Introduction

This report will examine the background information about Netflix Inc., its innovation history, and business models, along with factors that influenced its development, and an overview of the industry. The factors affecting the industry will be assessed via Porter’s Five Forces framework. In addition, an assessment of Netflix’s resources, SWOT and value chain analysis will identify the company’s current performance within innovation and its capabilities. Lastly, the report will discuss the current trends and forward perspectives in the video-streaming industry and recommend Netflix’s future areas of focus within innovation. The scope of the report is limited to the public data available online on various websites.

The Organization & Industry Overview

Background Information About Netflix

Reed Hastings founded Netflix in 1997 as a DVD rental company which later grew into a subscription-based internet movie-streaming platform (Wang, 2022). The initial business structure was a DVD rental outlet that used pay-per-rent and monthly subscription models.

It allowed people to rent movie DVDs, which would be delivered straight to their homes. In 2006, Netflix had 44 distribution facilities around the United States, which facilitated the delivery of DVDs to its members (Wang, 2022). By 2007, Netflix will move its attention to streaming media. With a sufficient customer base, it expanded overseas, beginning with Canada in 2010, and is now accessible in over 190 countries (Wang, 2022). Netflix has more than 200 million customers worldwide and generates $7.7 billion annually (Wang, 2022).

Overview of the Video Streaming Industry

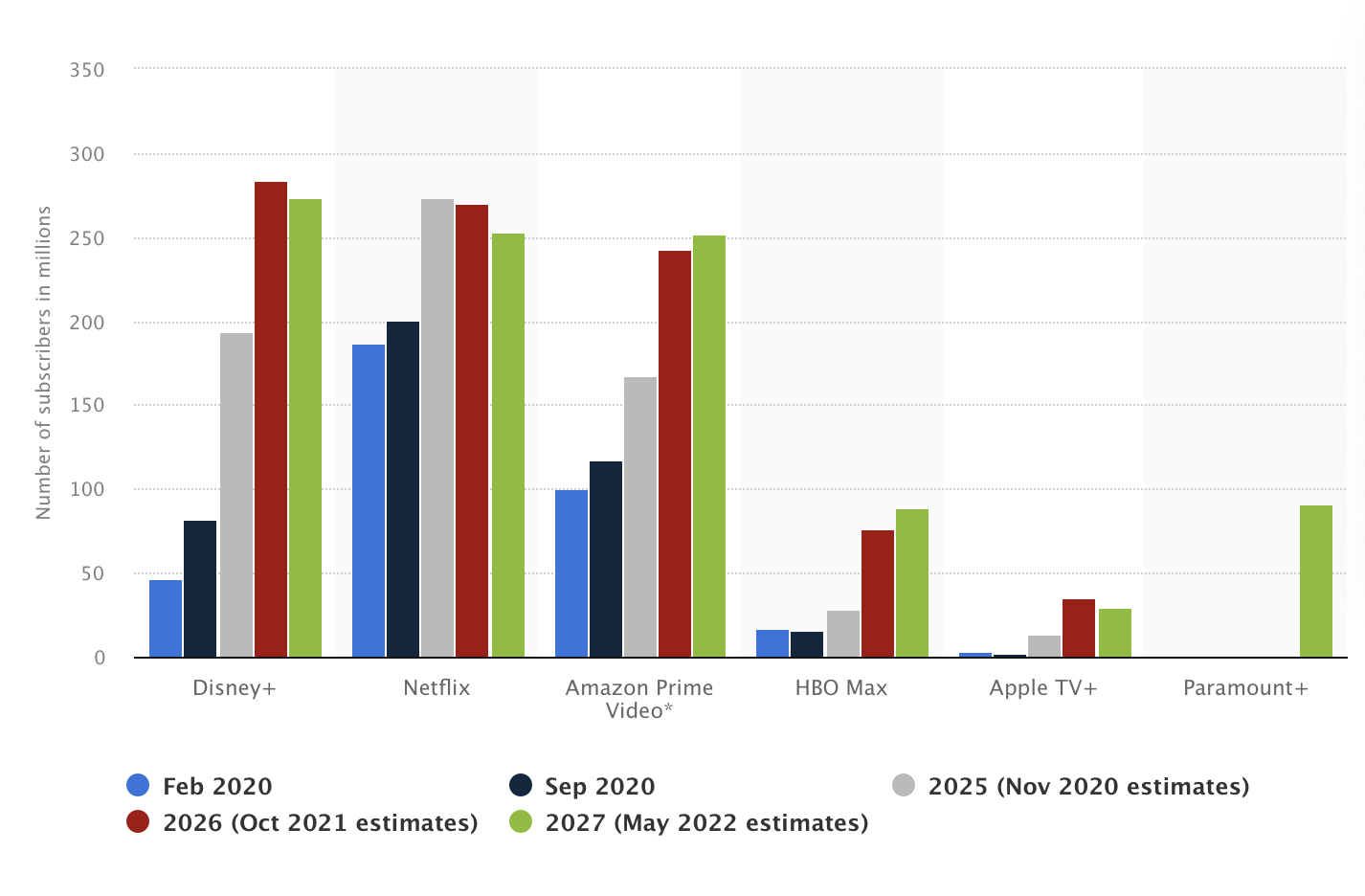

