Description of job-order costing

Costing systems are a key component in organizations’ accounting processes. This arises from the fact that they provide organizations with an opportunity to control their expenditures. Cost systems enable organizations to determine their current status. This is made possible by evaluating their cost of operation. There are various costing systems that organizations can integrate in their accounting processes.These include process costing and job order costing.

Job order costing system is a unique cost accounting method that is mainly suited for organizations that specialize in provision of unique or customized products. In most cases, the system is used by service oriented organizations such as hospitals, advertising agencies, law firms, and accounting firms. However, the system can also be employed by firms that specialize in other activities such as firms that deal with repairing various products, construction companies and furniture making companies amongst others.

Job-order costing system is mainly used if the production of one unit does not influence production of another. As a result, the cost of one job varies from that of another. To be effective in using job-order costing, it is fundamental for an organization to monitor each job separately.

By integrating job-order costing system, an organization can establish the total direct cost of material and the amount of labor costs. Therefore, upon completion of a particular job, it is possible for an organization to trace the unit cost of production. This can be achieved by dividing the total cost incurred in the production process with the total number of units produced. For example, if the total cost of producing 100 pencils is $300, then the cost of producing one pencil is $3. This represents the unit cost of the job.

Moreover, integrating job order costing system enable a firm’s management team to determine whether selling its product at the current market price will result to attainment of an acceptable profit margin. If this is not the case, the accounting manager is able to make the necessary decision. For example, the manager might decide to review the firm’s costing system. One of the options that the accounting manager can consider entails reducing the unit cost of production.

Despite its advantages, job-order costing is ineffective in that it is not possible for an organization to establish the overhead cost of a particular job. To deal with this limitation, a predetermined rate is used in calculating the total overhead cost incurred in the production process.

The second challenge associated with job order costing is that it requires an organization to evaluate the cost of every item produced. In order to achieve this, an organization is required to be very effective in keeping records of the products it deals with. However, this is a challenging process especially for firms that deal with numerous products.

Description of cost flows in job order costing

The first step in job-order costing involves recording the cost of labor, manufacturing overhead costs and the cost of labor used in the manufacturing process. The direct cost of labor and materials used are recorded on the debit side of the work in process account. On the other hand, all the indirect labor and material costs incurred in the manufacturing process are recorded on the debit side of the manufacturing overhead account. Other costs that are recorded in this account include additional actual manufacturing overhead costs that are incurred during the production period. Examples of these costs include cost of repair, cost of utilities such as insurance and the cost of depreciation.

The manufacturing overhead costs recorded in the work in progress account are based on a predetermined rate. The next step entails debiting the cost of finished products in the finished goods inventory account. Upon selling the finished products, the amount received is debited in the cost of goods sold account and credited in the work in progress account. This accounting system is not complex which makes it popular amongst most service oriented organizations.

Illustration of job order costing

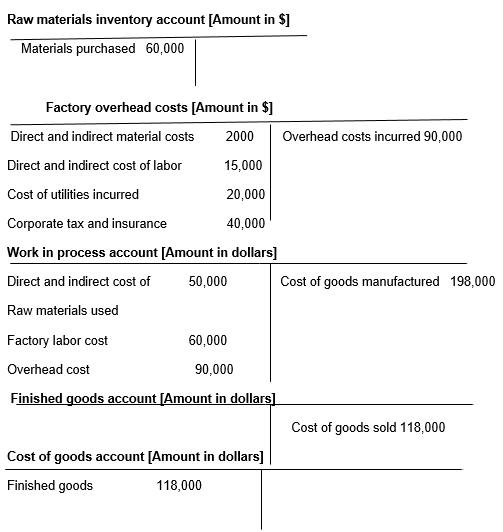

To demonstrate job order costing accounting method, the following case of MxC which specializes in assembling sewing machines is used. The firm is located at Ohio, US. On 4th March 2012, the firm ordered raw materials worth $ 60,000 which was received on 8th March. In job order costing, the first entry that an organization makes after receiving the order entails debiting the inventory account with the total cost of the raw materials.

The firm’s manufacturing process is composed of a number of factory labor costs. The three main categories of factory labor costs that the firm incurs relate to the gross earnings paid to the employees, the benefits offered to employees such as vacation pays, pensions, sick pay and the employer payroll taxes on the earnings gained. The firm incurred a total of $ 60,000 in factory labor costs. The firm also incurred a cost of $2000 in direct and indirect material cost. On the other hand, the firm’s total cost of direct and indirect labor amounted to $15,000. Its factory overhead cost amounted to $40,000. This cost was composed of the cost of various utilities that were consumed during the production process. During the production process, the firm incurred a substantial amount of money with regard to taxes and cost of insurance. The transactions are illustrated by the following T accounts.

From the above analysis, it is evident that job-order costing is more appropriate in organizations that engage in production activities that are independent of each other. Additionally, the system is more effective in determining the unit cost of a product. One of the advantages of this costing system is that it is relatively easy for an organization to adopt. Moreover, using the system enables an organization to make effective decision regarding the price point that it should set for its products.

Process costing

This refers to a costing method that is mainly used by manufacturing companies that specialize in mass production. Process costing is mostly used by organizations that specialize in production of identical products. Examples of organizations that use process costing include food processing and chemical producing companies amongst others. Unlike job-order costing method which entails determining the cost of a particular job separately, process costing method involves allocating cost to a particular production process.

