Introduction

Business standards and quality of management are principal areas of changes through which nations can enhance their financial status. Improving the ease of doing business can be achieved through measures that stimulate significant benefits. Small and medium scale enterprises (SMEs) are engines of development, growth, employment, and social union in rising economies and developing countries.

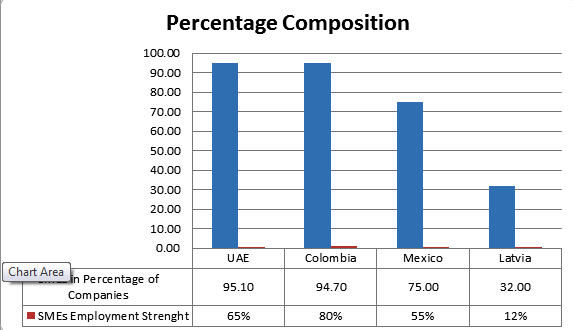

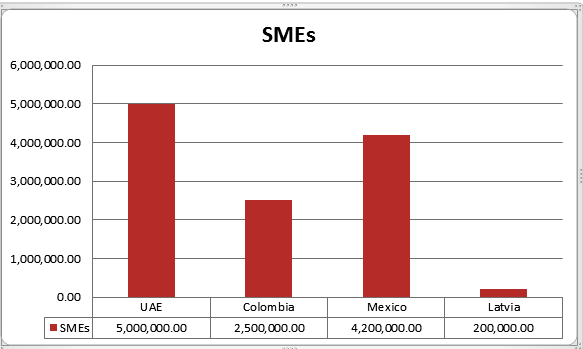

In the UAE, 94% of investments are SMEs, providing 24% of jobs. As found in figure 1, small enterprises estimate 36%, medium enterprises 9.9% and micro-enterprises 48%, and large enterprise is 5.3% (Statistics of Micro, Small, Medium, and Large Enterprises in Abu Dhabi 2015). The UAE ranks tenth as a free economy, a competitive index of 27, while its freedom score is 77.6% in 2018 (Statistics of Micro, Small, Medium, and Large Enterprises in Abu Dhabi 2015). The percentage population of small and medium enterprises in Mexico, Latvia, Colombia, and the UAE is summarized in table 1.

Table 1: Breakdown of SMEs by Sector.

SMEs and business visionaries can achieve their maximum capacity when they get finance to begin, sustain, and build their business. The lack or absence of credit facilities is a long-standing obstacle for SMEs, with challenging variations of financing requirements among nations. Financing is a unique requirement in developed economies, where credit gaps for SMEs and business people were aggravated by the 2008-09 financial and monetary crises (Basri 2016).

Financing requirements vary across regions and countries. Firm size, age, and period of advancement have a bearing on performance and access to loan facilities. SMEs confront higher loan costs, strict credit terms, and are bound to be credit-apportioned than established firms. A tabulated view of four countries can be found in table 2.

While numerous SMEs confront obstacles when accessing bank credits, access to non-bank loans is increasingly constrained. Most credit sources aside from bank loans are accessible to few enterprises, particularly in economies where capital markets are immature, and SMEs lack information and abilities to seek alternative sources of credit. While bank credit facilities remain significant for SMEs, there is growing concern to build a differentiated arrangement of choices for SMEs loans, to diminish their helplessness to changes in credit economic situations, fortify their capital structure, grasp development openings, and support investment.

Based on this context, this paper evaluates the process and access to finance in the UAE. The ease of doing business in the UAE would be discussed, while a comparative analysis of the policies adopted in the UAE, Mexico, Colombia, and Latvia will be highlighted. The benchmarking study will be concluded with a gap analysis as it relates to SMEs and access to finance. The recommendations on best practices for SMEs in the UAE will be suggested.

Benchmarking SMEs Access to Finance in the UAE, Mexico, Colombia, and Latvia

Recognizing the significance of SMEs to the economy, the UAE government has established a few regulations to help SMEs as a significant aspect of its endeavors to enhance its economy. The government has set up institutions to finance SME growth and stimulate various projects that offer specialized support to SME proprietors and directors (Hallami et al. 48). The government established the Khalifa Fund, The Mohammed Bin Rashid Establishment, Bedaya program, Ruwad Establishment in Sharjah, Al Tomooh finance scheme, and the Federal Credit Bureau to assist SMS access investment funds.

