It is often argued by economists that supply side policies are more effective than demand side policies in achieving macroeconomic objectives. Assessment of the effectiveness of supply side policies which have been used in many countries such as UK and Malaysia and examination of the impact it had on the business community.

Executive Summary

Cooke and Healey (2001), found out that journalist Jude Wanniski coined Supply side economics in 1975. It is a school of macroeconomic thought that argues that economic growth can be most effectively created using incentives for people to produce goods and services, such as adjusting income tax and capital gains tax rates. Demand side economics on the other hand argues that growth can be mostly effectively managed by controlling total demand for goods and services by adjusting level of government spending.

Supply side policies can be defined as a policy intended to improve conditions favourably, which encourages supply in an economy. An example of supply side policy is that when an education system is improved, more educated people will be in the labour force. In contrast demand side policies seek to increase and stabilize GDP by limiting demand.

Government and large corporations normally use macroeconomic models to develop and evaluate economic policy and business strategy. The field of macroeconomics began to expand with great depression of 1930’s. Before 1930s the National Accounts currently used today were not there. Keynes played a great role in explaining the great depression.

According to, Cooke and Healey, (2001), the aggregate demand is used to explain unemployment by the Keynesian economics. Keynesian economics also focused on aggregate demand to explain business cycle. He said that business cycle fluctuations should be reduced through fiscal policy. Fiscal policies refer to the policies adopted by the government to regulate the economy some of them are government spending, printing of money, sale and buying back treasury bonds.

Supply side economics tries to explain the role of monetary and fiscal policy. The price of money as determined by the supply of money and the demand for money is focused by monetary policy (Mish kin. 1995). Supply-side policies can be used to improve the quality and quantity supply of labour in the market. By increasing the UK’s total labour supply the productive potential of an economy can be expanded. An efficient use of the labour market supply-side policies will shift the long-run aggregate supply curve to the right.

Some of the supply side policies for the labour market are; reform in the trade unions, impact on the income tax, introduction of the national minimum wage rates and expenditures on the labour education and training. Also supply side policies can be used to improve the product markets. The LRAS curve will be shifted to the right if the productivity of an industry improves. Some of the supply-side policies for product market are; privatizations, encouragement of the small business start-ups, emphasis on free trade and deregulation.

Demand-side policies developed by Keynes can be used to control the level of demand in the economy. Reflationary and expansionary policies may be used to regulate the demand in the economy. Demand-pull inflation will occur in a point where there is excess level of demand in the economy hence prices will tend to rise. Market efficiency can be indicated by demand-side policies particularly consumer behaviours. Some of the elements of demand-side policies are; public procurement and putting in place regulations and standards.

Fiscal policy focuses mostly on the role of government to raise money for investment. By so doing the government also places a great consideration on the impact the taxation has on domestic trade. According to Say’s law, which states that, recession do not occur because of failure in demand or lack of money.

As held by Milton Friedman, inflation is a monetary phenomenon. monetarism phenomenon rejects fiscal policy as it leads to crowding out of the private sector. Laisses Faire an Austrian economics, and which is a macroeconomics school focuses on business cycle, which arises from government interference through central bank leading to deviation of interest rates.

Several criticisms have been leveled against supply-side policies. Some of them are; the policy focuses mainly on massive federal and current account deficits that were accumulated in the U.S. since 1980 and, supply-side policies focuses only on long-run aggregate supply curve and has no concern to the short-run aggregate supply curve and focuses on established potentially mobile capital.

In order to fight inflation the government the government uses contractionary policy by raising interest rates. The analysis below looks at the various explanations regarding the phenomenon of supply policies and particularly how such affect or influence macroeconomic objectives. The analysis highlights how supply side and demand side behave to shape macroeconomic policies.

Introduction

As earlier defined Supply side policy is a policy intended to improve conditions favourably, which encourages supply in an economy? An example of supply side policy is that when an education system is improved, more educated people will be in the labour force. In contrast demand side policies seek to increase and stabilize GDP by limiting demand.

Supply side policies have played an important role in U.S. politics for a quite a long period. The Keynesian economic policy gave much concern on the demand side on economic policy, but government policy focuses on supply. The government policies are more concerned on encouraging faster growth and making production more profitable. When government reduces taxes, they stimulate more investment, which would lead to high productivity.

The supply side has a significance importance for potential growth. This is because resources are mobilized for supplying goods and services also the supply of labour and capital. If supply side operates flexibly and efficiently, the income opportunities for residencies increase. Some of these policies are health, education, research and development.

