Overview

Johnson & Johnson is a large multinational company that produces medical devices, consumer, and pharmaceutical packaged products. Founded in 1886 by Robert Wood Johnson and his brothers James Wood Johnson and Edward Mead Johnson, the company focused on improving the sanitation practices and quickly became renowned for its products. At the moment, Johnson & Johnson employs over 125,000 workers across sixty countries to achieve the goal of helping customers live a healthier and happier life. The three key product segments produced by the company include pharmaceuticals, medical devices, and consumer health.

The major franchises within the sector of pharmaceuticals include Oncology (e.g., Velcade and Zytiga) and Immunology (e.g., Remicade and Simponi), as well as Neuroscience (e.g., Concerta and Invega Sustenna) and Infectious disease (e.g., Incivo and Intelence). Within the segment of medical devices, Johnson & Johnson covers aesthetics, diabetes care, general surgery, delivery of insulin, and much more. Within the consumer care sector, the company includes skin and hair care, wound and vision care, nutritional products, oral health care, and over-the-counter medication. For 2016, Johnson & Johnson reported annual sales of $71.94 billion (Market Watch, 2016).

For this assignment, it was chosen to analyze the Neutrogena Light Therapy Acne Spot Treatment, a product that combines the specialization of Johnson & Johnson in both medical devices and skincare segments. It is an affordable product that has beneficial qualities to heal skin and offer the experience of a professional facial at home.

Supply, Demand, and Market Equilibrium

Johnson & Johnson is a global leader in the manufacture and supply of consumer and pharmaceutical products and medical devices. Its mantra of caring for the world individually has become the company’s corporate culture, motivating its employees to go to great lengths to satisfy their customers’ needs. The firm prides itself on manufacturing products that help people live happier, healthier, and longer lives. These products range from medical breakthroughs to the simple everyday essentials that improve the quality of life. Johnson & Johnson has more than 125,000 employees scattered in 60 countries in about 250 subsidiaries. Nevertheless, they are bound by their unifying mission of improving and prolonging human life. Johnson & Johnson has enjoyed relative success in its operations; it is listed among the Fortune 500 companies with annual sales of over $70 billion (Johnson & Johnson, n.d.).

The firm encourages innovation of revolutionary ideas to maintain its competitive edge over its rivals across the board and ensure that the health of the global population is advanced. It is well known for baby care, skincare, and beauty products, including the Band-Aid Brand bandages, Clean & Clear facial range, Tylenol medications, Acuvue contact lenses, and Johnson’s baby products range. Its latest product, the Neutrogena Light Therapy Acne Spot Treatment, promises to offer a breakthrough in the safe and effective treatment of acne. It falls under the skin and beauty products category, which the company has enjoyed relative dominance for some time now in several markets. The device utilizes red and blue light emissions to prevent and treat pimples. The lightweight pen-sized gadget is aimed only at the specific pimple spot for a few minutes every day to reduce the inflammation and is suitable for people of all ages and gender. As such, the company has the potential of exerting significant pressure on the production of the device to keep up with the high demand (Johnson & Johnson, n.d.).

The Neutrogena Light Therapy Acne Spot Treatment provides an excellent choice of examining the concept of elasticity and its sensitivity. The pencil-sized light treatment device has been on the market since June. The demand has been low, as expected of a relatively untested medical device that has been around for only four months. The market still seems wary of the gadget regarding its ability to perform as per its claim. The company has embarked on a vigorous marketing campaign, including a reduction in the price of the device, from $60 to $40. Johnson & Johnson project a sales increase for the gadget from 15,000 units monthly to 25,000 in the US. The subsequent price elasticity of demand for the change in price is as follows:

- Percentage change in price: -33%.

- Percentage change in demand: +66%.

- Coefficient of PED: 2.

In this case, demand for the Neutrogena Light Therapy Acne Spot Treatment is price elastic. Johnson & Johnson stands to gain additional revenue from price reduction (Christensen, 1997).

Neutrogena Light Therapy Acne Spot Treatment product is affected by two nonprice factors that impact demand:

- Substitutes.

- Expectations.

Currently, the market is flooded with other light therapy devices, such as Johnson & Johnson’s own Neutrogena Light Therapy Face Mask, which is cheaper in comparison. Also, consumers expect the price of the device to drop after the euphoria of a new product goes down, and as such, they do not feel a rush to buy it when they can get it later at a cheaper price (Landsburg, 2013).

Two nonprice factors that impact the supply for the Neutrogena Light Therapy Acne Spot Treatment are:

- Improved technology.

