Introduction

Economic policies are built of structured principles and theories. In the process of drafting these policies, economists base their arguments on theories and models. Policy formulation has become more systematic and procedural. Aside from these established mechanisms, policies are developed to be flexible (Rodrik, 1996). The presence of time and other circumstantial events make these policies hollow. In addition, uncertainties in the global and local economies challenge the validity of these policies.

Among economic policies, general economic output and employment are the most prominent. Countries consider a boost in output as a gauge of success. Output in a strict economic sense refers to the Gross Domestic Product (GDP). This measure was developed to value the goods and services produced by an economy in a given period. The technical components of the GDP include the spending of the government, the investments, the consumption, and the net trade balance. Goods and services have to be produced, consumed, and distributed within a local economy.

Employment, on the other hand, is more specific in nature. Various tools are used to determine the level of employment in an economy. Most countries use a labor force composed of individuals 15 years old and above. The students are exempted because their concentration is on gaining an education. Policies on employment are critical. The income gained by the workforce provides the buying power. This capacity is then translated to spending. Employment policies have a direct effect on the output of an economy.

Basic Assumptions

Policy formulation uses the notion of an open economy. The Mundell-Fleming model promotes this concept. The model illustrates the relationship between the output and exchange rate. Moreover, the model argues that it is impossible for an economy to maintain an independent monetary policy, a fixed exchange rate, and a free capital movement. Intervention is critical to ensure that output is sustained at maximum figures. In addition, the model follows traditional components of open economies.

There are two important curves that interact in this model. The IS curve is drawn as a downward slope. The components of the curve include the elements in the GDP. These elements are affected by both interest rates and inflation. It has to be noted that government spending is an exogenous variable. The model assumes that the domestic economy is dwarfed by the global economy. A domestic economy also produced a single composite commodity. This good, however, is an imperfect substitute to the global output. The model also asserts that output is dependent on demand where the price is constant.

The Mundell-Fleming model is a supplement to the IS/LM Model. This model exists under the assumption of autarky. There are also other instances when the Mundell-Fleming model is different from the IS/LM model (Hicks, 1980). The Mundell-Fleming model has various implications under exchange rate regimes. Under these circumstances, intervention needs to be emphasized. The government through the Central Bank plays a critical role in this process. Central Banks are vital contributors in formulating monetary policies.

Short-term Policies

There are certain considerations that have to be made. Policies are both fiscal and monetary. It is important to balance the impact of these policies on the economy (Mundell, 1960). Some economies formulate policies that provide immediate results. The time frame for the effect of these policies is usually set within one year. To improve current output, the government has to increase spending. Improving the infrastructures and delivery of social services does this. On the monetary side, the government can reduce the taxes charged on goods and services (Barro, 1990).

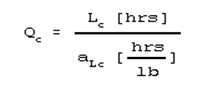

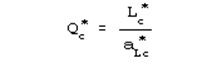

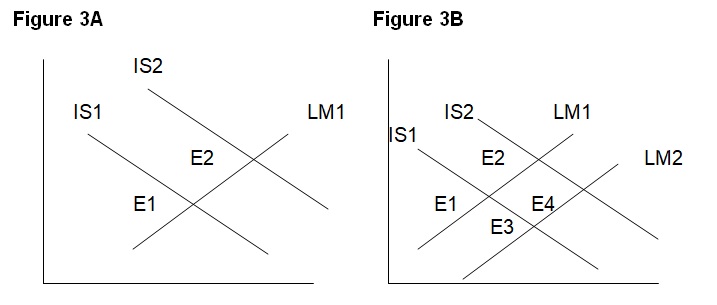

The above figures show the impact of the fiscal and monetary policies on the equilibrium of the market. In Figure 1A, the effect of increased government spending is exhibited. Based on the illustration, increased expenditures incurred by the government will shift the IS curve to the right. This means that output will increase on the notion that the government will require more goods and services to facilitate spending. Moreover, the government will boost its capacity to channel commodities and services.

But overemphasis on government spending can lead to inflation. As the government requires more goods, an artificial shortage can happen. The public and the government will have to compete with the limited goods. Figure 1B shows the impact of a monetary policy in the equation. For instance, there will be a decrease in the rate of tax collected to enterprises. The drawback of this policy is evident in the decrease in government revenue. The policy, however, will ensure that government spending will have minimal impact on price. The reduced tax charged on goods and service will balance future price increase.

The effect of these policies on employment is also drastic. Increased spending by the government will boost employment. The building of roads and bridges requires massive manpower. In addition, the government needs workers to deliver basic services to the public. Figure 1C explains the impact of the policy on employment. The increased spending has improved the number of employed individuals in an economy. Most importantly, the figure also shows that the buying power of employees was boosted.