In 2020, the amount of Netflix subscribers was equal to approximately 201 million people rendering the company the market leader (Statista, 2022b). The income of the worldwide subscription video-on-demand (SVOD) industry has risen by over 300% between 2016 and 2020 (Statista, 2022a). The market expanded from the initial 17 billion to 67 billion US dollars (Statista, 2022a). The revenue is anticipated to reach 126 billion US dollars by the year 2026, assuming continued strong expansion in the foreseeable future (Statista, 2022a). In this industry, the number of subscribers is directly correlated to revenue. Therefore, Chart 1 reflects the main competitors of Netflix in the industry, such as Disney+, Amazon Prime Video, HBO Max, Apple TV+, and Paramount+.

Innovation History

Core drivers of innovation in Netflix could be considered from the perspective of Human Resources and technological trends. A major tenet of the company’s culture is that innovation is best fostered by recruiting and retaining the most talented individuals and imposing as few restrictions on their work as possible. Reed’s notion of preparing the company’s culture for continual innovation is ultimately responsible for Netflix’s success. The first step toward mediocrity is frequent complacency. Netflix’s rules dictate a degree of uncensored feedback that could be politically unacceptable in other organizations in order to keep people pushing toward self-improvement. During the initial stages of the company’s development, the success was driven by the early decisions to invest in disruptive technology without a definite understanding of future development. This was a risk that ultimately paid off under the proper leadership and management of employees.