- Less costly regulations.

As technology improves, the cost of production of the light therapy device will drop. Another issue is the cost of government regulations. The FDA may impose regulations on the production of the gadget since its impact is relatively unfamiliar to the market (Christensen, 1997). When it comes to skin and beauty products, consumers need to be certain that a product will not cause any harmful reactions that could scar them for life. Consequently, Johnson & Johnson has experienced a dip in demand for the Neutrogena Light Therapy Acne Spot Treatment. The changes ensure that orders align with production and inventory. The market realizes the quality of the product and sales increase. The demand for light therapy increases and the company is compelled to accelerate its production. Johnson & Johnson increases the price of the device and the demand reduces to manageable levels.

Based on these predictions, I would conduct more market research to determine areas that would have a positive reception to the product. Production would proceed normally in these sections. Other sections would wait until they are ready for the complete launch (Landsburg, 2013).

Production and Costs

When developing a plan for the management of production and costs associated with a particular product, such as the Neutrogena Light Therapy Acne Spot Treatment, it is important to determine which factors of production will be involved in the manufacturing of the product, what the fixed and variable costs will be, what factors influence the producer’s choice of inputs, and what production decisions should be made based on the analysis. This paper will provide an overview of these aspects and give recommendations on the optimal production practices Johnson & Johnson can implement with regards to its new skincare product.

Key Factors of Production

The factors of production are the collection of inputs a company uses to manufacture an output (a service or a good). Such inputs are the resources that manufacturers need to generate an economic profit through the production of goods and services. They are divided into four categories, including capital, labor, land, and entrepreneurship (Vitez, 2017).

The first key input necessary for the production of the Neutrogena spot treatment is the land on which the manufacturing plant will be located. The land is not only limited to the physical property, but also includes resources such as water, natural gas, coal, and crude oil, all of which are essential components of the manufacturing process.

The second key input involved in the manufacturing of the product is the capital, which is a collection of tools (equipment, buildings, machines, etc.) that the company will use for production. For example, the Neutrogena factory needs processing equipment, assembly line equipment, and conveyors, along with other machinery to manufacture the Light Therapy Acne Spot Treatment.

While labor is a vital resource for the production of the skincare product, it is entrepreneurship that combines all aspects of manufacturing a product for earning a profit. In the case of Neutrogena, an entrepreneur is someone who brings together the resources, capital, and the workforce to develop a cohesive production strategy for manufacturing the Acne Spot Treatment. A specific example of an entrepreneur is the innovator that came up with the idea of using the combination of blue and red lights to reduce the appearance of skin breakouts without burning the subject (Neutrogena, n.d.).

Fixed and Variable Costs

Variable costs usually refer to inventory costs because they are often associated with production units and accounts of recorded inventory, such as the cost of goods sold to customers (Wilkinson, 2013). On the other hand, fixed costs do not fluctuate with the volumes of production. Instead, they include manufacturing overhead costs and indirect costs. In the case of Neutrogena’s production of their Acne Spot Treatment, fixed costs include the payment of rent for the warehouses or manufacturing plants (if any of them are rented), or the machinery which is used in production. Fixed costs also include salaries for the company’s executives, expenses on interests, insurance, and depreciation expenses. Variable costs that the company is expected to pay include direct material and labor costs (Wilkinson, 2013).

Factors Impacting the Choice of Inputs

When choosing the inputs that go into the production of the Neutrogena Acne Spot Treatment, it is essential to consider the factors that may influence the choice. The first factor refers to the supply of raw materials from an outside source (Benge, 2017). This factor is important because complications in the operation of the supplier can delay or limit the regular production schedule of the Acne Spot Treatment. Such complications may involve system glitches, transportation problems, or weather problems. If suppliers are not forthcoming about the issues they experience, the manufacturing process may be significantly delayed (Benge, 2017). Therefore, a smooth supply chain and a well-developed and managed inventory are factors that impact the choice of inputs by the company.

The second factor that has an impact on the choice of inputs is the need for special parts. Because the Acne Spot treatment is a unique product that uses the combination of red and blue lights to treat the skin, the manufacturing process requires the company to produce special parts to assemble the product. Any unforeseen changes in the “made-to-order” parts can influence the production of the commodity, especially when they are delivered from offsite (Benge, 2017). Factory overhead is the third factor that needs to be considered when choosing inputs for the production process. Because the company significantly depends on having the appropriate equipment to manufacture the product, even short-term shutdowns (of power, water, etc.) can influence the process overall. Additionally, if the manufacturing process is poorly managed or the management style does not align well with the process, it is highly likely that factories will generate excess overhead.

