Introduction

India is a federal republic whose capital is New Delhi. India has the second-largest population in the world. The country has a population of 1.2 billion people. The Indian rupee (INR) is the official currency of the country. India is a lower-middle-income country. Sound economic policies have helped in improving the economy of the country. India is one of the major emerging markets. It is a member of BRIC. BRIC is the abbreviation for Brazil, Russia, India, and China. These countries would have a great influence on the global economy in the future. Sound economic policies have enabled the country to experience very high economic growth rates. In fact, India has one of the highest economic growth rates in the world.

Services, industry, and agriculture are the main sectors of the Indian economy. In 2012, the service sector accounted for 55% of the GDP. The service industry includes tourism, telecommunications, and healthcare. On the other hand, the industry accounted for 29% of the economy. India is one of the major producers of steel. In addition, the country produces various types of automobiles. In 2012, agriculture accounted for 16% of the GDP (Atradius Credit Insurance, 2012). Rice is one of the major agricultural products of the country. Milk, wheat, mangoes, fresh vegetables, and bananas are other major agricultural products of the country.

India has a thriving international trade. China, U.S.A., and U.A.E. are some of the major trading partners of the country. In 2011, imports from China accounted for 12.1% of the total value of imports. On the other hand, imports from the U.A.E. accounted for 8.3% of the total value of imports. Imports from Saudi Arabia accounted for 5.8% of the total value of imports. Oil is one of the major products that India imports from the U.A.E. and Saudi Arabia. Electronics, petroleum products, machinery, and capital goods are some of the major imports of the country (Atradius Credit Insurance, 2012).

India has various types of exports. These include engineering products, textiles, gems, and petroleum products. India exports these products to various countries. The U.S. and U.A.E. are some of the major destinations of the country’s exports. In 2011, exports to the U.A.E. accounted for 13.0% of the total value of exports. On the other hand, exports to the U.S. accounted for 11.4% of the total value of exports (Atradius Credit Insurance, 2012).

Analysts expected the GDP of the country to grow by more than 6% in 2013. Despite the high economic growth, youth unemployment is still one of the major problems of the country. Youth unemployment denies the country a vibrant workforce that would help in improving the economy. Inflation is another problem that the country faces. The government strives to control the rate of inflation. In 2011, the rate of inflation in the country was more than 9%. Since then, the government has implemented several measures that have led to a significant reduction in inflation. In January 2013, the country inflation was 6.6%. This value was within the comfort range of the Reserve Bank of India.

The Reserve Bank strives to ensure that the external value of the rupee reflects the economic realities of the country. Market forces determine the exchange rate of the country. The government has various policies that help in controlling the exchange rate. The Reserve Bank has huge foreign reserves. These foreign reserves help in cushioning the country from external factors.

Economic Indicators

GDP

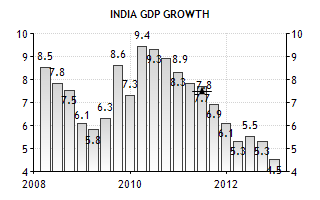

Prior to the global financial crisis, India had a very high economic growth rate. The growth of the GDP of the country averaged 8.5% between 2004 and 2009. This was significantly higher than the rate of the GDP growth in the preceding decade. In fact, the growth of the GDP between 2004 and 2009 was double the growth of the GDP in the preceding decade. After the global financial crisis, the rate of economic growth of the country returned to the initial value of more than 7%. However, in 2011, the economic growth of the country slumped to 5.4% (Atradius Credit Insurance, 2012). Various structural factors contributed to the significant reduction in the economic growth of the country.

Analysts expected the GDP of the country to grow by 6.5% in 2013. The growth rate of 6.5% would increase the GDP of the country to US$2,209,430. The GDP per capita of the country would increase to US$1,785. The poor performance of the agricultural, manufacturing, and service sectors was one of the major factors that led to a significant reduction in the growth rate of the country. In the second quarter of 2012 (July-September), the GDP of the country increased by 5.3%. This was a significant reduction in the growth rate of the country compared to the growth rate during the second quarter of 2011. During the second quarter of 2011, the GDP of the country increased by 6.7%. The poor performance of the agricultural and manufacturing sectors was one of the major factors that led to the significant reduction in the growth rate (Atradius Credit Insurance, 2012).