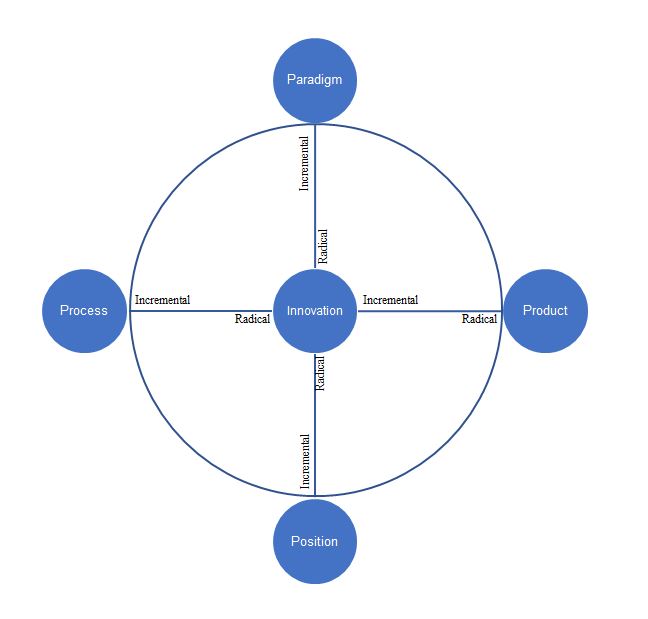

It is possible to use the Diagram of 4Ps of Innovation Space to understand the innovation capabilities paradigm within Netflix Inc. The company focuses on process innovation by improving its product delivery models. Radical innovation in this segment allowed the company to adopt a completely new business model, which transferred movie renting to the internet. Moreover, the assistance of the AI-enhanced recommendation system allowed the company to differentiate its customer experience from competitors and maintain a dominant position in the market.

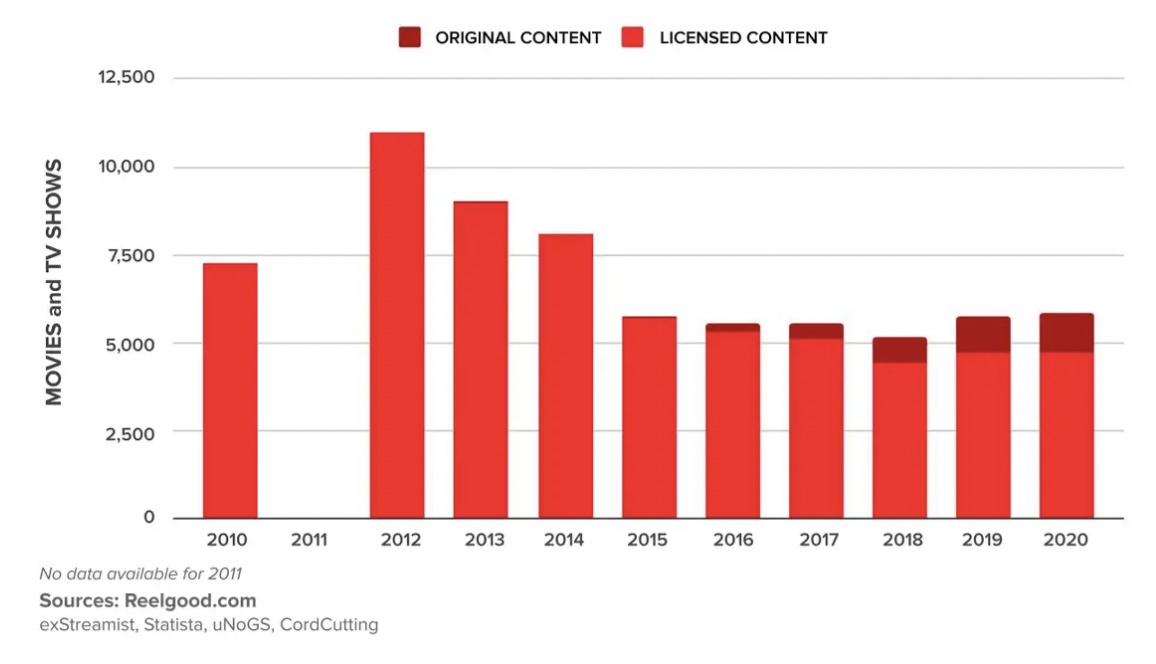

Constant expansion of the company’s original digital library and improvements in AI development could be considered an incremented innovation that supports the company’s current position. The company offers over 5000 licensed titles while the number of original titles produced by the company is over 1,100 (Clark, 2022). These titles are extremely popular globally and have a significant effect on the subscription count and company revenue. They are presented as an exclusive product of the company, which positively affects its differentiation in the market and profitability.

Some original titles contribute to product innovation on the market. Netflix is the single streaming service that offers interactive content among its competitors (Astley, 2022). The experience transforms linear storytelling into a game-like reality of the movie production, creating a new segment of experience for the customer and expanding on the product diversity of the company. In 2021, Netflix started to offer games within the mobile application of the platform. These new features signify progressive development of the company and its products.

