Financial statements provide information on the financial condition, operations results, and changes in its financial state. It should contain information about the enterprise’s assets and liabilities, the consequences of actions, events, and circumstances. This information is needed by a wide range of users when making economic decisions. In the United States, the so-called Generally Accepted Accounting Principles (GAAP) ensure that the financial accounting information circulated in the public domain is consistent and accurate.

It is essential to determine the meaning of GAAP and to trace the history and evolution of GAAP. It can help understand and evaluate the importance of this system in terms of its well-run financial process. Moreover, for creating the full image of GAAP, it is crucial to perceive basic principles and core organizations. There are also some alternatives to GAAP; the comparison would be useful and reveal the benefits and limitations of GAAP.

Definition – GAAP

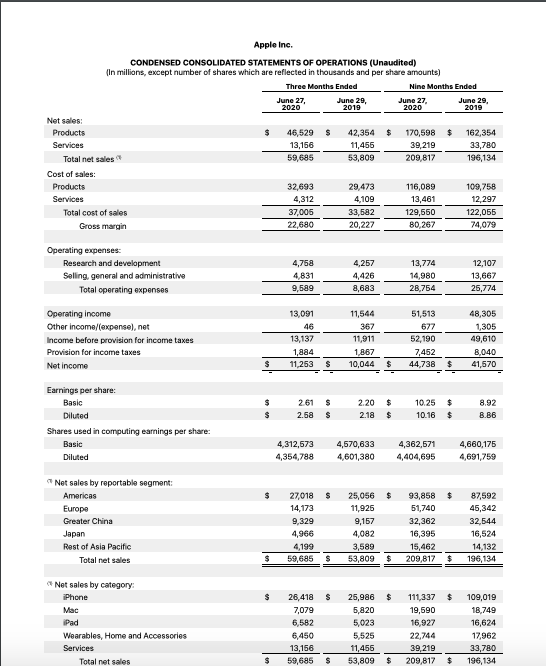

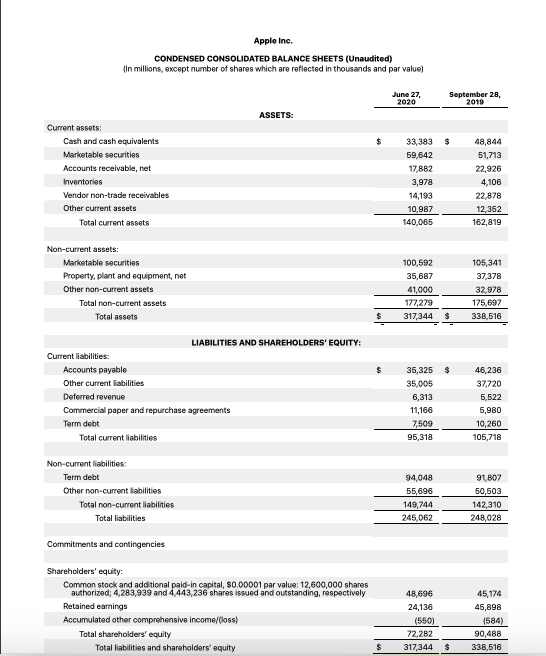

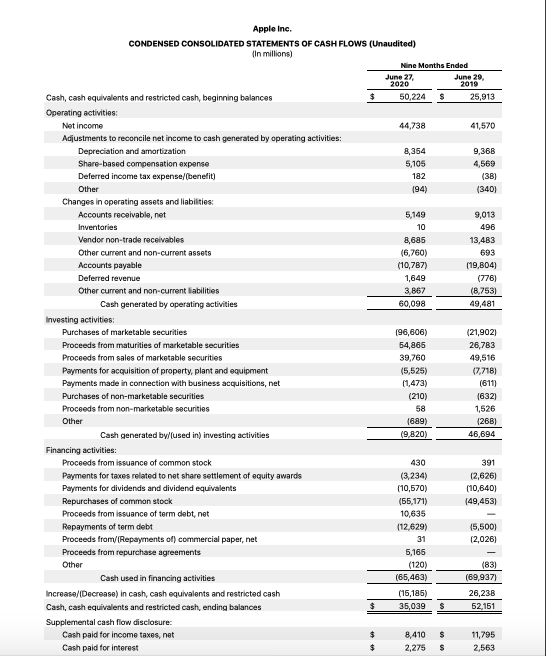

Generally Accepted Accounting Principles (GAAP) are financial statements prepared under the US accounting rules. As long as a company conducts active foreign economic activity with any region of the world, it may become necessary to publish reports in an understandable country format (Donelson et al., 2016). Companies can publish GAAP in multiple languages, such as the language of the reporting country. According to Donelson et al. (2016), traditionally, GAAP contains several mandatory reports such as the enterprise’s balance sheet, displaying its property, the income record that characterizes the received revenues, and profits. It also includes the cash flow statement that shows the company’s direction’s money circulates.