Inflation

Inflation refers to the increase in the price of various products in the economy. Countries usually strive to reduce the rate of inflation. High inflation reduces the purchasing power of people in a certain country. A country may use several strategies to reduce inflation. Single digit inflation does not pose so much threat to the growth of a certain economy. On the other hand, two-digit or three-digit inflation may pose a serious threat to the growth of the economy (Gupta, 2008).

India strives to control its inflation. The government uses various monetary policies to control inflation. The government tracks the prices of 435 commodities to determine inflation. These commodities represent various strata of the economy. This gives a comprehensive rate of inflation. In addition, the commodities enable the government to determine the effect of inflation on the rate of economic growth of the country. In January 2013, the inflation rate was 6.6%. This was the lowest value of inflation since December 2009. The inflation rate has continued to reduce in recent months (Gupta, 2013). This has made the rate of inflation to be within the comfort range of the Reserve Bank of India (RBI).

However, India had a very high yearly inflation in 2011. In 2011, the yearly inflation rate was 9.2%. The high inflation rate reduced the purchasing power of many households. According to the World Bank, more than 75% of Indians live on less than US$2 per day. Therefore, significant increase in inflation had adverse effects on the economy. High rate of inflation forced the government to implement tight monetary policies. In 2012, the Reserve Bank of India reduced the reserve requirements of banks from 4.5% to 4.25%. This measure increased the lending of banks. In addition, the government injected 175 billion rupees (US$3.2 billion) into the economy (Atradius Credit Insurance, 2012). These measures helped in reducing the rate of inflation. The significant reduction in the inflation rate shows that the measures managed to reduce the rate of inflation successfully.

Employment

Countries strive to ensure that they have their rate of employment is 100%. However, it is very difficult to achieve this rate. High rate of employment shows that the country is using its workforce to improve the economy. Idle labor harms the economy of a country. Unemployed people use the services that the government offers without contributing anything to the economy.

In 2012, the rate of unemployment in India was 9.3%. This value shows that the country has so much idle labor. The unemployment rate of 9.3% shows that millions of people are unable to find jobs in the economy. Analysts expect the rate of unemployment to increase to 9.4% in 2013. The significant reduction in the growth rate of the economy is one of the major factors that would lead to the increase in the rate of unemployment. However, various sectors would add jobs into the economy. The IT sector is one of the sectors that would add jobs into the economy. The retail industry would also add jobs into the economy. Analysts expect the e-commerce and education industry to experience high growth in 2013. This would enable the industries to add more jobs to the economy. In addition, the pharmaceutical and healthcare industry would experience tremendous growth (Tejaswi, 2013).

On the other hand, certain sectors of the economy would maintain their status quo. The automobile industry is one of the sectors that would maintain its status quo. Slowing of this sector is one of the major factors that would make it maintain its status quo. The banking and financial services sectors would also maintain their status quo. This is because global impact would reduce the intentions of banks and other companies that provide financial services on India. Analysts expect India to have a net addition of just one million jobs. This value is significantly higher than the value in 2012. However, it is lower than the value in 2011 (Tejaswi, 2013). This shows that India is unable to create jobs to millions of people who join the job market annually. Therefore, it is vital for the government to take urgent steps to reduce the rate of unemployment.

Domestic Politics

Domestic politics have a significant influence on the growth of a country. Domestic politics may create an environment that supports economic growth. On the other hand, domestic politics may hamper the economic growth of a country. Corruption is one of the major factors that may inhibit the economic growth of a country.

India is a democratic country. During the May 2009 election, the United Progressive Alliance (UPA) got 262 seats (48%) in the lower house. This makes it easy for the UPA to govern the country. Before the general election, the UPA had very few seats in the lower house. This made it difficult for it to govern the country. It had to enter into compromises with other parties. However, several massive corruption scandals have hit the country since 2010. These scandals have increased the pressure on the government. They have increased the resistance from the opposition. The opposition has blocked the implementation of several government policies due to the corruption scandals (Atradius Credit Insurance, 2012).

There are several violent conflicts in India. There has been a significant increase in the tensions between Muslims and Hindus in Kashmir. In addition, there are more than 20,000 Maoist rebels in rural areas of the country. These rebels are a threat to the peace and stability of the country. In addition, India has strained relations with Pakistan. The Mumbai attacks in 2008 prompted India to withdraw from peace talks with Pakistan. India has a delicate relationship with China. There are several border disputes between the two countries (Atradius Credit Insurance, 2012). However, relations of the country with China are improving slowly.

