He comes unfailing for the loan

We give and then forget;

He comes, and probably for years

Will he be coming yet,—

Familiar as an old mistake,

And futile as regret.

~ Edwin Arlington Robinson

In a time when the economic crisis is at its apex, more and more industries are turning towards traditional alternatives of financing in the hope to survive. The most efficient and profitable solution is the Islamic way of financing. Islam is not only a religion but rather a lifestyle; it deals with every aspect of human life as well as society. No religion has ever described the economic, political, and social rules and regulations in such depth. It is therefore an eye-opening realization that such a religion cannot be a creation of a human but a power bigger than humans has devised all of its strategies. It is believed by Muslims that Islam is the religion of the creator of this world, Allah (SWT). The world around us is perfect, therefore its creator must have been a some being bigger than the humans it created; that is the basic belief of all Muslims, which they embed in every part of their life, even in business and trade.

This topic was chosen because the Islamic way of financing, especially for personal loans, is booming at a rapid pace. Many non-Muslim nations and industries are adopting these ideas to overcome their losses in this economic crunch. Islam is a religion that promoted equality, not only within in front of God but throughout society. The rules are based on the notion that wealth should be shared so that every individual and every household of the economy benefits from it. It is the basic principle that prevails in the Islamic society that the wealth of a nation should be shared amongst its citizens, and the people doing business together should share the profits as well as the losses.

The rules of the economy under Islam are not “entirely capitalist or socialist,” that is it does not promote a “free trade market” or a completely government-owned economy. Instead, it promotes the welfare of all on the principle provided by the Prophet of Islam and the Qur’an. Islamic financing and economics have in-built preventive measures because of which it would remain unaffected by the current financial crisis. The financing through the “tangible assets,” the “prohibition of debt trading,” the restriction on selling un-owned assets along a mediocre style of life are a few of the factors (Khan, pp. 2-3). Other than the Shariah, Prophet’s words, and Qur’anic verses Muslims also rely on the “Ijma” or the rulings of scholars, “qiyas” the interpretations of Qur’an and Prophet’s words, and “ijtihad” which is the “reasoning” of a scholar (Mohamed, p.3). The Islamic scholars are consulted when the meaning and interpretation of a Qur’anic verse of the Prophet’s saying is unclear or ambiguous. The rulings given by the scholars and the basis of these rulings are adopted by the Muslims of the world.

In other words, the entire “Shariah” governs the “economic, social, political, and cultural” decisions of an Islamic nation. In Shariah, Islamic financing is defined clearly; it says that finance and economy should benefit the poor as well as the rich. The economic system of Islam prevents the increase in the gap of social classes. It approves “investments” in which people share “profits and losses” and there is an “interaction between capital and labor.” Common Islamic principles such as being truthful, honest, just, and “transparent” are also embedded in the financial aspect of Islam (Mohamed, 2).

