Introduction

Analyzing leasing, there might be several definitions varying in terminology, but nevertheless, stemming from the same financial concept. In that regard, leasing can be defined as a contractual agreement, between two parties, in which the right to use specific property or asset is transferred for a specified duration and rental payment. The benefits of leasing as a driver of the economy can be seen in that the equipment lease market in the US, as of 2007, constitutes $625 billion, with projected growth of 5 percent (Nikolai, Bazley and Jones 65). In that regard, leasing is an important concept, which nevertheless can be a subject of dispute in terms of income statement preparations. This paper analyzes leasing, its methods, and its challenges, based on the case of two companies, Krispy Kreme and Xerox.

Business Overview

Krispy Kreme is an international retailer headquartered in Winston-Salem, NC, specializing in sweet treats and coffee. The company was founded in 1937 and grew to include 560 locations around 18 countries with about 3900 employees. As of 2008, the company ended the year with total revenues of $383,984 thousand, in both the United States and the world (KRISPY KREME “Krispy Kreme Doughnuts Inc: Annual Report; KRISPY KREME “Krispy Kreme: Corporate Fact Sheet”). In 2002, the company’s expenditures fell from $59 million to $38 million, while the earnings rose 73 percent. With impressive financial statements for that period, the company brought controversy, when announcing its $30 million investment in a 187,000 sq. ft. plant and warehouse. The asset was obtained through a synthetic lease, setting up a special purpose entity, which led to negative publicity for the company.

Xerox is the world’s largest technology and services company specializing in document management. Headquartered in Norwalk, CT, the company was founded in 1906, and now has more than 54,700 employees in 160 countries. As of 2008, the company’s revenues constituted $17.6 billion (Xerox). The company is ranked 147 in Fortune 500 rankings, providing products and services through more than 6,500 agents and about 10,000 technology resellers (Xerox). A portion of the company’s income is coming from leasing equipment, where equipment, in general, can be seen as one of the main directions in leasing, as provided by the statistics of the market in the introduction. The main challenge can be seen in that Xerox reports equipment leases contract as sales, with the problem being that lease receipts comprises the payments for various items as well as the fact that payment periods affect the reported timing of the income.

Methods and Types

There are several leasing types, which definitions and purposes can be summarized as follows:

Capital Leasing – capital leases can be simplified as the substantial transfer of the benefits and the risks of ownership to the lessee. The latter is derived from the definition provided by FASB and FASAB, while IFAC, although defining capital lease similarly, it is titled finance lease. The criteria for the lease to be considered capital lease include:

- Transfer of ownership by the end of the lease term

- An option to purchase the asset at a bargain price

- The lease term being 75 percent or more of the economic life of the asset

- The present value of rental to be 90 percent or more of the asset’s fair value (Lee)

Operating Lease – such a lease differs from a capital lease in that it does not assume the risks of ownership, where the agreement is merely over the right for usage over a limited time. Generally, if the lease does not meet one or more of the criteria for a capital lease, it can be considered as an operating lease for both the lessor and lessee (Lee).

Direct Financing Lease – the lease to be classified as a direct financing lease, its fair value should be the same as its carrying amount, and at the same time, it meets one or more of the aforementioned criteria of the capital lease with two additional criteria. The additional criteria include:

- The condition that the collectability of minimum lease is reasonably predictable

- The absence of important uncertainties surrounding the unreimbursable costs incurred by the lessor.

If involving real estate and meeting additional three criteria, the direct financing lease can be classified as a leveraged lease, which does not fall within the scope of this paper (Lee).

