Definition

Money is an essential component in everyone’s life. It is used in every sphere of our lives. We work to earn it, and we use it to save, invest or just spend it. It is imperative for us to make personal financial goals.

We make financial goals to enable us to have control over our finances. In so doing, we can see and seal the loopholes that would otherwise lead to the loss of money. The plan helps us channel our finances for the right use. It enables us to know when we have a shortfall so that we make a quick decision on how we source for more.

We can share a lot of information about finances. We cannot live alone. We need to find out what our colleagues know and share what we know. Since the information gives power, we can use it to our advantage.

Five Personal Financial Goals

- I want to do a budget in December for the coming New Year in order to manage my money well.

- I want to get out of my $10,000 debt in the next ten months by paying $1,000 per month from my salary.

- I want to start saving $1,000 a month in a fixed deposit account for the next two years to buy a tractor for farming.

- I will start my financial literacy classes next week to learn more about money and finances.

- I want to invest $5,000 in the stock market by buying LionGold shares for a period of seven years

The basic Liquidity Ratio = Total Cash and Cash Equivalents/Monthly Expenses

= 26,700/5166.7

= 5.2

The basic liquidity ratio is a personal finance ratio that helps give the time (in months) for which a household can meet its expenses with its monetary assets. The recommended minimum ratio is three months. The figure arrived at, in this case, is 5.2 months.

Debt Service Ratio = Net Income (Total Income-Total expense)/Total

Debt Service

= (72,980-62,000)/15,500

= 0.7

It represents the number of times the income can pay off the principal and interest payments on loans and leases. A higher ratio is good. In our case, 0.7 is less than one.

It, therefore, means that the obligations far outweigh the income. For this reason, more effort should be channeled towards increasing the revenue base and reducing the debt.

Liquid Asset to Net Worth Ratio = Total Invested Assets/Net Worth

= (65,000/74,000) %

= 88%

The figure above (88%) shows a healthy portfolio. A sound investment plan to prepare for retirement is seen here due to having more than 50% invested assets compared to Net worth.

Debt-to-Asset Ratio = Total Liabilities/Total Assets

Debt-to-Asset Ratio = Total Liabilities/Total Assets

= (200,000/274,000)100

= 72.99%

The answer above means that 72.99% of the assets are financed by debt while 27.01% is funded by self. It is not safe for the financial goal because it is supposed to be 50% at the minimum

Savings Ratio = Personal savings/Gross Income

= (91,700/72,980) %

= 127.4%

The recommended level of saving should be 10%. The resulting ratio above is very high; therefore the ratio gives very definite thumbs up.

An Investment of $60,000 borrowed from siblings and parents in a scam gold investment scheme:

The basic Liquidity Ratio = Total Cash and Cash Equivalents/Monthly Expenses

= 26,700/6,000

= 4.45 months

It gives a positive figure since the minimum desired is five months.

Liquid Asset to Net Worth Ratio = Total Invested Assets/Net Worth

= 65,000/14,000

= 464

The figure is far much more than the expected 50%.

Debt-to-Asset Ratio = Total Liabilities/Total Assets

= 260,000/274,000

= 94.9%

This is to say that 94.9% of the assets are financed by debt while 5.1% is funded by self. More money will be required to pay off the loan from parents and siblings. More money will come from the profits. It will undermine the ability to increase savings and cut down on some expenses.

The Factors to Consider Before Investing in a Structured Deposit

Due to the different forms that structured deposits come in, one should make a decision on whether a structured deposit fits with his or her financial goals, risk appetite and personal situation. Therefore the following four factors should be considered.

Liquidity

Ensure that you have adequate savings for investing in structure saving. Your money will be tied up for a period agreed upon with the investment officials/authority. You cannot withdraw before maturity date.

Doing so might cause you to lose part of your return or principal or both of them as well. You should, therefore, make sure that the money you intend to save does not have any immediate use. The period that one set must be a period that is agreeable to the goals that one can set for achievement.

Risks

It requires the investor to be a risk taker because things might take the direction of a worse scenario. As compared to fixed deposits, structured deposits are much riskier. Professional financial advisors might come in handy to help you understand all the expectations involved. If you do not understand the process, make sure you ask all the questions you can to get a clear picture.

Returns

Structured deposits are tied to other market eventualities and instruments. One of the examples may include market indices. Others can be fixed-income instruments, equities, foreign exchange, interest rates. But still a combination of all these can be a disaster. Seek to get enough information to understand how the performance of these instruments affects the return on your deposit.

It will be significant also to remember that historical performances may not necessarily indicate the future expectations. Depending on how volatile the business environment is, think first and have confidence.

Terms and Conditions

It is advisable to also read the terms and conditions and other documentation of the structured deposit thoroughly before assenting to them. If there is anything you do not understand how it works, seek explanation. You can avoid buying anything that you have very little knowledge about.

2nd year 4487*102%=$4,577

3rd year (4577*102%=$4,669

Future Value= 500,000 Expected rate of return i=3% Inflation rate=2%

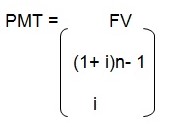

{(1+0.03)20-1}/0.03 = 18,608. Each year or 1,551 per month

- Under Medical Expense Insurance, a policyholder will not receive full reimbursement

- on the medical expenses incurred. It is a policy under this scheme to do so. There could be a fixed amount you have to pay before the insurer pays the policy benefits. There could also be a percentage of the bill you have to pay on the portion of the bill on top of the deductible.

- For a Critical Illness Insurance, a policyholder can claim for benefits when a qualified medical practitioner can diagnose a particular type of disease and surgery during the waiting period. Critical illness condition or operations are covered by the policy that very well defines the condition in the policy contract. The policyholder can only receive the benefits he or she suffers from a condition that meets the stated definition.

- Disability Income Insurance aims to fully replace policyholder’s total income. This is not entirely true since it only no more than 80% of your average monthly income. Disability Income Insurance only seeks to ease your financial burden.

Under Trust Nomination, a policy owner will continue to retain full rights and ownership over the insurance policy. He or she can revoke the policy at anytime. While under Revocable Nomination, the policy owner will lose all his rights to the ownership of the policy and can only revoke the policy with written consent from all nominees. The irrevocable nomination creates a statutory trust in favor of the beneficiaries. It is good for the policy to seek to provide protection of the policy proceeds from the creditors who may have an interest in it.