Overview

Concha Y Toro is a Chilean wine brand that is often considered to be among the most popular ones in the world. Established in 1883 as an individual winery by Don Melchor Concha Y Toro, it slowly expanded, eventually becoming a corporation and beginning to trade on the stock exchange in 1933. However, the change that has led to its current success happened in 1957, when Eduardo Guilisasti Tagle joined the Board of Directors and began overhauling the business’s practices1.

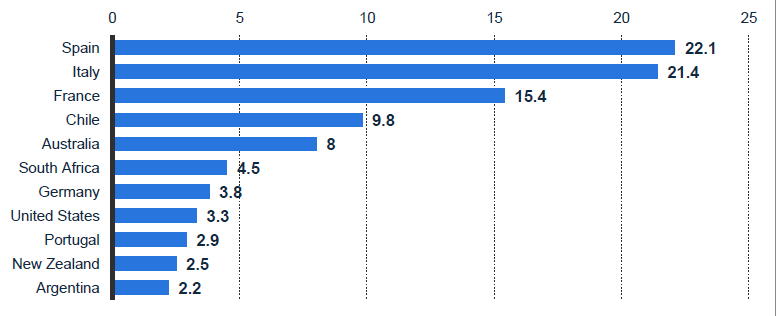

Concha Y Toro started expanding its holdings and acquiring additional wineries in different segments, including premium and ultra-premium wines. During that time, Chilean wine exports grew dramatically, leading it to take fourth place in terms of volume worldwide2. As a result, nowadays, the company is a large conglomerate of different sub-brands that offer a diverse range of products at reasonable prices and are exported worldwide.

The company’s mission and vision have changed accordingly, accommodating its new objective of global leadership. The former is to become consumer-centric while also capable of delivering premium wine to customers globally3. In the effort to reach this goal, the company has defined a broad mission for itself that includes a variety of objectives.

It aims to fulfill the highest quality standards and deliver safe products that are legal worldwide. It will understand customers’ needs and expectations and establish healthy relationships with them as well as suppliers and producers. It will promote healthy wine consumption and operate sustainably to preserve health and the environment. Lastly, it will provide an excellent, fair work environment with numerous opportunities for professional growth. The company’s values likely reflect its mission and vision, though they are not explicitly outlined on its website.

Competitive Environment

Chilean wine brands do not necessarily compete with each other intensely, instead aiming to capitalize on the international market. This practice is consistent with the nation’s general approach to production, which is strongly export-oriented because of its small population4. The global market is sufficiently large that competition between Chilean wine companies is limited, as each can find a distinct and stable customer base without interfering with the others. With that said, global competition can be intense, particularly as Chile is one of the New World wine producers that are rising to challenge well-established Old World countries.

These nations, particularly France, Italy, Germany, and Spain, have the advantage of a longstanding reputation that makes their products safer to buy in the customer’s view5. Concha Y Toro has to take brands from these nations into account when considering its competition and identifying opportunities.

To evaluate the brand’s global competition, the report will feature two other leading brands from different countries. The first is Barefoot, an American brand that is generally considered the highest-selling in the world. It also sells a wide variety of different wines, ranging from cheap to premium and demonstrating a number of different styles that are adapted to customers’ needs. It is a powerful competitor to Concha Y Toro because it is capable of serving the same global market.

The other competitor chosen for the purposes of this report would be Château Pétrus, a French producer of premium, costly wines. Instead of competing with Concha Y Toro in every regard, it provides a different premium offering with a well-established reputation. It also represents the Old World’s approach to wine, which involves numerous small companies that do not produce high amounts of it but emphasize quality.

Concha Y Toro is similar to Barefoot in its general approach, offering a broad and diverse range of various wines to customers worldwide. With that said, it is different from Barefoot in its selection of wines and their origins, using Chilean grapes as opposed to American ones. Depending on the customer, this difference can be advantageous or disadvantageous, and it is challenging to evaluate the difference.

With that said, Barefoot currently likely sells more wine than Concha Y Toro does, which can be attributed to a variety of different reasons. It may produce more wine, offer better prices, have a better reputation, benefit from its access to the American market, or fulfill other potential criteria. However, currently, the two companies’ differences are not large enough that Concha Y Toro cannot achieve the same results with time.

On the other hand, Concha Y Toro is different from Château Pétrus in many ways. Both produce premium wines, which are the entirety of the portfolio of the French estate. However, in addition to its Don Melchor line, Concha Y Toro also makes a diverse range of other options, many of which are much lower-priced and affordable to different customer categories.

Moreover, the two firms have different distribution channels, with Château Pétrus wines often being auctioned, particularly if older, and generally unavailable through traditional retail channels due to the low production numbers. While the more expensive Concha Y Toro wines may have the same issue, its other products are available in many stores worldwide. As such, they can reach a much broader customer base, both economic class-wise and geographically.

