Introduction

The fundamental function of cost management, according to available literature, is to assist financial and management accountants to generate more customer value at a lower cost (Weil & Maher 24). From the case study, it is evident that the president of Kranbrack Corporation is attempting to create stakeholder value by reclassifying period costs as product costs and postponing expenditures to the next financial year. This paper sheds some light on these actions

Comment on Actions

Both actions (postponing expenditures and reclassifying period costs as product costs) are intended to minimize the expenses of the company for financial and tax reporting. An expense can be described as “the measure of the cost incurred when a resource is consumed or sold to generate revenue” (Walther & Skousen 47). Because expenses are matched to revenues to measure the accrued income of a company, postponing such expenses or reclassifying period costs as product costs would substantially increase the earnings of a company as the expenses would be minimal compared to revenues.

Period costs relate to any costs that are not product costs and are identified as expenditures during the timeframe in which they are incurred rather than with units of purchased or produced goods. It is also important to note that a product cost is a cost assigned to goods that were either purchased or manufactured for resale, implying that it is the historical cost of the inventory of manufactured or purchased goods until the goods are sold (Drury 101). It, therefore, follows that reclassifying period costs as product costs would ease the burden on expenses since goods and products will still be held as inventories, effectively doing away with what is normally called as cost of sales.

Possibility to reclassify all Period Costs as Product Costs

It is not possible to reclassify all period costs as product costs since there must be a base to calculate the profitability or loss of a company in a given financial year. It is impossible to hold all goods and products as inventories that have not been sold since there will be a problem coming up with revenue streams (Atrill & McLaney 55). There is also the issue of selling and administrative expenses (e.g., advertising, management salaries, sales commissions, public relations, and other nonmanufacturing costs) which cannot be reclassified as product costs. It is not possible to control for all costs incurred during the year since some of the costs cannot be reclassified from period costs to product costs.

Why Reclassifying would Increase Earnings

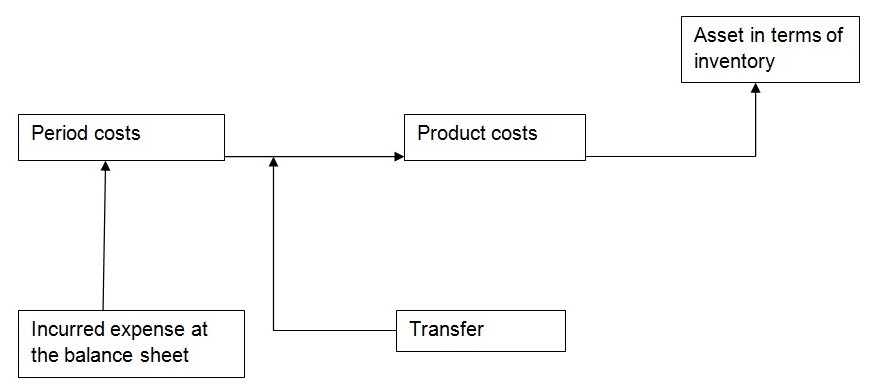

It is important to note that period costs are expensed in the period they occur, while production costs are reported as part of the organization’s inventory and are reported on the balance sheet as a current asset. Reclassifying from period costs to product costs, therefore, “moves the costs from being an expense on the income statement to being part of the inventory on the balance sheet, thereby increasing profits” (Proctor 212). Concurrently, increased earnings are achieved as costs for the ending financial year are no longer charged as an expense; on the contrary, they are passed in the financial books as an asset awaiting disposal. Reclassifying would also increase earnings since production costs are not tax-deductible. Unlike period costs which appear in the income statement as an expense and hence are tax-deductible, product costs appear in the balance sheet as an asset and hence are not tax-deductible. The following diagram serves to explain these relationships.

Although it is the function of today’s management accountant to create value through values, it is my submission that the actions may not be ethically or morally correct. First, the actions involve playing with numbers to achieve the intended results of the management even after full knowledge that the company cannot realize the set financial outlook. It would have been more plausible to communicate to the company’s shareholders that the organization was unable to grow its earnings by 20% due to market reasons rather than to reclassify period costs as product costs to insinuate that the company indeed grew by the said margin. Second, it is against accounting rules and principles to undertake such an exercise with the full knowledge that it is intended to hoodwink the public about the growth of the company. Finally, it is ethically wrong for the manager of the said company to engage in practices that compromise his moral standing as well as the reputation of the company. On the contrary, it should be the task of management accountants like Mr. Gallant to sustain a staunch commitment to ethical principles while employing their knowledge, skills, and expertise to influence decisions and perspectives that generate value for the company’s stakeholders as well as shareholders (Weetman 185).

Conclusion

This paper has shed light on the weighty issues of period costs and product costs. More significantly, the paper has illuminated how reclassifying period costs as product earnings may lead to increased earnings for the company, though the action goes against the ethical tenets of doing business. A major learning point is that period costs can be transferred to assets by merely changing them from incurred expenses to inventories. Another major learning point is that inventories are merely charged as assets in the balance sheet, thus the possibility of increasing earnings when period costs are reclassified as product costs.

Works Cited

Atrill, Peter and Eddie McLaney. Management Accounting for Decision Makers. 8th ed. 2015. London, UK: Pearson. Print.

Drury, Colin. Cost and Management Accounting: An Introduction. 7th ed. 2011. Boston, MA: Cengage Learning. Print.

Proctor, Ray. Managerial Accounting: Decision Making and Performance Improvement. 4th ed. 2012. London, UK: Pearson. Print.

Walther, Larry M., and Christopher J. Skousen. Managerial and Cost Accounting. 4th ed. 2013. Thousand Oaks, CA: Sage Publications Ltd. Print.

Weetman, Pauline. Management Accounting. 2nd ed. 2010. London, UK: Pearson. Print.

Weil, Roman L. and Michael W, Maher. Handbook of Cost Management. 2nd ed. 2005. Hoboken, NJ: Wiley. Print.