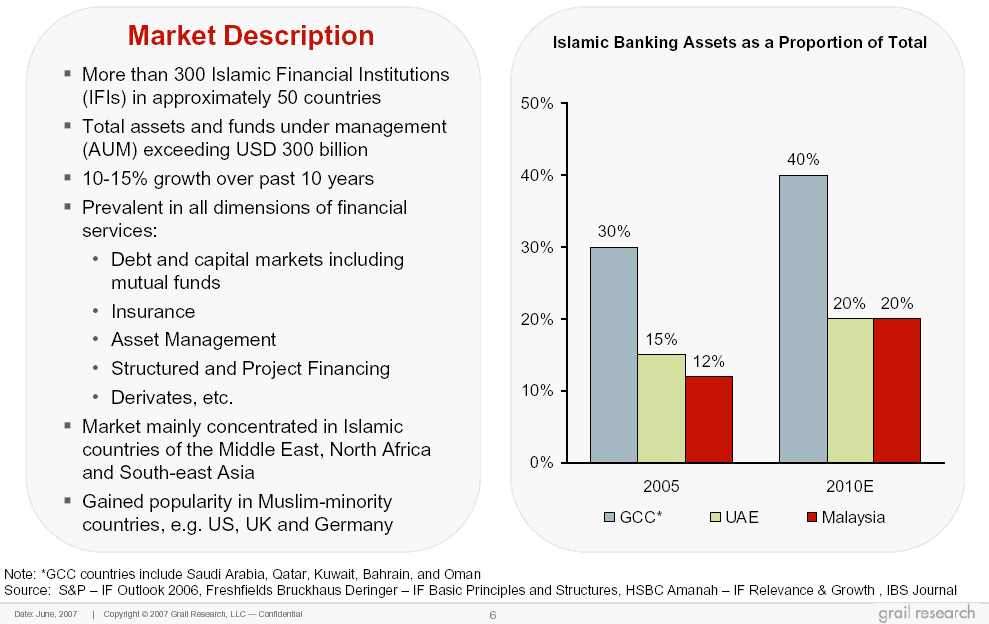

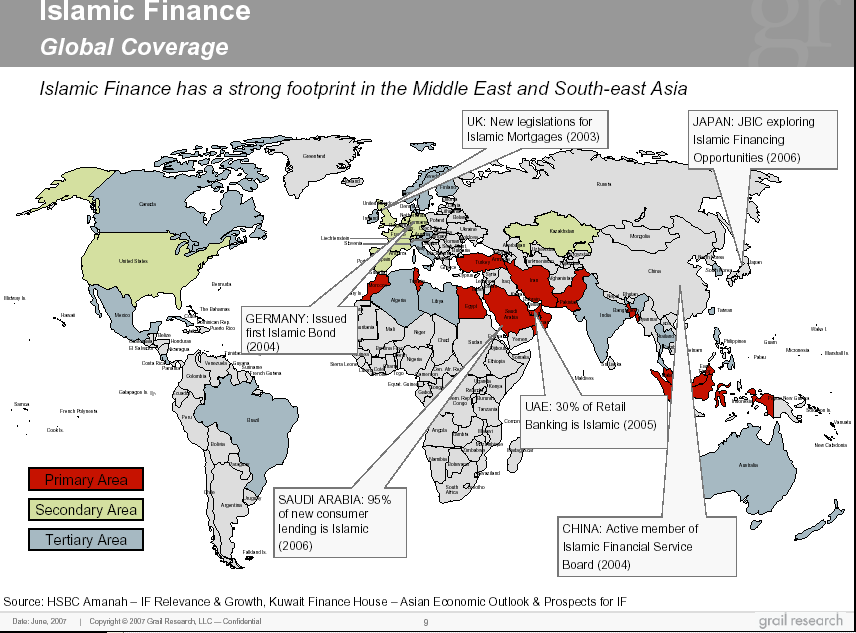

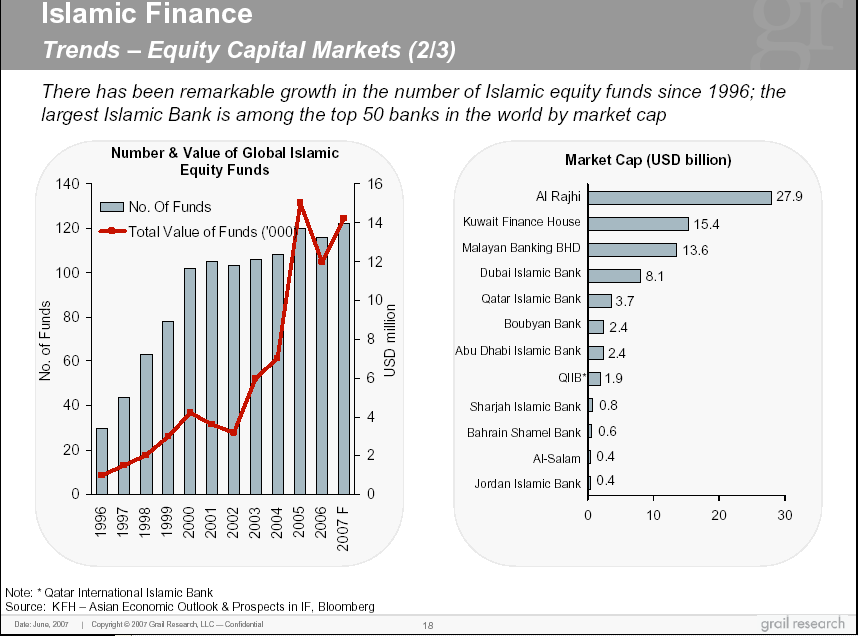

As mentioned earlier, the basis is Sharia and it promotes ban on “speculation and interest” or “gharar and riba” in an Islamic financial economy (Economist, 82). The increase in the Muslim population in Western societies has led to an “untapped market” for the banking segment. The market has recently developed and did not exist until a few years ago. International bankers are now learning about the Islamic way of financing to attract consumers belonging to this segment. International banks have also introduced new products which abide by the rules of Islam. The global Islamic sector has witnessed rapid growth and is “one of the most dynamic” areas in the international finance market. The total assets were “estimated” to be controlling around $500 billion. Muslim scholars have found ways of getting around the rules of Shariah by devising a range of products that are allowed according to Islamic laws (Euromoney, p. 2).

