The United States central bank, the Federal Reserve is tasked with regulating money supply through two significant approaches such as monetary and fiscal policies. The Federal Reserve’s activities and communications to facilitate maximum employment, consistent prices, and average long-term interest rates encompasses of its monetary policy (Egea & Hierro, 2019). In particular, America’s central bank is a vital maker of economic policies that govern the world’s leading economy. The origin of the financial authority can be traced back in 1913 when the Congress created the Federal Reserve System. The initial effort to stipulate macroeconomic objectives arrived after World War II (Egea & Hierro, 2019). As such, the Great Depression acted as an impetus that brought a deep desire for individuals to prevent similar downturns in the future.

Basic Procedure of Open Market Operations when used to Engage in U.S. Expansionary Monetary Policy

An open market operation is a financial instrumental used by the Federal Research to reach an anticipated outcome by purchasing and selling principally United States securities. Treasury securities are traded on the open market to control money supply stored on U.S. banks reserve (Rocheteau et al., 2018). In addition, an expansionary monetary approach is a financial policy that intends to raise the rate of economic expansion to invigorate domestic economy growth.

The Federal Reserve can utilize open market operations to promote the objectives of expansionary monetary policy. For example, it participates in buying government securities in an attempt to guarantee that the federal funds trades within a reduced range as formulated by the Federal Open Market Committee (FOMC) (Rocheteau et al., 2018). Therefore, the payment received is added to the reserve balanced under the management of commercial banks at the central bank, which in turn increases the amount of money available for lending. This infusion of reserves into the banks reduces the federal funds rate, which also lowers other interest rates. As a result, the entire process leads to promoting considerable borrowing across the country (Rocheteau et al., 2018). From a policymaker’s perspective, this process is referred to as expansionary monetary policy, which ensures that the economy is invigorated to spur economic activity.

Basic Procedure of Open Market Operations When Used to Engage in U.S. Contractionary Monetary Policy

Sometimes the Federal Reserve may engage in contractionary monetary practices in an attempt to curb economic expansion to combat inflation. In particular, this monetary policy minimizes the supply of money to stop excessive conjecture and unsustainable capital investment. The U.S. central bank may also use open market operations to promote the objectives of contractionary monetary approaches. For example, it participates in selling government securities it possesses which allows purchasers to pay from their accounts. As such, it contracts the funds that are available in banking institutions for borrowing (Israel & Latsos, 2020).

In addition, it puts an upward pressure on the federal funds rate since banks have less reserves in their depositories to loan and will charge higher interest rates to do so. From a policymaker’s perspective, this process is referred to as contractionary monetary policy meant to curb expenditure when price stability is in jeopardy due to inflation.

Is It Good or Bad for Businesses to Engage in Additional Borrowing for Business Operations When the Fed Is Implementing Contractionary Monetary Policy?

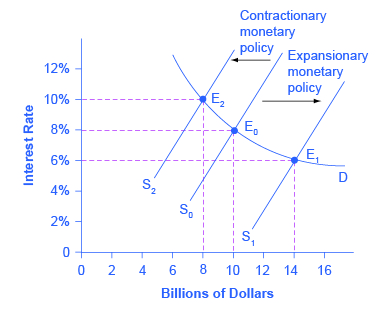

When the Federal Reserve is engaged in using contractionary approaches to curb the effects of inflations, businesses should refrain from additional borrowing to fund their growth and expansion. It is because during this time, the government has increased interest rates making it expensive for firms to borrow. As indicated in the graph below, a contractionary government initiative will move the supply of funds to be borrowed to the left from the initial supply curve while also increasing the interest rate to 10% (Nelson et al., 2018). In particular, businesses should refrain from additional borrowing when the central bank is orchestrating contractionary monetary approaches.

Non-U.S. Country Engaged in Expansionary Monetary Policy

The United Kingdom is an example of a country that has used an expansionary monetary policy. For example, if the Bank of England lowers interest rates, it will raise the demand in the country. During the 2008/2009 recession, the Bank of England had to implement various mechanisms, which involved using expansionary monetary approaches to lower interest rates in a bid to reinvigorate the country’s economy for recovery (Wegman et al., 2017). In particular, interest rates declined from 5 percent to 0.5 percent in a short time (Egea & Hierro, 2019). As a result, this expansionary approach helped the UK especially in economic revival.

Non-U.S. Country Engaged in Contractionary Monetary Policy

Australia is an example of a country that utilizes contractionary monetary policy. The Reserve Bank of Australia (RBA) uses this approach to increase interest rates in an attempt to regulate inflation. Therefore, the RBA raises cash rate which eventually augments flows. In essence, the country has benefited from using this approach especially when balancing between stimulating economic growth and controlling inflation (Rocheteau et al., 2018). Therefore, while an expansionary approach is essential for countries, some scenarios require contractionary approaches.

Conclusion

This paper has explored the macroeconomic approaches, particularly the expansionary and contractionary monetary approaches used by the United States Federal Reserve. It applies various tools to achieve its aim of either stimulating economic growth or regulating inflation. Therefore, it utilizes open market operations to purchase government securities in a bid to ensure that federal funds trades within a specified range. In contrast, it can also participate selling these securities to enable buyers pay from their accounts.

References

Egea, F. B., & Hierro, L. Á. (2019). Transmission of monetary policy in the US and EU in times of expansion and crisis. Journal of Policy Modeling, 41(4), 763–783. Web.

Israel, K.-F., & Latsos, S. (2020). The impact of (un) conventional expansionary monetary policy on income inequality–lessons from Japan. Applied Economics, 52(40), 4403–4420. Web.

Nelson, B., Pinter, G., & Theodoridis, K. (2018). Do contractionary monetary policy shocks expand shadow banking?. Journal of Applied Econometrics, 33(2), 198–211. Web.

Rocheteau, G., Wright, R., & Xiao, S. X. (2018). Open market operations. Journal of Monetary Economics, 98, 114–128. Web.

Wegman, F., Allsop, R., Antoniou, C., Bergel-Hayat, R., Elvik, R., Lassarre, S., Lloyd, D., & Wijnen, W. (2017). How did the economic recession (2008–2010) influence traffic fatalities in OECD-countries?. Accident Analysis & Prevention, 102, 51–59. Web.