As found in figure 2, Mexico has over 4.2 million SMEs providing over 75% of employment. Based on this figure, 98% are microenterprise investments. The Nacional Financiera collaborated with the Mexican government to assist local enterprise access funds and other incentives. The Mexican government all created support channels through the Ministry of Economy, the Ministry of Labor, and Bancomext, FIDECAP, and Fondo. Latvian government created the ALTUM to collaborate with lending backs to assist SME.

The lending institutions provide startup grants for SMEs. However, the ease of doing business in the UAE has been challenging. Lack of funds for investment is a challenge for SMEs in the UAE. Most investors rely on family and individual savings as the source of their investment. Human resource (HR) is a component of business sustainability. Most enterprises do not have the required knowledge to organize their business. The inefficiency in allocating funds for employment, resource allocation, and marketing strategies affect business growth.

The benchmarking analysis compares SME policies in the UAE, Mexico, Colombia, and Latvia. The aim of SME benchmarking is to evaluate the influence of these policies for investors. The recommendations will be based on a critical analysis of the importance of these policies in these countries. SME in Mexico is categorized into the industry, commerce, and service. The investments are classified as micro, small, medium, and large enterprises.

The size of the workforces and financial flow determines the nature of the organization. The Mexican government established a collaboration called ‘COMPITE.’ The initiative assists entrepreneurs in personal training. Small investors are trained in business plan initiatives and requirements to access grants and bank loans. Another policy is for SMEs is called ‘SARE.’ The policy assists entrepreneurs during the incubation phase.

The sources of funds for SMEs in Mexico include suppliers, credit, commercial banks, foreign banks, development banks, and other sources. The Colombian government has been leading the development drive of small and medium enterprises. The government established two critical policies that address the financial and non-financial components. The economic component assists SMEs in project development, brand differentiation, and product positioning.

Some initiatives under the policy include the FOMIPYME, Law 590, MIPYME law, and the ‘Program of Commercialization.’ Based on this context, the actions seek to strengthen PYME, provide statistical information for investors, develop business initiatives, regulate competition among SMEs, and develop export initiatives. The government of Latvia established the ALTUM agency in line with the Small Business Act.

The agency provides financial help and other loan channels for small and medium enterprises in Latvia. The UAE government creates initiatives such as the Mohammed Bin Rashid Establishment for SME Development and the Khalifa Fund to assist SMEs. The initiatives are backed by laws such as Law No. 8 of 2012, and Law No. 23 of 2009 (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% in 2015). The UAE government strengthens the SME sector by removing the minimum startup requirement and reducing the time of business registration.

Benchmarking Challenges for SMEs Based on the Comparative Analysis

Poor Regulatory Framework and Policy Style

The fundamental challenges of SMEs in the UAE include lack of funds, human resources, executive aptitudes, marketing abilities, innovation, informed knowledge, education, policy structure, market standards, and motivators. These challenges can be solved when the government creates an adequate regulatory structure to manage business investments (Basri 2016). Most startups require favorable policies such as task leave, access to funds, and cost wavers.

These challenges affect the ease of doing business in the UAE. As found in table 4, the small and medium enterprises account for 95% of the business population in Dubai. The SME sector employs 52.4% of Dubai’s workforce (Statistics of Micro, Small, Medium, and Large Enterprises in Abu Dhabi 2015). This figure accounts for 47% of SME’s value to the economy.

Table 4: Breakdown of SMEs by Sector.

The challenges for business enterprises in the UAE include access to funds, the absence of entrepreneurial abilities, and complex authoritative systems. Among SMEs, micro investors represent 72% of the general organizations in Dubai, while small investments represent 18% of the business tally, and medium-sized firms represent 5% of the business sector (Statistics of Micro, Small, Medium, and Large Enterprises in Abu Dhabi 2015). Business trade and services are vital components of Dubai’s economy. At present, the trade division represents the more significant part of SMEs in Dubai (57%), trailed by the service segment (35%), while the production plant represents (8%). Dubai has turned into a global trade destination with 90% of the populace originating from different countries (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015).

