Introduction

The field of Human Resource (HR) management presents an important dilemma for employers in terms of rewards and performance. On the one hand, employees are viewed as the main asset of the company and its main capital (Crager, 2002). On the other hand, employers go along the costs reduction path in order to remain competitive (Moniz, 2010, Richmond, 2009). Layoffs, redundancy, and outsourcing are a few of the difficulties HR managers go through to reduce costs. At the same time, employers should keep staff motivated, strive for performance improvement, train and develop staff, and be ready to address any new strategy directions and initiatives the company might aim for. All of the latter, indeed, should be accomplished in view of high uncertainty and volatile business environment, in which a recession might put an end to any plans that the company might have had for their staff. In that regard, it can be stated that managing performance and reward can be seen among the most difficult tasks in HRM. The mangers are constantly trying to revise, modify, and improve the practices of performance reward, in order to optimise organisational processes.

In that regard, PricewaterhouseCoopers, “the largest professional services firm in Ireland”, outlined cost reduction and performance improvement among the factors driving the transformation agenda for companies (PWC, 2011). Thus, those seemingly opposed sides are among the challenges that make the task of HRM in developing performance rewards difficult. In that regard, there are many reward practices to begin with. All of those practices revolve around the philosophy of investing in human capital, given that such capital provides a return on those investments (Armstrong, 2007).

The rewards practices can be categorise according to their extrinsic and intrinsic nature, varying between social rewards, developmental rewards, and financial rewards and numeration for extrinsic rewards, and job challenges, responsibility, autonomy , and others, for intrinsic rewards (Shields, 2007). In that regard, it should be mentioned that financial rewards are of the utmost importance reward practices, being almost unanimously implied by default when it concerns reward management. The purpose of reward management revolve around three objectives, summarised as attract, retain, and motivate. Performance-based rewards can be considered as an important part of rewards management, which can be defined as the practice of assessing the work of the employees, measuring the results of such work, and providing a corresponding compensation to them (Shields, 2007).

Such practice has its main set of advantages, specifically when aiming for performance improvements. Nevertheless, such practice has its own weaknesses as well. The main point is that cost reduction and performance management are achievable goals. It is argued that the success of a brand in the company and its overall reputation is directly connected to whether such company is successful in its HRM strategy and the way it rewards its employees (McCall, 2010). Thus, the identification of what strategies to use is an important step for organisations to take.

Evidence from Research

In a general sense, the implementation of performance management is proved to have a beneficial impact on organisations. Such fact is widely supported in literature, where it recognises the importance of effective systems regarding performance measurement and reward (Yiannis et al., 2009). Nevertheless, the explanation of measurement of performance and the structure of rewards can be seen lacking in that matter. Analysing different methods of motivating employees, one of the problems in that matter can be seen through the lack of consensus on what motivates people the most.

The disadvantages of incentives in general, including those based on performance, are summarised by Alfie Kohn, a US social psychologist and an influential critic of performance related rewards. Kohn identified the following drawbacks (Shields, 2007):

- Rewards undermine the intrinsic motivation in a job.

- Motivation to pursue one aspect only.

- Rewards manipulate behaviour.

- Rewards undermine cooperation and teamwork.

- Rewards ignore the underlying reasons for work problems.

- Rewards discourage risk-taking.

The appreciation of the aforementioned drawbacks does not imply that monetary or extrinsic rewards should be ignored. It is just the matter that solely focusing on such rewards might not provide the expected effect in the long term. Making a distinction between low-performers and high performers might suitable in certain contexts, but not be applicable in case when high performance is expected from all employees (Helm et al., 2007). An example of one of the drawbacks can be seen in practice through a study on the effect of pay-for –performance programs in a healthcare setting. A study in Meddings and McMahon (2008) outlined the case when the focus on a single aspect for reward leads to establishing goals which might not benefit the customer, i.e. the patient in this case. Using two cases, the study argued that a universal approach to provide incentives might not be suitable in health care setting, in which evidence-based care is to be provided to patients to patients (Meddings and McMahon, 2008). Translating the latter to a general business setting reveals support for the drawbacks outlined by Kohn, where establishing rewards for specific measures, lead to employees aiming at those measures, ignoring any other performance processes in an organisation. The way

