Introduction

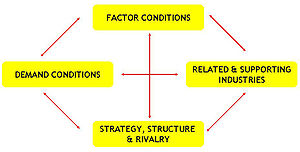

Diamond National Advantage is a model developed by Michael Porter and is used by countries and companies to gauge international business prospects. This was a culmination of a study on leading enterprising countries in the world. This model is made up of four main pillars which influence individual company or country competitiveness. A firm’s Strategy, structure and rivalry are of paramount importance since a factor like direct competition will always compel the company to come up with strategies and structures that will boost production. For a company that wants to venture into wine sector in Australia, it is important to come up with workable structures for this particular market. It is important to note that Australia ranks sixth in the world in the wine production with a history stretching back two centuries. For a prospective investor this calls for a structure that will facilitate production of very high quality wines so as to be able to penetrate the market as a competitive brand well as cut a niche. It is also important to note that there already exists a vibrant industry with set standards and hence need to come up with products of equal or higher echelon.

Porter’s model

Demand condition, according to porter’s model is important as this makes the company to improve competitiveness through innovative production and high quality production. The Australian wine market has been in existence for the last two and a half decades an indication of a market that boasts of top class products. This requires new entrants to come up with innovative moves and come up with strategies that will see the market crave for its products. The other factor lies with the related supporting industries, like sources of raw materials or providers of essential services. The position is that a companies that are strategically positioned so as to be close to all industrial facilitators will always lead in exchange of innovations and new ideas putting it ahead of others.

There are over 140 varieties of grapes in Australia that are used in making wine. Factor conditions the fourth determinant involves availability of skilled labor, capital and infrastructure. There exists a very strong brand that is Australian wine and this makes it easier to market a wine products product made in Australia. The government through the wine regulator has given manufacturers a leeway to experiment and come up with new innovations. These key factors are core to competitiveness as a company will have the ability to source for the quality and the standards they prefer. There exists a strong infrastructure that lenders support to the wine sector, viticulturists (grape growers and wine makers) as well as research institutions in grape farming and wine manufacturing. The big plus for investing in Australia is that the rules are relaxed as compared to the rigid regulations in Europe. There exists a very strong working relationship between the wine industry are related industries, like tourism and the food sector which are major consumers of wine and this the industry lots of potential. There are non key factors which include unskilled labor and raw materials which can be sourced easily by any company. The model was introduced to analyze why some countries were more competitive than others.

Traditionally the factors that were looked upon for a business to thrive included land, location, labor, natural resources and population size. Porter argued that since these factors were static and could not be influenced by the investor, they were improper determinants of competitive production. He adds that the above mentioned might be actually contributors to undermining competitive advantage. Companies trading in their home base will always have an upper hand when it comes into achieving their goals especially on global market. For an investor the porter’s model can be used to take a professional look into a business venture in order to make an informed investment decision.

The National Diamond frame come about as a result of study of trade patterns in what well performing industrialized nations. This is a test on whether a firm is capable of competing nationally; this is the first level before venturing into the international market. The model is made of four pillars namely, factors, demand, rivalry related and supporting industries, and firm’s structure. The first two seeks to address the macroeconomics which determines whether there is demand as well as looking other factors needed in production. According to (Bell 1994 p. 221) “A firm with competitive advantage is witty enough to create and implement market strategies which at that time are not being employed by any current or potential competitor in the market. This is a result of proper use of innovations.”

Market status

Australia is the fourth largest exporter of wine in the world with 760liters of wine worth $5.5 billion per annum; major markets are in south Asia. In India 65% of the imported wine comes from Australia. In the year 2007 the Australian Wine export market grew at a rate of 9% and was worth 2.8 billion Au$. Of this whole amount, is North America and the UK imports amounts to AU$2 billion. This is a 17% share of the total value of U.S. imported wine. France another major market followed with 31% while Italy had 28% the local market is also lucrative with it consuming 500 million liters per annum The demand for Australian wine industry has experienced remarkable change for the last two and a half decades. Her exports stood at 32% of total production.

