Introduction

Pharmaceutical Product Development Incorporated (PPD) is an organization dedicated to improving drug development and provides laboratory testing and research services. Established as a one-person consultancy by Fred Eshelman in 1985, PPD grew into a global organization while expanding in multiple countries and providing high-quality drug development services (PPD, 2020a). The primary way of growth was to vary the company’s offerings and develop more services for clients, and with the increased scope of operations, PPD was incorporated in North Carolina.

The primary purpose of the corporation is to improve people’s health by providing high-quality drug development and laboratory testing systems. PPD’s official website (2020a) describes the mission as “the deployment of an exceptional span and quality of solutions to demonstrate the effectiveness, safety, and value of promising drugs” (para. 4). It is now one of the largest researchers and patient-driven drug trial companies with offices in countries like Canada, Brazil, China, Russia, the UK, and more.

The History of Pharmaceutical Product Development Incorporated

Pharmaceutical Product Development expanded due to the acquisitions it made along with the company’s history. PPD had the initial public stock offering in 1996 and then acquired many drug development and research companies in different parts of the world. In 1997, BioScience International, based in Europe, and a Brazil-based contract research organization (CRO), was purchased by PPD. By 2001, PPD also expanded to Asia, Australia, and Latin America, it implemented services for drug discovery and moved its strategy to clinical research and medical trials.

These new parts of operations let PPD acquire Medical Research Laboratories International that provided the company with clinical research offices and equipment in Europe, the Middle East, and Africa. In 2002, PPD also bought the Asian CRO called ProPharma and established its positions in Asia. Combined with the public offering and the one-for-the-stock dividend approach, PPD raised its revenue to $1 billion in 2005 (PPD, 2020a). The company opened its offices in many countries and gave jobs to thousands of employees in laboratories, clinics, and the drug development industry.

The company continued to grow within the last fifteen years: PPD purchased Russian firm InnoFarm, acquired AbCRO based in Eastern Europe, and also bought several research and drug development companies in China. PPD broadened its services by acquiring Acurian in 2014, the provider of clinical trial patient enrolment (PPD, 2020b). In 2015, PPD started to provide clinical services in Japan, and then purchased several firms that work on evidence-based research. The company also affiliates with The Carlyle Group and has investors such as Abu Dhabi Investment Authority (United States Securities and Exchange Commission [SEC], 2019b).

By 2019, the scientific impact of PPD also became significant: it established Accelerated Enrollment Solutions, the unit that combines patient data with clinical research, and introduced the PatientAdvantage trial examination method (PPD, 2020b). The company uses its advantage of being global to build comprehensive analysis and involve people of different ethnicities, cultures, and lifestyles to develop medicine.

PPD invests in biotechnology, multifunctional labs, and collaborates with other clinical developers to create research and healthcare solutions for people worldwide. Today, its revenue exceeded $4 billion, and the firm announced its initial public stock offering in September 2020 (“PPD, Inc.: Key developments,” 2020). It also keeps opening new offices and expanding the number of employees to fulfill the mission and values it follows through its 35 years of history.

The Company’s Purpose and Functions

PPD’s leading service is to provide world-class drug development services by using innovative medical and scientific approaches. Moreover, it works on building patient-driven trials that improve the process of creation and approval of medicals around the world. PPD values the patient experience and counts it as a vital criterion for the future of drug development (PPD, 2020b). The company designs patient-driven studies in the research laboratories worldwide and examines people with diseases for exploring new ways of drug implementation. There are advisors, sociologists, and recruitment experts involved in the studies which provide the full-service care of a patient’s experience.

The patient-driven studies also allow PPD to collect and analyze significant assets of data. The PPD (2020b) official website states that “PPD also has 20+ million identified patients in pre-screened databases, which provide granular eligibility data” (para. 4). As all of the information is stored and sorted, one of the company’s missions is to provide hospitals with the data necessary for high-quality treatment quickly. Certified or PPD-affiliated clinics can access a patient’s age, conditions, and previous examination results to speed up the diagnosing and further procedures.

Another way of supporting drug development is to help other companies by giving them expertise and resources to improve their production of medicine. PPD is dedicated to supporting biotech and drug companies, and they do so by consulting, strategical evaluation, clinical development, and researching for optimizing operations (PPD, 2020b). It now has the Accelerated Enrollment Solutions program that allows drug development and patient-driven trials to receive financial or data support from PPD.