In the late 1970’s and early 1980’s, US implemented some structural terms which culminated to what is called “supply side economics”. This entailed liberalization of several industries which were previously regulated for example telecommunications.

The supply-side policies have a significant impact on the conduct of monetary policy and financial stability. Firms’ productivity would be increased by competitive product and labour markets. Supply side reforms tend to facilitate monetary policy and increase its effectiveness. A significance consequence of reform is reduction in the inflation rates.

Reforms aiming at developing the financial sector would strengthen the effect of supply side-policies. An economic environment whish is flexible makes it easier for monetary policy to maintain price stable and also keep unemployment levels very low.

Macroeconomic deals with the aggregate economy. It is more concerned with the structure behaviour and performance of the whole economy. Macroeconomics has more focus on National income, unemployment, inflation, investment and international trade. Microeconomics on the other hand deals with the determination of prices and the role of prices in allocating scarce resources

Purpose of the study

The report is meant to make an assessment of the effectiveness of supply side policies which have been used in many countries such as UK and Malaysia. And also examination of the impacts it had on the business community. The report should also give conclusions and recommendation for a sustained growth and development of the economy.

Limitation of the report

Although the report is comprehensive and sufficient it is compiled under constraint of time. However attempts have been made to incorporate all the necessary and available resources. The report is limited to the books, internet, journals and slide shows used. However the conclusion and the recommendation represent the writer’s own opinion and also any other area that required the expertise of the writer.

Macro Economic Tools Depicted by Supply Side Policies

Governments normally make adjustments through policy changes so as to stabilize the economy. The success of these adjustments is meant to maintain stability and continue growth. Two types of strategies are used for economic management. They are:

Fiscal policy

Does the government to check on the sources of funds and how those funds are used apply the tools. The government employs tools like spending, borrowing or taxation to stimulate or slow down the economy. In contrast the monetary policies deal with policies concerning the supply of money.

Fiscal policy can be expansionary, neutral or contractionary. It is expansionary when the government lowers taxes and /or increases spending hence expanding National income. Increased government spending or reduced taxes shifts the aggregate demand curve to the right: thus an expansionary fiscal policy will lead to expansion of the economic growth. On the other hand a contractionary fiscal policy arises when the government raises taxes and or/reduces its spending, therefore lowering the National income. Decrease in government purchases or an increase in taxes shifts the demand curve to the left.

Ways of raising funds by Government:

- taxation;

- borrowing;

- fines;

- printing money.

The money raised through this ways is spend on several, ways like healthcare, education policy force and infrastructure.

Fiscal policy as a supply side tool

As earlier defined, supply side policies are policies that aim to increase the capacity of the economy to produce fiscal policies acts on the level of demand in the economy and the deflation nary and reflationary policies are known as demand side policies. Incentive to work will always be affected by income tax. If income tax of low income earners is too high people may choose not to work but still remain on the benefit side instead. On the other hand if income tax on high income earners is too high, people may choose not to work so hard and take risks. They may also opt to leave the country if taxes elsewhere are too low(brain drain) (Mish kin, 1995).

As it can be seen from the above diagram, supply-side policies is one of the macroeconomics. Supply side policies also includes; reducing the tax of the higher income earners encourage enterprises, risk-taking and the incentive to work hard, cutting lower basic rates to open up the gap between earnings in and out of work and ensure that people have an incentive to work (Mish kin, 1995).

Fiscal policy and supply-side policies

In times of economic boom deflationary fiscal policies are appropriate. In a situation whereby the economy is growing at a higher rate than its capacity, it may bring about inflation and Balance of Payment problems (Cooke and Healey, (2001). To counter the increasing economy the government may raise taxes all reduce gover4nment spending. It may increase indirect taxes which will raise prices and prevent people from spending too much or it may increase direct taxes, which will leave people with less money in their pockets and so stop them from spending so much.

Examples of deflationary fiscal policies include; increasing the lower basic or higher rates of taxes, reducing the level of government expenditures, reducing the level of personal allowances.

The intention of the supply side policy is to shift the aggregate supply curve to the right, increasing the long term productivity capacity of the economy. The supply side policy tends to be long term (Mish kin, 1995).

Assessment of how supply side policies are effective for example,

- Lowering taxes increases incentive;

- Reducing welfare dependency increases the urge to find work.

Monetary policy

Monetary policy it is the process employed by the government or central bank to manage the supply of money.

