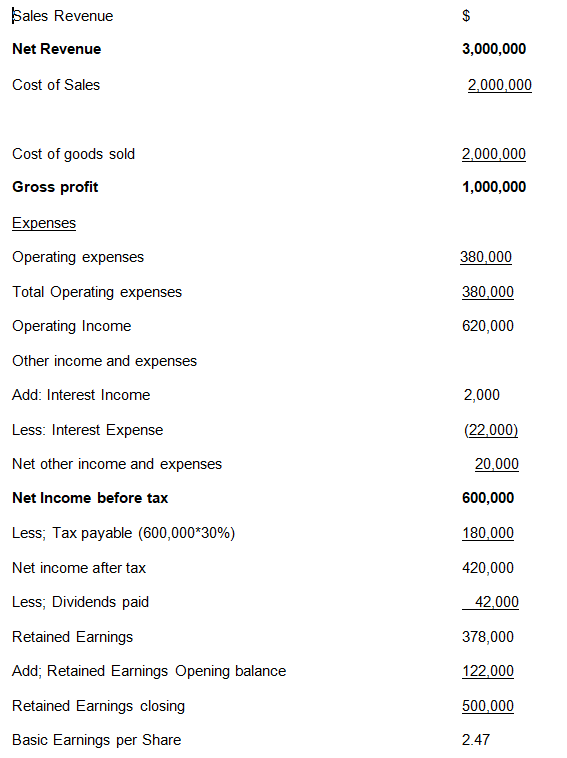

The financial accounts of Kyle’s Lawns Inc, using the multiple step formats appear as below.

For the Year ended November 30, 2005.

Calculations

The EPS of a company is calculated as below;

EPS = Retained Earnings

No. Of outstanding ordinary shares

= 378,000/150,000 = 2.47

The EPS of a company is a ratio that shows how much earnings an investor’s ownership has had. In the case of Kyle’s, there has been $2.47 for every share held.

Statement of Retained Earnings

Kyle’s Lawns Inc’s statement of retained earnings appears as follows;

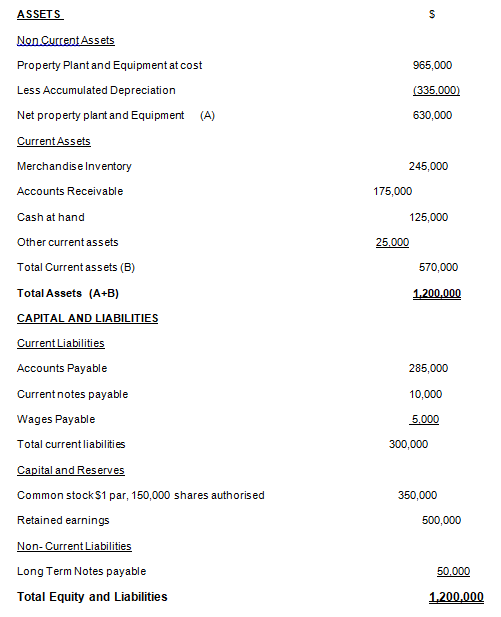

Balance Sheet

A Balance Sheet is prepared as at a particular date the company wishes to give the financial position. In the above case, Kyle Lawns balance sheet will be prepared as follows as at November 30, 2005.

Kyle’s Lawns Inc. Balance Sheet As at November 30, 2005

Ratios

Assets Turnover ratio is calculated as follows;

Asset Turnover ratio = Total Revenue/Total Assets

3,000,000/1,200,000= 2.5

The higher the ratio, the more efficient a company is utilizing its assets to generate sales. Kyle’s Lawns Inc has utilized its assets optimally. This is a ratio of the total credit sales over the average accounts receivable of a company. Assuming that Kyle’s Lawns Inc makes all sales on credit then the debtors’ turnover per year is very good at 16.39 for this company.

Accounts receivable ratio = Total Credit Sales Average Debtors

= 3,000,000/(191,000+175,000)/2

= 3,000,000/183,000= 16.39

The average accounts receivable collection period is the number of times in year a company collects its accounts receivables. Debtors collection period = 360

Debtors’ turnover= 360/16.39= 21.96

The debtors of Kyle’s Lawns Inc take on average 22 days to pay up it accounts. Anything below 30day is highly recommended for most companies. This company is therefore doing very well. The current ratio is the ratio of a company’s current assets over its current liabilities it is calculated as below;

Current Ratio = Current Assets/Current Liabilities

= 570,000/300,000= 1.9

This means that for every $1 owned by the company $1.9 is recovered. In its computation, it normally leaves the value of inventory out as sometimes inventory may be difficult to turn into cash. This is calculated by leaving the stock value out in the computation of the current ratio as follows. Quick ratio = Current assets – Stock

Current Liabilities

= 570,000 – 245,000/300,000= 1.08

This means that for every $1 owned by the company there is $1.08 to pay it up when it falls due. The interest earned ratio shows how well the company is able to pay interest expense using the profits generated as a result of using other people’s money and is calculated as follows.

Times interest Earned ration = Earnings before interest and tax

Interest Expense

= 600,000/22,000= 27.27

The higher the ratio the better is the company since this shows that the company has the ability to pay it interest expense by that number of times that is, 27 times. In general, Kyle’s Lawns Inc is financially sound and it is able it meet its obligations when they fall due. This is an indicator of a company that is financially sound and runs its affairs efficiently.

Depreciation

J.T Company’s depreciation the stamping machine is calculated as below;

Depreciation = Cost of asset – Residual Value/Useful economic life

= 480,000 – 40,000/5yrs

= $88,000

This depreciation is recorded as follows. With this value, we debit the depreciation expense account and credit the provision for depreciation account.

Selling this asset at the end of the second year means that the asset has an accumulated depreciation of $176,000 that is, (88,000*2yrs). This means that its book value is (480,000 – 176,000 = 304,000) selling it at $350,000 gives a gain on disposal of $46,000. This is recorded as follows, with the accumulated depreciation of $176,000 we debit the provision for depreciation account and credit the disposal account. With the gain on disposal of $46,000 we debit the disposal account and credit the profit and loss account. The proceeds from disposal of $350,000 we debit the bank account and credit the disposal account.