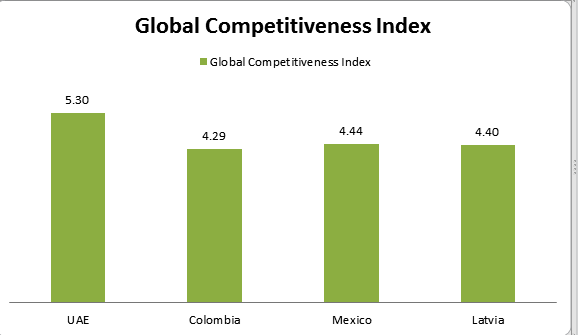

The United Arab Emirates is the most rewarding business environment in the Arabian Gulf and the most creative economy among Arab countries. The UAE is among the 137 economies perceived by the Global Competitiveness Report of the World Economic Forum as a development-driven economy (King 2014). As found in figure 3, the competitiveness score is measured by development models, policies, and variables that enhance business productivity. The development model of SMEs in Dubai is described by hierarchical structures, financial control, high managerial intensity, and communication. The development models include stakeholder assessment, SME survey, indicator fit assessment, macroeconomic analysis, data analysis, international best practices, and SME mapping.

The comparative analysis considers the UAE, Mexico, Latvia, and Colombia. The UAE ranks 11, while Mexico and Colombia rank 54 and 65 respectively (Dong & Men 2014). In starting a business, it is challenging for entrepreneurs in Colombia as they ranked 100 according to the report. The UAE ranks 25 while Latvia and Mexico rank 24 and 94 respectively. The major challenge of SMEs is access to funds.

Most investors abandon their vision when they exhaust resources (Dong & Men 2014). The UAE ranks 44 in its access to loans. This accounts for reduced access to funds in the UAE. As found in table 5, Mexico ranks 8 while Latvia and Colombia rank 12 and 3 respectively. In protecting minority investors, the UAE government ranks 15 while Mexico ranks 72 (Dong & Men 2014). The disparity in these rankings suggests that SME growth and development rely on government capacity to create a business environment to sustain its operations (The state of small & medium enterprises (SMEs) in Dubai 2018).

Table 5: Ease of Doing Business.

Inefficient Administration

Inefficient administration of government offices is a persevering issue in developing nations, particularly as to guidelines and standards regarding SMEs. SMEs in the UAE confront bureaucratic deterrents as perplexing methods that obstruct business startups. An investigation led by the SME Center at the Riyadh Chamber of Commerce and Industry showed that 44 percent of SME proprietors consider labor regulations issued by the Ministry of Labor to be the principal impediment to their improvement (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015).

The Absence of Management and Human Resource Skills

Another significant reason for business closure is poor administrative experience and skill. Numerous examinations have discovered that some SMEs had weak administration and unfit laborers (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015). Poor administration in most SMEs is because of the firm’s inability to allocate resources in improving their HR structure. This is attributed to low familiarity with the significance of preparing and enhancing employee skills (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015).

Marketing Problems

One of the challenges faced by UAE SMEs is an advertisement, which incorporates delivery, product campaigns, and sales (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015). Given that SMEs contend with the low-value of local and foreign products and services, the high cost of manufacturing and promoting sales in the UAE affect startups. The cost of electricity, product registration, a business permit, direct, and indirect expenses influences the cost of business.

Direct costs include wage bills and building rent while indirect costs include asset depreciation and insurance. Awareness of the significance of advertising and product promotions among UAE SMEs is low, contrasted with other countries. To expand their business, SMEs must focus on advertising devices and procedures, for example, product package and delivery, promotions and an advertisement, and other sale services.

Access to Finance

Access to finance is the foundation of the advancement of SMEs in any economy (Nuseir 2018). Expanding access to capital for SMEs is essential to guarantee the development and management of the segment, enhance performance, permit commercial development through liquidity, and funds accessible to new businesses and organizations (Nuseir 2018). As the liquidity of lending institutions expands, firms can secure their financial need to subsidize their tasks and operating capital to guarantee the survival of the business. Based on the benchmarking analysis, high-risk ventures, insufficient marketable strategies, the absence of security and inadequate data make potential financial suppliers and financial specialists hesitant to finance SMEs (Basri 2016).

