Introduction

Hill & Smith Holdings PLC is a company that engages in the design, manufacture, and supply of infrastructure, building, and construction products as well as in the provision of galvanizing services. The company sells its products in the United Kingdom, China, the United States, Thailand, and France. The company is situated in Solihull, the United Kingdom. The company has various subsidiaries which it has acquired over several years.

Profitability

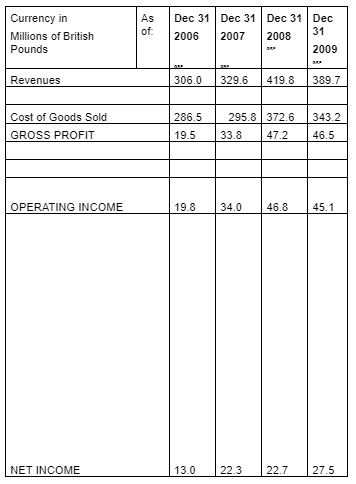

This is a company that is highly profitable. An analysis of the company’s net profit for the last four years is as follows (Arbiter 2010): The revenues increased in the year 2007 up from 2006 then it increased sharply in 2008. In 2009 however, the revenues dropped. The cost of goods had a similar trend.

Every investor when considering whether to invest in a company or not has to scrutinize the profit of the company over the last number of years. This is to examine the trend of the profits of the company. It is not just about the performance of the company in the current year but even in the prior years. Various kinds of information may be obtained. This is the net income, earnings per share, and dividends payout ratio. Debt information and legal information are also analyzed and full disclosures of legal suits against the company have to be disclosed in the notes to the financial statements. The cash flow is also analyzed to determine the liquidity of the company. As shown in the chart above over the year 2009 the revenues of Hill & Smith Holdings PLC reduced from 419.8M GBP to 389.7M GBP. Nevertheless, the company was able to grow its net income from 22.7M GBP to 27.5M GBP.

Dividends

There are investors who buy shares in a company expecting that the dividends paid semi-annually will be a good return on their investment. They desire a good pay-out rate. When a company pays out dividends at a good rate and the rate keeps increasing yearly it is a good sign since the company’s directors are expecting the growth to be sustained. The earnings of the company are also re-invested at a certain rate depending on the payout policy of the company. An analysis of the Hill and Smith holding company shows an increase in the dividends paid out per share in both the interim and final dividends as shown in the chart below (Hart, 2010):

In the stock markets, this is a company that has increased its share price range from 235p to 377p per share this year (Goude, 2010). These are shares that brokers are advising the clients to buy.

The company also has a high turnover per employee at GBP 120,575.50. This is the sales of the company in a certain year divided by the number of employees the company has. This information is used to analyze whether the sales the company makes justify the number of employees it has employed. The revenue per employee is GBP 12,283.42.

Earnings Per Share

The history for earnings per share is as follows (Bowman, 2010):

The earnings per share are calculated by taking the net profit less the preferred stock shares divided by the ordinary shares.

An investor needs to know the earnings per share as this determines the number of dividends that will be paid out and the amount of retained profits. The earnings per share are important data information used to calculate the share price. The earnings per share of a company have a direct relationship with the share price therefore a high EPS leads to a high share price. An investor though when comparing two companies may need to look at the equity value of both companies closely. Both companies may have the same earnings per share however the one with less equity value will be considered more efficient in its operations as it is using less equity to earn more money.

In calculating the diluted EPS the number of convertible securities outstanding that the company has is included in the average number of shares outstanding. These convertible securities that a company may have as at balance sheet date are warranties, convertible preferred stock, and stock options. The diluted EPS is used to measure the earnings per share if all the shareholders choose to exercise their rights.

If a company has convertible securities the diluted EPS is lower than the basic EPS. Hill and Smith Holding PLC’s diluted EPS are lower than basic EPS indicating they do have outstanding convertible securities outstanding. This is usually not very good for a shareholder since the earnings per share are diluted. However, it is rare to have all shareholders that have convertible securities exercising their rights at once. For Hills and Smith, the margin between the diluted EPS and basic EPS is minimal therefore an investor should not be concerned. For this company, the figures for all the categories of earnings per share have been increasing over the five years.

Conclusion

Having analyzed the net income, earnings per share, dividends per share, and the share price of the company it is proven that the company has a good historical financial record. It is stable. It has continued to find a market for its products thus the continuously high profits. The senior management and directors are making strategic sound decisions and an investor would not be wrong in investing in the company. If one desires the dividends they will not be disappointed as the payout rates keep going higher. The earnings per share are also high.

Reference List

Arbiter, M. (2010). HILL & SMITH HOLDINGS PLC (HILS: London). Bloomberg Businessweek. Web.

Bowman K. (2010). Hill & Smith Holdings plc Ordinary 25p Shares plc (HILS). Hargreaves Lansdown. Web.

Hart, J. (2010). Share Prices: Hill & Smith Holdings (HILS). thisismoney. Web.

Goude, D. (2010). Hill & Smith Holdings (HILS). Digital Look. Web.