Pharmaceutical Product Development Inc.’s Financial Status

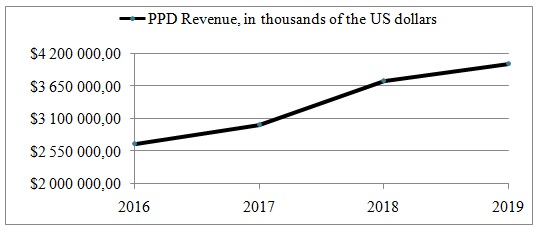

PPD Inc.’s revenues grew, as the company acquired firms in different countries and participated in drug development. Its annual income contains direct, third-party pass-through and out-of-pocket payments from providing services, and was $4,031 billion in 2019 (United States Securities and Exchange Commission [SEC], 2019a). PPD is capable of growing its revenues every year and does so by worldwide expansion and improvement of its primary services (Figure 1). PPD’s SEC (2020a) annual report states that “revenue increased $282.0 million, or 7.5%, to $4,031 billion for the year ended December 31, 2019, as compared to the same period in 2018” (p. 53). Most of the revenue grows organically, and due to the acquisitions, PPD makes almost every year.

The Company’s Competitors

Pharmaceutical Product Development Incorporated operates in the highly competitive research and development fields that contain a variety of firms providing qualified services on a local and international basis. Full-service providers like PPD mostly drive the drug development industry, thus the company has the leading positions among the representatives. However, many contract research organizations exist at universities, biopharmaceutical firms, and clinics, and they have more opportunities for analyzing the local data. PPD’s DEF 14A Proxy Statement of SEC (2019b) names its competitors: “IQVIA Holdings, Inc., ICON plc, PAREXEL International Corporation, PRA Health Sciences, Inc., Covance Drug Development, Syneos Health, Inc. and Medpace Holdings, Inc” (p. 31). These firms have significantly well-developed structures of laboratories, innovative technologies, and impacts in different therapeutic sections.

The company has the same financial and development opportunities as most of its competitors. PPD SEC (2020a) annual report states that “we generally compete on the basis of testing capability, scientific and therapeutic experience, global footprint, price, quality and speed” (p. 17). PPD manages drug development in many countries, and the quantity of its researches is higher than that of the country or region-based CROs. Its aim to invest in data digitalization and biotechnology can assist it in winning over its competitors at the innovative level.

Pharmaceutical Product Development Inc.’s SWOT Analysis

The company’s SWOT analysis reveals that its competitive opportunities depend on the results of rivals’ operations, changes in regulatory policies, updates of pharmaceutical guidance, or natural disasters. The main strength of PPD, Inc. is the company’s worldwide operation centers: it has thousands of employees in more than 46 countries (PPD, 2020a). PPD’s company Form K10 annual report includes markets’ descriptions and the related risks, therefore strengths, weaknesses, opportunities, and threats can be determined in detail.

The strengths of PPD are related to its global presence, philosophy, mission, and authority among the clinical and pharmaceutical companies. The organization has offices in each continent, and it gives PPD economic benefits like decreased taxes and the authority as a trusted international company. Moreover, the diversity among patients it works with during the drug trials makes the results more accurate and provides medical developers with more considerable data assets. Another strength is the mission to develop biotechnologies and evidence-based patient trials (SEC, 2019a). Investments in these industries will save the leading positions of PPD as the pioneering and authority organization for scientific and medical studies. PPD has successful operating efficiency and can provide flexible solutions in case of severe margin operations (SEC, 2019a).

The way the company’s teams are built also is a strength as it creates the option to have a sustainable system of clinical and laboratory professionals working together. It causes quick data exchange and makes the company more attractive for clients or patients.

The weaknesses mostly appeared because of industries and institutions PPD operates with to provide the services. Firstly, the business requires medical devices, while the providers of the latter have more profit from collaborating with pharmaceutical companies than with development researches. It might force PPD to spend extra amounts on its research programs, while the money could be spent more efficiently. Secondly, PPD is not involved in oncology nor has infections disease clinical expertise, and its competitors might win over by launching drug development in these spheres that are in high demand to be explored. Thirdly, PPD’s contract research organizations are not diversified as major parts – 71% of the market belongs to North America, and the last 29% to other researches (SEC, 2019a).

This weakness can severely affect the PPD’s performance on the global level. Lastly, the government requires companies to pay almost 11% of revenue by following its contracts (SEC, 2019b). Such an obligation tightens the financial operations that can be performed during a year by PPD.

The variety of opportunities opened for PPD during the last few years due to the investments and the expansion of its industries of operation. The company’s clinical development is based on full-service clinical trial management that includes trial feasibility, investigator recruitment, monitoring, database management, and biostatistical services (SEC, 2019a). Such a variety provides PPD with the growth opportunity by establishing more similar facilities. Another growth point for the company is its targeted expansion to countries like Japan and China (SEC, 2019a).

