Introduction

The concept of Islamic finance has undergone considerable expansion over the last few years, as evidenced by the many Islamic Financial Institutions (IFIs), which have been developed across the globe. A study conducted by the Council for Islamic Banks and Financial Institutions (CIBAFI) in 2004 shows that IFIs grew at an average annual rate of 23% from 1993 to 2003. The concept of Islamic banking was developed in an effort to address the financial need between the deficit and the surplus sides in the emerging markets. Islamic banking mainly focuses on providing an opportunity to borrowers and investors to attain their profit maximization objective based on Islamic law. Subsequently, IFIs provide shareholders and borrowers with a wide range of innovative Islamic financial products. Visser (2009) asserts that the development of Shariah-compliant financial assets increased the volume of deposits in IFIs to $ 1 trillion by 2010 (Hasan, 2011).

A number of factors can reveal the growth of Islamic finance. One of these factors relates to the high rate of economic growth amongst the economies in the Gulf region. The growth originated from oil discovery and the formation of the OPEC trading bloc, which facilitated trade in petroleum. The September 11 terrorist attack in the US motivated Arab investors to prefer investing in Islamic products. Subsequently, they preferred investing in IFIs (Hasan, 2011).

Islamic finance was mainly concentrated in GCC region. However, the concept has gained ground in other economies. This situation has been triggered by the increment in the size of the Muslim population in the world. Consequently, the global financial sector is increasingly being characterized by both conventional and Islamic banking systems. Several ethical principles guide Islamic finance. They make it attractive to both non-Muslim and Muslim investors. Investors are increasingly considering Islamic finance safer and ethical compared to conventional banking.

Definition of Islamic Finance

Islamic finance is a faith-based financial system, which is based on Islamic law, namely the Shariah. Different definitions of the term ‘Islamic finance’ have been advanced. Merna, Chu, and Al-Thani (2010) define IFIs as a financial institution, which has based its goals, objectives, and operations on the principles of the Quran. IFIs have an obligation to adhere to the moral system as stipulated by the Quran. Furthermore, IFIs are forbidden from engaging in investment activities that contravene the Shariah law. Hunt-Ahmed (2009) emphasizes that Islamic finance is focused on ensuring fairness and equitable distribution of resources within the society. Islamic finance advocates IFIs to adopt profit-sharing as one of the guiding principles.

Principles of Islamic Finance

Merna, Chu, and Al-Thani (2010) assert that Islamic finance is based on a number of principles that differentiate it from conventional finance. Below is a summary of the main principles of Islamic finance.

Divine Guidance

This principle emphasizes that God created man so that he can fulfill certain objectives by adhering and obeying His commandments. The commands given to man are not only limited to worship and other religious practices but also encompass other aspects of human life, such as financial and economic transactions. Merna, Chu, and Al-Thani (2010, p. 4) assert, “Man needs such divine guidance because he does not have the power to reach the truth on his own”. The basis of integrating divine guidance in Islamic finance further arises from the fact that human beings are imperfect and usually confuse ‘reasons’ with ‘desires’. In conventional financial systems, government and religious operations are distinct of each other.

No Interest

Islamic finance prohibits the charging of interest or usury on sales and loans. This principle is based on the Islamic belief that lending money should not be used as a way of generating unjustified income. Furthermore, this claim is based on the need to promote equality, protect individuals’ property rights, and to promote social justice (Zaman, 2008). However, Islamic finance does not prohibit the earning of profit. Interest is charged ex ante, which means that the borrower incurs cost irrespective of whether he or she will benefit from the amount borrowed. On the contrary, profits are determined ex post, which means that the amount borrowed is successfully utilised. Askari, Mirakhor, and Askari (2011) contend that prohibition of interest is the most important tenet of Islamic financial system.

Risk Sharing

Conventional banks are founded based on trade, lease, debt, and equity. However, debt is not a component of Islamic finance. Subsequently, providers of finances are considered shareholders rather than creditors. Askari, Mirakhor, and Askari (2011) assert that lenders and borrowers in Islamic finance share the incurred losses and the gained profits. The profits and losses are shared based on a pre-decided ratio. On the contrary, conventional financial systems operate based on interest-bearing debt. Thus, risks are transferred to the debtors.

