Executive Summary

IKEA examines its external environment utilizing Porter’s five forces and the PESTEL model. IKEA distinguishes itself from its competitors by offering modern furniture designs at affordable costs. The tangible resources of IKEA include properties, machinery, company facilities, and consumables that the firm and its competitors can readily identify.

IKEA’s intangible assets include its reputation, proprietary knowledge, copyrights and licenses, user connections, and goodwill. IKEA uses a vertically integrated supply chain tactic that integrates self-owned forest activities to achieve low prices across its enormous store network. IKEA’s major corporate-level strategy for generating revenue and achieving other critical enterprise targets should be international dominance.

One of IKEA’s most recent achievements in this regard was opening its first store in India. The changes IKEA is implementing to its processes indicate that the corporation is unhappy with its current setup. IKEA may make its business more attractive to buyers in the electronic era by delivering products suited to the needs and lifestyles of potential consumers.

Analysis and Diagnosis

Porter’s Five Forces

The threat of new entrants (high)

Market entrance is simple when assessing the furniture industry from the standpoint of financial process skills, making the danger posed by new entrants significant. A large amount of money is not necessary on a small scale because numerous cottage industries worldwide manufacture and sell furniture, which increases the risk of new businesses.

The bargaining power of suppliers (medium)

The producers’ negotiating power is moderate because they can sell their raw materials to multiple international and domestic interior designers. Wood is a rare resource; therefore, sellers of this material have the upper hand in negotiations with businesses. The corporations recognize the position and power of providers and give them the leverage they deserve to establish good and effective partnerships with them.

The threat of substitutes (medium)

The forms, varieties, and patterns of equipment have been evolving rapidly while the demand for furniture has expanded. Artificial timber is not a suitable alternative to natural wood in furniture construction. There is no probably close equivalent for furniture in the near future, making the risk of furniture substitution moderate.

The bargaining power of customers/buyers (medium)

Different local and international producers are satisfactorily selling furniture, giving buyers moderate negotiating leverage. As a result, purchasers have the option to purchase from numerous businesses, as switching costs are also minimal, which further strengthens their negotiating position.

Industry competitiveness (low)

The worldwide income collection of the furniture sector is high, thereby concluding in a gigantic market size. IKEA is the major retail equipment company globally, with the greatest customer base internationally. The rivalry between IKEA and other existing significant competitors in the business, such as Wal-Mart, Home Depot, Argos, and others, is low due to IKEA’s prominence in the international market.

Value Constellation

Recognizing the responsibilities and capacities of partners in a value constellation helps improve value production, as exemplified by IKEA. For its modifications to be successful, IKEA collaborated with its contractors to ensure that the furniture was developed, constructed, and bundled for easy shipment and assembly (Garvey, 2017). IKEA revolutionized not only its furniture but also the responsibilities and connections of its stakeholders within a sophisticated structure of service encounters.

Stakeholder Mapping

Stakeholder mapping aims to determine stakeholder interests and influence and facilitate comprehension of political goals.

PESTEL model

Political Factors

The Chinese administration’s macro-control measures have a greater influence on producers than on merchants. Although the price of timers is rising, the furniture has not responded accordingly. Consequently, this is related to the regulation that will soon lower furniture export rebates from 14% to 5% (Burt et al., 2011). Therefore, this reduced furniture exports and increased pressure on Chinese furniture producers.

Economic Factors

The conclusion of Brexit by December 2019 has affected the business’ effectiveness. After Brexit, it was challenging for the corporation to hire British personnel (Burt et al., 2011). In addition, the free flow of products and services within the EU ceased following Britain’s withdrawal from the union.

Social Factors

Social and cultural elements have a significant impact on corporate operations. For example, Chinese citizens value their “mianzi” and strive to provide their visitors with exquisite furnishings. Thus, this increases the future revenue potential of the furnishing retailing industry.

Technological Factors

Compared to European countries, the innovation of furniture producers is lacking in technological advancements and qualifying norms. Thus, this is attributable to a shortage of capital and competent labor. Consequently, this hinders IKEA’s development and profitability, and it also contributes to the fact that nations such As china lack a dominant consumer base.