Another problem associated with performance rewards can be seen in connection with the change in the business environment. Taking for example the bonus scheme as a sort of pay-for-performance reward, which implementation according to Duncan Brown, director of HR services at PricewaterhouseCoopers, is of varying benefit to the employees. Brown states that, the majority of organisations have a bonus schemes as rewards, and thus, the link the employees rewards to the fact how the organisation is doing business (Barrett, 2008). In such way, employers simply achieve cost reduction (Barrett, 2008).

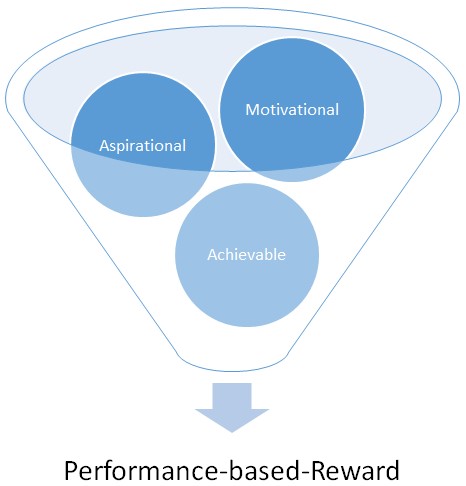

Thus, the motivation of employees is directly related to how well the organisation is doing. If the economic situation in an organisation is not directly related to the performance of employees, but rather to the external environment, and at the same time, the period of such lacklustre performance is prolonged, the motivation of the employees might be shattered. For example, the decrease in consumer confidence as a result of the recession decreased the spending of consumers in the retail sector, which lead to a corresponding decrease in the rewards paid to employees, due to reasons which are not related to their performance. Such circumstances might address employers concerns regarding to cost reduction, but at the same time, it is not linked to performance, for which it has to be aspirational, motivational, and also achievable (Barrett, 2008).

Another example can be seen through the way bonuses for performance might bypass employees, mainly due to the incompatibility of the type of business processes and the type of rewards introduced. An example of the latter can be seen through a teamwork job, such as a call centre in which no group reward incentives are properly developed, or a business in which rewards are offered only to personnel whose job are directly related to customer satisfaction and increased revenues. The last example was applicable to House of Fraser, a high street retailer (Barrett, 2008). House of Fraser offered bonus scheme rewards only to store support centre staff, head office staff and store managers. After restructuration, the store’s leadership managed to extend reward program to all 6,000 staff in the company (Barrett, 2008). It should be mentioned that the presence of pay in the activities of performance management was proved to have no significant impact, compared to the other stages performance management such as setting performance standards, monitoring, evaluating, and reporting back to employees (Lewis, 1998).

Current and Emergent Practices

The significance of managing the performance and the rewards of employees is such that failure in a particular strategy does not mean abandoning reward management as a whole. Constant changes in the business environment set such sphere of as reward management in constant improvements in search for an optimal strategy. Accordingly, new reward practices emerge constantly and are promoted by different companies, and contribute to their success as employers.

Two important aspects in reward practices can be seen through its strategic alignment and the contribution to the development of a high-performance culture in the company (Armstrong, 2007). Strategic alignment of the reward practice is an important notion, which eliminate pat of the drawback discussed in the previous section and which are attached to the implementation of extrinsic incentives. The company’s choice of rewarding employees is based on several criteria, which are motivation, costs effectiveness, culture, and what is most important the supporting the company’s objectives. The objectives should be long term with a connection to the company’s long term strategy and vision. Such aspect can be seen through the concept of strategic reward management. Strategic reward management is defined as predicting the needs of the organisation in terms of reward in the future, and plan policies and plans accordingly (Armstrong et al., 2007).

