Established in 2003, Tesla Inc., previously referred to as Tesla Motors, is an American-based electric automobile manufacturing corporation. The company’s main offices are situated in Palo Alto in California. After proving that the electrical technology was feasible when deployed to propel vehicles, Tesla Motors released the Model S into the market in 2012 (Karamitsios, 2013). Having established the most extensive supercharging network in the U.S. and Europe compared to any other EV manufacturer, Tesla Motors has a competitive advantage necessary to exploit the EV market fully. This paper suggests that the company is indeed now recognized as a manufacturer of reliable EVs.

Analysis of Tesla Motors’ Competitive Advantages

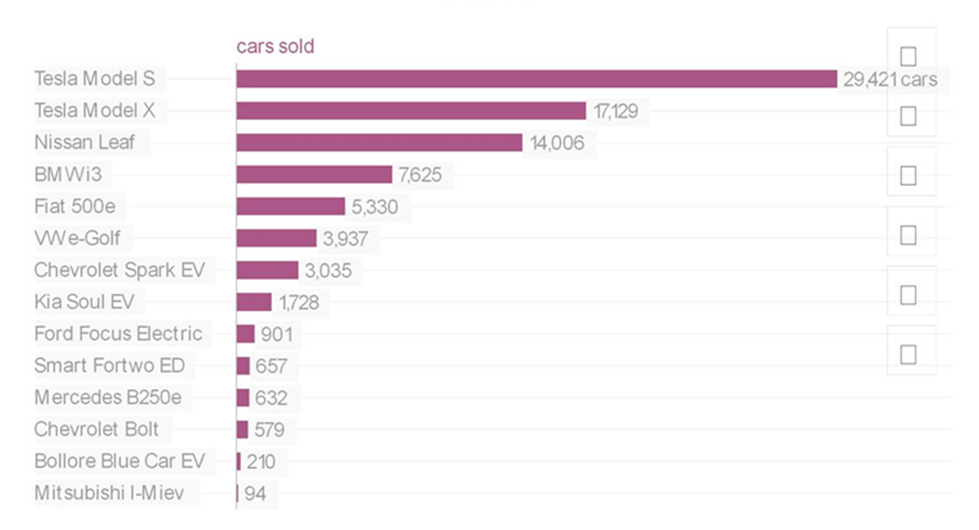

Tesla is currently growing into a strong direct competitor regarding internal combustion cars. Recognizing its strength in open innovation and technology, Karamitsios (2013) reveals how Tesla is presently not relying on external suppliers. The company started an in-house production of various components, including powertrains, injection-molded dashboards, and other plastic components (Van den Steen, 2015). This strategy has been effective in reducing suppliers’ high bargaining capacity. The move by Tesla to produce powertrains for other EV automakers implies that it has a competitive advantage in electric-car powertrain production. In fact, as shown in Figure 1, BMW Group only sold approximately 7600 units in 2016. In the same year, Tesla sold almost 29500 Model S and roughly 17,150 Model X units. As Tesla opens the Giga production facility, which it expects to be operational by 2020, the company’s competitive advantage is evident, especially when Model 3 peaks in the market.

The case study confirms that Tesla Motors’ items are much better compared to those of its competitors. For instance, in terms of operations, Tesla’s design team displays how a company can build a competitive advantage around innovation. Specifically, the team developed a battery pack rated at 60kWh costing between $250 and $300, which was “less than half the estimated cost per kWh for the Nissan Leaf” (Van den Steen, 2015, p. 7). The decision to bring almost all of its manufacturing operations in-house created cost-saving advantages. It also paved the way for the development of new business lines. Tesla sells internally produced powertrains to other EVs manufacturers such as Mercedes Benz.

Moreover, Tesla has a competitive advantage regarding its follow-up concerning product performance. For example, Model S customers have a range of alternatives when in need of repairs. They can call Tesla Rangers or visit an authorized service center. The company boasts of being the leader in EV technology and innovation. According to Van den Steen (2015), Tesla improved its Roadster battery by incorporating 7000 cells. This move ensured that the Model S would have an accumulator with a higher energy density. The improvement led to a reduction of the total weight of the car and the amount of materials (Van den Steen, 2015). The improved technology regarding Tesla’s Model S increased its ability to pick up speed. This advancement reveals why it was selected as the most preferred car in 2013 (Tesla Motors, 2014). Indeed, Tesla’s competitive advantage in EVs innovation is undeniable.

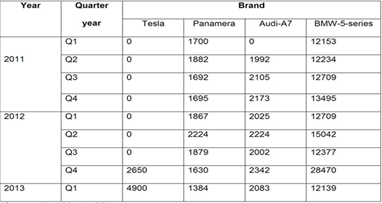

The case study also confirms Tesla Motors’ unrivalled competitiveness in terms of its selling and marketing abilities. As revealed in Table 1, the company began selling the Model S from the last quarter of 2012. BMW-5 series and Panamera were on sale since the first quarter of 2011. After stopping taking Roadster orders, Tesla successfully introduced the Model S into the market. By the end of 2012, it surpassed Audi-7 and Panamera in terms of units sold, a situation that demonstrates the company’s competitive advantage regarding its product quality and preference. Although Tesla could not outshine BMW-5 series, it sold 10500 units compared to Nissan Leaf’s roughly 9800 items traded by July 2013 (Van den Steen, 2015). This achievement is evidence of its high selling competitive advantage. Regarding marketing, Tesla focuses on the momentum, reassurance, and usage of its products. In other words, it enjoys a marketing-centered competitive advantage when assessed based on the attributes of its products that inform clients’ buying decisions.