Finally, it is important to talk about people as the fourth factor that affects the choice of inputs. The workforce that is directly involved in the process of manufacturing can affect it in a variety of ways. For instance, sick leaves and vacations of key employees should be discussed ahead of time to prevent any adverse outcomes for the production. Another example is human error, which is an intangible factor affecting the process of manufacturing a product.

Production Decisions

Based on the analysis above, Johnson & Johnson has some decisions to make when it comes to optimizing its manufacturing process to achieve the best possible outcome. It has been discovered that outsourcing of some parts presents challenges such as overhead costs and delays. For this reason, it is recommended that the company should bring the manufacturing of the “special parts” to in-house facilities to prevent any disruption in the supply and delivery. In-house production will allow the company to become more flexible and react to the market quickly. For example, if the product gained exposure in American media, which would lead to a rise in demand, manufacturing in-house would address the spike in popularity more efficiently.

The second recommendation for optimizing the production of the Neutrogena Light Therapy Acne Spot Treatment is involving more human capital in the quality control department and replacing workers with automized equipment during the production itself. This would allow the company not to avoid firing workers by training them to be quality control specialists who monitor the automated processes. Human error, in this case, would be reduced significantly, leading to the overall optimization of the production. If the machinery made a mistake while assembling the product and there were not enough quality control personnel, the possibility is high that the product would come out faulty from the manufacturing plant.

In conclusion, production and costs are essential to consider for the maximization of the profits. It was recommended that Johnson & Johnson should assess the risks and benefits of their inputs and make changes in their production practices, including in-house manufacturing of special parts and focusing the efforts of the workforce on quality control through automating the assembly line.

Market Structure

Because Johnson & Johnson sells its products globally, it is essential to assess market structures in Europe, the US, and Asia. The European market for skincare products is more fragmented compared to the United States and countries such as Japan. In the latter two markets, a few large companies dominate the market while the European market is characterized by a large number of smaller companies (Rossi, Prlic, & Hoffman, 2007).

This means that in general, the production of skin care products in the United States is higher in the capital than that in Europe and thus is more productive. Therefore, it can be concluded that the structure of the skincare industry in the U.S. is monopolistically competitive: large companies bring similar products to the market that cannot be considered complete substitutes for one another. Large companies have the same market power and thus influence the development of prices.

Monopolistic competition is characterized as a middle ground between perfect competition and monopoly. Several large corporations act as umbrellas for brands; therefore, they compete with each other while there is less competition between brands that belong to the same umbrella. L’Oreal, Johnson & Johnson, Shiseido, Estee Lauder Companies, Coty, Unilever, and Procter & Gamble own 183 companies. These large conglomerates employ thousands of workers to make billions of dollars in revenue annually (Willett & Gould, 2017). This means that the seven umbrella companies control the advertising within the industry and thus influence the decision-making of consumers.

Johnson & Johnson is among the smaller umbrella companies and includes only nine brands, such as Neutrogena, Johnson’s, Roc, Clean & Clear, Aveeno, Le Petite Marseillais, and several more. The company is a part of the competitive monopoly that prevails in the market of personal care products. It is important to mention that Neutrogena is a top-selling brand within the umbrella, which makes it possible for Johnson & Johnson to invest in research and production of innovative products, such as the Light Therapy Acne Spot Treatment.

If to assess how the monopolistic competition impacts the financial performance of Johnson & Johnson, it is important to mention that the brand can make excess profits. In beauty sales alone, the company made $7.1 billion in 2016 (baby care products, oral hygiene, and skincare) (Beauty Packaging, 2016). Because the entry barriers are low and the umbrella companies acquire smaller brands that can offer unique products to customers, competition increases, putting at risk the profit of already established brands. Innovation has a direct influence on the financial performance of Johnson & Johnson, and products such as the Light Therapy Acne Spot Treatment can allow the umbrella brand to stay relevant.