Monetary policy can be expansionary or contractionary. Expansionary monetary policy is used to fight unemployment by lowering interest rates, while contractionary policy is used in raising interest rates to fight inflation (Cooke and Healey, 2001).

Supply side policies for the labour MKT

According to Cooke. and Healey (2001), to improve the quality and quantity of supply of labour in the market some policies can be adopted. The productive potential of an economy can be expanded by the increase in the UK’s total labour supply. Successful labour market supply side policies will shift the long Run Aggregate supply curve to the right

Reforms in trade union

Legal protection previously enjoyed by the trade unions has been withdrawn. As a result strikes had declined and in the long run an improvement in the industrial relations in the United Kingdoms.

Impact on the income tax

Lower rate of tax provides short term boost to demand. This is because they save a higher percentage of money they get as salaries.

An historical approach is that in 1980’s the conservative government has cut the tax rates however the greatest tax reduction was handed over to the higher income groups.

Expenditures on labour education and training

Some economists deny that Investment in education has the potentiality of increasing the total skills in work force and improve employment prospects of the many unemployed people. Many economists agree that the economics return from extra education spending can vary according to the stage of economic development of that country.

According to a research in 1999 of London, investing more money on education has a direct impact on improving economic performance. This report also suggested that developing countries which spend more on education of the workforce expects handsome dividends for workers, firms and the states. Also the government expenditure on education and training improves workers human capital. Their productivity improves; hence the long run aggregate supply curves shifts to the right.

Supply side policies for product markets

According to Ellison (1998), all the policies of the product markets are designed to improve competition and consequently efficiency. If the productivity of an industry improves then it will be able to produce more with a given amount of resource hence shifting the LRAS curves to the right.

Privatisation

This is one of the greatest policies used by Mrs. Thatcher and John Major. It was the major supply side policy on the product market of 1980s and 1990s. State run industries like telecommunication, gas, steel, electricity and so on were privatized to create more competition.

Encouragement of small business start-ups

For an economic growth, small business must be attracted. At the start of 1999 there were about 3.7 million small businesses in UK. This is as per a report produced by the department of trade and industry. 63% of all the small businesses were self employed in 1999 alone. Government initiatives have been launched to attract new businesses:

- a comparatively low corporation tax rate for small businesses;

- government grants for small businesses start ups;

- loan guarantee schemes;

- granting of investment allowances.

Emphasis on free trade

The UK government is a member of several trade agreements. UK is also a full paid up member of European single market which promotes free trade and free movements of goods, services, labour and capital through out the European Union member states.

Deregulation

Competition is highly encouraged. This deregulation facilitates coming up of new markets for competition. The purpose of deregulation is to increase market supply hence driving prices down. Example of deregulation is urban bus transport, parcel delivery, services, mortgage lending and so on.

Measures to increase investment by use of supply side policies

Capital investment is unusual in that it adds to aggregate demand but also has an important effect on the aggregate supply in the long run. (Ellison. 1998)

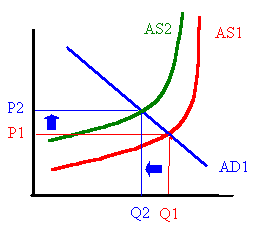

Demand pull inflation B

The graph above is used to explain how the increase in long term capacity can help the economy to grow without undue pressure on inflation. Supply side policies can help to push the AS curve to the right increasing the capacity of economy from YF1 to YF2.

Benefits of supply side policies

- Lower unemployment. There are different types of unemployment for example frictional, structural and real wage unemployment. This unemployment types can be reduced by supply side policies

- Help in lowering inflation. Inflation refers to the general increase in the prices of goods and services. It is a result of shifting the aggregate supply curve to the right will lower prices. When the economy is efficient, the cost push inflation will be reduced.

- Improvement in trade and balance of payment. Trade is the exchange of goods and services for money. When firms are more competitive they will increase their exports. Increased exports would mean more foreign exchange. In UK there is an increased competition from S.E Asia.

As the government increases its expenditure, LRAS shifts from LRAS1 to LRAS2. The aggregate demand curve is not affected by government expenditure. It remains constant.

