Introduction

In 1886, the Coca-Cola Company was formed in Atlanta, Georgia. The corporation is among the world’s largest manufacturers and suppliers of non-alcoholic drinks, ranging from coffee to soft drinks. The company is one of the most valuable brands globally, besides controlling some of the most common soft drink products, like Fanta and Sprite (Financial Analysis of Coca-Cola, 2018). PepsiCo and Redbull are among Coca-Cola’s number one competitors. As a result, the corporation established policies to strengthen its competitive advantages via its massive resources, brands, and unequaled distribution strategy.

The Coca-Cola Company has operations in Africa, the Middle East, North America, Asia, and more than two hundred nations worldwide. It is the world’s biggest beverage company, with over five hundred sparkling and still brands, the most significant market share, and a market value of nearly 105 billion US dollars, far more than the industry average of 80 billion US dollars (Coca-Cola Company, 2020). Additionally, the corporation engages in global commerce and has expanded its bottling alliances to 230 partners globally (Coca-Cola Company, 2021). The company enjoys a large market value besides an ever growing demand.

Method

This study will be based on an investigation of Coca-Cola and Pepsi’s financial statements. Fiscal data were gathered from the Income Statement and Balance Sheet for 2018, 2019, 2020, and 2021 to perform an economic analysis using the above-stated ratios. This information will serve as a horizontal and vertical analysis of these assertions. Following this first study, the balance sheet and income statement data and sector data will be utilized to create several sorts of ratios that will aid in comprehending both firms’ financial statements. There are four ratios: activity ratios, profitability ratios, solvency ratios, and liquidity ratios. While the ratios of both firms may be compared, they cannot be utilized to judge each company’s actual performance. Consequently, these ratios will be compared to those in the non-alcoholic drinks business, which will serve as a reference point for comparison and assist in determining how companies perform in comparison to their sector. The underlying causes of the divisions between the firms and the industry will be examined.

About Ratio Analysis

A business is lucrative when it demonstrates its potential to generate profits, while a company that maintains solvency is deemed effective at repaying liabilities when required. A firm need to have an effective business administration system founded on budgeting and predicting to accomplish these objectives. While measuring financial performance, a business must evaluate its faults and strengths to take corrective action or preserve economic competitiveness. Nuhu states in this perspective that ‘accounting provides us with information that helps these two roles’ and proposes that both the income statement and balance sheet ought to be reviewed to ascertain a company’s profitability and solvency. A fiscal analysis approach is necessary to gather information and interpretations from financial statements. Nuhu suggests that this examination be conducted using “financial ratios to allow consumers to comprehend the significance of the absolute values shown and make educated business choices.” (2014, p.113). Thus, ratio analysis may evaluate prior performance and compare it to the contemporary version.

Ratio analysis is a reliable method for determining the link between the balance sheet and income statement statistics. As Nuhu describes in a current paper (2014, p.108), “Ratio analysis is often stated proportionally to demonstrate the link between financial statement statistics.” Ratio analysis helps consumers uncover abnormalities and opportunities concealed in a firm’s financial performance. Liquidity, profitability, and solvency ratios are all used in economic analysis. These factors help investors determine a company’s capacity to pay its short- and long-term responsibilities and whether it is profitable and efficient. The ratios alone will not reveal much, but comparing the ratios of two firms to those of the industry will offer important information about the companies.

Additionally, these ratios will highlight significant trends. It is important to remember that, although ratios are intended to compare firms and sectors, the dimension component is not eliminated. The ratios’ significance will be determined by the size of the balance sheet or income statement and how much it fluctuates year over year. Small variable numbers cannot detect a trend accurately, but considerable fixed amounts may.

Activity ratios

Activity ratios quantify a business’s capacity to convert various accounts on its balance sheets into cash or sales, assessing the quality of various capital components. Activity ratios determine a firm’s relative efficiency based on its asset utilization, leverage, or comparable balance sheet statements. They are critical in analyzing whether a company’s management is doing better or wrong in sales and cash generation from its resources. Activity ratios quantify the number of resources involved in gathering and administering a business’s inventory, hence assessing the organization’s efficiency and profitability.

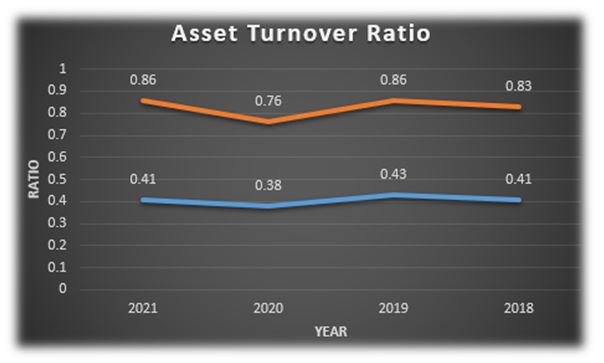

Asset Turnover Ratio

Assets Turnover Ratio is a metric that indicates how well a business utilizes its assets to generate revenue. It is used to determine the quality of the company’s investments in its overall assets. It compares its sales to its asset base and expresses the frequency with which purchases are refreshed. The better the outcome, the more profit the business earns on its investments and the fewer assets the company needs to create income, which means less debt and equity.

