Current Macroeconomic State

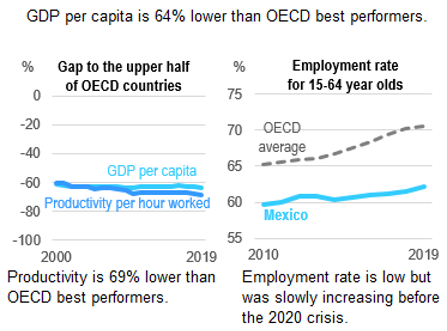

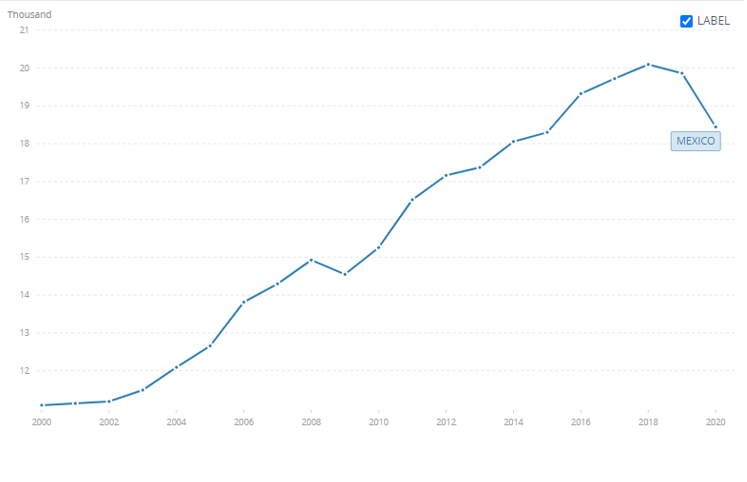

Mexico is considered a top-tier economy by gross domestic product (GDP) with a significant dependency on US public policy. In fact, the nominal GDP for the year 2021 was $ 1.170 trillion, which is nearly the 15th position in the world list. At the same time, the GDP per capita was $18 963, which is nearly the 70th position in the world (GDP per Capita, PPP (Current International $) – Mexico, n.d.) (Appendix B). Thus, we may observe that the average person does not commit a significant part to the national economy and that enterprises are the country’s GDP locomotive. The inflation rate for the Mexican economy was 3.64% in 2020 but has significantly increased to nearly 5.37% in 2021. Due to the inflation increase, the country’s real GDP of nearly $ 790.5 billion is calculated with a peak deflator of 148.4 (Ganti, 2022). The national currency is the Mexican peso, which is exchanged with a 20.31:1 ratio compared to the US dollar. The Bank of Mexico has established an interest rate target between 4 and 8 percent and decreased to the 6% rate compared to the 8% peak in 2018 due to the pandemic situation in the world. The unemployment rate is established at a relatively low level of 4.71 % compared to the developed countries, such as the USA, with 6.4 % (Unemployment, Total (% of Total Labor Force) (Modeled ILO Estimate) – Mexico, n.d.). This is majorly due to the absence of public institutions that would pay any temporary unemployment benefit.

General Macroeconomic Data Analysis

To understand whether a country is experiencing an inflationary or a recessionary gap, it is critical to compare the hypothetical real GDP at full employment and a real GDP with current employment. In fact, the 2021 forecasted GDP is $ 1 170 trillion. Since it is impossible to precisely calculate the potential GDP at full employment, one may compare the anticipated and the real GDP increase. Based on the statistics, the anticipated GDP growth for 2020 and 2021 would be 2.08 and 2.05 percent, respectively (GDP Growth (Annual %) – Mexico, n.d.). The two-year data was taken due to the world pandemic, which led to a significant GDP decrease in nearly all economies in the world. At the same time, the real GDP has fallen by 8.31% in 2020 and will increase by 6.25% in 2021 (Mexico and the IMF, n.d.). Thus, the actual GDP growth per two years is -2.06%, which is 4.11% lower than economic anticipations for two years. When the expectations outperform actual GDP growth, one may state a recessionary gap exists (Recessionary Gap Definition, 2020). Due to the inexistence of significant real inflation, it is possible to state that the country should put significant resources into stimulating enterprises and households to collaborate and return to their production potential.