The Organization’s Existing Innovation Performance and Capabilities

Innovation Capabilities

Netflix originated from the leadership of Reed Hastings whose vision of the company focused on the development of the movie watching method that people would be fond of. This vision helped the company to pursue its current success as it allowed to innovate the delivery of DVDs to direct streaming of the product and expand on the company’s dynamic capabilities. Thus, boosting the firm’s capacity to integrate, develop, and adapt internal and external resources and competencies to meet and shape quickly changing business conditions. The organizational structure of Netflix Inc. is appropriate for their business model. It is organized in a hierarchical manner with adaptations to accommodate company adaptability and response to global market developments. Through this business organization, the firm is able to provide original shows and movies and an on-demand entertainment service that attracts potential clients globally.

Key individuals in the current success of Netflix include its co-founder and co-CEO Reed Hastings. Hastings managed the company with firm belief and despite numerous failures persisted to develop the company towards innovation in the sphere of on-demand video. He was responsible for the company’s change management and smooth transition towards fully digitalized business model resulting in the current perception of the company. Netflix organizational culture is focused on excellence hence employee training and development involves intensive examination of personnel skills and competencies. Employees that perform in a way that does not promote greatness are often fired. This way the company was able to maintain its high professional profile.

Netflix is structured to promote the value of data-driven learning, including A/B testing. Their Data and Insights group comprises teams that collaborate with various corporate divisions to enhance the member experience, from analyzing global content preferences to offering seamless customer care. They use qualitative and quantitative customer segmentation, statistics, innovation, and predictive modeling, among other techniques, to get a comprehensive picture of its customers. The company is organized for data-driven innovation and operates based on constant learning and effective knowledge management.

The study of Netflix’s value chain is focused on its core and secondary operations in order to achieve a competitive advantage and provide a differentiating foundation. It is evident on Table 3 that due to the effectiveness of its value chain in gaining a competitive edge, Netflix has generated enormous profits. The price structure of Netflix provides an unlimited membership for a comparatively cheap monthly charge. Historically, video renting has been based on a per-item fee. Therefore, this is certainly a reason for the service’s success.

Netflix’s streaming service may be seen as a digital innovation platform due to its extensive use of technologies, such as the intelligent recommendation engine and family-friendly interface. It has followed the integrated innovation process in the early transformational period from the brick-and-mortar structure to digital world, by slowly introducing the shift towards the internet-based video streaming. This development was the most essential part of company’s success.

Netflix’s marketing is an innovative, adaptable strategy built on the growth of its brand via customer connection management. Netflix has dramatically expanded its marketing budget over the last several years. In 2019, Netflix spent $2.65 billion on marketing activities. Promotions and marketing were implemented to increase the consumer base. Netflix’s goods and services are made available online. Netflix offers consumers superior and timely after-sales support. Its support staff assists consumers with their inquiries in real-time, such as account or payment concerns. Because the company’s activities take place worldwide, it is important to be available 24 hours a day, seven days a week, and in many languages to make communication easy.