One of the interpretations by scholars is that since interest is not allowed, financial institutions can earn money through rents, “leases,” or “profit-sharing agreements.” Scholars have approved of a mortgage that is designed as a “lease-to-own-deal,” where the bank owns the property and the interested party makes “installment payments” in form of rent. At the end of the lease term the property is transferred in the name of the actual buyer. In this case the bank earns its profit through the monthly payments of rents instead of loans. Another form of approval is related to bonds, Islamically known as “sukuk,” in this scenario the bank also makes money through the payment of rents rather than interests (Wiseman, p.06b). It is wrong to say that Islam does not allow trade and entrepreneurship. Instead, the Prophet of Islam (P.B.U.H), himself was involved in trading of goods and materials. Also, the Islamic law of financing promotes the innovative and entrepreneurial spirit among individuals. Most people would think that as Islam prohibits interest it also prohibits lending to start a business, whereas it is allowed to finance someone without interest. The financer gains from the profits that the business reaps, and as an Islamic law he also shares the losses (Kuran, p. 33).

Saleh Kamel, Chairman of the General Council of Islamic Banks and Financial Institutions (GCIBFI), claims that the “total worldwide assets” made through the principles of Islamic finance are now “USD 260 billion,” with “267 Islamic financial institutions.” The growth in half a decade is estimated to be around 23.5%. Several principles, apart from the basics of riba and garrah, are important when dealing with Islamic financing. The first one is “Fiqh Mumalat,” which deals with the principles of designing contractors. Second is the “Maqasid Shariah,” which means meeting the principles set by the law of Shariah; or administering “general wellbeing and good” for the entire society. Holding personal wealth is allowed but the spending of this wealth should be in a way that is “socially and ethically” conscientious. This is ensured by “Zakat” or “social tax” which is given to the Muslims belonging to the lower social class or low-income households (Gassner, p. 26).

Islamic way of financing is through “Mudarabah” which is defined as an “investment partnership.” The money is used here is basically for a business or investment where the money is given by the “investor (the Rab ul Mal)” to the “the Mudarib.” The profits earned from conducting these businesses are then shared by both parties, but the losses are handled by the investor only. “Murabaha” is the case where the lending party purchases the property and the people pay rent for a period of time. Once the amount of rent has been completely paid off the property is transferred in the name of the actual party, thus interest is not involved and money is earned through rent. The Islamic insurance is called “Takaful,” which is devised to avoid the problems of riba and gharar. The insurance is based on an arrangement that is “charitable collective pool of funds.” Lastly, “Tawarruq” in the form of personal financing in Islam. It is when a person in need of cash buys a commodity on “credit” and sells it immediately to a “third party.” He then obtains immediate cash without having to go through the forbidden way of loan taking (Challiner).

A major difference between Islamic and conventional financing is the view of money. It is the basis that makes the entire economy and the rules of the economy different. In an Islamic economy, money is viewed simply as a “means of exchange.” It is something that is considered to be a gift of God to humankind. The responsibility of mankind is to spend it in all right ways, ethically and justly. A Muslim is not told to spend without thinking about the welfare of other people in society. Instead, he is supposed to adopt the means of Zakat and “Khairat” to share its wealth with the low-income households. Islam promotes a simple way of life, Muslims do not believe in spending on luxuries and things that are not necessary for their survival. In simple terms, money is just something through which you can buy the basic necessities of life. In a capitalist society it is looked upon as a commodity, which is why people continue to spend and overspend without having second thoughts about the people of lower social classes. Therefore, the wealth of the economy goes undistributed (Ismail, p. 19-20). It is also different from a socialist form of government where the government owns the money of the people and determines what it should be spent on?

According to Walsh (p. 753) Islamic belief is that religion needs to be embedded in every part of life, even in trade and business. Due to religious beliefs, Islamic banking and financing are differed from a traditional ones, as Islamic financing involves ethics. This is majorly why Islamic economy does not rely on Capitalism or Socialism. It wants its followers to use their beliefs and ethics to determine right from wrong and to follow the path which is best for every individual in society.

