The objective of this study report is to highlight the correlation between profits, dividend and share price in assessing shareholders value change and to critically evaluate share value charts. The publicly traded company selected for the purpose is TESCO.

TESCO is one of the largest food retailers in the world and largest food retailer in the UK, operating over 3,200 stores. The group is also one of the largest online food retailers. The group launched Tesco direct to market its non food offerings online. With the opening of a new channel to market its non food merchandise, the group seems well placed to leverage its position in online food market for non food market. The group operates in three geographical segments: the UK, Rest of Europe and Asia. “The group is one of the largest online retailers in the world. Tesco has a long term strategy for growth, based on four key parts: growth in the Core UK, to expand by growing internationally, to be as strong in non-food as in food and to follow customers into new retailing services.” (Premium Company Profile Tesco Plc. 2007).

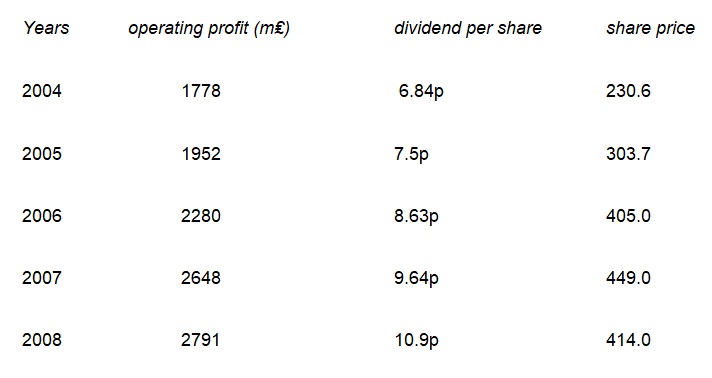

The financial report for the period of five years (2004 to 2008) of Tesco company is taken for an in-depth analysis.

By analyzing the financial report we can conclude that the increase in the operation profit has increased the rate of dividend and share price each year. There is a set back in the share price in the year 2008 which is due to some external factors. The changes in the retail market policy by the UK government and aggressive expansion plan of Tesco in UK and other geographical areas leaves a little cash with Tesco for other operations. But as a whole the market share of the company is growing in UK which is maximizing the wealth of shareholders. They hold around 32% market share in UK’s grocery market, it shows a rapid growth in the retailing of non-food items. In insurance field the market share was 7% in 2004 which increased the market share up to 12% in the year 2008.Tesco online is the online supermarket that receives maximum online orders i.e. around 66% of the total order. Brand image of the product has helped Tesco to enjoy the market leadership.

Tesco has 29% share of the UK food market. Being a monopoly if forces the suppliers to sell in low prices. It is a threat for small local shops. They provide discounts to their suppliers due to the huge quantity they buy. The customer gets their product in cheaper rates. The supplier can sell more with lower overheads. They have better trained sales force having good negotiating skill. Local shops are struggling to retain in the market because of low price offering of Tesco. Another criticize is that this firm is having an adverse impact on other businesses and is squeezing prices paid to farmers.

One of the significant strategies for the success of Tesco is diversification of business. They specialised in food and entered into retailing of non-food items, which shows a high growth over the years. Tesco has specific market share in business like General insurance, financial services, telecom services, Fuel, Health and Beauty, etc. Besides its core business in UK, Tesco expanded its business to US, Europe and Asia. The subsidiaries in these geographies also show an excellent growth rate. Tesco can source goods from these geographies for a cheaper cost to with stand the price war in UK. The humane farming methods, low pricing, quality of product, direct marketing campaign always help them to capture new markets. They provided to the customers what they want, by acquiring customer data and meeting their needs.

In general, wealth maximisation of share holders means maximising the share holder’s welfare. For this a firm should optimise the utilisation of share holder’s contribution. The maximisation of wealth implies the increase of share prices in the market. There are many factors effecting the changes in the share price- changes in the profit distribution of a firm, changes in tax rules, changes in the government rules and regulations and other market changes. Public perception is also an important factor to be considered. If the public perceive the firm is going on right track and making money they will invest. Some times, a window dressed financial report of a firm helps them to raise the market share. It is also seen that the repurchasing firms which are also called opportunist, buy back shares when price drops and wait for a price increase. Besides these factors the share holders consider not only the profit rates but also the risk attached to it. They speculate the rate of interest which they get during the sale.

The market is indeterministic. Then also, the stock brokers predict it on the basis of the market strategies and market conditions of a firm. Different strategy is adopted at different stages of the firm. Every firm undergo through four different stages – introduction, growth, maturity and decline. In the case of Tesco, the firm is in the maturity stage. In this stage, the sales are at peak, large customers are there, brand image makes the customer loyal and intensive distribution channel are used. The firm is concentrating on diversification. The profit earned is invested in the expansion purposes. As they are the old players in the market the market share is on the aim for them. They have to face new strong competitors in ht market. The shareholders also expect decline in the share price. They start to disinvest their shares.

In the starting of 2008, global financial market conditions have worsened. Actually, the global market condition has worsened since October 2007 but the after effects are seen in the starting of the 2008. The market recession has resulted fall in equity prices in the market. The recent falls in equity prices suggested emerging markets spillovers. So, in this year the investment in equity shares have diverted to other investment schemes as investor’s aim is to maximum rate of return to their contribution.

By this analysis we can conclude that, changes in the share price have a drastic impact in the market and in the same way movement in the market, changes the equity prices. The changes are based upon many factors as above said according to the nature of the business.

Bibliography

Premium Company Profile Tesco Plc. (2007). Report Buyer. Web.

Investor Information: Summary Five Year Record. (2008). Tesco. Web.