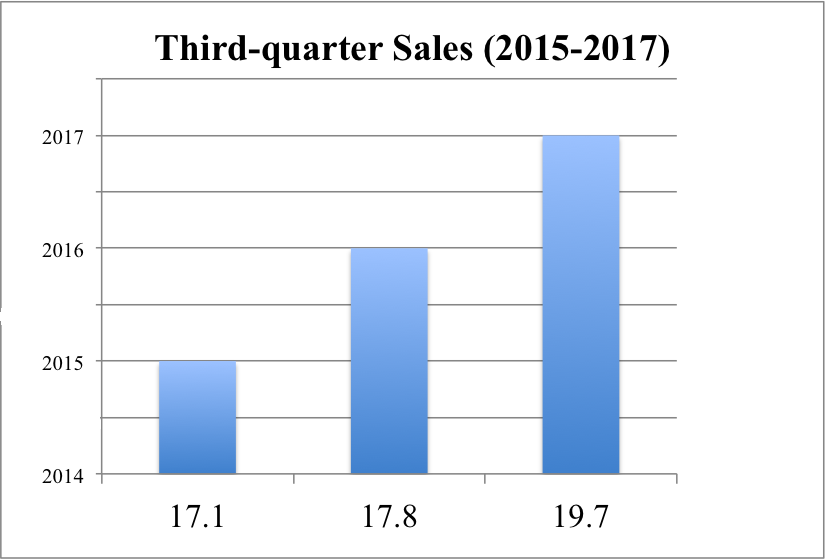

According to Johnson & Johnson (2017) report on the third-quarter sales results, 2017 third-quarter sales increased by 10.3% compared to 2016 and currently are $19.7 billion. Overall, sales volumes accelerated during the third quarter of 2017, which is explained by the strong performance of the pharmaceutical compositions of their business. As mentioned in the report, “the Company increased its sales guidance for the full-year 2017 to a range of $76.1 billion to $76.5 billion. Additionally, the Company increased its adjusted earnings guidance for full-year 2017 to $7.25 – $7.30 per share” (Johnson & Johnson, 2017, para. 4).

Compared to the previous year, consumer sales of $3.4 billion (in the third quarter of 2017 only) point to an increase of almost 3% if to combine the positive impact from currency of 1.3% and the operational increase of 1.6% (Johnson & Johnson, 2017). It is also important to mention that the domestic sales of Johnson & Johnson decreased by 0.5% in the third quarter of 2017; however, international sales increased by 5.1% if to combine the positive impact from currency of 2.1% and the operational increase of 3.0% (Johnson & Johnson, 2017). To better compare the mentioned figures, it is essential to analyze the company’s financial report for the third quarter of 2016 and 2015.

According to Johnson & Johnson (2016), compared to the third quarter of 2015, the 2016 sales increased by 4.2% and were $17.8 billion in 2016. The third-quarter results of 2016 pointed to the overall success of new product launches and the reliability of its core brands, including those involved in the pharmaceutical industry. As mentioned in the report, “the Company maintained its sales guidance for the full-year 2016 of $71.5 billion to $72.2 billion. Additionally, the Company increased its adjusted earnings guidance for full-year 2016 to $6.68 – $6.73 per share” (Johnson & Johnson, 2016, para. 4).

Johnson & Johnson also reported that the consumer sales for the third quarter of 2016 decreased by 1.6% compared to 2015 and were $3.3 billion if to take into account the negative impact from currency (1.7%) and the operational increase (0.1%) (Johnson & Johnson, 2016). Lastly, it is important to mention that in 2016 the international sales of the company decreased by 3.3% while domestic increased by 1.1% if to consider the negative impact from currency (2.7%) and the operational decrease (0.6%) (Johnson & Johnson, 2016). These dynamics show that 2017 was more successful for the company than 2016; however, it is important to review the operational results of 2015 to have a full picture of the situation.

According to Johnson & Johnson (2015), compared to the third quarter of 2014, the company’s sales decreased by 7.4% and were $17.1 billion. The year was characterized by the extension of the product portfolio and investing in innovation to meet the needs of customers and patients worldwide. In the report, it was mentioned that “the Company increased its adjusted earnings guidance for full-year 2015 to $6.15 – $6.20 per share. The Company’s guidance excludes the impact of after-tax intangible amortization and consumers worldwide” (Johnson & Johnson, 2015, para. 4).