Financial Indicators

Countries strive to ensure that they have enough foreign reserves to finance their activities. Monetary authorities use foreign reserves to protect the economy from external factors that may have a negative influence on the economy. Monetary authorities use foreign reserves to regulate the magnitude of the payment imbalances. Foreign reserves enable a country to pay for various imports. In addition, foreign reserves enable a country to regulate the exchange rate. Foreign currency held by banks and members of the public is not included in the official international reserves of a country. The foreign currency held by banks and members of the public is usually very small compared to the reserves held by the monetary authorities of a country (Cherunilam, 2008). The Reserve Bank of India Act gives the Reserve Bank the right to be the custodian of foreign reserves of the country. The Reserve Bank may hold the reserves in the form of gold or foreign securities.

A country may hold foreign reserves for speculation, transaction, or precautionary motives. However, central banks do not hold foreign reserves for speculative purposes. Individuals or corporations are the major parties that hold foreign reserves for speculative purposes. Central banks provide a last resort stock of foreign reserves. Therefore, central banks use foreign reserves mainly for precautionary motives. In addition, central banks use foreign reserves to manage the exchange rates. Foreign reserves facilitate the absorption of international money and capital flows in a manner that does not disrupt the economy of the country.

Prior to the balance of payment crisis in 1991, India used its foreign reserves to maintain a suitable level of import cover. During the balance of payment crisis, the foreign reserves of the country could only cover three weeks of imports. Generally, foreign reserves should be able to cover three or four months of imports. Currently, India does not use the duration of import cover to determine the foreign reserves that the Reserve Bank should hold. India ensures that its foreign reserves help in improving the confidence of the international community on the ability of the country to meet its financial obligations. In addition, India ensures that the foreign reserves help in taking care of the seasonal factors of the transactions of balance of payments.

The Reserve Bank ensures that foreign reserves would take care of the uncertainties of the monsoon conditions of the country. In addition, the Reserve Bank ensures that it holds enough foreign reserves to counter speculative tendencies of various parties. Speculations from these parties may have adverse effects on the economy of the country if they are not controlled. The Reserve Bank also ensures that it holds foreign reserves that would reduce the cost of carrying liquidity (Ghate, 2012). This ensures that the country frees up money for the development of the economy. It is very difficult to determine the right amount of foreign reserves that the central bank should hold.

A country may hold foreign exchange reserves in various forms. India holds foreign exchange reserves in the form of foreign currency assets, special drawing rights (SDRs), and gold. As of April 26, 2013, the value of foreign reserves of India was US$296.37 billion. The foreign reserves increased by US$1.6 billion from the preceding week. Foreign currency assets accounted for the largest proportion of the increase. During this period, foreign currency assets increased by more than US$1.5 billion (Manas, 2013). The value of the foreign reserves of the country keeps fluctuating. Fluctuation of the foreign currency assets is one of the major factors that contribute to the fluctuation of the foreign reserves.

Foreign currency assets account for the largest percentage of the foreign reserves. It accounts for about US$260 billion of the foreign reserves. On the other hand, gold accounts for approximately US$25 billion of the foreign reserves. SDRs account for approximately US$4 billion of the foreign reserves. Reserves at the IMF account for approximately US$2 billion. This is a clear illustration of the effect of foreign currency assets on the total foreign reserves of the country. Gold plays a critical role in managing foreign reserves during times of crisis (Obstfeld, Shambaugh & Taylor, 2010). In March 2002, the foreign reserves of the country were US$55.6 billion. This shows that the foreign currency reserves of the country have increased significantly over the past decade.

The central bank uses foreign reserves to ensure macroeconomic stability. It takes into consideration the costs of and benefits of managing reserves to determine the right amount of foreign reserves that it should hold. Holding sufficient amount of foreign reserves is one of the major factors that reduced the effect that the global financial crisis had on the economy of India. However, maintaining a high value of foreign reserves has various opportunity costs. It reduces the liquidity level of the country. In addition, it makes a country lose a sizeable amount of money, which it would have invested in the economy.