Asset-based

Askari, Mirakhor, and Askari (2011, p. 366) affirm, “Islamic teachings on finance forbid treating money as a commodity”. Therefore, assets or services support transactions in Islamic finance. This leads to the creation of real assets and inventories, hence eliminating pyramidal money-lending schemes. Islamic finance is mainly associated with the real sector.

Investment in Non-Shariah Compliant Products

IFIs are forbidden from investing in products that are considered haram in Islam. Examples of such products include armaments, gambling, and alcohol and pork business.

Exclusion of Provisional Conduct

Islamic monetary schemes are required to refrain from provisional practices such as hoarding, betting, and engaging in transactions that are characterised by tremendous suspicions and danger. Speculative practices are regarded as haram in Islamic finance. This principle limits Islamic financial systems from engaging in speculative contracts such as the above options and the future markets (Merna, Chu & Al-Thani, 2010).

Ethical/socially responsible Investment in Islamic Finance

Anas and Mounira (2009) observe that ethics and financial investments are mutually exclusive. The two aspects are of great significance in the financial sectors. Investors are increasingly appreciating the benefits associated with investing in socially responsible fields. Islamic financial institutions are focused on fostering justice and eliminating unfair business practices. Thus, they have incorporated financial ethics in their operation. Anas and Mounira (2009, p. 123) define ethics as “the set of values and principles that are accepted by any person or a group”. On the other hand, Nienhaus (2011) proposes that financial ethics are concerned with ethical principles and rules with regard to financial investments.

Moral savings constitute an increasing occurrence in the financial field and are mainly concerned with what is incorrect or true. Nienhaus (2011, p. 592) defines ethical investment as “the use of ethical and social criteria in the selection and management of investment portfolios, usually consisting of company shares”. Ethical investments are based on subjective sources such as personal ethics and objective purposes such as an individual’s reflection on social gains or losses such as investing in an activity that increases the rate of environmental pollution. Thus, ethical investors are not only concerned with the profits generated from their funds but also with the characteristics of investment vehicles in which their funds are invested.

Ethical practices in Islamic finance are based on the teachings of Quran, which outlines how businesses should operate. Islamic religion emphasises ethical and social dimensions of doing business. Therefore, Muslims have an obligation to comply with the ‘Shariah’ requirements, which guide Muslims on all aspects of their life including business. Islamic finance is one way through which religious beliefs, principles, values, and norms are integrated in investment decisions (Garas & Pierce, 2010).

Islamic investors have a wide range of options that they can consider when designing their financial portfolio. An example of such investment includes interest-free bank deposits, which provide investors with an opportunity to share the profit generated by the Islamic financial institutions. Islamic banks are considered one of the most ethical investment vehicles in Islam because their everyday operations are based on the Shariah teachings.

The second ethical investment that Islamic investors should consider entails investing in Islamic investment companies and unit trusts. Furthermore, Islamic investors should also consider investing their money in Muslim-based private placements and conventional businesses, which base their investment on halal (what is permitted). Islamic financial institutions are prohibited from saving in what is viewed as haram in Islam such as purchasing shares in liquor-making businesses and obtaining interest-making deposits. An autonomous Shariah Supervisory Board must commend all Islamic investments. The board comprises experts on Islamic finance and commercial jurisprudence. The purpose is to ensure that the investment products comply with the Islamic principles (Merna, Chu & Al-Thani, 2010).

Islamic framework emphasises the importance of taking into account the wellbeing of other people by viewing each other as a brother and/or sister. Thus, every individual has an obligation to desist from practices that might result in exploitation of others. All Islamic financial institutions are required to adhere to operate justly and social responsibly. To achieve this goal, Islamic financial organisations are required to adhere to the moral code of behaviour, which advocates fair treatment towards each other, avoidance of evil practices, trustworthiness, generosity, and truthfulness.