Criticism of supply side policies

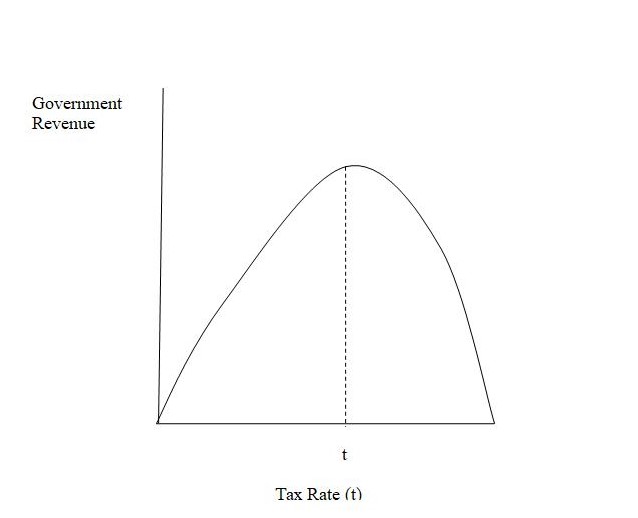

Critics of the supply side policies point out that this policy focuses only on the massive federal and current account deficits that were accumulated in the U.S. since 1980. In contrast the Laffer curve only predict revenue increase and have nothing to do with government spending.

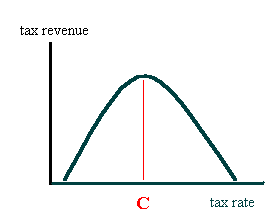

Laffer curve

Supporters of supply-side policies and many politicians fail to understand the Laffer curve. They argue that every reduction in tax will increase revenues, but the curves shows clearly that only cutting tax rate to the right of the peak rate will increase revenue conversely cutting tax rates to the left of the peak will decrease revenue.

Supply side policies focus only on the long-run aggregate supply and don’t consider that short-run aggregate supply is an important factor. Supply siders don’t believe that low unemployment will cause inflation as the NAIRU concept says. A cut in taxes would stimulate aggregate demand, frustrating the purpose of the policy. This might be offset by reducing government spending.

Demand Side Policies

Demand side policies are also known as demand management policies. These policies were developed by Keynes He argued that the policies should be used to control the level of demand in the economy. If there was a shortage of demand in the economy the government should aim to boost it through deflationary or expansionary policies. When there is excess demand the government should do the opposite. In a point where there is excess level of demand in the economy, prices will tend to rise. This will bring up a type of inflation called demand pull inflation

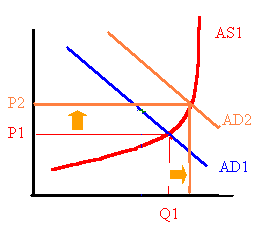

From the above diagram, as demand increase from AD1 to AD4 there is increasing inflation pressure on prices. This type of inflation is a result of too much money chasing too few goods.

The demand side, particularly consumer behaviors, is an important indicator of market efficiency, it has long been recognized that a competitive supply structure is necessary. As much as we focus on supply-side policy, demand side policies are as well very important. They lead to efficient markets outcomes resulting from interaction of suppliers and consumers.

According to the University of Manchester slide show, Demand side policy, “is the willingness of government and other large customers to use policy measures to set ‘stretch target’ for suppliers which demand high levels of radical innovation in order to meet products/service specifications.”

Elements of demand side policies

Public procurement

Public procurement process could be used very extensively o reduce demand uncertainty and facilitate innovation experiments. Procurement of goods and services and research and development has to take place before delivery.

Putting in place regulations and standards

Enacting regulations and standard often structure the markets for innovative goods for example environmental regulation such as zero emission legislation. Malabre and Alfred (1994), Postulated that, the major policies available to influence the demand side of markets are called fiscal and monetary policies. Fiscal policy is the use of the governments’ budget to influence the total level of economic activity in the country by influencing the total demand for goods and services. Monetary policy is the manipulation of the amount of money and credit available, and cost that credit to borrowers (that is interest rates) in an attempt to influence total demand. (Gronewegen, 1987).

“I. Why Shift AS?

Stagflation

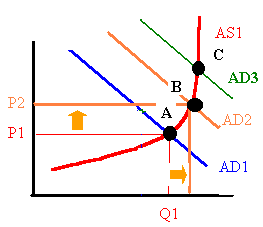

In the mid 1970s both inflation and unemployment rose at the same time. This situation is known as stagflation. This cannot occur with an aggregate demand shift. If AD increases, then inflation rises but unemployment falls (because output rises). If AD falls, then inflation falls but unemployment rises. The explanation lies with the aggregate supply curve. If the AS supply curve shifts left (decreases) due to costs increases (like with the rising oil prices in the 1970s), we see both higher prices and lower output (higher unemployment):

Also, if we are near the vertical portion of the AS curve, increases in AD will impact mostly prices and not output:

Stagflation creates a big problem for policy makers: Do they increase AD to increase output (and employment) but make inflation worse? Or do they fight inflation by decreasing AD, but making unemployment worse?