Environmental Factors

As people got more conscious of global warming, it became an enormous obligation of businesses to produce goods and offerings that are sustainable in some way. IKEA has invested around $1 billion in the renewable energy sector for developing nations. The business is dedicated to powering all of its stores exclusively with green sources.

Legal Factors

Since it operates in numerous nations, it must comply with the rules. Several former IKEA personnel have launched a complaint against the firm, alleging bad working conditions. The administration should reflect on its errors to avoid such litigation.

Key Success Factors

With the increased competition in the furniture industry, consumers value high-quality merchandise at lower costs. IKEA has distinguished itself from its competition by providing contemporary furniture designs at accessible prices. Its compelling brand image has helped it acquire client loyalty and marketplace domination in numerous nations across Europe, Asia, and North America. Intense rivalry among firms stimulates the production of greater efficiency in the manufacturing of goods and services. It adheres to a low-cost and obligation-free company strategy, with high flexibility and low capital investment, to meet the diverse needs of customers in various geographic regions. IKEA is a major player in the retail furniture sector. Its competitive edge stems from its capacity to address client demands through a diverse product offering and unique design principles. The firm’s website is interactive and provides clients with detailed product details, including assembly instructions based on end-user requirements.

IKEA is also one of the few organizations that allow clients to modify things before purchasing. The firm also uses an innovative straightforward delivery method in which things are brought straight from its warehouses to the homes of its consumers. This method has developed consumer loyalty in numerous European and North American countries. Its emphasis on cost-effectiveness has significantly influenced IKEA’s expansion. The company employs simple yet elegant designs to keep expenses down and then passes those advantages on to the customer. Moreover, its distribution system is organized to enable it to save money on shipping expenses.

The Organization’s Resources and Capabilities

Tangible assets are physical capabilities that can be easily recognized by both the company and its rivals and include properties, equipment, company premises, and supplies. Furthermore, these materials are widely available today or can be produced over time. IKEA’s property encompasses all places possessed and leased by the firm to house assembly plants and warehouses. IKEA’s machinery encompasses all the technology possessed by the corporation for manufacturing, packing, and other operational functions. IKEA’s infrastructure is also a ponderable resource that its competitors readily identify.

The business’s premises include all of its manufacturing units, depots, headquarters, and associated structures and services, which aid in simplifying its processes and controls and contribute to its effectiveness. IKEA’s consumables are also a tangible resource consisting of all materials and components used and needed to facilitate the institution’s shipping and operational capabilities. Supplies also encompass all items and auxiliary materials required by other IKEA departments for the positive outcome of company objectives. Equipment encompasses all the material possessed by the corporation for assembly, packing, and other functional areas. In this way, all technical breakthroughs and technological incorporation for enhancing workflows can be described as applying the group’s equipment used to expand its product range and implement cost advantages.

Intangible materials are non-tangible assets that firms like IKEA still hold despite their limited physical significance. Company reputation, proprietary information, trademarks and royalties, consumer relations, and goodwill are some of IKEA’s intangible assets. IKEA’s reputation is founded on its decades-long efforts to supply consumers with high-quality items and gain confidence. IKEA’s production techniques and the originality of its products are protected by intellectual property rights, which restrict competitors from duplicating or gaining access to the company’s commercial product mixture, item components, and inputs.

IKEA holds patent protections for its manufacturing methods and goods compositions and the research and development operations it conducts to strengthen and improve its products. These trademarks and copyrights safeguard IKEA from potential infringement or imitation. The IKEA brand has worked tirelessly over a long length of time to build the company’s reputation, which competitors cannot replicate. IKEA’s human resource consists of its employees, including top executives and subordinates.

To achieve low pricing across its vast store network, IKEA utilizes a vertically integrated distribution network approach that incorporates self-owned woodland activities, forestry professionals, and direct purchasing from over 1,000 vendors in more than 50 nations. Thus, this has allowed the company to pursue an asset-light marketing strategy without substantial real estate or inventory investments. It provides a variety of low-cost merchandise for consumers to pick from. Hence, this has helped IKEA acquire numerous loyal consumers and motivated them to frequent IKEA stores on multiple occasions.