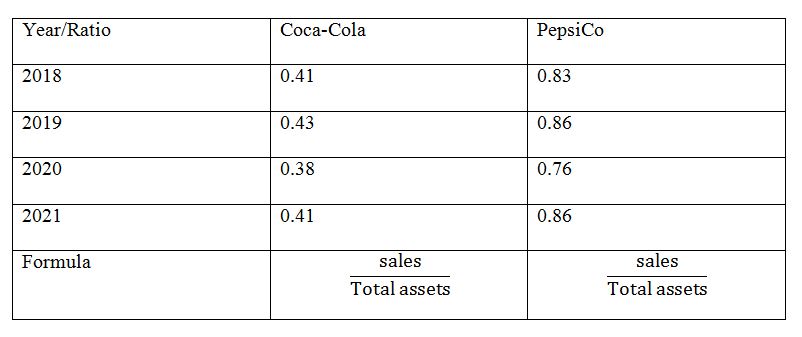

This graph shows that Coca-Cola has a low-income relative to its possessions; its asset turnover ratio is excellent every year, implying that Coca-Cola is not utilizing its assets as efficiently as the sector and Pepsi. Pepsi uses its assets more effectively than the benchmark since its asset turnover ratio is the greatest for each year.

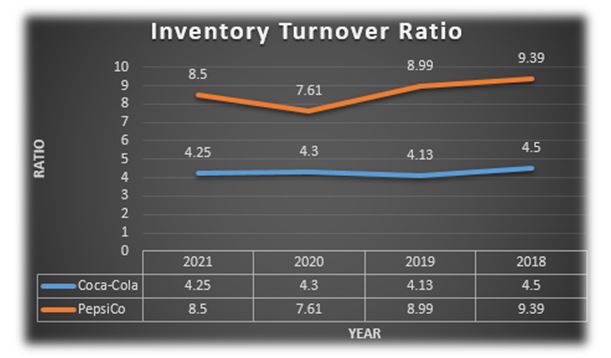

Inventory Turnover Ratio

Inventory turnover ratios determine the pace at which inventory is consumed over a specific period. In a nutshell, the frequency with which an inventory balance is sold throughout an accounting period. It may be used to determine if a firm has excessive inventory relative to its sales, resulting from low sales or poor inventory management. A low turnover rate, in particular, indicates that a firm purchased an excessive amount of items. A low turnover ratio will affect the rate of return. Inventory days refer to the number of days a business consumes its stock and hence the time they will need to purchase fresh items.

The graph above shows that Coca-Cola has an inventory turnover ratio lower than the industry average every year, with the most significant disparity in 2019 and 2020. Pepsi’s inventory turnover ratio is always higher than Coca-and Cola’s, higher than the industry average, indicating that Pepsi has effective inventory planning and sells what they intend to sell in the specified time, but Coca-Cola does not.

Table 1: Coca Cola Company Financial Data

Table 2: Pepsico Company Financial Data

Liquidity Ratios

The primary purpose of liquidity ratios is to evaluate a company’s capacity to attain its obligations in the short run. The short-run is defined as the period up to twelve months, so liquidity ratios measure a company’s ability to pay its debts over the next twelve months. There is no rule stating that one liquidity situation is superior to another; each business will have an optimal degree of liquidity based on the structure of its costs and revenues. The most accurate technique to determine the amount of liquidity is to associate the company’s ratios to those of the industry. A balanced short-term financial situation demands a link between realized investments and financing sources so that expenditures and collections are consistently in sync.