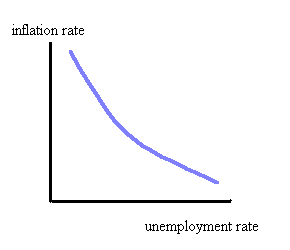

The Phillips Curve

As long as the AS curve is upward sloping, changes in AD involve a tradeoff between two undesirable outcomes: higher inflation or higher unemployment:

This tradeoff was first developed by economist A.W. Phillips, as is known as the Phillips curve:

This relationship guided fiscal and monetary policy in the 1960s and 1970s. But with stagflation in the 1970s it became clear that we could experience both high unemployment and high inflation. Also in the past 5 years we have enjoyed both low inflation and low unemployment. Shifting the AS to the right improves the Phillips curve tradeoff and is the best antidote for stagflation.

How might the government engineer a shift in AS?

Supply-side economics deals with ways to increase aggregate supply so the economy can enjoy both economic growth and low inflation. President Reagan was a fan of supply-side policies in the 1980s, so supply-side economics is also known as “Reaganomics.” When President Bush was opposing Reagan for the Republican nomination in 1980, he call supply side economics “Voodoo economics,” a phrase that came back to haunt him almost as much as “Read my lips, ‘no new taxes.'” There are four potential ways government policy can influence the AS curve.

We saw in chapter 11 that tax cuts were part of fiscal policy, designed to shift the AD curve. Under fiscal policy all that matters is the size of the tax cut, not how it is accomplished. Supply-side policy is more concern with the incentives built in the tax system that encourage working and investment. They are interested in the type of taxes levied as well as the tax rate.

Low marginal income tax rates allow people to keep more of what they earn, perhaps encouraging them to work more hours. This would increase AS. Low tax rates on profits as well as special investment tax breaks encourage investment in plants and equipment that also increase aggregate supply.

How do these tax cuts impact the federal budget?

Supply-siders argued that by increasing work and investment incentives, a tax cut could actually INCREASE tax revenue because the taxes would be levied on larger incomes and profits. Arthur Laffer, one of Reagan’s advisors, demonstrated this relationship with the Laffer curve:

If tax rates are above C, then a tax cut will actually increase revenue. Unfortunately in 1982 tax rates were well below C, and revenues fell sharply. Reagan tax cuts certainly played a role in the economic expansion of the 1980s, but this could be due to the impact of the tax cuts on aggregate demand. The tax cuts also contributed to large deficits.”

Examples and empirical evidences of supply curve

Margaret Thatcher the Prime Minister of England used the supply side policy for product market in 1980s and 1990s.The hallmark of her economic policy was privatization. Industries which were run by the government were privatized. For example the rail transport, water and gas.

For continual commitment to free trade the UK government has signed up to trade agreements brokered by world trade organisation. At the start of 1999 there were about 3.7 million active business in UK.This is according to the department of trade and industry. Supply side policies for the product market have encouraged the growth and development of small businesses.

Self employed people consisted of 63%of all businesses in UK.According to a research published by a small service nearly three quarters of the increases in employment between 1999came from small and medium sized firms supply side policies for the labour market can be used to increase productivity for labour.For example expansion in the UK’s total labour supply increases the productive potential of the economy. Industrial relations have increased the flexibility in the labour market leading to decline in employee strikes.

According to a research from the university center for economic performance, developing countries which increase education spending and achieve higher qualified workforce, can expect “handsome dividends: for workers , and the state” government spending on education and training improves workers human capital. Quality work is produced. Productivity also improves and the LRAS curve shifts to the right. Government involvement to setting minimum wage rate is a key to boost the economic growth.

For example the UK government introduced a minimum wage. In March 2001 the government announced an increase in the adult pay from £3.70 per hour to £4.10. According to a speech by Jean-Claude Trichet, President of the Europeans Central Bank, at the institut der detshen Wirtschaft, Koln, 2004 suggested that, “The supply side economy is a responsible for mobilizing resources to supply goods and services, entailing a crucial part of labour and capital. The supply side thus contributes to determining the economy’s potential growth path and real income

Impacts of the supply-side policies on business community

Lipsey (1992) profounded that Government promotes growth of businesses. Government may provide subsidies inform of reduced taxes or increasing capital allowances; through supply side policies, growth is promoted by lowering production factor cost. An emphasis on established, potentially mobile capital leads to establishment of new businesses. This is because there is readily available capital. The government supports the private sector decision on where to invest, the kind of business and what products to sell. By so doing there is growth in the private business opportunities.