Its extended value chains consist of cross-border production and transshipment of goods through its transportation facilities. IKEA’s growth in emerging overseas markets is the key to its continued success. Generally, it enters a new nation after establishing a solid foothold in nearby markets. Therefore, it must concentrate on reaching clients and developing its brand recognition before extending to other countries. Creating strategic collaborations with regional stakeholders is also essential to IKEA’s growth strategies. It also purchases businesses with comparable or similar services to expand its product line. This approach has allowed the organization to expand internationally and become more competitive.

Strategic Options

Required Strategic Move

The major means of achieving competitive advantage in any sector are cost leadership and diversification tactics, emphasizing low prices. The major institutional administration frameworks that facilitate the successful implementation of a cost leadership tactic include tight cost containment mechanisms, quantitative price objectives, rigorous monitoring of personnel, raw materials, and stock, and a cost management mindset. Generally, IKEA should execute them all as part of its enterprise-level initiative. Thus, this is due to IKEA’s promotional presence in mainstream media being restricted, whereas marketing is primarily conducted through store-distributed pamphlets and flyers.

As for differentiated products, IKEA should employ it as a complementary technique since cost leadership is a significant differentiator as low-cost commodities are offered at a distinct rivalry level. It, therefore, implies that they must accommodate a diverse array of customer wants and tastes. Therefore, the company should use skilled designers to assist in creating fresh, appealing, and practical items. In addition, the company must utilize effective customer engagement channels and solicits their comments. Product differentiation is crucial because it helps businesses to distinguish themselves from the competition. Moreover, the novelty and distinctiveness of an item are typically accompanied by higher costs and, thus, higher pricing. Consequently, differentiation initiatives are not necessarily as lucrative as cost leadership approaches. Given that IKEA’s primary purpose is to cut additional expenses and increase its market share, it is evident that cost leadership should be its primary approach.

New Strategic Options

Entering New Markets

Global expansion should be IKEA’s principal corporate-level tactic to generate income and achieve other critical business objectives. In this respect, one of IKEA’s most recent accomplishments was establishing its first shop in India. This action illustrates that the corporation recognizes India’s importance in fueling the expansion of the overseas furniture customer base. Notable is IKEA’s adherence to its company’s brand and goal even as it enters overseas markets. IKEA personalizes the storefronts in China to reflect the local way of life. IKEA has introduced model sets and unique balcony areas in China to demonstrate how to arrange a balcony.

Adopting New Technologies

The modifications IKEA is making to its operations demonstrate that the company is not pleased with its current system. IKEA could take steps to make its business more appealing to customers in the digital era by offering a product tailored to prospective clients’ lives and requirements. IKEA is developing future competitive commodities, offerings, and approaches in addition to technical services that enhance the user experience. It has begun offering smart home accessories such as amplifiers and motion sensors (Marr, 2018). The company’s entry into the smart home industry is a significant development, even though these smart plugs are not as complex or dependable as those of competitors. Additionally, IKEA wants to have a fleet of zero-emission commercial trucks in certain markets by 2020 and in all international markets by 2025 (Marr, 2018). It is also conceivable that clients will be eligible to receive a self-driving mobile exhibition to bring the furnishings they are intrigued with to their locations for a whole new perspective on purchasing from home. Instead of customers transporting their goods, self-driving vehicles may distribute merchandise to customers (Marr, 2018). The corporation also anticipates how fully driverless vehicles would affect automobiles’ interior and exterior appearance.