Without monetary adjustments, the policies introduced can lead to problems. As the buying power increases, prices of commodities also tend to go up. There has to be a policy that will limit the negative impact of the policy on the price of goods and services. Figure 1D depicts the adjustment taxation policies can accomplish. The figure shows that the buying power of the individuals has decreased. Employment, however, remained at a growing phase. It is important to note that the process will result in more consumption and better output.

Medium-term Policies

Mid-term policies are important for emerging economies. These policies are building blocks and fundamental to future economic growth. Usually, the effects of these policies are experienced during the third to fifth year upon the policy implementation. There are several mid-term policies that can be used to boost an economy. But the most prevalent in the current economic setup is improving the export markets. Exports are important as promoters of output in the local economic scene. There are also monetary policies that can balance the promotion of exports.

Exports serve as vital cogs in increasing output. Increased exports mean that local industries are channeling their goods and services in foreign markets. Most importantly, the emergence of exports improves the dependence of markets on local consumers (Young, 1991). Moreover, the increase in exports means that local firms are gearing towards maturity. When this happens, it is expected that diversification and innovation will become priorities. These developments are critical in the expansion of goods and services.

In the realm of monetary policymaking mid-term effects are also crucial. Most of the monetary policies provide immediate impact, but there are some designed for medium-term purposes. The Monetary Board is tasked to determine to supply of money in an economy. The Board is in charge of printing and distributing money. There are targets used to ascertain the bulk of money produced. The Board has the power to limit money to prevent inflation. There are rare instances when monetary policies are preferred overproduction of money.

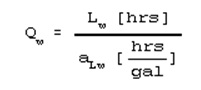

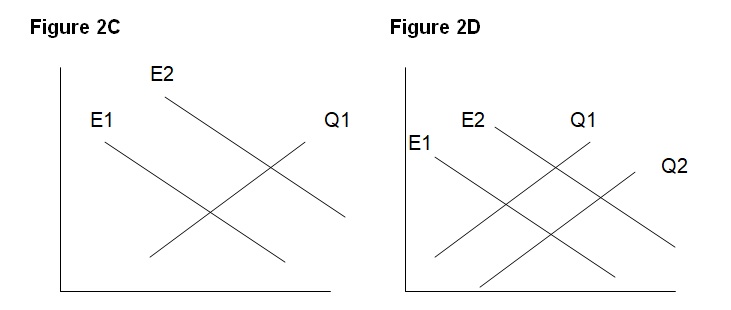

There are some important points that have to be explained in these illustrations. As shown in Figure 2A the increase in exports has also upped the output of the economy. The shift to the right illustrates the improvement in output as exports are continued to be promoted. Excessive production of goods and services is normal. When the local consumers fail to absorb the extra production, these commodities are channeled overseas. This will also boost an economy’s foreign currency reserve.

As countries focus on exports, the monetary risks also become more evident. The influx of foreign currency in an economy will make the local currency overvalued. This will have an impact on the prices of local commodities. Since the value of money is high, prices also tend to follow. Inflation is a likely outcome as prices make adjustments. There are some policies that can be implemented to ensure equilibrium. The Central Bank can dispose of its foreign currency reserve to maintain the supply level. Exports need to be sustained but with caution to a possible rise in the price of goods and services.

As exports are increased, the demand for labor also increases. The policy in promoting exports result in massive hiring done by several firms. Demand is an important catalyst in boosting employment. Assuming that local and foreign demand continues to rise, the workforce is expected to follow. Moreover, the high value of the local currency poses future problems for the consumers. Controlling the money supply is a viable option. But limiting the reserve foreign currency of an economy is a more reasonable policy. Foreign exchange has to be monitored to ensure balance in effects.

Long-term Policies

In the assumptions part, it was discussed that an open economy will be followed. Perhaps the most compelling long-term economic policy that open economies promote is globalization. Economies start eliminating trade barriers and welcome foreign goods and services. Current economic trends suggest that globalization is pushed in most emerging economies. Even third-world countries are moving towards such economic policy. Globalization is considered as the answer to saturating markets and growing competition. In addition, firms need to expand that distribute their goods to other economies.

The impact of globalization on an economy’s output is obvious. Countries have created the World Trade Organization to facilitate globalization’s growth. In addition, there are various regional organizations that push for this change. As the market opens to foreign opportunities, the available commodities for consumers increase (Tabb, 1997). Moreover, local firms are pressured to produce quality products to compete with imported goods. But even open economies remain some trade barriers to protect domestic firms.