The financial framework for SMEs in the UAE has five primary capacities as a motor of SME development (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015). The first function is to lessen investment risk through inclusion, trade, and expansion. The second capacity is to accumulate data and distribute assets. By decreasing data asymmetry among banks and borrowers, the financial framework allocates assets to the most productive sector, empowering monetary effectiveness, and social wellbeing. The third capacity is to assemble investors hoping to invest their assets (Schilirò 2015).

The financial framework unites the holdings of various entrepreneurs for allocation to expansive and profitable ventures. The fourth capacity is to reduce the cost of business information needed to allow contracts and direct the conduct of borrower firms. This capacity improves capital maximization, proficient asset designation, and long-term development. The last function is to encourage specialization by lessening trade costs. Specialization enables firms to focus on production activities, allowing SMEs to enhance their procedures and items (Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015).

Gaps in Access to Finance

A financing gap is characterized as the distinction between the demand for loan resources and the supply of funds. The explanations behind SMEs experiencing financial gaps can be found in their business, and proprietor, or supervisor quality, and market flaws in supply distribution. While numerous SMEs confront obstacles when accessing bank credits, access to non-bank loans is increasingly constrained. Most credit sources aside from bank loans are accessible to few enterprises, particularly in economies where capital markets are immature, and SMEs lack information and abilities to seek alternative sources of credit.

While UAE banks remain significant for SMEs, there is growing concern to build a differentiated arrangement of choices for SMEs loans, to diminish their helplessness to changes in credit economic situations, fortify their capital structure, grasp development openings, and support investment.

The fundamental reasons behind the absence of access to capital by SMEs are the additional attributes of SMEs and the defect of financial suppliers in the capital market (Schilirò 2015). SMEs in Dubai encounter an economic gap because of the absence of guarantors and insufficient financial data (The state of small & medium enterprises (SMEs) in Dubai 2018). As a result, the financing gap may emerge because of vulnerabilities related to asymmetric data and organizational issues, which increase the risk of debt financing.

Based on this context, Dubai’s banks operate with ethical risk and unfavorable determination hazards and may charge a high loan cost, limiting borrowers without collateral (Schilirò 2015; Study shows SME share of Dubai GDP at 47% and workforce at 52.4% 2015). As a result, lending institutions may take part in credit proportioning and not address the credit request of candidates, thus, depriving them of startup loans. Credit distribution centers on the financing gap between SMEs and lending institutions. The data asymmetry can restrict information to moneylenders about the company’s financial conditions or influence the bank to operate with moral risk. As a result, financial institutions limit SMEs ‘ access to funds, which creates the gap between the demand and supply of loans.

Recommendations to Improve SMEs Access to Finance

The recommendations are based on the comparative analysis of policies that improve SME access to funds. The first step in building an effective process for SME’s access to finance is by identifying the financial needs and gaps within the system. Since regulatory agencies have a blueprint in controlling and developing SMEs, creating a transparent process of loan profiling would improve the ease of doing business in the UAE.

This requires a solid proof base and a superior comprehension of the SME requirement. Access to finance is the foundation of the advancement of SMEs in any economy. Expanding access to capital for SMEs in Dubai is vital to guarantee the development and management of the segment, enhance performance, permit financial development through liquidity, and funds accessible to new businesses and organizations (Schilirò 2015). As the liquidity of Dubai banks expands, SMEs can secure their financial need to subsidize their tasks and operating capital to guarantee the survival of the business.

Reinforce SME Access to Conventional Loans

As a principal source of external financing for most private companies in Dubai, endeavors to enhance the banks’ ability to give loans must be established. Measures may incorporate credit assurance, securitization, credit protection, and satisfactory provisioning for high-risk investments. Risk relief measures must be fortified using innovations and instruments for risk appraisal. Powerful and unsurprising insolvency practices should guarantee debtor’s rights while supporting strong organizations and offering another opportunity for legit SMEs.

Consequently, credit facilities must be given on reasonable conditions and adequate client protection standards. Policymakers through the Department of Economic Development of the Emirate of Dubai should empower SMEs to utilize a more extensive arrangement of movable collateral to access loans. The utilization of credit data should be authorized to enhance risk assessment for lenders and access for SMEs. The improvement of optional financial instruments must be created to expand sources of funds and upgrade their comprehension of SME markets. Resource-based finance could be encouraged to empower startups.