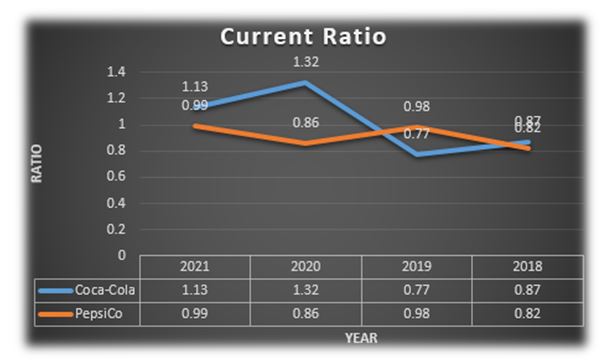

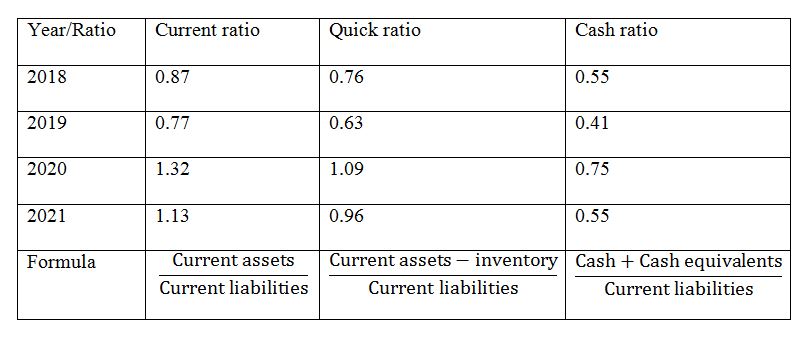

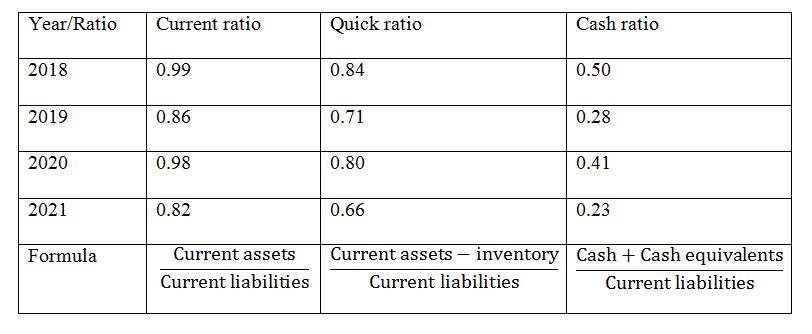

Current Ratio

The current ratio is expressed as a percentage of working capital, which is used to analyze a company’s liquidity and capacity to pay short-term obligations. It enables investors to determine the safety of short-term investment in the firm. If the ratio does not exceed one, the business will be unable to satisfy its short-term commitments and be forced to seek finance or make profits before they are due. Divide current assets by current liabilities to get the current ratio.

Quick Ratio

The Quick ratio, often known as the acid test, quantifies a company’s capacity to meet its short-term obligations using just its most liquid current assets (all existing assets except inventories). The quick ratio’s interpretation is more accurate than the current ratio’s because it uses only assets that may be utilized to pay obligations at any moment. The greater the ratio, the more liquid the business is and the less likely it will default on its obligations in the near term. Calculate this ratio by deducting inventory from total current assets and dividing the result by current liabilities.

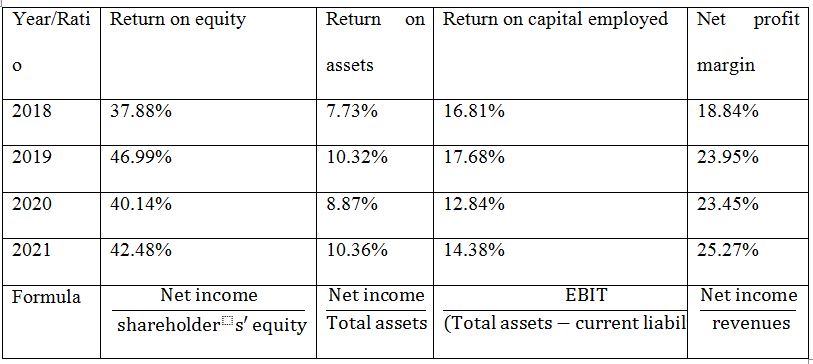

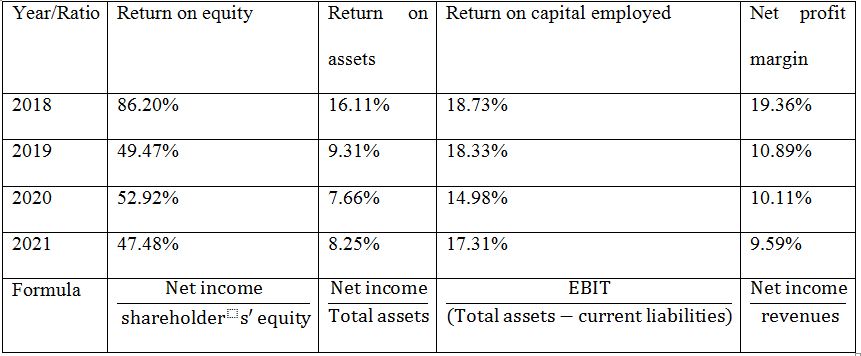

Profitability Ratios

The overall goal of a company is to maximize profits. The idea of productivity is used to quantify the gains gained by the company in relative terms of their costs, incomes, possessions, and equity. These ratios will specify if the company overall is doing well. Profitability Ratios evaluate a business’s capacity to profit from its sales. This financial instrument provides information to owners, investors, and creditors about the profits made by the firm and the cash flow created to meet financial commitments. Profitability ratios, sometimes called activity ratios, include the return on assets, the return on equity, the return on capital employed, and the net margin ratio. Return on purchases is a solid metric for determining a business’s capacity to profit from its resources.