The company can provide Asian regions with approaches and investment and gets innovative technologies and more laboratories. Besides, the COVID-19 pandemic drew an opportunity for the developments made by PPD to participate in the vaccine production, and the company has many recourses like laboratories to share with the involved medical organizations (PPD, 2020b). The stable yearly growth of revenues shows that PPD is capable of finding and using opportunities.

There are threats that might lead PPD to significant revenue losses and let the competitors win over multiple fields of the industry. One threat comes from inside of the company: PPD’s growth rate is 35%, and it has to maintain a high level of services in its old and new facilities (SEC, 2019a). It increases the number of employee turnovers in the company, and many new workers are harder to manage. The last significant threat is the financial obligations that can lead the firm to legal difficulties. PPD SEC (2019a) annual report states that “as of December 31, 2019, we had total long-term debt and finance lease obligations outstanding of approximately $5.7 billion” (p. 59). The company’s Board of executives has to consider each threat in the strategical stage to prevent PPD from losing its leading positions among the competitors.

The Company’s Board of Directors and Stakeholders

The company’s Board of directors and executive officers includes 9 members, divided into shareholders, external stakeholders, and internal ones. The Chief Executive Officer of PPD is David Simmons, who has the chairman position since 2012 (SEC, 2019a). The stakeholders related to vendors and other industries are Johnston D., Hilado M.T. from PepsiCo., Kindler J. B., and Hill C. from GNS Healthcare (SEC, 2019b).

As the company went through initial public offerings, it got shareholders with various shares purchased. The five most valuable stockholders are Wellington Management Co. LLP (3,11% stake), FPR Partners LLC (2,15% stake), The Vanguard Group, Inc. (1,77% stake), T. Rowe Price Associates, Inc. (1,10% stake), and Boston Partners Global Investors (0,85% stake) (“PPD, Inc.,” 2020). The ownership of the share allows these companies to influence PPD’s decisions, although they are not internal. External and internal stakeholders’ collaboration prevents the conflict of interest and provides PPD with vendors and governmental assistance.

The company’s DEF 14A proxy statement provides the data related to the shareholders and aims to affect their decision-making. PPD’s filling includes the list of shareholders and reveals the weight of their votes showing that the internal ones have more power in the company (SEC, 2019b). The representatives also use the DEF 14A to establish and regulate relationships between PPD and its competitors via data analysis and negotiation.

Pharmaceutical Product Development Inc.’s Accomplishments and Future Plans

PPD achieved various goals throughout its 35 years of existence: the company established a global network of laboratories that do qualified research and makes clinical trials available for many people. Moreover, it took part in vaccine developments, provided countries with jobs, and created the full-service approach for patients who participate in drug development trials (PPD, 2020b). Today, the company invests in digital data-driven technologies and aims to build a sustainable system to help clinics examine the clients quickly and qualitatively.

PPD aims to strengthen the company’s positions on biopharmaceutical, clinical trial, and drug development markets in the future. The company’s United States Securities and Exchange Commission annual report (2020a) claims that “the key elements of our growth strategy to help our customers bend the cost and time curve of drug development include” (p. 11). Moreover, PPD plans to accomplish goals in innovative networks it builds with the Accelerated Enrollment Solutions program. The expanse of Pharmaceutical Product Development Inc. will not only be related to new locations, but also to the therapeutic areas where laboratory research is required.

The worldwide pandemic affected almost every industry and company, and biopharmaceutical businesses are not excluded. PDD’s revenue and expenses related to the COVID-19 spread were up, according to its second quarter of 2020 report (PPD, 2020a). Callison (2020) states that “PPD’s revenues for the quarter ended June 30 totaled about $1.01 billion, representing growth of 1.4% over revenues of $996.5 million in Q2 in 2019” (para. 2). The company’s operations were on hold due to the lockdown and keeping the employee’s safe cost vast amounts of money.

Conclusion

PPD’s history shows how a corporation dedicated to its mission, accomplishes worldwide success and becomes a leader of its industry. The company’s vision is to receive people high-quality medicine by providing drug development and patient-based testing (PPD, 2020a). The strategy of PPD was mainly to grow by acquisitions of smaller pharmaceutical companies worldwide, and this business approach helped in achieving the goals driven by the mission.

References

Callison, J. (2020). Virus impacts reflected in PPD’s Q2 earnings report. WilmingtonBiz. Web.

PPD, Inc. (2020). CNN Business. Web.

PPD. (2020a). PPD company history in drug development and laboratory. Web.

PPD. (2020b). How we help. Web.

PPD, Inc.: Key developments. (2020). Reuters. Web.

United States Securities and Exchange Commission. (2019a). Form K10, annual report: PPD, Inc. Web.

United States Securities and Exchange Commission. (2019b). Form DEF 14A proxy statement: PPD, Inc. Web.