The concept of social responsibility in Islamic finance is further highlighted by IFIs’ commitment in nurturing a high level of transparency and justice in all their financial transactions. Islamic finance is committed towards reducing poverty level in the society. Lewis (2004) asserts that poverty is perceived as a threat to social stability and security in Islam. Islamic monetary zones such as the Islamic banks have an obligation of showing concern for the needy in order to cultivate communal integrity and stability.

IFIs have adopted diverse asset allocation techniques. For example, Islamic financial institutions are required to “establish the Zakat fund (tax system), which entails collecting a certain amount of tax from depositors and investors and distributing it to the less fortunate” (Anas, & Mounira, 2009, p. 128). The fund is aimed at improving the living standards of the poor. The other method used by Islamic banks entails engaging in charity work through Sadaqah (sharing willingly on the foundation of Allah).

Growth of Islamic Finance

Islamic finance has undergone a rampant growth rate since the 1970s. This achievement followed the introduction of a wide range of Shariah-compliant financial assets. The total value of Shariah-compliant financial assets in the US was estimated to be $ 1 trillion in 2010. This amount has increased to $ 1.5 trillion. The level of profitability within the Islamic finance industry is expected to increase to $ 32 billion by 2015. Islamic finance has been established in 100 countries up from 48 countries by 2010. Islamic financial institutions are increasingly being established in the developed and the developing economies across the world. Some of the African countries in which Islamic finance is being established include Ethiopia, Uganda, South Africa, Senegal, Algeria, Morocco, and Egypt. Middle East countries such as Qatar, the United Arab Emirates, Oman, and Qatar have also experienced an increment in the number of Islamic financial institutions.

Increase in the global Muslim population is one of the factors stimulating growth of Islamic finance. A study conducted by PricewaterhouseCoopers shows that Muslim population would increase by 35% by 2030. A high rate of growth is evident in Asian and African countries. The two continents account for over 95 percent of the global Muslim population. Most countries in Africa and Asia are reviewing their banking regulations in an effort to accommodate Islamic finance (PricewaterhouseCoopers 2010).

Personal Investment Portfolios

Islamic finance provides investors with an opportunity to construct a comprehensive investment portfolio. This strategy emanates from the wide range of products and contracts that an investor can integrate such as financing and investing instruments. Examples of financial instruments include Bay Al-Muajjil (deferred payment products), Murabahah (cost-plus sale), and Bay’ Salaam (forward sale). Other contracts that an investor might consider include Ijarah (lease contract) and Istisnah (manufacturing contract). On the other hand, investing products include Musharakah and Mudarabah (Grais & Pellegrini, 2010).

Comparing the Performance between Islamic and Conventional Financial Institutions

Islamic financial institutions have adopted distinct operational strategies compared to conventional financial institutions. For example, conventional banks use interest as a strategy to generate income from the money lent. Thus, money is regarded as a commodity. On the contrary, IFIs consider money a medium whose purpose is to promote financial transactions. Subsequently, the performance of the two financial institutions differs (Mohieldin, 2011).