History and Evolution of GAAP

The formation of public demand for generally accepted financial accounting standards has gone through several stages in the United States. For the most part, American scientists date the beginning of making the present form of the financial information system at the turn of the past and present centuries (Zeff, 2016). According to Zeff (2016), this is due to the significant process complication of capital formation in US companies at the beginning of the 20th century. The rapid spread of technologies has caused the need to finance the largest enterprises and investment projects. There was a need to attract significant capital from various sources to involve investors and creditors who do not control the company’s operations daily (Zeff, 2016). In turn, investors and lenders needed reliable information to enable them to make funding decisions.

The historical prerequisite for creating a federal accounting regulation system in the United States was the stock market collapse, leading to the Great Depression’s beginning in 1929. It made the need for state and public control over public companies evident. Zeff (2016) notes that, consequently, the American Institute of Accountants (AIA), in conjunction with the New York Stock Exchange, published five accounting principles that contribute to the reliable disclosure of accounting data. The Securities and Exchange Commission (SEC), established by the US Congress in 1934, issued a directive on the need to disclose information about the financial position and economic activity results for companies that publicly offered securities(Zeff, 2016).

In 1935, the SEC recommended that companies keep their records based on historical estimates to avoid misleading financial statements (Zeff, 2016). The term Generally Accepted Accounting Principles (GAAP) appears in 1935 when the AIA publishes Examinations of Financial Statements, which introduces it into public circulation (Zeff, 2016). In the 1940s, the process of public comment on the principles underlying the standards was gaining momentum.

The main task was to determine whether federal financial reporting regulation fundamentals should be strict or relatively loyal. Zeff (2016) claims that in the 1950s and 1960s, a trend was gaining momentum associated with postulating financial accounting foundations for national standardization.

Attempts to shape the basic principles of business accounting into a normative act or generally accepted rules first led to a noticeable result in the United States – the FASB officially adopted the Conceptual Frameworks in 1978 as the logical basis of the US GAAP (Zeff, 2016). Regardless, US GAAP standards contain some elements of rule-based regulation. At the end of the 1970s, attempts were made to introduce inflation accounting rules into the national standards of the USA, Canada, Great Britain, and other countries (Zeff, 2016). It was proposed to replace in accounting the historical value of assets and liabilities with their current state.

In general, there are distinctive features of the formation and development of US national standards. Firstly, national standards appeared in response to the economic and political problems of society. Secondly, the criteria reflected the state’s interests and followed them; the business’s opinion on topical issues was often ignored. Even though the present value ideas appeared in the 1920s and were widely supported by the professional community, the official preference was given to the more controlled accounting concept at historical cost; a shift occurred in the second half of the 1960s under massive pressure from the public. Therefore, the standards remained uncontested; they did not contain even a hint of accounting policies and other self-organization methods.

Why GAAP is Important

In the context of high professional legal responsibility, which might be measured in hundreds of millions or billions of dollars, it becomes justified that accountants in the United States require definite rules for their work. In contrast to the latter, the general principles declare the priority of neutrality, objectivity, and fair reporting. They leave many practical, detailed solutions to judgment and conscience, and hence responsibility, including legal obligation.

Along with honest and neutral professional appraisal, reporting users have to deal with conflicting opinions, questionable ranges of estimates, and other flexible approaches. These strategies can serve as a cover for other purposes, other than the accurate display of economic reality in the enterprise’s reporting. It is the reason why US GAAP continues to generate precise, specialized reporting rules that address specific narrow issues of industry reporting and specific business situations.

