Introduction

Companies that operate in today’s competitive market embark on providing unique services and experiences to consumers by producing creative and innovative products. The goal of this paper is to analyze a particular company’s strategic objectives that are organized around innovation. In particular, Tesla Motors provides an important case study regarding innovative manufacturing businesses. Tesla Inc., an American fully electric car manufacturer, was established in 2003. The company’s main offices are located in Palo Alto, California. The company has recorded continuous growth following the development of innovative items that have helped it to remain at the top compared to its competitor companies that mainly deal in manufacturing and selling internal combustion engine products. Exceptional products have provided this organization with a competitive advantage that has led to its financial success and hence the reason why this paper identifies various accomplishments that define Tesla’s trajectory of success.

Main body

Tesla Motors joined the car market in 2003 with the primary goal of building an electric sports vehicle for sale to secure finances for developing additional consumer and environment-friendly products that could serve the mass market. The company’s success was first realized when it developed its first sumptuous unit, Tesla Roadster (Cendrowski, 2017). In particular, it recorded net revenue of approximately 10 million US dollars from the sale of its high-end EVs (Van den Steen, 2015). After proving that electrical technologies could be tapped to propel vehicles, Tesla Motors released the Model S into the market in 2012 (Cendrowski, 2017). This category of vehicles targeted the lucrative sedan market segment. Later, it introduced Model X. Model 3, an affordable EV car for the middle class, paved the way for Tesla to enter the EV market with a mass-produced vehicle. The company’s extensive supercharging networks in the U.S. and Europe exceed those of any other EV manufacturer. This achievement has earned it recognition as a manufacturer of reliable electric vehicles. It is crucial to realize that the organization’s innovation strategy has enabled it to build a competitive advantage necessary for exploiting the EV bazaar fully.

One of the fundamental factors that determine a company’s innovation-driven success entails its capacity to compete with alternative products (Kopel, Lamantia, & Szidarovszky, 2014; Kuksov, Prasad, & Zia, 2017). Tesla embarked on developing other sumptuous items with the view of phasing out conventional internal combustion engines. The organization had confirmed that it could produce superior products compared to these brands. In particular, the company was ready to demonstrate that indeed the EV technology was not only possible but also more reliable compared to internal combustion engine technology. Through its innovations and design, Tesla has demonstrated these possibilities following its booming sales of EVs in America to the extent of surpassing the corresponding amount of income recorded by Nissan and General Motors (Van den Steen, 2015). Recognizing its strength in open innovation and technology, Fry (2018) reveals that Tesla is currently not relying on external suppliers. The company started another successful venture of doing the in-house production of various components, including powertrains, injection-molded dashboards, and other plastic components (Van den Steen, 2015). This strategy has been effective in reducing suppliers’ high bargaining power. In particular, Tesla now produces powertrains for other EV carmakers, implying that it has a competitive advantage in EV technology compared to other brands.

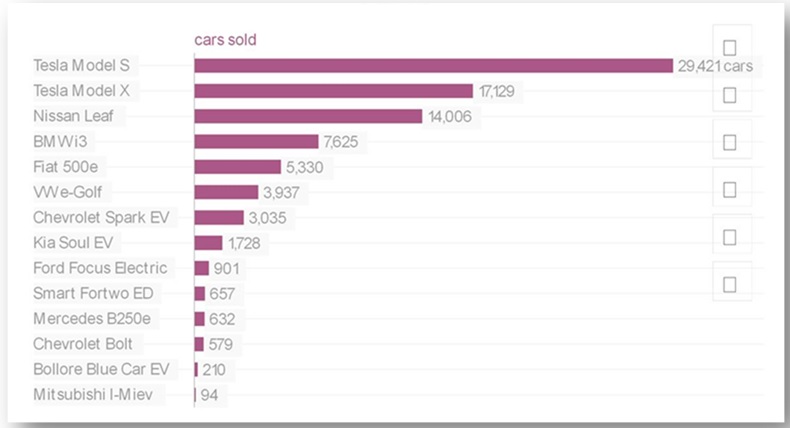

Tesla Motors’ capacity to build success around its innovation strategy is evident upon considering its performance over the few years it has been operating. For example, from Figure 1, the Nissan Leaf, which is its closest competitor in the EV car sales, introduced more than 14,000 units to the market in 2016 (Fry, 2018). During the same time, Tesla had close to 29,500 Model S and approximately 17,200 Model X units. Therefore, this success is bound to last, especially when Tesla operationalizes its Gigafactory facility by 2020. The company’s market for its Model 3 units will have matured, implying more sales and, consequently, profitability.

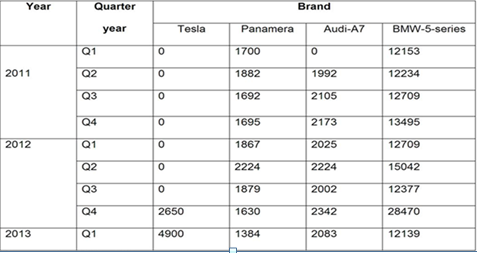

Tesla Motors’ continuous success is also attributable to its selling and marketing strategies. Based on the information presented in Table 1, it began selling the Model S from the last quarter of 2012. BMW 5 Series and Panamera had been in the market since the first quarter of 2011. Sales for the Audi-7 started to be recorded during the second quarter of 2011. After stopping orders for the Roadster model, Tesla was successful in its introduction of the Model S to the market. Indeed, towards the end of 2012, it outperformed the Audi-7 and Panamera. Although Tesla could not surpass BMW 5 Series’ sales performance, it traded more than 10,500 units compared to the Nissan Leaf’s close to 9,900 items by July 2013 (Van den Steen, 2015). These results indicate the company’s high selling potential. Moreover, in its marketing efforts, Tesla Inc. focuses on “speed, comfort, and handling, before taking low emissions” (Van den Steen, 2015). The company conducts an intensive analysis of its products’ attributes, which are critical in influencing customers’ purchasing decisions.