Lastly, to compare the 2015 results to 2016 and 2017, it is important to include global and domestic sales. The financial report mentioned that the global consumer sales decreased by 7.7% compared to the previous year and were $3.3 billion if to combine the negative impact from currency (10.8%) and the operational increase (3.1%) (Johnson & Johnson, 2015). Domestic sales of Johnson & Johnson products increased by 8.9% in 2015 while international sales fell by 15.7% due to the dramatic impact of the negative currency influence of 16.1% and the operational increase of 0.4% (Johnson & Johnson, 2015). The following diagram shows the progression of the company’s sales for third quarters of 2015, 2016, and 2017 (in billions of US dollars):

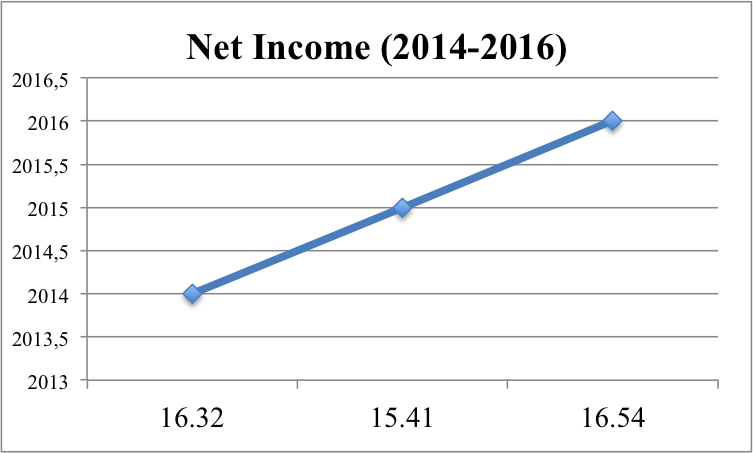

The company’s net income is illustrated in the graph below (in billions of US dollars; 2017 results are not available yet):

Critical points of Johnson & Johnson’s strategy are associated with bringing original value through innovation, extending research on products, and inspiring leadership. The company’s strategic principles are managed for long-term success, imply a decentralized management approach, are based in human healthcare, and involve both people and values. An interesting change in market structure that can influence the strategy of Johnson & Johnson can include a shift towards an oligopolistic market with higher entry barriers, where only several large companies sell a commodity and thus dictate policies on prices (Kumar, n.d.). While some characteristics of the monopolistic competition will be preserved, an important point for discussion is the interdependence of first under oligopoly. For instance, in a perfectly competitive market, there is an abundance of smaller firms, and there is no one specific company that is influential enough to impact the price or output; therefore, under such conditions, companies do not pay enough attention to what other firms do. Contrary to perfect competition, there is nothing similar to the interdependence of firms since there are only a few large companies that dictate market characteristics.

In an oligopolistic market, there are only several firms (which coincides with the current condition of the skincare industry) that produce slightly differentiated products and thus have a dramatic influence on the decisions associated with output and prices. Therefore, companies are interdependent, and thus none of them can ignore the reactions or actions of rivals. Also, under oligopoly, there are two kinds of competing attitudes that prevail between the leaders of the market. On the one hand, companies acknowledge the disadvantages of mutual competition and want to cooperate to increase their profits. On the other hand, such cooperation can increase the likelihood of conflicting antagonisms and clash.

For Johnson & Johnson, an oligopolistic market can become an opportunity to create more connections between the brands under its umbrella as well as cooperate with other larger conglomerates such as L’Oreal or Estee Lauder. The innovative technology introduced in the Neutrogena Light Therapy Acne Spot Treatment is a perfect opportunity to do so because higher-end companies will be interested in combining what Neutrogena did through adding a differentiating characteristic to the product to target consumers that buy more expensive skincare products.

References

Beauty Packaging. (2016). Johnson & Johnson. Web.

Benge, V. (2017). What factors can affect the manufacturing process? Web.

Christensen, C. (1997). Innovator’s dilemma: When technologies cause great firms to fail. Harvard, MA: Harvard Business School Press.

Johnson & Johnson. (2015). Johnson & Johnson reports 2015 third-quarter results. Web.

Johnson & Johnson. (2016). Johnson & Johnson reports 2016 third-quarter results. Web.

Johnson & Johnson. (2017). Johnson & Johnson reports 2017 third-quarter results. Web.

Johnson & Johnson. (n.d.). About Johnson & Johnson. Web.

Kumar, M. (n.d.). Top 8 characteristics of an oligopoly market. Web.

Landsburg, S. (2013). Price theory and applications. Stamford, CT: Cengage Learning.

Neutrogena. (2017). Light therapy acne spot treatment. Web.

Rossi, E., Prlic, A., & Hoffman, R. (2007). A study of the European cosmetics industry. Web.

Vitez, O. (2017). Economic definition of the four factors of production. Web.

Wilkinson, J. (2013). Variable vs fixed costs. Web.

Willett, M., & Gould, S. (2017). These 7 companies control almost every single beauty product you buy. Web.