Core Organizations Behind GAAP

GAAP is being developed by the American Institute of Certified Public Accountants (AICPA), the Financial Accounting Standards Board (FASB). Besides, the Governmental Accounting Standard Board (GASB) administers state and local reporting. Before creating the FASB, the American Institute of Licensed Auditors (AICPA) committees were responsible for defining generally accepted accounting principles (DeGennaro, 2017). For example, it has elaborated a code of professional ethics that all Institute members must adhere to (DeGennaro, 2017). Besides, the AICPA committee sets professional auditing standards that are binding on all examiners (DeGennaro, 2017). AICPA also analyzes accounting issues and shares its findings with the FASB.

Financial Reporting Standards Regulations are issued by the FASB and are considered Generally Accepted Accounting Principles. The FASB also publishes the Principles’ Interpretations, which are modifications or refinements to existing standards (DeGennaro, 2017). In addition to issuing the Regulations, the FASB creates a draft outline of the conceptual framework for financial reporting, which includes the financial statement’s objectives, the desired characteristics of the accounting information (DeGennaro, 2017).

It also concerns the elements of the financial charges, the criteria for reporting, and the calculation concepts for the financial statements’ totals (DeGennaro, 2017). The FASB is part of the economy’s private sector; the development of accounting principles in the United States has traditionally been the private sector’s responsibility, although the government has significant influence due to its organizations.

The Securities and Exchange Commission (SEC) is a government agency with legal authority, which sets the accounting principles and financial reporting requirements for public corporations. The SEC has not developed its accounting principles, following FASB guidelines (Johnston & Petacchi, 2017). Thus, the private sector’s accounting principles continue to be acquired but take law after the SEC’s approval (Johnston & Petacchi, 2017). Moreover, for the new accounting standards to become widespread, the FASB needs the SEC’s support, so the two organizations work closely (Johnston & Petacchi, 2017).

The Commission also reviews the compliance of the financial statements of public corporations with the requirements. If this compliance is not observed, the SEC can take action against the corporation and the perpetrators. The American Accounting Association (AAA) is composed primarily of educators. The Association has supported several research programs and publications in which the authors and members of the committees of the Association expressed their opinions on various accounting issues (DeGennaro, 2017). However, AAA has nominal power; its strength is the authors’ prestige and the arguments’ persuasiveness.

The Principles

There is the main list of GAAP principles developed by the International Committee of Accountants and operating under the International Accounting Standards (IAS). Concerning measurement rules, the first is the dual-aspect concept. It means that the sum of the company’s funds is always equal to its liabilities and capital. Equality assets = Liabilities + Equity is called the balance sheet equation and must always be respected (Donelson et al., 2016). According to the materiality principle, accounting should not consider immaterial transactions and reflect all critical events (Donelson et al., 2016).

The realization concept means that the company records revenues. It happens when its products are delivered to the consumer, and when services are provided to the client (Donelson et al., 2016). For example, in January, the company was awarded a contract to paint a house. The painting was done in February, and the company received the money in March. The company should post the income from paint jobs in February. Under the matching concept, the income tax expense shown in the benefits statement must equal the amount of tax calculated based on accounting and not taxable income.

With regard to boundary rules, there is the entity concept, which means the company’s records should be separated from its owners or employees’ accounts. Analyzing the money-measurement principle, accounting reports include only those data that can have a monetary value due to which accounting is an incomplete statement of the enterprise’s position (Donelson et al., 2016).

It does not always contain the most critical information about the state of affairs of the company. The going-concern concept is based on the fact that an enterprise will continue to operate unless there is evidence to the contrary (Hong et al., 2018). In these terms, the accounting does not contain information about the price at which the enterprise’s funds could be sold if it ceased its activities.

Ethical rules include several principles, such as the principle of prudence, which suggests that speculation does not impact financial data recording. Consistency indicates that rules are applied during the economic reporting (DeGennaro, 2017). The objectivity rule claims there should not be any personal bias and prejudice when selecting and using the accounting rules (DeGennaro, 2017). The relevance concept determines that the data formed by an accounting practice should influence the decision-making process of the person gathering information.

Alternatives to GAAP

An alternative accounting system to the US GAAP is the so-called IFRS – International Financial Reporting Standards. It is a set of documents, standards, and interpretations that regulate the rules for preparing financial statements, which will guide external users when they make economic decisions regarding an organization (Hong et al., 2018). The history of the creation of IFRS dates back to 1973 when public accounting and auditing organizations in some countries created an international professional non-governmental organization – the Committee on International Financial Reporting Standards (IASB) (DeGennaro, 2017).