Return On Assets Ratio

The Return on Assets ratio compares the advantage realized to the entire value of the company’s assets. It is utilized to determine the efficiency with which a business’s assets create income regardless of funding source. This ratio is calculated by dividing net income by total assets. When assessing a firm’s financial performance over a certain period, a higher percentage shows that the company is more profitable and effective in managing its properties to generate income.

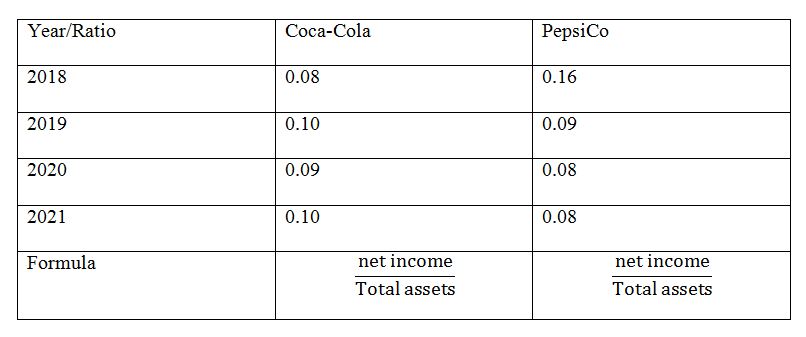

As seen in this graph, Coca-return Cola’s on assets is lower; previously, when comparing net revenue to sales, Coca-Cola had a significant gain over other industry competitors; however, Coca-Cola no longer has this advantage, as their return on assets is slightly lower than Pepsi’s and the industry. Pepsi consistently outperforms the industry, except in 2017, as previously indicated, owing to the TCJ legislation.

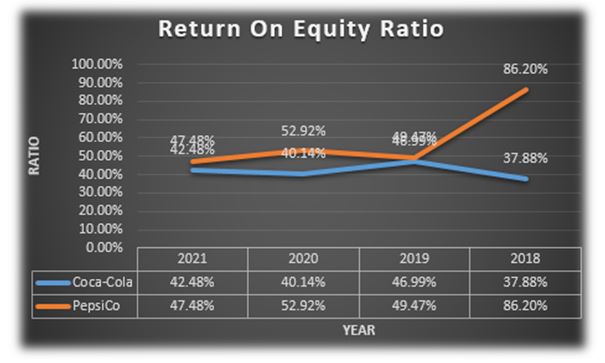

Return On Equity Ratio

The Return on Equity metric is used to determine a business’s return on its resources, specifically the return that the shareholders received on their investment that year. To pinpoint the source of the possible issue or advantage, a ratio including three factors may be used: total asset turnover, profit margin or return on sales, and the equity multiplier, which equals assets divided by equity. The equity multiplier is also known as financial leverage, and it is used to determine the amount of external finance a business has or how leveraged it is. The simplified ROE, or net income divided by equity, may be achieved by simplifying this equation.

The return on equity graph demonstrates how Pepsi consistently has the greatest ROE. Coca-Cola usually is in line with the industry average but has decreased recently due to the regulatory reasons discussed. As a result, Coca-Cola produces a lower rate of return on its owner’s investment than Pepsi does. They provide comparable returns to the industry, which is not an issue for Coca-Cola but is a benefit for Pepsi since it indicates that Pepsi is more efficient in using its owners’ resources. This does not guarantee that Pepsi’s shareholders will receive a more significant return on their investment at the end of the year since this will rely on its decision to retain and reinvest retained earnings.

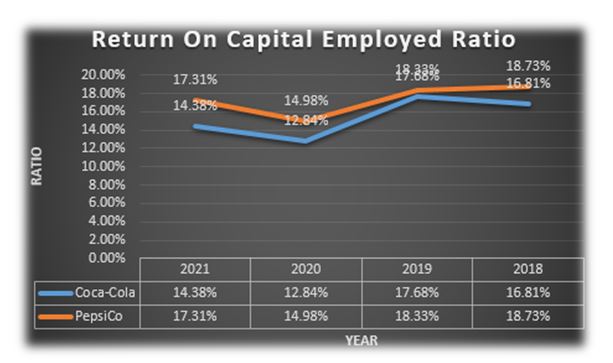

Return On Capital Employed

The ROIC (Return on Invested Capital) ratio measures the net income created using the company’s long-term funding sources (long-term liabilities and equity). It is used to determine the rate of return that a business can make for its investors, partners, and steady financial debtors. Thus, net income will be divided by the amount of long-term debt and equity. This might serve as a guide for potential financiers before investing their cash.

The industry’s return on invested capital ratio is very volatile but is more consistent at Coca-Cola and Pepsi. In 2020, the ROIC decreased significantly owing to the regulatory reasons discussed above. Pepsi and Coca-Cola have historically had relatively comparable ROIC rates and were also quite close to the benchmark in 2018 and 2019 but fell significantly short after 2019. This is concerning because they will face a solvency crisis if they cannot maintain the earnings required for long-term financing for an extended time.

