of financial reports by multinationals. This will also increase companies that will wish to be listed in the Saudi Arabia stock exchange.

The research objective perused in this paper

Is to identify a strategy that will be used by the Saudi Arabia stock exchange in order to improve reporting of financial performance of companies listed in their stock exchange.

- To identify currently the accounting standards used and their limitations to companies listed in the stock exchange.

- To identify and develop the most appropriate approach to use while ensuring uniformity in reporting standards.

- Enquiring about the importance of IFRS.

- Finding out about the policies of stock exchanges of various countries that have adopted IFRS.

- Checking the data relating to convergence to IFRS.

- The importance of the research

International Financial Reporting Standards has been adopted at a faster rate and it is becoming almost an internationally affected standard for reporting accounting information for companies. It provides also a window for companies that have not thought of going international to view the international market as a place to be. The type of information reported by companies under international financial reporting standards is almost similar to other reporting standards except for a few differences which require converging or doing away with the local accounting standards and adopting international financial reporting standards.

Research questions

- How should Saudi Arabia approach the issue of international financial reporting standards? Is it adopting or converging?

- What is the impact of IFRS on the performance of multinationals?

- How have other countries approached IFRS and how is it implemented?

- What are the possible relationships between IFRS implemented and the reported financial statements of companies, their profitability, and market share in other stock exchanges?

Scope of the study

The scope of the study follows a literature review of converging to IFRS standards and how they are used currently in various stock exchanges as well as where they are not used that is places like New York stock exchanges were generally accepted accounting standards are in use with only harmonization of the standards being applied.

The researcher manages the entire gamut of processes from the initial stage of identifying the problem to the final stage of report writing and providing a predetermined and predefined method of adopting IFRS. The capabilities required by the researcher in this research in managing the entire project and providing real-time information sharing, decision synchronization, and research optimization to all stakeholders. What is the necessary attribute required by a researcher to manage the dynamics of accounting reporting?

The scope is defined as a range of accounting standards used in reporting the financial performance of companies within and outside the country. It also covers whether the reporting standards adopted in reporting focuses on a wide spectrum of all stakeholders interested in all financial health of a company.

The proposed study will be used as a supplementary framework to focus entirely on the competence of the research and a method of using IFRS. The objects of the study will include:

- Correlation

- Grounded theory

- Ethnography

- Narrative

- Mixed method

- Action research.

This study will be based on a process based on narrative and grounded theory as well as mixed-method in coming up with criteria that will be adopted by these multinationals.

Rationale for the research

The benefits accrue from adapting IFRS are well defined by the international accounting standards board which is adopted by various companies and countries. There are more countries that have joined a European union n in converging towards international accounting standards. The American generally accepted accounting principles have been harmonized with international accounting standards in order to have uniformity in reporting of the financial performance of companies.

Methodology

There are two methods of research that are always in use while carrying out research papers. These methods include quantitative and qualitative research methods, whereas quantitative is applicable where theories are applicable and numbers are used in analyzing the results. The qualitative technique measures the feelings, perceptions, attitudes of individuals. The qualitative technique involves the analysis which is done using tables, graphs, pie charts, Gantt charts, and other analytical theories based on various assumptions. These normally include experiments, surveys, quasi-experiments, and a review of accounting of literature existing.