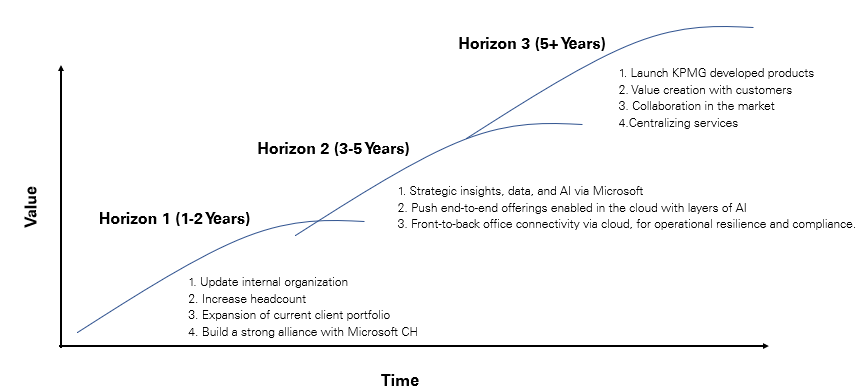

Options Within the Overall Strategic Horizon

Horizon 1

IKEA Holding engages in three core business lines: Franchising, assortment, and procurement. The majority of the company’s revenue is generated through franchises. The core companies collaborate with franchisees and partners to improve IKEA’s offer and franchising system.

Horizon 2

As an emerging prospect, steel has a substantial market demand that follows a consistent annual pattern. Due to its durability, low maintenance, and portability, steel furniture is used in businesses, commercial settings, and homes. IKEA may establish a production unit and begin selling its products online using this furniture. E-commerce platforms are increasing in popularity among consumers; thus, it is a smart option for IKEA to distribute furniture.

Horizon 3

IKEA can utilize the following ideas to explore emerging prospects and entrepreneurial ventures. Collaboration with technology firms, adopting innovations in production, enhancing value creation with buyers, centralizing its business activities, and reducing costs in new products.