Innovation Performance

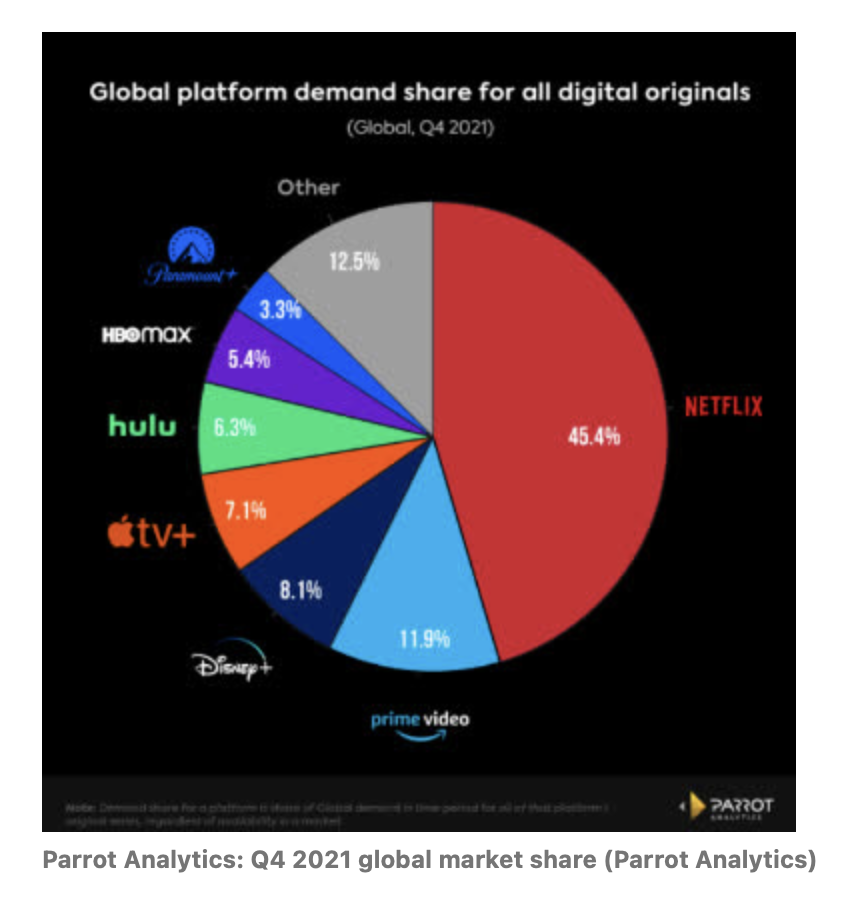

In 2021, the market share of Netflix, among other streaming platforms, was 45.4% (Seeking Alpha, 2022). Simultaneously, the company’s net profit was equal to 5.1 billion US dollars which indicates a dramatic increase in comparison to 2020 and 2019 with 2.7 billion and 1.8 billion US dollars, respectively (Netflix, 2022). The company owns copyrights for over 1,100 original series and 962 patents, among which 149 patents are inactive (Insights by Greyb, 2022). Currently, Netflix’s stock is valued at 234 USD, with a market capitalization of 104.7 billion USD (Yahoo Finance, 2022). Simultaneously, the brand is valued at 29.4 billion USD (Statista, 2022c).

The industry in 2022

Porter’s Five Forces Analysis

The examination of Netflix’s competitive rivalry demonstrates the presence of strong competition in the content market. Due to the expenses and limited profitability, new entrants face significant impediments. However, it is rather simple for corporations such as Amazon and HBO, already active in the industry, to adopt this operating model. Therefore, rivals with more additional services and more content control pose a significant danger.

There are several obstacles for new entrants in the video-on-demand market. Due to the time required to grasp customer demand, a small number of new entrants are successful in this market. In addition, contemporary competitors are aware of and have enhanced consumer devotion to their products through time. There is a low threat of new entrants to Netflix due to its extensive international distribution network and well-respected brand. The limited number of suppliers allows the company to dominate the market. However, suppliers act as competitors who enter the consumer or VOD market. Therefore, suppliers desire to brand their content for their streaming service, evidenced by the removal of Friends from Netflix in favour of HBO.

Almost all services are provided at a little price difference, resulting in minimal client switching costs. Therefore, the primary consideration here is not pricing but content quality. All of these elements contribute to the strength of the bargaining power of consumers in Porter’s five forces analysis of Netflix. There are extremely few alternatives to the material inside the sector. Therefore, the danger of replacement services could be considered mild. Netflix faces competition from firms that produce the same material for DVDs or streaming. However, the greater danger is the availability of other recreational and amusement options.