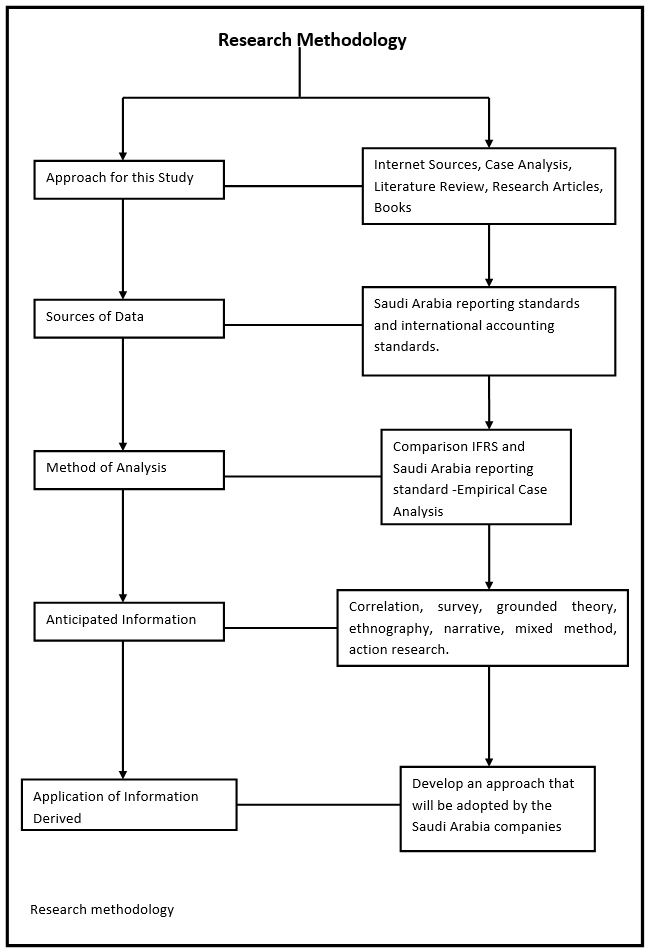

An intensive study will be used as a primary tool to give insight for this research. This is explanatory and exploratory and researches where a simple case study will not be suitable. An empirical inquiry that will investigate wholesome the contest of the problem without boundary will be in use. The research will follow laid down theories that will help to build a framework for adopting of converging towards international accounting standards. The research methodology will take the following structure.

Data collection tools and methods

The data for this research has been obtained from internet sources, books, and journals.:

- Books and journals: – Most of the materials to be used in this report will be collected from books.

Many books have been written covering issues on IFRS but the research questions have not been covered. Books will offer me good general information that will assist me to complete this project. Most books have a bibliography from the back where more information about IFRS.

- Internet: -The internet is also a very good source of data.

On the internet, different topics have been covered. Through the internet, I will collect the relevant materials that show the IFRS. Through the internet, I will be able to get the latest journals and conference papers that cover my topic in greater depths. Through the internet, I will be able also to request more materials in the form of CDs for further reference. Through the internet, I will learn more from conference papers about the relationship between IFRS and the stock exchange. This will assist me to understand the future of IFRS of companies. For further reference, I will use the internet facilities in offloading more relevant literature from the digital library.

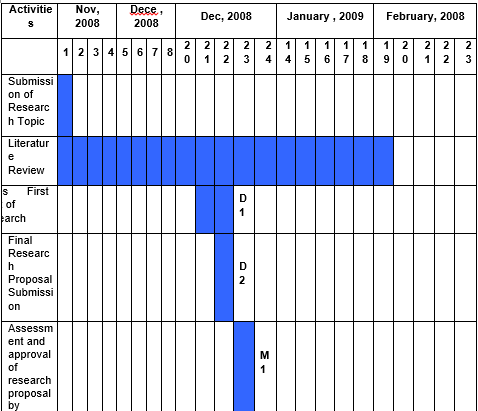

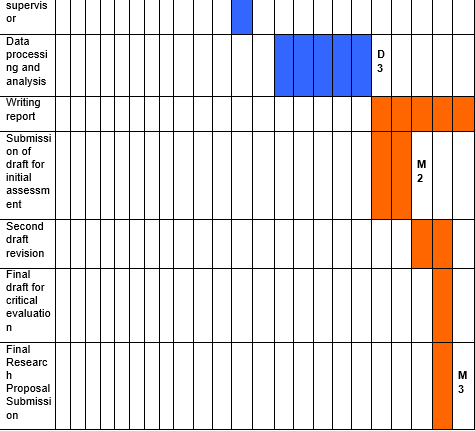

Implementation Program

This research paper performs various tasks and processes ranging from literature review, literature survey, developing a method for analysis of collected information to the formal representation of the same. Few of the processes can be concurrently followed and some may warrant the completion of the previous tasks. A broad framework is conceptualized in the form of a Gantt chart to describe the activities, schedule, and timeframe of the processes of this research program.