Other giant producers were at 17%. Australia produces only 2% of world wine, which translates to 2.4% of the world wine market by volume. Marsh and Shaw 2000). The change in industry ownership which affected the structure and the investment scales in these industries, decline in the Australian dollar value also affected the volume of international trade. There were changes in overall business orientation in its engagement with international markets which propelled a rapid growth in exports. The Australian wine market is favorable and in line with the National Diamond model. Manufacturing firms ceased their fierce rivalry and instead joined efforts in matters of shared concern. Initially the manufacturers engaged in dirty practices and unhealthy competition outmaneuvering each other instead of focusing on issues that would have improved on the whole sector, this has raised the markets level of integration as well as making it a knowledge driven sector.

Industry status

The Diamond National Advantage in relation to related and supporting industries, in Australia there is readily available source of the major raw materials with different vineyards scattered across the cooler southern and western parts of the country producing the major ingredient. The acreage area under vineyard cultivation is 160,000 hectares. Over the past one decade the total area under grapes doubled as the value of wine increased by 10% is an indicator that an investor would be at an advantage by investing in Australia since the industry is growing. World wide there has been efforts by many countries to produce quality wine this has led to increased acreage on grapes in the world. (Unwin 1994 1). Suggests that as the emerging producers seek to get a slice in the market Australian expertise comes in handy with massive technological and market skills being transferred to other producing regions many countries are seeking joint ventures and consulting with Australian wine makers. This has given rise to innovations that are crucial to effective wine production. The outcome has been very stiff competition emanating from other producing regions; however this competition has yielded healthy fruits for it over saw the improvement in the quality of wine produced.

Another uncertainty in the imminent change in tax system, this would push the Australian win to the international market. It has been a trend once the market exigencies a boom it is followed by a long spell, this has been felt on five instances. Analysts say the current boom is expected to last due to amongst other reasons, the Australian wine demand has out grows the supply, this has been a plus to the grape farmers. In the event of decline in international demand and good prices, the wine manufacturer will pass the burden to the farmer.

An investor should know that venturing in to winery in Australia one should be focusing on the export market since the locals are not big time wine imbibers.(Irvine 1982 p.6) terms the Australian wine market as having taken too long in the gestation stage. Leading wine merchants of London and other crucial commercial hubs admit that Australia is soon to be a fierce player in the worlds market against the established vineyards of Europe.” Over the past one decade there has been a notable increase in grape farming and earnings which went up by 73% this is comparing to 48% increase in earnings from wine production. Crushed grapes had increased by 42%. This would mean that the farmers reaping more from the improving prices. Improved productions, quality products, are some of the heights of the wine industry. One of the biggest contributors to increased production and export growth rate is the sharp increase in wine producers from 200 establishments in the 70s, 300 in the 80s to the current 900.

In line with changing market trends, there have been several mergers and take overs of small firms by larger players, this has increased their individual market share and ability to produce more. One way to go is to have as many innovations as possible this will help in keeping pace with the competitors as well as be abreast with the current market demands.

In the formative years there was very low quality of wine that was being produced this was attributed to the employment of some very archaic methods of wine making, there was also no proper distribution and marketing strategies as well as poor security and quality packaging which compromised the product standards. Despite the falling value of the Australian dollar, the tidings are good since there has been significant growth in the export volume. Australia currently supplies 2.5% of the world’s wine compare to 1.5 % production in the 90s. On the other hand there has been an increase in global exports up to 4 % from 1%. Consumption abroad expanded with increased imports by some key markets. United Kingdom absorbed 45%, North America 20%, and other EU countries taking 12%.south Asian markets took 6% of Australia’s exports. (Wine Biz 2009 1) Investors in wine making should put into consideration that there will be very stiff competition from other forms of alcoholic beverages like beer and spirits. This two are ranked as favorites in the domestic market with beer taking the lead and sprits in close tow. (DFT G 1). Investing in Australia is advantageous since the government has signed several bilateral trade agreements aimed at cushioning wine exporters from unfair trade practices and tariffs in the international market. Some of this includes the 2001 Mutual Acceptance Agreement, (MAA) signed with other wine producers, the EU Trade Agreement of 1994. These blocks sets standards of the quality of their production as well as prevent any unethical trade practices.