In my opinion, Tesla Motors’ success story suggests its likelihood of entering the competitive market using its Model 3. However, victory in the car market depends on a particular organization’s capacity to select strategic options that can guarantee its short-term and long-term financial success (Stringham et al., 2015). Considering Tesla Motors’ currently low financial performance, its success in other lines such as marketing and innovation remains questionable. The company may start recording reduced profitability levels. As indicated previously in Figure 1 and Table 1, one major concern is that BMW, Mercedes Benz, and Volvo among other car manufacturers are also venturing into the EV market. These companies have traditionally competed in the IC engine market segment. Their financial capacities threaten Tesla Motors’ competitiveness in its EV production, especially when such manufacturers also perfect this technology.

Based on the above concern, I believe that Tesla still has various strategic options to consider in the future for it to remain successful in the market. For example, it can continue with its generic competitive strategy of deploying high-end technologies in the production of reliable EVs to compete with BMW, Volkswagen, Nissan, Honda, and Mercedes Benz among others. Nevertheless, when IC engine manufacturers develop unswerving and higher performance EV vehicles, they would be having two products as sources of their revenues while Tesla will be relying only on the electric vehicle sales. Hence, in my view, for it to retain market dominance and success in EV technology, it may have to push more vehicles to the market to gain positive margins.

According to Fry (2018), in 2016, Tesla sold the Model S and Model X, which accounted for more than 50% of the total EVs supplied in the United States of America. This achievement presents Tesla as the most valuable EV maker across the U.S. because its returns on sales are higher compared to other electric vehicle sellers. However, as Cendrowski (2017) reveals, in 2016 and 2017, the company continued reporting negative net profits, despite its heavy investment in marketing, research, and design. In my opinion, when the organization reaches the exponential phase, its negative operating margins and net profits may turn positive, hence increasing its competitive advantage in the electric vehicle market.

How Other Companies can Apply the Same Strategies of Success and Tactics to Improve their Business Results

Tesla Motors provides a typical case demonstrating how technology and innovation can be a source of competitive advantage to an organization. Other companies in the automotive sector and other industries can deploy similar success strategies and tactics to build their global images. For instance, they can introduce unique manufacturing processes and practices, new technologies, and innovative materials among other things to lower their production costs. As witnessed in the case of Tesla, having such resources not only increases the pace of production but also enhances the quality of manufactured products. This way, Tesla’s innovation becomes an important aspect of a benchmarking whereby other companies can learn ways of increasing their productivity levels (Dyer, Gregersen, & Furr, 2015).

Other innovative tactics that can be benchmarked by Tesla include its waste reduction approaches, reduced equipment downtimes, and the company’s manner of increasing the quality of its products. Instead of focusing on limited product lines, it is important for other companies to embrace the idea of diversification to create additional revenue streams, especially if they are recording poor performance in their existing commodities or services. Tesla has mastered this strategy. Particularly, in addition to building extensive supercharging stations, it has produced highly innovative and efficient solar-powered gadgets and batteries with the view of revolutionizing the electric energy grid and storage.

My Contribution to Tesla’s Success

The mission of Tesla Motors entails producing items that can efficiently serve the highest number of clients around the globe. The company’s production of Model 3 indicated its possibility of realizing this mission. When given an opportunity to work for Tesla, I would dedicate my effort and energy to ensuring that this category of vehicles succeeds in the market. Specifically, I would play a crucial role in marketing Model 3 units in all markets across the world. I believe that these units can move the company from the current lactating phase to the exponential growth stage where it is guaranteed of reporting positive margins. Since Tesla has now diversified to other non-automotive products such as solar panels, I would consider recommending changes in its mission to capture the company’s need for innovating, designing, and producing clean electric energy products for domestic and industrial use.

Conclusion

All organizations establish mechanisms for gaining competitive advantages in the present-day production economy that is characterized by intense rivalry for complementary and substitute products. One of the ways of accomplishing this outcome entails developing strategic goals and objectives that facilitate product and service differentiation. Consistent with its mission, Tesla stopped accepting orders for its Roadster units and immediately focused on Model X and later the Model S. Such a strategy was successful because the company recorded remarkable sales of these units. Tesla is currently focusing on Model 3 and other products such as solar panels and batteries, which it believes would help it redefine its success trajectory. Such additional commodities are meant to steer automobiles, industrial, and domestic operations. The focus demonstrates the company’s commitment to building its competitive advantage around technology and innovation.

References

Cendrowski, S. (2017). Tesla makes a u-turn in China. Fortune, 175(8), 128-136.

Dyer, J., Gregersen, H., & Furr, N. (2015). Tesla’s secret formula. Forbes, 196(3), 90-118.

Fry, E. (2018). Tesla. Fortune, 177(1), 68-69.

Kopel, M., Lamantia, F., & Szidarovszky, F. (2014). Evolutionary competition in a mixed market with socially concerned firms. Journal of Economic Dynamics and Control, 48(3), 394-409.

Kuksov, D., Prasad, A., & Zia, M. (2017). In-store advertising by competitors. Marketing Science, 36(3), 402-425.

Stringham, P., Miller, K., & Clark, J. (2015). Overcoming barriers to entry in an established industry: Tesla motors. California Management Review, 57(4), 85-103.

Van den Steen, E. (2015). Tesla Motors. Boston, MA: Harvard Business School.