Research Project Schedule

Deliverables:

- D1 = First draft of research proposal

- D2 = Final draft of research proposal

- D3 = Collection of data

Milestones:

- M1 = Approval of Research proposal

- M2 = Final draft of research thesis submitted for evaluation

- M3 = Final draft of research submitted and approval obtained.

Organization of the study

The research paper will be organized into five chapters. Chapter one will have an introduction that will outline the background of the research by laying the ground of the research. It will also discuss the importance of the research, research questions, objectives of the research, the scope of the research, and its importance to the researcher. This chapter will consist of seven pages.

The second chapter will have a literature review that will include a review of the existing literature. Fifteen articles will be reviewed to find out what other writers have written about this topic. This chapter will consist of thirty pages.

The third chapter will deal with the methodology employed in carrying out the research. This will cover all the research methodologies, ethical considerations, and other related issues. This chapter will consist of twelve pages

The fourth chapter will be the results and findings of the research questions. It will discuss the data that will be correct their findings, it will include, graphs, tables, charts, to depict the results of the research questions. This chapter will be the basis for discussion. This chapter will have at least twenty-five pages since it is the most critical chapter of the research.

The fifth chapter will have fifteen pages and will consist of a discussion, analysis, and conclusion. It will discuss the results obtained from the finding and it will be discussed in relation to the existing literature reviewed. It will bring to light the answer to the question of the research.

Limitation of the research

The research paper is expected to have various limitations as it is considering international financial reporting standards in relation to the Saudi Arabia stock exchange where most of the information available is not in English. The scope of the study will not provide enough space to discuss the reasons behind the adoption of international financial report standards by different accounting bodies worldwide. Another limitation is that this research will be carried out on a limited scale and with limited time for academic purposes.

References

Aksu M. (2006) ; transparency and disclosure in the Istanbul stock exchange: did IFRS adoption and corporate governance principles make a difference?; faculty of management, Sabanci University.

Al. Shammari B.A (2005) compliance with international accounting standard by listed companies sin the Gulf- Co-operative council Member states: An empirical study.

Beuren I.M,Hein.N and Klann R.C (2008) ; impact of the IFRS and US-GAAP on economic financial indicators ; managerial and auditing journal

Harverty J. L (2006) ; Are IFRS and U.S GAAP converging? Some evidence from people’s republic of china companies listed in the Ne York stock exchange; Journal international accounting, auditing and taxation.

Irvine H. (2008); the global institutionalization of financial reporting; the case of the United fArab Emirates; accounting forum.

Kinsey J.P (2006); developing countries converging with developed country accounting standards; Evidence from South Africa and Mexico; journal international accounting , auditing and taxation

Larson R. K and Street D.L (2004); large accounting firms ‘ survey reveals emergence of “two standards” system in the European union; advances in international accounting.

Larson R. K and Street D.L (2004); convergence with IFRS in an expanding Europe: progress and obstacles identified by large accounting firms survey; journal international accounting , auditing and taxation.

London stock exchange (2005); international financial reporting

Palmer P.D (2008) ; disclosure of the impact of adopting Australian equivalents of international financial reporting standards; accounting and finance.

PriceWaterHouseCoopers (2004) the impact of IFRS on regulatory reporting in the telecommunications sector

Razvan M. and Dumintru M (2007); measurement of needs for harmonization between National accounting and international financial reporting standards; Munich personal RePEc Archive.

Stenke R (2007) ; the impact of IFRS in the UK – issue in group accounting; European financial reporting research group.

Tyrrall D., Woodward D and Rakhimbekova A (2007); the relevance of dinternationla financial accounting standards to developing country; ; journal international accounting , auditing and taxation.

Working group (2007); IFRS impact and CBSO databases; a European committee of central balance sheet data offices.