Competition is encouraged in the supply side policies. The business community will compete with each other. Also the customers will benefit by enjoying high quality products, and also they will have wide choice of goods. Deregulation of business process has enabled free trading with minimum government interference. This has encouraged more businesses to come up. More industries have been set up. These industries employ peoples who earn their living; hence improving their living standards.

Government is able to raise more taxes by emergence of more industries. Also when peoples are employed they taxed on their employment income. The government is able to invest such money raised from taxation to build schools and hospitals and also improve the infrastructure.

Lipsey (1992) presented the following table as a contrast for traditional supply side policy and demand side entrepreneurial policy.

Supply side policies are the traditional approaches and demand side policies reflect the more recent new wave approaches followed by many states. Eisenger recognized that supply side policies are more likely to redistribute jobs rather than create new ones. Demand side policies have the potential to create more jobs in the long run because they encourage innovation and growth. (Mc Connell, 1987).

The following are the state level actions, which according to Mc Connell, (1987) that influence the demand of global competition and technological change and have been designed to transform state economic activity among the innovations discussed are:

- Public venture capital funds to stimulate projects that are too costly for individual entrepreneurs or too risky for private capital.

- Programs to stimulate technical innovations such as academic business projects for technology transfer, and government sponsored research in area of global competition.

- Business labour managements agreements to restructure labour management relations to increase worker participation, productivity and job security.

- Educational programs that go beyond literacy and numerally to emphasise life long learning and continual acquisition of new skills.

Conclusion

The greatest challenge facing policy makers is deciding how much the government should be involved in the economy. The government has been interfering with the economy for too long. However, a degree of government involvement is accepted to sustain a vibrant economy. The supply side effects of the minimum wage bill hence production, this increases the wage bill hence production costs, which may have an adverse cost on output and employment.

Developing countries which increase the education spending on their staff will achieve qualified staff which will be a useful resource to the company. Demand side promotion of lead markets is centre piece of technology procurement policy. In UK market size and structure is key attraction factors.

As per the above discussion, it can be concluded that the performance of the economy is very important to every one; macro economy is analyzed by primarily looking at National output, unemployment and inflation. Although to a greater extend its consumers who determine the direction of the economy government also influence it through fiscal policy and monetary policy.

Recommendation

Developing countries should embrace the supply side policies for potential growth. This is because for example, they lead to improvement in trade and balance of payment. Export will bring in foreign exchange which may be used to initiate development projects. Unemployment, inflation and National output should be thoroughly examined for a sustained growth for any given country. It is a long belief that small businesses are the lifeblood of any growing and sustained economy. Therefore, small businesses should be encouraged. Government should encourage free trade. This is achieved by deregulation process whereby business community is allowed to conduct business without government interference. Prices of goods and services are determined by processes of demand and supply

References

Cooke M. and Healey N. (2001) Supply side policies. Harcourt Heinemann.

Ellison l. (1998). Supply-Side Policies and the U.K Commercial Property Markets: 1979-1990. Journal of property Research. Vol. 15 pp. 15-33 (19).

Feller J.W. (1976). American enterprise institute for Public Policy Research. American Enterprise Institute.

Heyne P.T., Boettke, P.J., (2002). The Economic Way of Thinking. Prentice Hall.

Lipsey. G. (1992). First Principles of Economics. Oxford University Press.

Malabre, Jr., Alfred L. (1994). Lost prophets: An insiders History of the modern Economists, p. 182. Harvard Business school press.

Mc Connell R.C (1987). Economics: principle, problems and policies: McGraw-Hill.

Michael J.A. (1982). Demand management; supply constraints and Inflation, Manchester University Press, England.

Michael P. (1978). Demand management. Heinemann.

Mishkin F.S. (1995). The Economics of money Banking and Financial markets. Harper Collins New York.

Gronewegen. P. (1987). “Supply and Demand” in Eatwell ET AL. (ed) “the new pal grave- a dictionary of Economics” p.553.

The importance of supply-side policies. Web.

Labour market economics. Web.