As Coren (2017) reveals, in 2016, Tesla’s Models S and X sales accounted for more than 50% of the total EVs sold in the U.S. Hence, Tesla stands out as the most valuable EV maker across the world. The fact that it sells many vehicles compared to any other EV producer indicates the corresponding high income it records. Therefore, Tesla can utilize economies of scale to acquire more cost leadership. However, as Blokhin (2016) asserts, in the fiscal year ending September 2015, Tesla’s operating margin stood at roughly negative 14%. This figure was anticipated to turn positive within a period of 5 to 10 years. Nevertheless, in 2016 and 2017, Tesla continued to report negative net proceeds. The company is currently in its lactating stage, despite nearing the exponential growth level. It invests heavily in marketing. In the long term, the company can increase its competitive advantage in the EV market after entering the exponential growth phase.

Strategic Options for Tesla

Tesla Inc. entered the automobile market as an expensive high-end sedan manufacturer. This entry strategy allowed the company to target the rich and affluent consumer segment. The company projected to not only exploit the idea of supplying fully electric vehicles to the market but also building a strong brand image and recognition before venturing into a highly competitive market segment of low priced models. Indeed, this strategy can be evidenced by Tesla’s design and the production of the Model S followed by Model X and now Model 3 whose production started in July 2017.

The case study demonstrates Tesla’s success story. It also gives some indications of the company’s likelihood of entering the competitive market with a mass-produced car design, Model 3. However, success in the market will depend on how Tesla selects it strategic options. This step is vital upon noting that automakers such as BMW, Mercedes Benz, and Volvo, which have traditionally competed in the IC engine vehicle market, are now designing and manufacturing plug-in sedans. Hence, the company can choose to continue with its generic competitive strategy of focusing on deploying high-end technologies in the production of reliable EVs as a way of competing with BMW, Volkswagen, Nissan, Honda, and Mercedes Benz among others. This option is aligned well with its mission of building a sporting car, using the money generated to supply an affordable sedan, and going further to produce an even more reasonably priced vehicle (Van den Steen, 2015). Arguably, Model 3 is a true realization of this mission.

Having successfully introduced a low priced car, Model 3, Tesla Motors can alternatively focus on its intensive growth strategies such as market penetration, growth, and diversification. In fact, diversification encompasses an important strategic alternative for Tesla that is well aligned with its mission of encouraging the world to embrace sustainable energy. The company’s engagement in manufacturing highly efficient roof solar panels and power units for its non-automobile applications supports diversification as an important strategic option. Model 3 has only received customer bookings. Its market adoption remains not fully practically evaluated. Hence, Tesla should continue emphasizing more on its generic strategy.

Advantages and Disadvantages of the Chosen Strategy

The chosen strategy has various advantages. It reflects Tesla’s competitive advantage regarding its successful introduction of EVs into the market. Such a step can further increase its popularity and consequently profitability. The company’s continued focus on the generic strategy will enhance its resilience in the EV market that is characterized by advancing and changing technologies in addition to the continuously varying customer preferences (Motavalli, 2013). The strategy ensures that Tesla continues to use its highly capable and innovative design team and its operations-centered competitive advantages to improve its EV technology. Adopting this strategy may lead to high economies of scale.

Nevertheless, the strategy faces disadvantages. The EV technology poses uncertainties associated with negative preconceptions about the performance electric cars relative to the conventional oil or gas engines. Therefore, Tesla may take a long time to report positive operating margins due to the continued dominance of IC engine vehicles in the market. As a result, diversifying into other product lines can help in establishing other profitable business ventures. This move may support the company’s main objective of manufacturing low-priced EVs for the mass market.

Conclusion

Tesla introduced its first model, namely, Roadster, with the objective of setting the way for the development of an electric car as an alternative to gasoline-propelled vehicles. Soon after the company stopped accepting orders regarding Roadster units, its focus shifted to Models X and S. Its efforts are currently directed to Model 3, which it hopes will be a game changer in the discounted competitive automobile mass market. The company has displayed a far-fetched technological improvement and resilience concerning the three models. This situation indicates its ability to remain profitable in the future.

References

Blokhin, A. (2016). Tesla’s 3 key financial ratios (TSLA). Web.

Coren, M. (2017). Tesla’s biggest competition for the model 3 will not come from other electric vehicles. Web.

Karamitsios, A. (2013). Open innovation in EVs: A case study of Tesla Motors. Web.

Motavalli, J. (2013). As it increases production, Tesla worries about battery supply. The New York Times. Web.

Tesla Motors. (2014). About Tesla. Web.

Van den Steen, E. (2015). Tesla Motors. Boston, MA: Harvard Business School.