Consumer Profile and Targeting Strategies

The first consumer category that warrants a discussion are young and middle-aged adults worldwide. Millennials, in particular, have been increasing their wine consumption as their incomes grew, and they discovered the advantages of the beverage. This customer category is often interested in experimentation and trying new experiences, whether they result from choosing a different brand, wine style, or other distinguishing factors6.

As such, they are likely to be interested in wines from New World countries and different styles or production technologies. These considerations appeal to them because they are novel and offer a wide variety of new tastes and opportunities for discovery. Concha Y Toro appeals to them on several different aspects, and they are likely to be a significant customer category. In addition to satisfying the criterion of diversity, it makes affordable wines that represent a substantial portion of the nation’s and region’s output.

To appeal to this customer category, the company has been continuously expanding its reach and variety of products. By making its wines locally available throughout the world, Concha Y Toro makes it easier for adult customers to discover its products and gain an interest in the company as a whole.

Then they can search for more specific wine types from the same winery or brands that suit their preferences. Even if unavailable locally, these wines can likely be found digitally within the country and delivered to the person. Moreover, with the growing repertoire of Concha Y Toro wine, the business can satisfy an increasing number of different needs. To that end, the company is applying itself to make wine in new styles and improve on its current ones, working to create a selection that any potential customer would be satisfied by.

The second notable category consists of wine tourists, who can come from different backgrounds and have varying ages and other characteristics. With that said, they are likely to be wealthier than average, at least while interacting with the company, due to the costs of international tourism. The practice has been developing in different countries, with 1 million tourists visiting 167 wineries in Argentina in 20117.

These customers typically follow predetermined routes set by tourism agencies that focus on a specific aspect, such as a trail of renowned wineries or a focus on specific wine styles at which the visited locations excel8. This type of tourism can be beneficial to both the wineries, which generate additional revenue, and the overall region, which can begin developing tourist infrastructure9. A global brand such as Concha Y Toro can also benefit from the increased recognition of its products by tourists, who can begin purchasing them at home after the trip.

Concha Y Toro has numerous opportunities to satisfy such tourists and likely takes advantage of them. It is a conglomerate of different wineries that often use their own branding for the wine they produce, helping create a less corporate atmosphere when visited. Moreover, since production is not centralized, the overall appearance of these locations will be more rural, appealing to the sensibilities of tourists who enjoy going on country-wide wine tours.

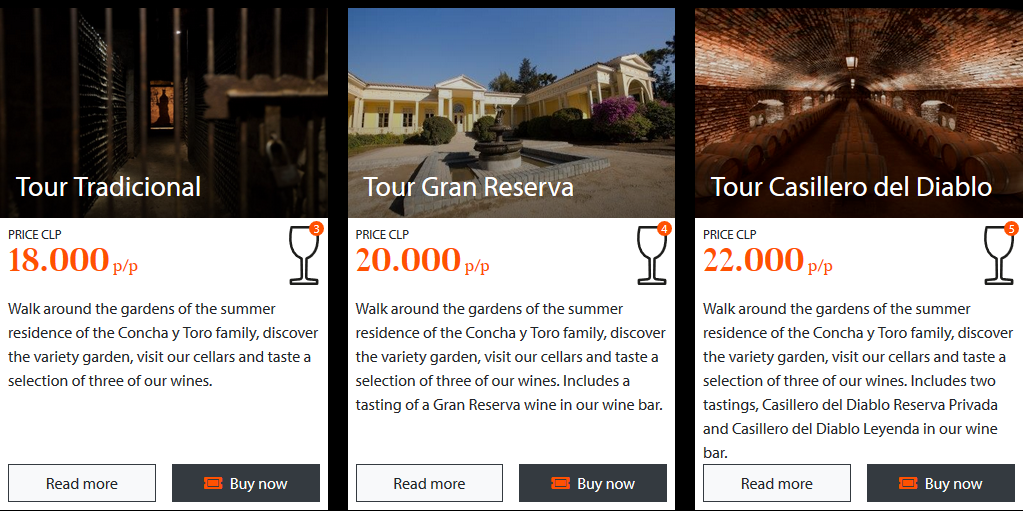

The company has several tour programs available, letting customers explore the Concha Y Toro family’s summer residence, visit the Don Melchor winery, and taste different wines up to the ultra-premium ones10. Additionally, the grape fields that belong to Concha Y Toro are often located in scenic areas that are likely to be popular among tourists independently11.

Branding Strategies

Concha Y Toro does not necessarily market itself heavily as an entity, preferring to let its different sub-brands generate independent reputations. The different names under which the company’s wines are sold include Sunrise, Frontera, Casillero Del Diablo, Don Melchor, and a variety of others. However, there is a shared tendency in the branding and marketing of these wines that is consistent with the general nature of the wine market. All of them explicitly identify themselves as Chilean, a use of the country image that has proven itself effective in many different industries12.