Thus, when developing a strategy the guiding principles are not based on operational objections at the present time, but also connected to what the company intends to achieve in the near future and how it will achieve it. Connecting the latter to specific rewards practices, stock options can be seen as an important reward practice connecting the performance of the company to employees. Share ownership schemes can be seen as suitable methods for rewarding performance and at the same time attaching the reward with the prosperity of the company in the long term.

Although such practice might contain variations, basically share ownership schemes can be divided into two forms of reward practices, share incentive plan, a plan for purchasing shares in the organisation, or save-as-you earn-schemes, which is the practice of giving the opportunity for employees to buy share in the company in a particular period in the future with discounts or by today’s prices (Armstrong, 2007). Microsoft is an example of a company that successfully implemented the share options as a reward (Priyadarshini, 2005). The purpose of implementing such practice is consistent with the strategic reward management direction, and accordingly offered to those employees who are considered “a long‐term asset of the company” (Priyadarshini, 2005). Certainly, the company does not offer such options to all employees, where the differentiation of the type of reward offered is based on position and experience with the company, and the value perceived to be held by a selected employee. In that regard, the criteria and the measures established by the company for performance, through semi‐annual performance reviews (Priyadarshini, 2005).

A variation of such form of reward can be seen through the incentive offered by Google, Inc, which offered restricted stock to employees for completing a certain project, which in addition to appraising performance, aimed at providing incentives to apply for job at Google. Accordingly, the company distributed the shares according to each individual contribution with the company (HAFNER, 2005). Indeed, such practice might not be applicable to all companies and considering the value of the shares, it is not a wise decision to be implemented in a recession, for example. Nevertheless, it sets the example on how the company connects its own prosperity with the prosperity of their employees, and makes them interested not in the achievement of a certain team or project, but the company as a whole. Comparing to such incentive as performance unit, which is a cash payment at the end of a long-term performance period, the employees will not focus only on a single period alone (Moniz, 2010). The need for constant evaluation can be seen through the general scheme for evidence-based – rewards management (EBRM), which steps can be seen through the following figure.

Thus, it can be stated that the main aspect on which employers should focus is determining the criteria of success and attach them to what the rewards should constitute to the employees. Monitoring, evaluating, and revising those criteria and objectives will make sure that the reward strategy corresponds to the changes in the environment. Such changes might include the necessity for cost reductions as well.

Conclusion

The aims of reducing costs and improving performance present a dilemma to employers in general, and HRM in particular in terms of developing new schemes of performance rewards. The present report provided an analysis of the common reward practices, their advantages and drawbacks, along with a way such practices shall be moving in the future. The report started with analyzing the literature on the problems of rewards management, specifically performance rewards. The main statement was based on that implementing different practices in rewards management might achieve desired performance improvement, and if not reduce costs, it at least can eliminate unnecessary expenditures.

The findings of surveys regarding rewards practices revealed that cash is a common reward, regardless of the size of the company, although development initiatives can be found as well. Cash and extrinsic motivation in general, was argued to have several drawbacks among which the focus on a single aspect and the undermining of intrinsic motivation can specifically outlined. The report cited evidences from researches in healthcare setting where, there might be differences in the way the reward might influence performance. For many of employers such optimisation might be seen as a sequence of attempted innovative strategies in performance rewards, which subsequently are changed because they failed to deliver.

Setting generalised outcome as a measure of improved performance might inhibit employees from taking risk and focusing on the overall success of the business. Other drawbacks are related to specific types of performance rewards such as bonus. The general consensus on such types of rewards is that beneficial treatment of employers, rather than employees, specifically in industries in which the downturn is not associated with the performance of employees. The report provided examples of retail industry in which employees, despite their efforts might not receive rewards, due to the decrease of consumers spending, caused by changes in the business environment.