Net Profit Margin

Finally, the profit margin ratio reflects the returns on sales after all expenditures and costs are deducted. This ratio specifies a business’s capability to control operational and non-operational expenses (Nuhu, 2014). The gross margin ratio will provide the proportion of gross profit earned on sales. The bigger the gross margin, the greater the return on investment and, therefore, the lower the manufacturing expenses. This ratio will be used to determine the product’s efficiency. The ratio is derived by dividing gross margin by sales. Gross margin is defined as sales minus the cost of goods sold (COGS). A company’s financial performance is deemed to be improving if its Profitability Ratios are increasing.

In this scenario, Coca-Cola has the most significant gross margin at about 25.27% of sales after subtracting COGS. By comparing it to the industry, it is clear that Coca-Cola is more efficient at using the resources required to create the items marketed. Pepsi was more or less in line with the industry every year until 2015 when the industry’s gross margin declined.

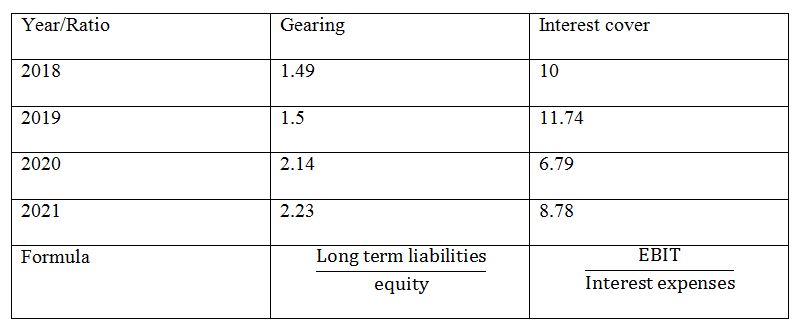

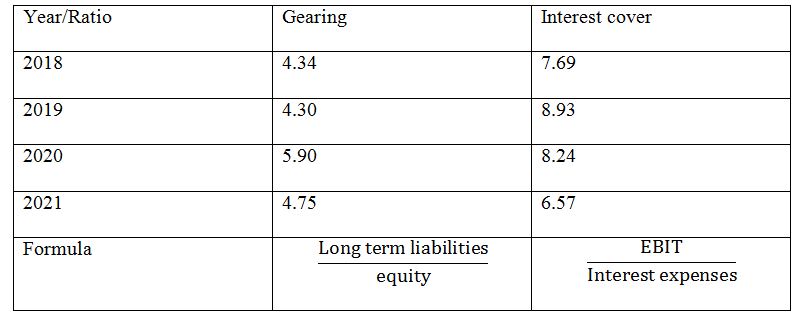

Solvency Ratios and Debt Ratios

Solvency and debt ratios are used to study a company’s financial status over time, determining its ability to repay long-term debt. A long-term equilibrium stance implies that the recovery of investments and payment of obligations occur in lockstep. Due to the vital link between returns and solvency, while examining this variable, the emphasis must be on the company’s ability to provide consistent returns over the long term. Without reliable profits, a business will be unable to service its debt for a long time and may face solvency issues.

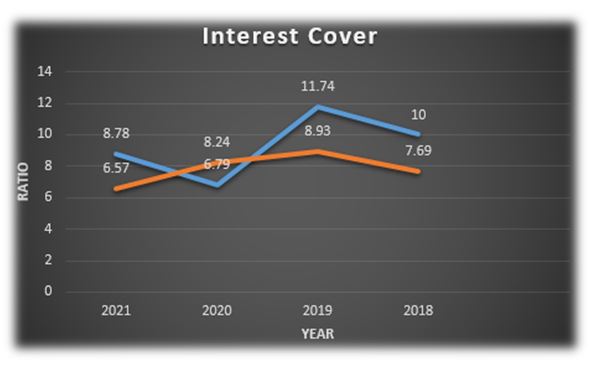

Interest Coverage Ratio

The interest coverage ratio is one metric for assessing creditors’ risk. This ratio compares the interest paid by the corporation during the current fiscal year to the EBIT (earnings before interest and taxes). This allows for assessing the firm’s ability to repay debt costs using its annual revenue. The lower this rate, the more interest the business will pay on its EBITDA—divide EBITDA by interest to arrive at this ratio.

The sector interest coverage ratio has fluctuated significantly throughout the years, commencing above both businesses, falling below them in 2019 and 2020, and rising above them again in 2021. This implies that Coca-Cola and PepsiCo are paying more interest than the rest of the industry on their outstanding debt. All corporations and enterprises are over one, which indicates they always have sufficient money to cover their interest payments. By reviewing the graph, it is evident that Coca-Cola and Pepsi are typically solvents since their profitability has been consistent throughout the years. Still, their first year was not strong enough, as the market significantly surpassed them. In Coca-Cola’s instance, the interest coverage ratio is slowly deteriorating every year, being beaten by both the benchmark and Pepsi in 2019. If this pattern continues, the future will be precarious, and the corporation will face significant solvency issues.