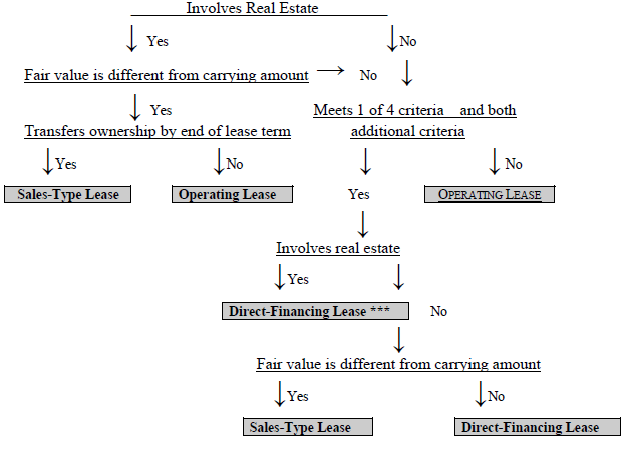

Sales-type lease – there are two cases for the lease to be classified as a sales-type lease. If real estate is involved, then the lease is sales type is the ownership is transferable. If real estate is not involved, the lease is classified as sales-type if it meets one of the four classification criteria and both additional criteria.

For a better demonstration, the questionnaire (see Fig.1) can be helpful.

Following such classification guidelines, it can be assumed that Krispy Kreme is using a capital lease, although the company is reporting it as operating. In that regard, it can be stated that the company is SPE is owned by the company and thus, the ownership is transferable, although off balance. In the operating lease, the company does not record asset or liability, with only rental expenses to the lessor being recorded, while in the capital the asset and the liability are recorded.

In the case of Xerox, it can be stated that the lease is a sales-type lease, in which the company, i.e. the lessor is the manufacturer of the product, with the four criteria met as well as the two additional criteria.

Accounting for Income

Despite the recognition of certain lease types, the way the companies account for their income is different than the lease identified. In the case of Krispy Kreme, the company accounts operating lease as a lessee, with the property being off-balance, while for tax purposes the company is the owner receiving a tax deduction for the property.

In the case of Xerox, the lease is reported as sales, and in that regard, the main allegations in an incorrect allocation of income, where despite the fact that the sums in long term might be the same, the company reporting sales, might increase the revenue of the company for income it only about to receive. The latter can be used to artificially increase the operating performance of the company so that the investors are satisfied.

The Role of IRS and SEC

The role of both IRS can be seen in providing the guidance for tax payers, in that regard, in case the Krispy Kreme, the company was receiving tax deductions over the ownership of the an asset which is owned by a third party in other documentations. Accordingly, providing the guidance and collecting the taxes IRS enforces the income laws. IRS is not directly responsible for financial accounting practices, but nevertheless, IRS might trace manipulations leading to lesser tax payments and conflicting financial and tax accounting practices (Nikolai, Bazley and Jones).

The role of SEC, which can be seen in the case of Xerox, is enforcing the securities law, establishing accounting standards and principles and making sure that they are followed. It can be stated that SEC (Securities and Exchange Commission), in the Xerox case was more concerned with financial accounting, where Xerox used false statements misleading the company’s financial positions (Nikolai, Bazley and Jones).

The Challenge

The challenge might lie in the fact that despite dealing with objective entities, the accounting standards can be subjective, where the interpretation can utilized in frauds. In that regard, taking both cases it can be seen that the outcomes of each case were the result of the utilization of accounting principles and standards.

Conclusion

It can be concluded that despite the fact that leases are beneficial practices, which make a substantial contribution to the economy, they might be utilized in misleading financial statements and tax payment malpractices. In that regard, the role of such organizations as SEC and IRS is in providing the guidelines, the standards and the laws, as well as enforcing these laws for the companies. Thus, it can be concluded that leasing is important information for both financial and tax accounting practices, given that all the standards and the regulations are followed.

Works Cited

KRISPY KREME. “Krispy Kreme Doughnuts Inc: Annual Report”. 2009. Web.

“Krispy Kreme: Corporate Fact Sheet”. 2009. Krispy Kreme. Web.

Lee, Susan S. K. “Capital and Operating Leases”. 2003. FASB. Web.

Nikolai, Loren A., John D. Bazley, and Jefferson P. Jones. Intermediate Accounting. 10th ed. Mason, OH: Thomson/South-Western, 2007. Print.

Xerox. “Xerox: Who We Are Today”. 2009. Xerox.com. Web.