Analyzing emergent practices the report provided an overview of the granting shares to employees as a reward process. Showing examples from Microsoft and Google, the report argued that such reward process can be beneficial due to many factors. Such facts can be related to the concept of strategic reward management defined in report. The report argued that the development of reward practices should be connected to the company’s long term objectives. Share options, in that regard, connect the prosperity of the employees with the company’s prosperity, in which they become interested. Additionally, the example of Microsoft showed how shares allowed the progression and the development of employees whose expertise is not in the managerial aspect. No ultimate strategy will work for all. There are only general guidelines, the main points of which is emphasising the important of human resource as a valuable asset in organisations.

Recommendations

The main recommendations of this report are related to the differentiation of the reward schemes in the organisation. The variation in the approaches to set performance standards and corresponding rewards are likely to have more significant impact than a general approach to employees in the organisation. Similarly, the differentiation between employees whose activities are directly influencing the revenues of the company, and those who conduct complementary activities might not be a wise choice, although reward practices should not be necessarily similar. However, the strategic directivity of the rewards practices is an important aspect that should be considered when devising the reward strategy. Thus, the link between the prosperity of a company and the performance of employees can be considered when considering options other than granting shares, which is usually given for employees form higher ranks, or those who spent considerable time working with the company.

It is recommended that the factor of involvement in the company, characteristic with shares to be replicated as a reward in other reward practices. Considering that in the processes of evaluating performance, pay is not so significant, and then depending on the economic condition of the company, HRM can motivate employees as a reward, linking their future with the company and involving them in the process of setting plans, objectives, and performance evaluation. The main point is that there are no ultimate reward practices applicable to any company. There are merely general directions, following which is advised. Thus, an evaluation of the current situation in the company and a choosing a way to motivate employees and improve performance should be accompanied with an explanation to employees on the way their participation will be valued. In that regard, the processes leading to performance measurement and improvement are rewards in themselves, even better than payment. It is recommended that employers effectively manage such process through establishing clear objectives.

Reference List

ARMSTRONG, M. 2007. A handbook of employee reward management and practice. 2nd ed. London: Kogan Page.

ARMSTRONG, M., BROWN, D. & REILLY, P. 2009. Increasing the Effectivness of Reward Management: An evidence-based approach [Online]. Institute for Employment Studies. Web.

ARMSTRONG, M., MURLIS, H. & HAY GROUP. 2007. Reward management : a handbook of remuneration strategy and practice, London ; Philadelphia, Kogan Page.

BARRETT, S. 2008. Restructuring bonus arrangements. Employee Benefits. Web.

CRAGER, B. 2002. Are People Really Our Most Important Asset? Energy Houston, 4. Web.

HAFNER, K. 2005. New Incentive for Google Employees: Awards Worth Millions. The New York Times Company. Web.

HELM, C., HOLLADAY, C. L. & TORTORELLA, F. R. 2007. The Performance Management System: Applying and Evaluating a Pay-for-Performance Initiative. Journal of Healthcare Management, 52, 49-62.

LEWIS, P. 1998. Managing performance-related pay based on evidence from the financial services sector. Human Resource Management Journal, 8, 66-77.

MCCALL, B. 2010. Losing Numbers. Innovation. Web.

MEDDINGS, J. A. & MCMAHON, J. L. F. 2008. Measuring Quality in Pay-for-Performance Programs: From ‘One-Size-Fits-All’ Measures to Individual Patient Risk-Reduction Scores. Disease Management & Health Outcomes, 16, 205-216.

MONIZ, J. 2010. Beyond Payroll: Rewarding Employees in Today’s Economy. Society for Human Resource Management. Web.

PRIYADARSHINI, J. 2005. Microsoft’s HR Strategy – An Analysis. HR Planning Report.

PWC. 2011. HR Transformation: Cost or Investment? Pricewaterhouse Coopers. Web.

RICHMOND, R. 2009. How to Cut Payroll Costs Without Layoffs. Business Week. Web.

SHIELDS, J. 2007. Managing employee performance and reward : concepts, practices, strategies, Cambridge ; New York, Cambridge University Press.

YIANNIS, T., IOANNIS, S. & NIKOLAOS, K. 2009. Performance Management and Reward. AIP Conference Proceedings, 1148, 909-912.