Wine is often identified first and foremost based on its country of origin, with customers able to tell different nations’ wines apart13, and this branding approach is not necessarily unusual. Using this approach enables Concha Y Toro to attract customers who may not be knowledgeable about specific brands but are interested in trying different wines.

This use of multiple sub-brands enables Concha Y Toro to offer a broad range of wines without compromising the reputation of its premium brands. Customers can purchase less expensive varieties without concern due to the Concha Y Toro trademark generally featured below the sub-brand, knowing that a level of quality is guaranteed.

At the same time, potential prestigious wine buyers can be confident that Casillero Del Diablo and Don Melchor are made without compromises at distinct facilities, with Concha Y Toro taking a removed management role. Considering that the price and attractiveness of wine rely strongly on the prestigiousness of the brand14, such separation is essential. In a highly traditional industry such as wine-making, the focus on individual wineries rather than large global brands is likely advisable.

With that said, Concha Y Toro has also taken steps to reinforce its position in the international scene. Brand alliances have proven to be a particularly useful tool in enhancing its image and spreading awareness of its products. Notably, Casillero del Diablo has become an official wine partner of Manchester United, becoming possibly the company’s greatest international success15.

Through measures such as this one, the company spreads awareness of its offerings while also increasing their prestige by associating them with one of the most popular sports clubs in the world. Concha Y Toro will likely engage in similar partnerships in the future, aiming to market its different brands by associating them with popular ideas. This approach to marketing is innovative for the industry and has enabled it to become one of the world’s largest wine producers.

Conclusion

The first lesson that other wine brands can learn from Concha Y Toro is how they may succeed in an international environment. The company has been able to develop a wide variety of offerings that suit the tastes of customers worldwide while retaining a strong Chilean identity. It has promoted the nation’s wine-making throughout the world while remaining its prime representative in many countries.

As a result, it is now renowned as a source of excellent wine, while Concha Y Toro remains relatively unknown to end consumers. In doing so, it succeeds at presenting itself as a conglomerate of different wineries rather than a centralized entity. This appearance is beneficial because many wine buyers are used to such arrangements, which are common in Old World countries and evoke a feeling of individuality.

This separation of different brands is another vital lesson for companies that aim to produce diverse ranges of wine. Concha Y Toro produces wine in all price categories, from inexpensive to extremely premium, and has an excellent reputation in each of these areas. The reason is that its premium wines are typically not associated with its cheaper offerings due to the secondary role taken by the overarching brand.

As they established themselves independently and gained a reputation in the critic and premium wine drinker communities, they dropped the Concha Y Toro branding. As a result, a new customer will view them independently, and checking the origins of the wine will reveal that it comes from a dedicated winery. At the same time, customers who explore the Concha Y Toro lineup of offerings will eventually discover Casillero Del Diablo and Don Melchor.

The final lesson for winemakers is to try to associate themselves with celebrities and organizations with renowned images. Many wine brands, such as Dom Perignon, build strong reputations based on their popularity with celebrities who can afford most products but choose the specific brand. Concha Y Toro has also succeeded in doing so, partnering with Manchester United to promote its Casillero del Diablo premium brand.

As a result, it was able to increase awareness of its product and increase international sales, becoming recognized worldwide despite the relative novelty of the brand. Concha Y Toro was able to overcome the massive reputation advantage of established European brands by engaging in more modern forms of marketing and mass appeal. This achievement, along with its multitude of other successes, is worth noting and analyzing.

Bibliography

“Our History.” Concha Y Toro. 2020. Web.

“Tours.” Concha Y Toro. Web.

“Vision and Mission.” Concha Y Toro. 2020. Web.

Amorós, José Ernesto, Rodrigo Basco, and Gianni Romaní. “Determinants of Early Internationalization of New Firms: The Case of Chile.” International Entrepreneurship and Management Journal 12, no. 1 (2016): 283-307.

Castellini, Alessandra, and Antonella Samoggia. “Millennial consumers’ wine consumption and purchasing habits and attitude towards wine innovation.” Wine Economics and Policy 7, no. 2 (2018): 128-139.

Fernández, Rosana Fuentes. “Finding Common Ground: The Need for Cooperation and Collaboration in the Spanish Natural Wine Industry.” Wine Business Case Research Journal 3, no. 1 (2019): 65-93.

Goncharuk, Anatoliy G. “Alternative View on Wine Value and Its Measurement.” Journal of Applied Management and Investments 8, no. 2 (2019): 88-106.

Iatisin, Tatiana, Tatiana Colesnicova, and Mihail Ciobanu. “International Experience in the Field of Supporting the Wine Tourism.” Scientific Papers Series-Management, Economic Engineering in Agriculture and Rural Development 18, no. 2 (2018): 233-239.