Future Performance and Stock Price

Financial leverage ratios

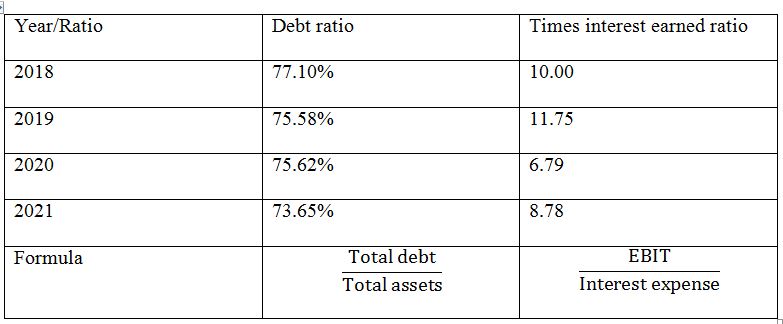

The following table, created using The Wall Street Journal data, summarizes The Coca-Cola Company’s (KO) financial leverage ratios for 2018-2021.

Table 2: Leverage Ratio

Coca-Cola heavily utilizes debt to support its operations. Since the 20s 18, the corporation’s debt-to-assets ratio has been more than 60%. In 2021, debt accounted for about 80% of the company’s assets. Typically, these percentages would be considered relatively high. Still, compared to PepsiCo, which had 86 percent of assets supported by debt in the same year, Coca-is Cola’s is lower. Coca-debt-to-equity Cola’s ratio Cola’s debt-to-assets ratio reveals how heavily the firm relies on debt to support its operations.

Coca-Cola remained debt-free in 2019. The interest coverage ratio for that year suggests that the firm could have more than repaid its debt obligations with earnings 12 times over. According to Boundless, if a business’s interest coverage ratio falls below 2.5x, this is cause for concern. If the ratio dips below 1, the company will be unable to pay interest using cash from operations. Coca-Cola has not encountered this problem in the previous five years. Even in 2019, when the business expanded its debt and reduced its interest coverage ratio to over ten times (the lowest level in five years), it could still satisfy interest payments quickly utilizing cash from operations. Given the degree to which Coca-assets Cola’s are backed by debt, one would reasonably inquire about the riskiness of the company’s bonds. When evaluating a company’s financial leverage, the significant risk is default risk. In other words, a bond investor is interested in learning if the firm would default on its payment obligations due to Coca-excellent Cola’s interest coverage ratio. The company can readily satisfy its obligations via the cash earned by its operations. Additionally, a bond investor may help ease their mind by validating the bond rating of a corporation.

Stock performance

Market ratios

Coca-P/E Cola’s ratio seems to be reasonable based on internal comparisons. Given that the five-year average P/E ratio of the firm is much bigger than the current P/E ratio, an investor may conclude that the company is undervalued on that basis. Comparing the company’s current P/E to the last two years would also imply that it is undervalued.

Moreover, an investor takes a broader view and compares Coca-P/E Cola’s ratio to its chief competitor, PepsiCo; the investor almost indeed concludes that Coca-Cola is expensive. Coca-price-to-earnings Cola’s ratio is 31.7, whereas PepsiCo’s is at 14.98. The Boundless textbook warns us that comparing businesses may be deceiving since organizations are seldom ever similar, which is undoubtedly true with Coca-Cola and Pepsi, as Pepsi is a more varied company that has extended beyond beverages to include food. When another market indicator, the Price to Book ratio, is considered, an investor may conclude that Coca-Cola is significantly undervalued in contrast to PepsiCo, given Coca-current Cola’s P/B ratio of 12.5 and PepsiCo’s current P/B ratio of 13.07.

Additionally, the figures above reveal that the Coca-Cola Firm’s current P/E ratio implies that the company is only moderately overvalued compared to the beverage sector’s current P/E ratio. When compared to the P/E percentage of the US market, the business seems to be highly expensive. Based on the above, I find that Coca-common Cola’s investors are not obtaining a sufficient return on their investment. That does not mean they are getting a low rate of return; instead, they may be receiving a higher rate of return on other assets.

Historical stock prices

The following charts illustrate Coca-Cola and PepsiCo’s stock values over the past year. The Wall Street Journal provided these charts.

As the data above illustrates, the recent year has been beneficial for Coca-Cola and PepsiCo stockholders. If an investor ignored everyday corporate news and held their stock without contemplating selling from the time they acquired it last year, they would have achieved exceptional returns on their investments. Investors in Coca-Cola would have gained 16.66 percent (if they purchased at $44.66 on July 5, 2018, and sold at $52.10 on July 5, 2019), while investors in PepsiCo would have earned 22.31 percent (if they purchased at $109.55 on July 5, 2018, and sold at $133.99 on July 5, 2019). Coca-Cola had a terrible day in the market on February 14, 2019. Shares decreased from a closing price of $49.79 on the 13th to a morning open price of $46.70 the following day. Otherwise, the stock trended higher throughout the year, and long-term investors who weathered that stormy day have been rewarded with a store that has climbed constantly since. PepsiCo saw close-ups and downs but maintained a constant upward trend throughout the year.