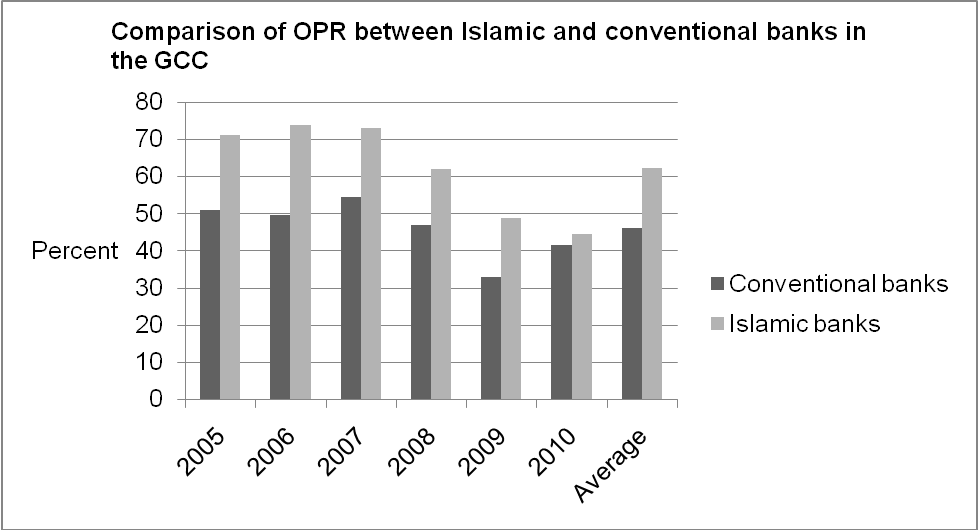

The difference in the performance of the two banks can be illustrated by their Operating Profit Ratio (OPR), which indicates the amount of profit that an organisation makes after subtracting the variable costs of operation such raw materials (Mayo, 2010). A study conducted on six Islamic and six conventional banks in different GCC countries, which include Kuwait, the UAE, Bahrain, Qatar, and Saudi Arabia during the period ranging from 2005 to 2010 showed that the banks had diverse operating profit ratio. The study showed that the two banking systems had different average operating ratios as illustrated in the table below.

Table 1: Comparison of OPR between Islamic and Conventional Banks in the GCC

The graph above shows that Islamic banks had relatively high operating profit ratio (62%) compared to conventional banks (46%) during the period ranging between 2005 and 2010. Islamic banks experienced a relatively high growth from 2005 to 2006 compared to conventional banks. However, Islamic banks experienced negative growth from 2007 to 2010. During this period, the average operating profit declined from 72.91% to 44.53%. The negative growth was occasioned by the economic recession, which occurred in 2007-2008 (Siraj & Pillai, 2012).

Conventional banks also experienced a negative growth during the same period. The operating profit ratio in conventional banks declined from 54.63% to 41.53%. The study shows that the Islamic banks had a relatively strong financial performance during the recession compared to conventional banks. The resilience of Islamic banks to global economic changes illustrates a high probability of investors integrating Islamic financial securities in their portfolio. Such a trend would stimulate the growth of Islamic financial institutions such as banks not only in Islamic countries but also in other countries.

Governance in Islamic finance

Corporate governance is defined as the process or method through which organisations are controlled and directed. The process of governance comprises customs and laws that guide the operation of Islamic financial institutions. Alnasser and Muhammed (2012) emphasise that corporate governance is aimed at eliminating operational inefficiencies by fostering a high level of accountability, transparency, and integrity.

Alnasser and Muhammend (2012) further assert that IFIs have an obligation to design financial instruments and products while complying with the set Shariah principles. Alnasser and Muhammed (2012, p. 2) contend, “Shariah supervision plays a fundamental role in promoting governance in IFIs”. Governance is regarded as a key component in the quest to develop a strong Islamic financial system. The concept of corporate governance in Islamic finance is based on the Islamic faith and practices. Thus, Islamic financial institutions are required to ensure that their governance structures comply with the Shariah. Additionally, Islamic financial institutions have an obligation to cultivate full disclosure of information. IFIs are required to design a comprehensive Shariah governance model, which comprises the following.

- The board: The board performs an oversight role in order to determine whether IFIs comply with the Shariah. Moreover, it is the role of the board to establish the governance framework. Subsequently, the board members have an obligation to understand the risks associated with non-compliance.

- The Shariah committee: The committee includes experts on issues related to Islamic finance. This plan aids in making sound Shariah decisions.

- An internal Shariah review system: The system ensures that the operations of the IFIs are reviewed on a continuous basis while complying with the set principles.

- Shariah audit unit: The unit’s role is to assess the IFIs’ operations and key functions on an annual basis to determine whether they are aligned with the Shariah.

- Risk management process: The process aids in identifying the various non-compliance risks, which might affect the operation of the firm.

Conclusion

Based on the expositions made in the paper, it is clear that there is a need to study the subject of Islamic banking. One needs to know what it entails, the benefits associated with it, as well as what an interested investor should avoid so that he or she is in line with the Sharia that governs this banking system. The study shows that there is a high probability of Islamic finance dominating the global financial industry. Currently, a significant proportion of Muslims across the world are unbanked. This presents a high potential for growth.