According to DeGennaro (2017), this organization was involved in the initial development of international standards, which have become mandatory for use since 2005 by all companies whose shares are listed on European stock exchanges. Such companies began to prepare consolidated financial statements following IFRS rules compulsorily.

IFRS and US GAAP are different, although the general principles, concepts, and accounting results are similar. In summary, there are over 200 significant differences in standard detail between IFRS and US GAAP (Hong et al., 2018). According to Hong et al. (2018), the difference between these two systems of standards starts at the foundation level. IFRS directly proclaims the postulate of the economic essence’s prevalence over the legal form. The Financial Reporting Framework for Small and Medium-Sized Entities (FRF for SMEs) is an alternative to US GAAP for US private companies (Hong et al., 2018). Accounting rules for them are brought together within the 188-page document framework, which leaves possibilities for different interpretations for professional judgment by both preparers and auditors.

Benefits and Limitations of GAAP

US GAAP contains a large number of instructions that apply to transactions in a particular industry. US public companies must follow additional guidance from the Securities and Exchange Commission; at the same time, there is no such guidance under IFRS (Hong et al., 2018). GAAP provides six sections in the chart of accounts: assets, liabilities, equity capital, income, expenses, taxes. This in-depth detailing of accounting following GAAP helps to reveal the specifics of the enterprise (DeGennaro, 2017). The level of detail within the invoice also depends on the size of the company (DeGennaro, 2017). GAAP is a set of reasonably detailed accounting rules, and the preparation of financial statements mainly focused on potential investors and creditors of the organization.

Moreover, US GAAP requires all preceding standards to be applied. However, there are transitional rules and specific standards that apply to newly formed companies. Functional currency is the money in which the company incurs expenses and receives income. According to Hong et al. (2018), compared to IFRS, there are less stringent requirements when choosing a functional currency. If the reporting currency differs from the usable money, assets and liabilities are translated using the balance sheet date’s exchange rates (DeGennaro, 2017. The income statement items are translated at the exchange rates prevailing at the date of the transaction or average rates if there is no significant fluctuation in the exchange rate.

US GAAP provides detailed guidance for various situations. Although US GAAP consists of over 20,000 pages, this system cannot cover the full range of potential problems. Regarding limitations and comparing the IFRS and GAAP standards, it can be noticed that several accounting standards can be simultaneously devoted to one topic in the GAAP system; however, there are also particular standards (Hong et al., 2018).

Hong et al. (2018) note that GAAP lacks standards on specific issues present in IFRS. These are a presentation of financial statements, stocks, construction, and work contracts (Donelson et al., 2016). There is also a deficit of accounting for government subsidies and information disclosure on its assistance, consolidated, and individual financial statements (Donelson et al., 2016). Besides, there is no accounting for investments in associates, financial reporting in a hyperinflationary environment, reports on participation in joint activities.

Conclusion

The accounting standards development process in the United States is multi-disciplinary and driven by both government and public institutions’ efforts. GAAP rules are a product of achieving a balance of interests of all parties involved in this process. Reaching a consensus on standards is a political process. GAAP standards are internationally recognized and fully compatible with the International Accounting Standards.

The International Committee develops the latter on Accounting and Reporting Standards, which includes representatives of the West’s industrialized countries and some developing countries that approve the mutual compatibility of their national accounting rules and regulations and their compliance with IAS standards. Compared to IAS, GAAP standards are more detailed; they can be considered as a more detailed exposition of the former.

References

DeGennaro, M. (2017). An economic comparison of US GAAP and IFRS. Journal of International Business and Law, 16(2), 7.

Donelson, D. C., McInnis, J., & Mergenthaler, R. D. (2016). Explaining rules‐based characteristics in US GAAP: Theories and evidence. Journal of Accounting Research, 54(3), 827-861. Web.

Hong, P. K., Paik, D. G., & Smith, J. V. D. L. (2018). A study of long-lived asset impairment under US GAAP and IFRS within the US institutional environment. Journal of International Accounting, Auditing and Taxation, 31, 74-89. Web.

Johnston, R., & Petacchi, R. (2017). Regulatory oversight of financial reporting: Securities and Exchange Commission comment letters. Contemporary Accounting Research, 34(2), 1128-1155. Web.

Zeff, S. A. (2016). Forging accounting principles in five countries: A history and an analysis of trends. Routledge.

Appendix A

Consolidated Financial Statements of Apple

These investor reports from Apple give a high-level example of financial filings that follow GAAP.