The policies on globalization are centered on reducing trade barriers. The most common action economies take is the reduction of tariffs on foreign goods. This makes imported commodities price competitive when sold in local markets. Another policy set by governments is the lifting of import quotas. Economies provide limitations as to the number of certain products entering their markets. Moreover, governments are more concerned with the positive effects of these initiatives on their economies.

As markets open up because of globalization, the output is also boosted significantly. There are several reasons that validate this observation. The influx of foreign goods pressures local producers to increase production. It is imperative for local firms to match the growing demand for goods and resources. Globalization also allows local companies to export their products overseas. The added demand requires firms to produce more. When tariffs are reduced, the price of imported products decreases. Local companies are required to produce more and use the excess production as leverage for future pricing campaigns.

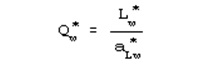

Focus on output, however, can have a negative impact on prices. As foreign goods enter local markets, local companies have to push the price down. The effect of this strategy can incur losses. There are evidence showing local firms closing down because of globalization. Foreign firms are established that competing against smaller companies is a mismatch. As shown in Figure 3B, the government’s monetary policy improved the situation. The specific policy was designed to lower interest rates on domestic loans. This will encourage allow firms to borrow money and recover their losses. Most important, it will ensure that output is increased domestically.

Globalization is an important cog in promoting employment. There are several countries that have decided to open their economies. The process of globalization requires economies to produce manpower. It is obvious that globalization has given access to multinational firms to expand their operations to other countries. The requirement for labor increases as foreign firms goes overseas to boost their production. Aside from manufacturing firms, there are also foreign companies that require individuals to distribute their goods. Foreign companies establish local offices for sales.

Figure 3C shows the increase in labor as foreign firms come into the local scene. The figure illustrates the shift in the curve as globalization is pushed. It is clear that the impact of globalization in the workforce is positive. Labor is one important element that entices foreign firms to do overseas operations. The cost of labor in emerging economies is cheap. In addition, the pool of talent ensures quality in production. In the long run, the policies implemented in the early years will still be applicable. Government spending is still promoted and the promotion of exports remains a priority.

But there are adjustments that have to be made. As globalization is introduced, the number of local firms also diminishes. These small to medium-sized companies are having difficult times competing against foreign companies. The reduction in the local market will affect employment. These firms have to restructure and change eventually close shop. There are monetary policies to ensure business continuity. Reducing the loans interest rates for loans of domestic firms will boost their capital.

Conclusion

The process in which policies are made is critical for an economy. In an open economy, there are some intricacies that need to be considered. As stated earlier, open economies have various limitations. These include a lack of control in foreign exchange and interest rates. Policies are usually cyclical and divided into three periods. These are important stages when economies work from being emerging to being industrialized. There are variations in which policies are drafted as equated with time.

Policies that will show immediate results include boosting government spending. The government has sufficient vehicles to ensure that infrastructures will be erected and social services will be delivered. The impact of these policies on output and employment is positive. Economies have to consider monetary policies to compensate for the possible effect on inflation. There are also policies designed to take effect in 3 to 5 years. Most common policies related to the promotion of exports. This will boost the output of domestic firms and improve labor figures. The government, however, needs to intervene to control the money supply.

The long-term policies of governments are the most compelling. These are the most critical for budding economies. As discussed, the effects of globalization are observed in 10 years. Globalization is a process and requires changes as the implementation phase progress. During this stage, economies experience a boost in output and employment. But there is a point when the increase in labor and output will be corrected. Lowering interest rates on domestic loans will help. At least it will maintain the current workforce.

References

Barro, R.J., (1990), The Journal of Political Economy, “Government spending in a simple model of endogenous growth,” Pp. 103-125.

Fleming, J.M., (1962) IMF Staff Papers, “Domestic financial policies under fixed and floating exchange rates,” Pp. 369-379.

Hicks, J., (1980), Journal of Post Keynesian Economics, “IS-LM: An explanation, Pp. 139-155.

Mundell, R.A., Quarterly Journal of Economics, “The monetary dynamics of International adjustment under fixed and flexible exchange rates,” Pp. 227-257.

Rodrik, D., Journal of Economic Literature, “Undersdtanding economic policy review,” Pp. 9-41.

Tabb, W.K., (1997), Monthly Review, “Globalization is an issue, the power of capital is the issue,” Pp. 1-20.

Young, A., (1991), The Quarterly Journal of Economics, “Learning by doing and the dynamic effects of International Trade,” Pp. 369-445.