Promote Financial Consideration for SMEs

The Department of Economic Development of the Emirate of Dubai should create policies to expand the volume of SMEs and improve access to financial service. Financial consideration is a vital instrument to reduce the sharp practices in accessing bank loans. Financial inclusion practices include legal practice, public intervention policy, and regulatory framework.

Regulations that Support Leading Instruments and Customer Protection

Policymakers and administrative experts in the Ministry of Economy must enact laws that encourage SMEs’ access to different financial instruments without trading their financial security and assurance. Regulatory assurance is expected to guarantee a stable working condition for firms and investors. Control standards must be proportional to the danger of various funding instruments. Policies must be established to prevent undue authoritative weight and encourage insolvency goals. Corporate administration and good governance should be energized to improve SMEs’ access to value markets. Administrative and legal structures should be enabled to promote different financing sources. International administrative coordination can advance cross-border funding for small and medium enterprises.

Enhance Transparency in Loan Operations

Data asymmetry in financial markets should be regulated to enhance loan transparency, support investors, and decrease credit costs for SMEs. Data frameworks for credit risk management must capture an accurate risk assessment. Loan assessment data must be created and access to essential market members and policymakers to encourage SME financing instruments. The information available at the global dimension should be upheld to improve cross-border operations and support foreign participation in SME financing.

The absence of financing projects and administrations for SMEs from banks or government agencies in the UAE affects the lifespan of SMEs. By decreasing data asymmetry among banks and borrowers, the financial framework allocates assets to the most productive sector, empowering monetary effectiveness, and social wellbeing.

Improve SME Financial Abilities and Vision

The Ministry of Economy and the Department of Economic Development of the Emirate of Dubai could create policies that improve SMEs’ financial knowledge, awareness, comprehension of different financial instruments, and changes in the enactment and projects for SMEs. This submission could assist uneducated investors to access funds. SME supervisors must acquire financial knowledge for bookkeeping and risk assessment to improve communication with speculators and react to risk requirements (Schilirò 2015).

Create Programs to Boost Entrepreneurial Efficiency

The Department of Economic Development of the Emirate of Dubai should plan public projects to improve SME access to finance. Policy consistency across government agencies and non-government bodies managing SME finance should be encouraged. The target population, qualification criteria, risk assessment structure, and startup costs should be considered and characterized when planning programs for SMEs.

The regulatory weight and business costs of new and existing regulations should be equal to the service provided. Entrepreneurial development programs and schemes for SME finance would leverage limited resources in high-risk investments. Under favorable conditions, entrepreneurial programs can be a channel for loan acquisition for SMEs. Using private assets and capabilities would enhance the flexibility of small and medium enterprises in the areas of financial and administrative change.

Conclusion

The lack or absence of credit facilities is a long-standing obstacle for SMEs, with challenging variations of financing requirements among nations. Financial requirements for loans from banks and other credit suppliers are one of the most significant impediments confronting the development of SMEs in the UAE. The recommendations discussed above would improve the ease of doing business in the UAE. Therefore, financial accessibility for SMEs in the UAE will permit business growth and enable them to exploit new areas of investment, guarantee a viable execution, and improve business service administrations.

Reference List

Basri, W 2016, ‘Social media impact on small and medium enterprise: case review of businesses in the Arab World’, Arts and Social Sciences Journal, vol. 7, no. 6, p. 236.

Dong, Y & Men, C 2014, ‘SME financing in emerging markets: firm characteristics, banking structure, and institutions’, Emerging Markets Finance and Trade, vol. 50, no. 1, pp. 120-149.

King, N 2014. UAE looks to diversify SME funding. Web.

Nuseir, M 2018, ‘Digital media impact on SMEs performance in the UAE’, Academy of Entrepreneurship Journal, vol. 24, no. 2, pp. 1-11.

Schilirò, D 2015, ‘Innovation in small and medium enterprises in the United Arab Emirates’, International Journal of Social Science Studies, vol. 3, no. 5, pp. 148-160.

Schwab, K 2018. The global competitiveness report 2017–2018. Web.

Statistics of micro, small, medium, and large enterprises in Abu Dhabi. 2015. Web.

Study shows SME share of Dubai GDP at 47% and workforce at 52.4%. 2015. Web.

The state of small & medium enterprises (SMEs) in Dubai 2018. Web.

The World Bank development indicators database 2017. Web.