The second driver that will stimulate growth of Islamic finance relates to the institutions’ strategy and performance. Islamic financial institutions such as banks have adopted effective operational practices compared to conventional financial institutions (Wilson, 2000). All IFIs are required to adhere to Shariah laws, which advocate for a high level of trustworthiness, social responsibility, transparency, and integrity in the operation of an organisation. This makes Islamic financial institutions appealing to Muslims. Islamic financial institutions have adopted comprehensive industry and regulatory standards, hence increasing the level of consumer confidence. Subsequently, there is a high probability of Islamic finance attracting a large number of Muslim customers across the world.

Areas of Future Research

For Islamic finance to penetrate the global finance industry, it is imperative for the stakeholders charged with the responsibility of formulating the relevant factors to consider conducting a study on the following areas.

- Financial engineering: The stakeholders should evaluate how the Islamic financial instruments and investment vehicles can be improved. This plan will aid in the establishment of innovative financial instruments. However, the new products should be Shariah-compliant.

- Shariah standards: Islamic finance is gaining ground amongst both Muslim and non-Muslim investors. Subsequently, it is fundamental for Islamic financial institutions across the world to consider how they can harmonise the Shariah standards across the world. Currently, every Islamic financial institution has its own Shariah board. Such a system is inefficient. To deal with this challenge, it is essential for the relevant stakeholders to evaluate the possibility of designing a Shariah board to control the operations of IFIs within a particular economy.

- Stability: Islamic financial institutions were not adversely affected by the recent global economic recession. Despite this matter, it is important for countries to consider improving the stability of their IFIs by designing an Islamic capital market.

- Legal integrity: IFIs face a challenge with regard to dispute resolution, which arises from lack of clear separation between Shariah and commercial law. Thus, it is vital for IFIs to consider developing a clear definition of the application of Shariah and commercial law.

Reference List

Alnasser, S., & Muhammed, J. (2012). Introduction to cooperate governance from Islamic perspective, Humanomics, 28(3), 220-231. Web.

Anas, E., & Mounira, A. (2009). Ethical investment and the social responsibilities of the Islamic banks. International Business Research, 2(2), 123-131. Web.

Askari, A., Mirakhor, A., & Askari, H. (2011). Globalisation and Islamic finance; convergence, prospects and challenges. Hoboken: John Wiley. Web.

Hasan, Z. (2011). A survey on Shariah governance practices in GCC countries, Malaysia and UK. International Journal of Middle Eastern Finance and Management, 4(1), 30-51. Web.

Hunt-Ahmed, K. (2009). Contemporary Islamic finance; innovation, applications and best practices. New York, NY: Wiley. Web.

Garas, S., & Pierce, C. (2010). Shariah supervision of Islamic financial institutions. Journal of Financial Regulations and Compliance, 18(4), 386-407. Web.

Grais, W., & Pellegrini, M. (2010). Corporate governance and Shariah compliance in institutions offering Islamic products. Washington: The World Bank. Web.

Lewis, W. (2004). The power of productivity; wealth, poverty and the threat to global stability. Chicago: University of Chicago. Web.

Mayo, H. (2010). Investments; an introduction. New York: Cengage Learning. Web.

Merna, A., Chu, Y., & Al-Thani, F. (2010). Project finance in construction; a structured guide to assessment. Chichester: John Wiley & Sons. Web.

Mohieldin, M. (2011). On risk sharing and Islamic finance; implications for financial stability. London: University of Durham. Web.

Nienhaus, V. (2011). Islamic finance ethics and Shariah law. Ethical Perspectives, 18(4), 591-623. Web.

PricewaterhouseCoopers. (2010). Shariah audit industry analysis. Web.

Siraj, K., & Pillai, S. (2012). Comparative study on performance of Islamic banks and conventional banks in GCC region. Journal of Applied Finance & Banking, 2(3), 123-161. Web.

Visser, H. (2009). Islamic finance; principles and practice. London: Edward Elgar. Web.

Wilson, R. (2000). Islamic finance and ethical investment. International Journal of Social Economics, 24(11), 1325-1342. Web.

Zaman, R. (2008). Usury, riba, and the place of bank interest in Islamic banking and finance. International Journal of Banking and Finance, 6(1), 1-16. Web.