Introduction

Project management remains a critical practice for starting businesses or introducing new products successfully. Proper planning and consideration of existing opportunities are evidence-based approaches for delivering quality results. The decision to invest in the confectionery sector is appropriate for the targeted company since it will attract more customers and increase revenues. However, unplanned situations might emerge that have the potential to affect performance. This proposal uses the Risk Breakdown Structure to identify and present some of the potential risks that this new venture might encounter.

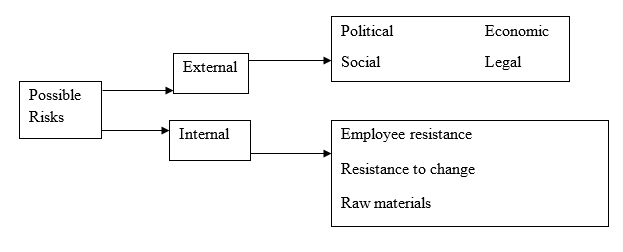

Risk Breakdown Structure

The confectionery market is characterized by many companies and small firms that produce and sell high-quality products to their customers. Being a leader in the carbonated drink sector, the move to produce a chocolate bar means that the organization will be pursuing a diversification model. This approach will create new opportunities for business growth and maximize profitability (Yang, Ishtiaq and Anwar, 2018). Nonetheless, there are unique internal and external risks that might emerge from the process (see Figure 1). Such potential situations are described in the Risk Breakdown Structure presented below.

Grouping and Discussion

The intended product is capable of transforming this company’s performance due to the possibility of increasing the recorded sales. However, the emergence of risks means that the leaders need to be prepared and willing to address them before they can affect the intended aims. The first group of such situations are external in nature. Firstly, political risks are possible since the company will have to add new stores and identify additional suppliers of raw materials.

The existing political climate might change within a short time, thereby disorienting performance. The established networks for carbonated drinks might not be affected by similar risks since they have been in operation for many years (Cerezo-Narváez et al., 2020). The second group of possible external challenges are economic in nature. The level of gross domestic product (GDP) in the country will have significant implications on the profitability of the chocolate bar. Poor economic trends will have increased chances of disrupting this company’s new venture.

The third possible source of risk is social in nature. The selected market or sector has established trends that dictate the way people purchase and consume different confectionary products. With the current changes in people’s lifestyles, this company will need to consider any possible trend that is capable of affecting the nature of consumption for this product (Miles, 2017). The fourth possible risk is the legal aspect.

The government might present additional laws in the future in an attempt to bar companies from venturing into specific markets or sectors. Should such a development occur, this organization will be unable to pursue the objective and find it hard to record positive results (Wolke, 2017). Those behind the entire project should also consider emerging policies and guidelines that will dictate the future performance of the entire sector.

Internal risks are usually recorded in many companies that chose to diversify or venture into new markets. The first category of such threats is that of employee behaviors. After the presentation of the targeted information, some people might remain resistance and fail to support the process. Such a risk will force the company to introduce a contingency plan and ensure that the product is eventually delivered to the targeted customers in a timely manner (Kot and Dragon, 2015). The second situation might arise from the manner in which stakeholders treat change. The introduction of additional product in this company’s business model might trigger a new form of objection. For instance, some workers might be unsupportive throughout the process. Specific leaders can fail to be part of this new process, thereby forcing the human resources (HR) department to consider a different strategy.

The issue of raw materials forms a possible threat to the proposed venture. Confectioneries usually require additional supplies and resources in order to record positive results. Such a development means that the organization will need to expand its current inbound logistical processes. The end result is that the company will have to expand its operations in an attempt to record positive results.

The bargaining power of the workers and the suppliers is a possible development that can eventually affect the level of business performance and profitability (Baker and Filbeck, 2015). The company’s top management should, therefore, consider these potential risks carefully and present evidence-based contingency plans that will minimize their impacts and make it easier for this company to produce and market the intended chocolate bar successfully.

Conclusion

The above proposal has highlighted the potential risks that might affect the successful introduction and profitability of the intended chocolate bar. The competitive nature of the confectionary market requires that managers develop a superior contingency plan to overcome every unforeseen situation and deliver positive results. The inclusion of all key stakeholders and employees from the very beginning will become a new opportunity to reduce the level of resistance and eventually deliver positive results within the stipulated period.

Reference List

Baker, K. and Filbeck, G. (eds.). (2015) Investment risk management. Oxford, UK: Oxford University Press.

Cerezo-Narváez, A. et al. (2020) ‘Integration of cost and work breakdown structures in the management of construction projects’, Applied Sciences, 10(4), pp. 1386-1417. Web.

Kot, S. and Dragon, P. (2015) ‘Business risk management in international corporations’, Procedia Economics and Finance, 27(1), pp. 102-108. Web.

Miles, R. (2017) Conduct risk management: using a behavioural approach to protect your board and financial services business. New York, NY: Kogan Page.

Wolke, T. (2017) Risk management. Boston, MA: Walter de Gruyter.

Yang, S., Ishtiaq, M. and Anwar, M. (2018) ‘Enterprise risk management practices and firm performance, the mediating role of competitive advantage and the moderating role of financial literacy’, Journal of Risk and Financial Management, 11(3), pp. 35-51. Web.