Advantages

The porter’s model is critical to any investor for it aids in self evaluation on the core areas that determine how successful an enterprise is. This tool helps in examining all the four major pillars of running a success story, it leaves one well furnished the push and pull factors that will be daily influences to one’s venture. This model contains information that helps an investor choose the path to pursue. This will help in measuring one’s potential and compare it with the current out put. On top of these it will come up with possible causes of the current out put and if there are rectifications to be made they are also suggested. This is an advanced way of keeping companies as well as countries with all the information needed to succeed on their finger tips.

(Osmond R Kym A 1998) Companies all over the world are under constant pressure to produce cost effective goods that are of high quality, this calls for an intensive and thorough approach in order to stay afloat in a competitive market. As the model suggests since a country is able to create its own factors which are crucial like skilled resources, the production is bound to go up. In any settings there are disadvantages like labor shortage and scarcity of raw materials, such situations compel companies to come up with innovations that will lead National advantage. It is easier to learn the trend of a product, using this model. If a product is doing well in the local market it gets the national advantage and its potential in the international market is very high. With this model it is easier for a company to identify avenues of setting up local advantages so as to elevate the company into status that can compete at a global front. Governments also will utilize the model so as to come up with policies that can create national advantage; this will enable organizations to model their standards to international levels. With high performing products, coupled with high quality environmental and safety standards, this puts a country in the class of competitiveness.

Creation of a company with national advantage will always be a boost to related and supporting industries. With the emergence of several wineries in Australia with national advantage has given rise to other equally successive related industries like printing and packaging companies which also have national advantage.

Disadvantages

Critics of the model term it as one sided since it tends to over look some very important aspects which it terms as static, this puts the model at a disadvantages. One factors such as land and unskilled labor are crucial to any company it is not always that these so called on essential are found with ease and readily. I some situations there are areas with stringent rules that govern say land acquisition. On the other hand her are areas with very strict labor laws and in such a situation the cost might be a real determining issue it’s weighty impact cannot be over looked sine remuneration takes the biggest chunk of organization’s running budget. It is important to note that despite the assumption that they are static they vary from country to country. There are situations where these two can be the major determining factor depending on the location. Some areas have very costly labor implications even on the unskilled end. Critics argue that it is not always that inward foreign direct investment is a measure of competitiveness. Some organizations might be having limited foreign trading, this model would depict such as a less competitive one. This is not always true since there are situations where the local market can be thriving with little activity from the foreign counter.

Conclusion

The model is a good way of doing self assessment; it aids in creating innovations and models to beat competition. The Australian market will offer an investor a wide rage of opportunities, there has been an increased demand in the premium variety at the time when this producer is moving away from the low end products and this gives an investor an opportunity to make use of the high demand for the high quality brands. However as this is going on, other producers have also moved towards the high quality products and hence making the market more competitive. There has been a sharp increase in wine manufacturing as well as a rapid expansion in planting of premium variety of grapes. In other countries like South Africa Chile and state of California in the US, non premium varieties are being replaced with better quality species. This has also been accompanied by decrease in consumption of non premium wines. In general the wine market is lucrative and investing in Australia is a wise move, since the country meets the crucial market needs. What an investor needs to do is approach the market with the wisdom that can be attained by applying the porter’s model practically.

References

Bell, G. (1994). The London Market for Australian Wine, 1851-1901: A South Australian Perspective Journal of Wine Research. 5(1): 19-40.

Centre for International Economic Studies University of Adelaide Department of foreign affairs and Trade, (2004). The Australian Wine industry. Web.

Irvine, H. (1992). Report on the Australian Wine Trade. The library of congress. Melbourne.

Marsh, M and Shaw, S (2000). Australasian Agribusiness Review – Vol. 13 – 2005. Web.

Osmond, R and Kym, A (1998). Treads and Cycles in the Australian wine industry. University of Adelaide, 5005 Australia.

Unwin, H (1994). Wine and the vine: a historical geography of viticulture and the wine trade. Web.

Wine Biz, (2009). Australia’s wine industry portal by winelets. Web.