Recommendations

Recommendation for the client

A Coca-Cola investor’s first concern should be the company’s financial sustainability. Coca-Cola has been more efficient in recent years due to its achievement in limiting revenue expenses and expenditures, as shown in “Coca-Cola Research Project Part 1.” Additionally, the firm boosted its net profits by 5% in the fiscal year. The firm has been expanding its leverage on its financial structure, with long-term debt exceeding 30% in 2018. This should not bother a potential investor since Coca-Cola’s working capital remains positive, and the company can continue paying interest on its debt. While gross profit declined by around 28% during the previous five years, total operating costs were reduced by a more significant percentage (44%), resulting in the company’s operating income ending the five years higher than it started. The firm’s current ratio is more significant than one, suggesting that it can cover short-term debt entirely from existing assets. On the other side, Coca-ratio Cola’s has deteriorated to 0.66, showing that the company does not have enough current assets minus current liabilities to pay current commitments. As seen by the firm’s near-80% debt ratio, the corporation finances the bulk of its assets via debt. The company will continue to be financially sustainable in the foreseeable future if it maintains an excellent working capital position.

As shown by the firm’s interest coverage ratio of 10.64, the probability of the Coca-Cola corporation defaulting on its debt payments is very remote. Additionally, according to FINRA (2019), the business has a positive credit rating from Moody’s and S&P, which should comfort bond investors. However, purchasing Coca-Cola bonds is not recommended at present. Coca-Cola Bond and Stock Performance Analysis Page 14 since the yield is slightly more than a 10-year US Treasury bond, there is far less risk.

A shareholder considering acquiring Coca-Cola stock may receive a much better rate of return than a bondholder. According to the estimations above, an investor should seek a rate of return of around 4.43 percent to compensate for the risk inherent in investing in the company’s stock. The company’s growth rate was at 1.45%, and this figure was entered into the Gordon Model to get the stock’s intrinsic value, which is now around $53.71. If an investor buys Coca-Cola stock for $52.10 and keeps it until the market price meets the estimated intrinsic value of $53.71, the investor earns a 6.16 percent return. This was calculated as (selling price + dividends – buying price) / purchase price = (53.71 + 1.60 – 52.10) / 52.10 = 3.21 / 52.10 = 0.0616 * 100 = 6.16 percent. The analysis assumed that the holding period would be one year, but it may take longer for the market and intrinsic values to align. If an investor is seeking a safe investment in a financially strong company, I recommend investing in Coca-Cola corporation stock, which now offers a 6.16 percent dividend.

Recommendation for company management

Coca-management Cola’s management team is doing an excellent job of preserving the company’s financial stability. While the firm’s debt is growing, working capital has been positive for the previous five years, demonstrating that it can meet its commitments. The firm may incur debt indefinitely if its working capital remains positive and improves. This course of action is recommended, given the company’s favorable credit rating. The management team should consider developing current assets or reducing current liabilities while repaying short-term borrowers. Additionally, the firm should consider raising ROE via increased asset turnover while maintaining net margins greater than 15%.

Conclusion

In conclusion, Coca-Cola is often regarded as the most prominent firm in the sector in which it works. As a distributor and manufacturer of non-alcoholic beverages, the firm has expanded into over 200 countries and territories, with over 4700 items and 500 brands globally (Coca-Cola Company, 2021). Given the firm’s colossal presence in the non-alcoholic market, financial performance using financial ratios analysis was selected for the study to determine the degree to which the company has been financially successful and the areas in which it has fallen short of financial management. Additionally, it is critical to emphasize that financial ratio analysis is often regarded as one of the most effective techniques for determining a company’s strengths and shortcomings (Nuhu, 2014). Additionally, it assists users, particularly shareholders, prospective investors, and managers, comprehend financial outcomes. Needles et al. (1996, p.795) define financial ratio analysis in this context as a method of economic analysis in which relevant relationships between financial statement components are shown. As a result, it is concluded that ratio analysis enables us to assign a value to each item in the income statement and balance sheet.