From the SWOT analysis in Table 2 and Porter’s five forces, it is possible to establish that the nature of this business requires a large funding source on the level of multinational corporations. Moreover, the situation in the business is in the middle of recovery since the filming industry was put on hold due to the COVID pandemic. The suppliers of the films are gradually approaching the development of new products. The success of suppliers will determine further development of the streaming companies if copyrights are secured early on. They are also innovation drivers in the industry since interactive content development depends on suppliers’ budgets and willingness.

China is a lucrative portion of the global market with millions of potential customers, but political restrictions do not allow streaming companies to enter it. Consequently, due to the popularity of the services in developed countries, concurrent usage of the application, and limited popularity in developing countries, stagnation would be a matter of time. Therefore, companies must differentiate their services and products on the market while creating a strong value for the brand. Key competitors of Netflix are trying to maximize their value via introduction of original content but so far this had no major effect on the market. In 2020, the market share of key competitors, Amazon Prime (11.9%), Hulu (6.3%), HBO Max (5.4%), Apple TV+ (7.1%), Disney+ (8.1%), and Paramount+ (3.3%), combined (42.1%) remained below the index of Netflix (45.3%) (Seeking Alpha, 2022).

On demand, video streaming platforms are developing towards new heights. It is evident from the emerging trends in the industry as the content produced is diversified and expands to production beyond Hollywood. The technology which supports the industry allows for an increase in video quality and loading speeds. Consumer behavior demonstrates that the preference towards a new type of entertainment is bound to increase. According to Nielsen’s State of Play report (2022), 93% of Americans are likely to increase their paid streaming services or continue utilizing existing subscription plans. In 2022, mobile devices such as smartphones and tablets will remain popular. These days, people spend more time glued to their mobile screens than they do to their televisions. As a result, streaming services are tailoring their interfaces for use on mobile devices. Individuals born in the 80s, 90s, and early 00s are the ones now investing the most time and money into streaming services. The streaming market is now dominated by reboots, sequels, and large franchises based on the pop culture they were exposed to as children. The industry is bound to remain profitable with fierce competition for the attention of the audience.

Conclusion

Netflix’s current position on the market is an indication of a successful value chain model and business management. The company constantly tries to improve and develop its services to increase its profitability which could be seen as effective since net profit doubled in a year.

The company has numerous opportunities to deliver new products such as music and books. If these market segments are coupled with the effective recommendation algorithm of the company, they will bring the company to new heights. In consideration of the industry’s future, it is possible to anticipate stagnation in the incoming of new subscribers due to the inaccessibility of the service in the Chinese market.

Nevertheless, the company secured a comparative advantage that should allow it to maintain a dominant position.

Appendix

Table 1. Innovation history of Netflix

Table 2. Netflix SWOT analysis

Table 3. Netflix Value Chain

Reference List

Astley, S. (2022) ‘Are you still playing?’: what the future holds for Netflix’s interactive entertainment. Polygon. Web.

Clark, T. 2022. Netflix has lost 3,000 movies in the last decade, but its originals catalog has soared to 1,100. Web.

Insights by Greyb. 2022. Netflix patents – key insights and stats. Web.

Netflix. (2022) Annual report on form 10-K Netflix 2021. Web.

Nielsen. (2022) Nielsen’s state of play report reveals that streaming is the future, but consumers are currently overwhelmed by choice. Web.

Statista. 2022a. SVOD revenue worldwide 2026. Web.

Statista. 2022b. Global number of SVOD subscribers by service 2027. Web.

Statista. 2022c. Netflix brand value 2022. Web.

SeekingAlpha. 2022. Why Netflix will likely remain the king of streaming (NASDAQ:NFLX). Web.

Wang, Y. 2022. ‘Netflix: How to Keep a Continued Success’, Proceedings of the 2022 2nd International Conference on Enterprise Management and Economic Development (ICEMED 2022), Atlantis Press, pp.1215-1219.

Yahoo Finance. 2022. Netflix, Inc. (NFLX). Web.