Jara, Franziska. “Wines Born by the River.” Concha Y Toro. 2020. Web.

Kiselev, Vladimir Mihailovich, Tatyana Fedorovna Kiseleva, and Vladimir Anatolyevich Terentyev. “Consumer Demand Descriptors for the Emerging Wine Market.” Transformations in Business & Economics 15, no. 1 (2016): 160-172.

Panibratov, Andrei, Maria Laura MacLennan, and Gabriel Vouga Chueke. “Chile: Terra Incognita.” In Talent Management in Global Organizations: A Cross-Country Perspective, edited by Marina Latukha, 321-342. Germany: Springer International Publishing, 2018.

Petroman, Cornelia, Cipriana Sava, Loredana Văduva, Diana Marin, and Ioan Petroman. “Enotourism-Instrument for Promoting Rural Development.” Quaestus 16 (2020): 82-90.

Ramírez, Willmer Guevara, and Cristian Morales Letzkus. “Performance of the Chilean Wine Industry through Trade Indicators in the Period 2001-2016.” Bulgarian Journal of Agricultural Science 24, no. 3 (2018): 341-351.

Suter, Mariana Bassi, Janaina de Moura Engracia Giraldi, Felipe Mendes Borini, Maria Laura Ferranty MacLennan, Edson Crescitelli, and Edison Fernandes Polo. “In Search of Tools for the Use of Country Image (CI) in the Brand.” Journal of Brand Management 25, no. 2 (2018): 119-132.

Türker, Nuray, and Faruk Alaeddinoğlu. “From Wine Production to Wine Tourism Experience: The Case of Anatolia, Turkey.” Journal of Tourism and Gastronomy Studies 25, no. 4 (2016): 25-37.

Footnotes

- “Our History,” Concha Y Toro, 2020. Web.

- Rosana Fuentes Fernández, “Finding Common Ground: The Need for Cooperation and Collaboration in the Spanish Natural Wine Industry,” Wine Business Case Research Journal 3, no. 1 (2019): 66.

- “Vision and Mission,” Concha Y Toro. 2020. Web.

- José Ernesto Amorós, Rodrigo Basco, and Gianni Romaní, “Determinants of Early Internationalization of New Firms: The Case of Chile,” International Entrepreneurship and Management Journal 12, no. 1 (2016): 284.

- Willmer Guevara Ramírez and Cristian Morales Letzkus, “Performance of the Chilean Wine Industry through Trade Indicators in the Period 2001-2016,” Bulgarian Journal of Agricultural Science 24, no. 3 (2018): 343.

- Alessandra Castellini and Antonella Samoggia, “Millennial consumers’ wine consumption and purchasing habits and attitude towards wine innovation,” Wine Economics and Policy 7, no. 2 (2018): 137.

- Tatiana Iatisin, Tatiana Colesnicova, and Mihail Ciobanu, “International Experience in The Field of Supporting the Wine Tourism,” Scientific Papers Series-Management, Economic Engineering in Agriculture and Rural Development 18, no. 2 (2018): 237.

- Nuray Türker and Faruk Alaeddinoğlu, “From Wine Production to Wine Tourism Experience: The Case of Anatolia, Turkey,” Journal of Tourism and Gastronomy Studies 25, no. 4 (2016): 32-34.

- Cornelia Petroman, Cipriana Sava, Loredana Văduva, Diana Marin, and Ioan Petroman, “Enotourism-Instrument for Promoting Rural Development,” Quaestus 16 (2020): 88-89.

- “Tours,” Concha Y Toro. 2020. Web.

- Franziska Jara, “Wines Born by the River,” Concha Y Toro. 2020. Web.

- Mariana Bassi Suter, Janaina de Moura Engracia Giraldi, Felipe Mendes Borini, Maria Laura Ferranty MacLennan, Edson Crescitelli, and Edison Fernandes Polo, “In Search of Tools for the Use of Country Image (CI) in the Brand,” Journal of Brand Management 25, no. 2 (2018): 130.

- Vladimir Mihailovich Kiselev, Tatyana Fedorovna Kiseleva, and Vladimir Anatolyevich Terentyev, “Consumer Demand Descriptors for the Emerging Wine Market,” Transformations in Business & Economics 15, no. 1 (2016): 170.

- Anatoliy G. Goncharuk, “Alternative View on Wine Value and Its Measurement,” Journal of Applied Management and Investments 8, no. 2 (2019): 101.

- Andrei Panibratov, Maria Laura MacLennan, and Gabriel Vouga Chueke, “Chile: Terra Incognita,” in Talent Management in Global Organizations: A Cross-Country Perspective, ed. Marina Latukha (Germany: Springer International Publishing, 2018), 332.