The holdings of gold in India have remained constant. However, the government sells the gold reserves to authorized dealers occasionally (Obstfeld, Shambaugh & Taylor, 2010). The government also sells foreign currency to authorized dealers. Sale of foreign currency to authorized dealers helps in meeting the foreign currency demands of importers. Purchase transactions help in maintaining the level of foreign reserves. In addition, the exchange rate policy of the government also helps in maintaining the level of foreign currency. The exchange rate ensures that the external value of the rupee is a reflection of the economic fundamentals of the country.

The exchange rate policy of India strives to reduce exchange rate volatility. The exchange rate policy ensures that the movements of the exchange rate are orderly. In addition, the exchange rate policy ensures that the government maintains a sufficient amount of foreign exchange reserves. The exchange rate policy strives to eliminate market constraints. The policy ensures that there is a healthy foreign exchange market. The policy ensures that speculation does not destabilize the economy of the country. The Reserve Bank buys and sells currency in the forex market regularly.

This helps in regulating the exchange rate. The Reserve Bank manages its portfolio to ensure safety and liquidity. In addition, management of the portfolio helps in optimizing the returns of the Reserve Bank. Currency composition, duration, and instruments are the major factors that the Reserve Bank considers when deploying foreign reserves. The Reserve Bank ensures that it invests foreign currency assets in top quality assets. In addition, it ensures that it can convert a sizeable percentage of the assets into cash on short notice (Kapila, 2009). The Reserve Bank considers interest and capital gains when determining where to invest.

Overseas markets account for a sizeable percentage of the investments of the Reserve Bank. The Reserve Bank takes extreme care when investing in overseas markets. Risks involved in investing in these markets necessitate the Reserve Bank to take be cautious. Applying suitable portfolio management enables the Reserve Bank to manage the risks of investing in overseas markets. The Reserve Bank also invests in local financial markets. This helps in spurring the growth of the economy (Kapila, 2009). Ability to convert assets to cash on short notice is one of the major advantages of investing in the local financial markets.

Conclusion

India is one of the emerging markets. The country has a population of 1.2 billion people. This provides the country with a huge workforce. The government has implemented several policies that have improved the economic growth of the country. Analysts expect the economy of the country to grow by more than 6% in 2013. However, this value is significantly lower than the growth of 9.8% in 2007. The global financial crisis had adverse effects on the economic growth of the country.

It reduced the rate of economic growth of the country to 3.9%. During the global financial crisis, the value of exports of the country reduced significantly. In addition, there was a significant reduction in the foreign direct investments. The country has recovered from the effects of the global financial crisis. The presence of huge foreign reserves is one of the major factors that enabled the country to recover from the effects of the global financial crisis. The Reserve Bank used the foreign reserves to cushion the country from external factors that may disrupt the economy.

Despite the high rate of economic growth, unemployment is still very high. The rate of unemployment is currently 9.3%. Analysts expect this value to increase. The economy is unable to absorb millions of people who join the labor market annually. The high unemployment denies the country valuable workforce that may help in improving the economy of the country. Inflation is another problem that the country faced. However, the government implemented several policies that have helped in reducing the inflation of the country.

It is a fact that India has a bright future if the government manages to maintain the current economic growth rates. Disruptive politics would hinder the economic growth of the country. However, India has an established democratic system. This reduces the probability of politics affecting the growth of the country. This is one of the major differences between India and China, another emerging economy.

References

Atradius Credit Insurance. (2012). Atradius country report: India – December 2012. Amsterdam: Atradius Credit Insurance N.V.

Cherunilam, F. (2008). International economics. New Delhi: Tata McGraw-Hill Education.

Ghate, C. (2012). The Oxford handbook of the Indian economy. Oxford: Oxford University Press.

Gupta, G.S. (2008). Macroeconomics: Theory & application. New Delhi: Tata McGraw-Hill Education.

Gupta, S. (2013). Inflation eases to 3-year low of 6.62%. The Times of India. Web.

Kapila, U. (2009). Indian economy since independence. New Delhi: Academic Foundation.

Manas, A. (2013). Forex reserves increased by USD1.609 billion to 296.37. Current Affairs Business News. Web.

Obstfeld, M., Shambaugh, J.C. & Taylor, A.M. (2010). Financial stability, the trilemma, and international reserves. American economic Journal, 2(2), 57-94.

Tejaswi, M.J. (2013). Unemployment rate in India to go up: Kelly Services. The Times of India. Web.