To determine the cost per unit using process costing method, the total cost of the inputs used in the production process is divided by the total output. Considering the fact that the units produced are identical, there is no need for an organization to track the total cost of an individual unit.

By incorporating process costing method, accounting managers are able to establish the cost that their organizations incur in each of the production processes. Furthermore, process costing provides organizations with an opportunity to develop products that are unique. This arises from the fact that an organization is able to assess the entire production process thus making the necessary adjustments on the process. The resultant effect is that a firm is able to develop products that meet the customers’ needs.

Process costing also provides management accountants with an opportunity to assess whether there is any way that the cost of production can be reduced. This arises from the fact that they can identify gaps associated with a particular production process. One of the advantages of process costing over job order costing is that an organization does not need to engage in comprehensive record keeping. Organizations that deal with production of homogeneous products can utilize process costing more effectively compared to other firms. By using process costing, accounting managers can be able to determine the production process that is most effective. This arises from the fact that it is possible to determine the total cost involved in each process by evaluating the various cost variables.

Despite its advantages, process costing is characterized by a number of disadvantages. First, process costing does not take into account the direct unit cost of production which may lead to errors. Such errors may limit the effectiveness with which an organization determines the price point to set for its products.

Secondly, process costing may lead to some non-production costs being integrated in the entire process. This may lead to increment in total cost of producing a unit of a particular product. The resultant effect is that the organization may not be effective in marketing its products due to the high cost. Consequently, one can assert that process costing may result in management accountants leaving the actual cost of production and develop products whose cost is under-estimated.

There are various types of process costing that organizations can adopt. Some of these methods include weighted average method, first-in first-out method [commonly referred to as FIFO] and standard costing. Weighted average costing method assumes that the total costs of production are summed up and the total cost of producing one unit determined.

Description of cost flows in process costing

Process costing method of accounting is composed of a number of steps. The first step entails recording the materials purchased for the production process in the materials account. The second step entails recording the direct cost of materials used by the respective production units in the work in process account. Thirdly, the direct cost of labor used by the various departments in the production process is entered in the work in process account.

When recording the direct cost of labor, to ensure that separate entries are made in accordance with the various departments involved in the production process. The fourth step entails recording the factory overhead costs incurred with regard to indirect materials and other costs such as the cost of depreciation in the factory overhead account. The fifth step entails entering the factory overhead cost incurred in each of the production departments in the work in process account. The total cost incurred during the production process is recorded in the finished goods account.

Illustration

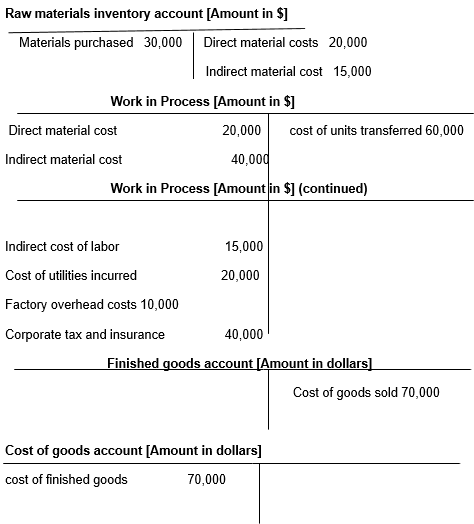

XMZ is a private limited company that engages in production of candies. In the course of its operation, XMZ intends to maximize its level of profitability. As a result, the firm engages in continuous production process in an effort to meet the market demand. On 3rd February 2013, the firm purchased raw materials worth $30,000 for its production processes. The firm commenced its production process immediately and incurred direct material costs amounting to $ 20,000. The firm incurred a number of costs that were recorded in the firm’s work in process accounts. Some of these costs include factory overhead costs amounting to $40,000, indirect material costs amounting to $15,000 and direct labor cost amounting to $5,000.

During its production process, XMZ incurred additional overhead costs amounting to $10,000. These costs were as a result of the depreciation charged on the processing plant and the cost of other utilities such as electricity, water and insurance. By the end of the production process, XMZ had managed to produce candies whose total cost amounted to $ 60,000. The cost of these candies is recorded in the finished goods account. The firm also managed to sell candies worth $70,000. The ‘T’ accounts below illustrate the cost flows of the firm’s manufacturing process.

From the above analysis, it is evident that there are different methods of costing that firms can integrate in their accounting processes. The two main methods of costing evaluated include job order costing and process costing. The methods differ with regard to their application and the nature of organization which they are best suited for. Job order costing is most applicable in organizations that specialize in provision of services such as hospitals and restaurants. Additionally, job order costing is applicable in organizations that engage in activities that are independent of each other. As a result, it is possible to determine the unit cost of a particular product.

On the other hand, process costing is most suited for organizations that engage in mass production. As a result, it is not possible for an organization to determine the unit cost of a particular process. Process costing is also characterized by a number of disadvantages such as the inability to determine the cost a single unit. Furthermore, process costing can result in accounting errors. The two methods also differ with regard to the process through which cost flows. Process costing is characterized by a more elaborate cost flow process compared to job order costing method.