Selected Strategic Initiative

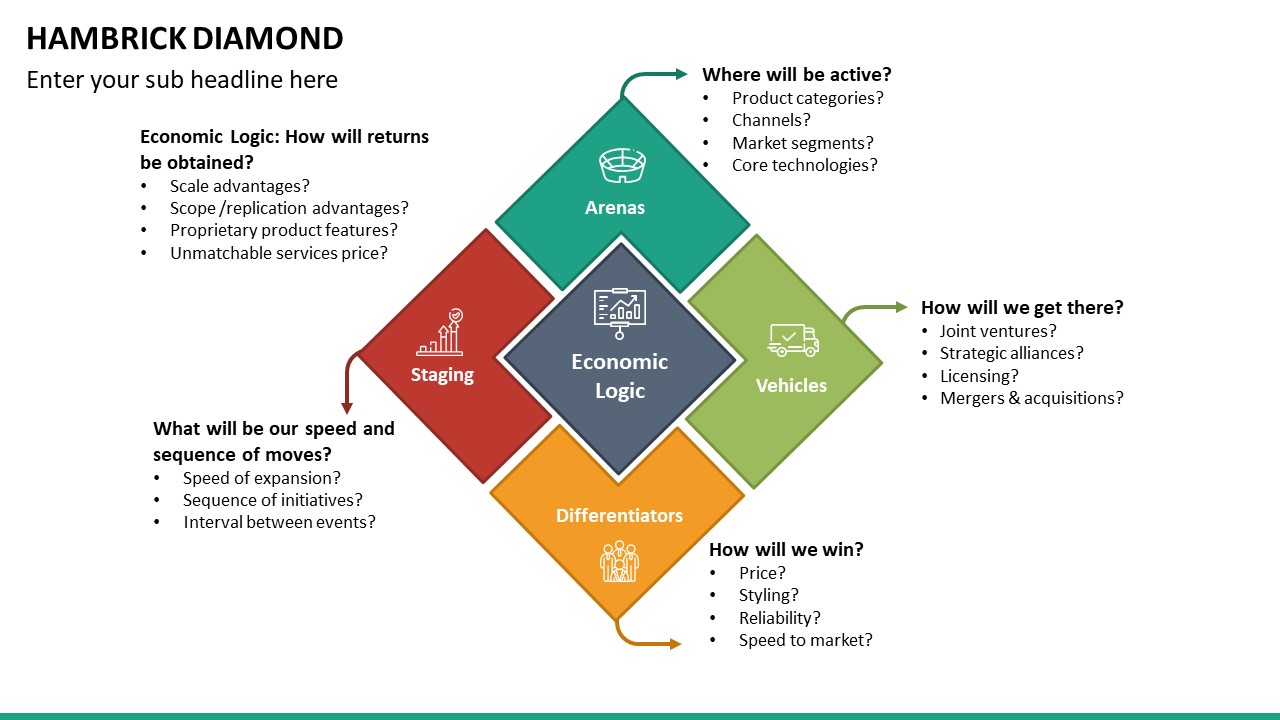

IKEA should focus on offering brand awareness through social media platforms or carry out online marketing. In mitigating implementation risks, IKEA would use an avoidance approach before approving the final action. The technique would undertake an online assessment to avoid the possibility of a software glitch. Moreover, the leading indicators would be the number of subscriptions and customer feedback about the online platform. This section analyzes the chosen initiative using Ham-brick’s strategic diamond.

Strategic Diamond Analysis of the Initiative

Arena

- Online marketing would be used.

- The company would target mostly the younger population aged between 25 to 40 years as they comprise the bigger percentage of digital users.

- Developed and emerging economies in Asia and South America would be targeted.

- Augmented reality applications that would permit buyers to test items in real-time through Apple iOS 11’s ARKit technology.

- Value creation stages used would be enhancing the value and communicating the value steps.

Vehicles

- Improve customer service and generally contribute to the expansion of the business.

- Partner with Apple Inc. to use its Apple iOS 11’s ARKit technology.

- License Asian Furniture companies such as Asia-Pacific in China

- No acquisitions would be made; rather, collaborations.

Differentiators

- Modern and appealing images.

- Supplement items with faux finishes such as Panyl.

- Use low-cost pricing to attract more customers.

- Recommend modern styling techniques such as using appropriate-size rugs.

- Implementing an efficient distribution network to enhance product delivery

Staging

- Monitor the progress for at least 2 years before deciding on expansion.

- Create a company website, conduct a piloting test, and launch the application depending on the reception and comments from consumers.

Economic Logic

- The firm would obtain its return by offering lower costs due to enjoying scale advantages.

Strategic Initiative and Competitive Advantage

Online strategy and competitive advantage are complementary aspects of a business’s growth and profitability. The Digital revolution has varying advantages and disadvantages, but it is a route to prosperity for enterprises. However, businesses that adapt to the rapidly expanding internet marketing techniques in the global marketplace gain a significant competitive advantage. The primary aspect of online advertising is that it facilitates direct, cost-effective, and quantifiable communication with customer segments. Effective online strategies and approaches enable businesses to engage in international trade in a price-effective manner. Thus, it plays a significant part in expanding a firm through foreign markets by recognizing its primary rivals and adopting marketing tactics to achieve an impressive result for global brand recognition.

Tracking prior business outcomes enables social media marketing to be evaluated to detect market behaviors and execute prospects. Consequently, this is an additional benefit to the strategic edge, as a corporation can flourish through monitoring and measuring productivity, sales, and earnings. Most firms believe mainstream media promotion is more expensive than conventional methods. Nonetheless, the reality is that internet advertising reduces a firm’s marketing and advertising expenses because it is accessible worldwide. There are numerous methods of choosing social media marketing campaigns to acquire a competitive edge. Online marketing, such as a webpage, is the most effective technique to convince clients to buy an item in a few clicks. Therefore, this is a great differentiator because some firms rely on walk-in sales, whereas a company that adopts Internet advertising can make a transaction with a single click.

References

Burt, S., Johansson, U., & Thelander, Å. (2011). Standardized marketing strategies in retailing? IKEA’s marketing strategies in Sweden, the UK and China. Journal of Retailing and Consumer Services, 18(3), 183-193.

Garvey, P. (2017). Unpacking Ikea: Swedish design for the purchasing masses. Routledge.

Marr, B. (2018). The digital transformation to keep IKEA relevant: Virtual reality, apps and self-driving cars. Web.