When it comes to real GDP growth, one might understand whether the real GDP is increasing or not by comparing the GDP deflator and the GDP growth dynamics. More specifically, the GDP deflator for the Mexican economy has risen from 128.31 to 148.37 from 2019 to 2021, which might be represented as a 15.4% increase. At the same time, the GDP has decreased by 2.24$ during the same timeframe. As a result, the real GDP is not growing in the 3-year perspective. Moreover, it is increasing at a lower percentage than the nominal GDP due to the deflator increase. As a result, the real GDP dynamics are negatively affected by both unemployment and consumer price inflation rate, which creates a potential risk for leading the economy into real stagflation despite the theoretical inexistence of real inflation.

To find the real GDP on purchasing power parity (PPP) basis per capita, one should consider the real GDP and convert the national product per capita into international money so that the real GDP will be presented without currency exposure. Real Mexican GDP per capita adjusted to PPP was $ 18 444 in 2020. The per capita real GDP is increasing in the long term, even though the 2020 crisis has deviated from the trend line and decreased in the short term. The relevant data might be easily found in the long-term timeline since it is tracked by the World Bank (Appendix A).

The non-accelerating inflation rate of unemployment (NAIRU) is a specific rate for the economy which establishes a ‘natural’ unemployment rate. By passing below this rate, an economy is put at risk for inflation increase. In fact, the current unemployment rate is 4.71%, while the NAIRU rate for the Mexican economy is 4.1 % for 2021 (Murphy, 2021). Consequently, the Mexican economy is safe since the unemployment rate is 0.6% higher.

Similar to the majority of other world economies, the Mexican economy is operating at the late stage of the credit cycle and the transitory stage of the business cycle. More specifically, the economy will surpass the transitory stage and enter the early stage of a new business cycle after achieving the peak of the previous business cycle (Principles of Macroeconomics, 2011). As was stated before, today’s growth rate is established at -2.06%, so by growing at a higher rate, the Mexican economy will enter a new business cycle. In addition, the country has a 4.11% recessionary gap, so there exists an additional pressure of unemployment.

Public Policy and Future Expectations

When it comes to the current policy, the Mexican economy follows one of the strictest fiscal policies in Latin America. In 2021, governments did not change their tax system so that the income taxes for Mexican residents varies from 1.92% for the lowest tier of income receivers to 35% for the highest one. At the same time, the country was actively adjusting the interest rate to the GDP growth so that it successfully cured the GDP decrease. In 2020, the interest rate dropped twice from 8 to 4 percent. However, in 2021, the central bank followed a contradictory policy and started to increase the interest rate to cure the inflationary process so that it reached 6% at the beginning of 2022. Consequently, one might state that the Mexican economy is majorly regulated through monetary policy by simultaneously supporting the high level of government tax income. The exchange rate policy in Mexico supports its fiscal and monetary policies. This is due to the fact that since 1994, the central bank has adopted a floating exchange rate regime. Moreover, the central bank does not actively intervene in the currency market.

In the future, the country will easily pass into the new business cycle with relatively stable inflation and unemployment rate. Even though the economy experiences some pressure from both factors, the correct public policy might help the economy effectively cure the losses from the 2020 crisis (Statista, 2021). The current situation does not allow Mexico to significantly increase production possibilities since the country does not have considerable research and development base (Principles of Macroeconomics, 2011). As a result, the unemployment and inflation rates will organically adjust to the economic situation in the country and stabilize on theoretically accepted levels of 3 % for unemployment and 4-5 % for inflation, with the interest rate around 5 and 6 percent.

References

Ganti, A. (2022, January 30). Real Gross Domestic Product (Real GDP) Definition. Investopedia. Web.

GDP growth (annual %) – Mexico. (n.d.). World Bank. Web.

GDP per capita, PPP (current international $) – Mexico. (n.d.). World Bank. Web.

Mexico and the IMF. (n.d.). IMF. Web.

Murphy, C. (2021). How the Non-Accelerating Inflation Rate of Unemployment Works. Investopedia. Web.

OECD. (n.d.). Mexico Economic Snapshot – OECD. Web.

Principles of Macroeconomics (1st ed.). (2011). [E-book]. University of Minnesota Libraries Publishing.

Recessionary Gap Definition. (2020). Investopedia. Web.

Statista. (2021). Gross domestic product (GDP) growth rate in Mexico 2026. Web.

Unemployment, total (% of total labor force) (modeled ILO estimate) – Mexico. (n.d.). World Bank. Web.

Appendix A

Appendix B