Appendices

Appendix A

Results of Ratio Calculations

Table 3: Liquidity Ratios of Coca Cola

Table 4: Liquidity Ratios of Pepsico

Table 5: Profitability Ratios of Coca Cola

Table 6: Profitability Ratios of Pepsico

Table 7: Solvency Ratios of Coca Cola

Table 8: Solvency Ratios of Pepsico

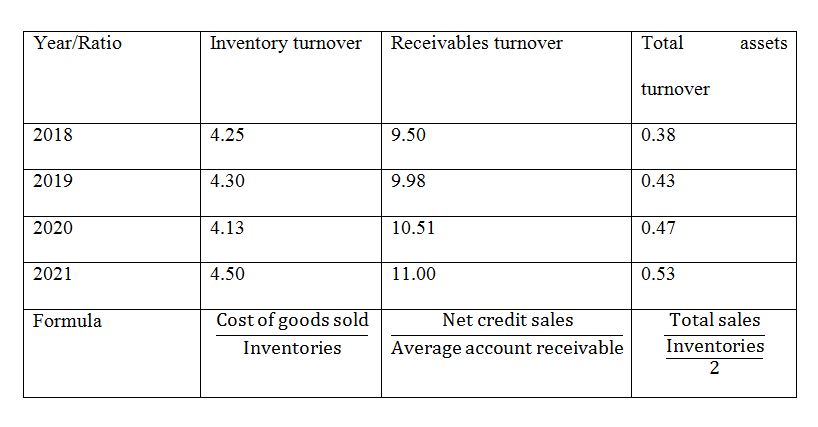

Table 9: Activity Ratios of Coca Cola

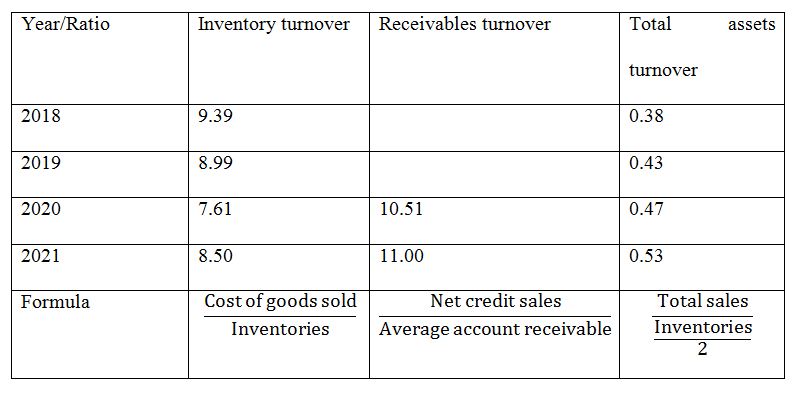

Table 10: Activity Ratios of Pepsico

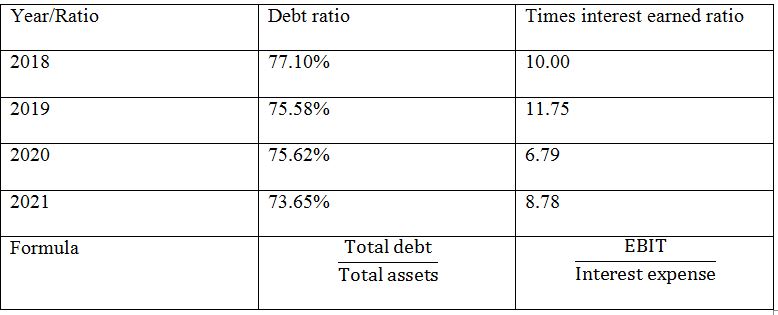

Table 11: Debt Ratios of Coca Cola

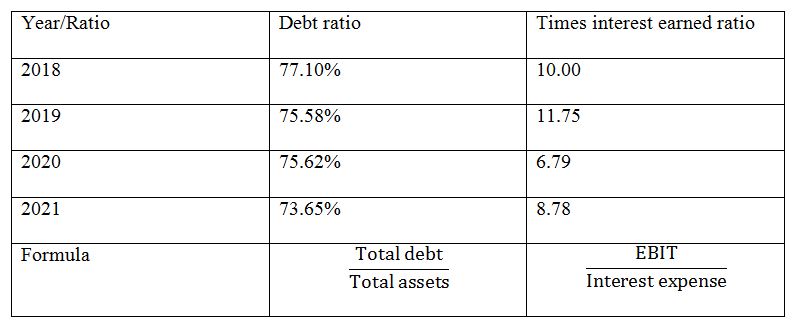

Table 12: Debt Ratios of Pepsico

Table 13: Asset Turnover Ratios of Coca Cola And Pepsico

Table 14: Asset Turnover Ratios of Pepsico

Table 15: Return On Assets Ratios of Coca Cola And Pepsico

References

Adedeji, E. A. (2014). A Tool for Measuring Organization Performance using Ratio Analysis. Advances in Social Sciences Research Journal, 1(8), 89–97. Web.

Nuhu, M. (2014). Role of Ratio Analysis in Business Decisions: A Case Study NBC Maiduguri Plant. Journal of Educational and Social Research, 4(5), 105-105.

The Wall Street Journal (2021). The Coca-Cola Company’s Balance Sheet. Web.

The Wall Street Journal (2021), The Coca Cola Company’s Income Statement. Web.

The Coca-Cola Company (2021), Company Profile. Web.

The Coca-Cola Company (2021), 2020 Business and Environmental, Social and Governance Report. Web.