Through Islamic financing, many things can be avoided especially the crashing or shrinking of the economy. A non-Islamic way of financing is not healthy for the economy and the society due to various reasons; these can be avoided if Islamic way of banking is used. The major reason is that the “allocation of resources” and the distribution of wealth are unequal. The poor people keep going down the tier of society whereas the rich people gain all the benefits from the loan-providing institutions. Banks usually run a rigorous back check before providing people with loans. They check their credit ratings, their property and the wealth and money owned by them. Once a person proves that he can afford the loan the bank allows him to take the money. The poor people of the society cannot get past the backchecking phase and are denied the loan. Therefore the gap in the social classes of a country keeps increasing at a rapid rate (Maulana Usmani).

Another issue that arises is the effect on the overall productivity of the society and economy. Loans, especially personal loans, are provided to enhance the lifestyle of a person or household. People rarely take loans for production, education, or entrepreneurial reasons. When the majority of money is being spent to create a better lifestyle and provide more luxuries, instead of increasing productivity the overall production of the economy declines (Maulana Usmani)

It has already been mentioned before that Islamic financing and economic rules promote the sharing of profits and losses. These laws also promote the wellbeing and welfare of the entire society regardless of their social status. When looking at businesses, Islam allows trade and business to create wealth in society, but most capitalist businesses are financed through debts and interests. Therefore, when a business suffers loss the businessman faces huge charges and debts because they own the institution money even if they have lost everything (Maulana Usmani)

Confusion among most people is that inflation has occurred? Or it is the deflation of currency? Most people do not have economic knowledge but a person of economic understanding is able to identify the causes and effects of evils on society interests. Once interest and debt start circulating the economy, the value of money declines to a great extent. It declines because the government produces more money as the loans have restricted the circulation of currency throughout economy. The money is only being circulated to a specific group of people in the society, not everyone benefits from its existence. Therefore, once more money is introduced its value goes down, whereas the commodities the cost of commodities increases. As now more devalued money is required to get the products (Ismail, p.14). The effect of this is not felt by the rich people, as they own most money of the society and have reserves of investments and wealth. The low-income groups suffer the biggest shock; their incomes do not increase as much as the price of products and services. Ultimately, these people find it hard to afford even the basic necessities of life, whereas the rich continue to enjoy the luxuries.

The developing countries are suffering losses but they have hopes to recover and their economists are continuously working on making their financial and economic system better. However, the developing nations are in huge debt to the world relief organizations that were actually meant to aid their development. The aid provided in the form of loan money has proven to be a burden on the developing nation’s economy. It not only slows and hinders their growth process but also deflates the value of their currency (Ismail, pp. 17-18). The Islamic system of economy and finance guarantees that no financial crisis will prevail because the system is perfectly designed. However, it is evident throughout history that the capitalist system has economic cycles and it faces economic depressions at the end of every booming period (Kutub, p. 51).

When analyzed critically, it becomes evident that the basis of Islamic financing and economy is the welfare of every socioeconomic class and group of the society. It is not only for Muslims to follow but even non-Muslims can take advantage of the system devised by the power which is Most Supreme and Knowledgeable. The system asks for compromises, but it ensures that the economy will run smoothly without any sudden crashes and economic depression. The compromises have to be made by the elite class of the society. They have to find ways to let go or to some extent minimize the luxuries of their life to enable the poor from taking advantage of all the money that is held by their banks and investments. Once the idea of living a luxurious life ends in their minds they will start seeing the results of their compromise. When the money starts circulating the economy freely, the government will not have to worry about the issuance of more notes or the inflation caused by their issuance. It is also the responsibility of the government to instill a sense of social and ethical responsibility in its citizens and make them understand the dangers of interests and loans. Rules, regulations, and policies should be devised to ensure that the economy does not suffer huge losses. It is not necessary to label it with the name “Islamic Financing,” rather governments can reap the fruits of this perfect economic system by simply embedding it in their economic system.

Appendix

Works Cited

- Anonymous. “Faith-based finance.” Economist Vol 338, Issue 8596, 2009: p. 82

- Anonymous. “Islamic financing – the next stage.” Euromoney Vol 38, 2007: p. 2-3.

- Challiner, Michael. “Mortgages And Loans. Islamic Finance Avoids Interest.”

- Gassner, Michael Saleh. “Islamic Finance: Short in Gambling, Long in Trade.” Swiss Derivatives Review, No. 25, 2004: p. 26-27.

- Ibrahim, Nidal M. “Alternative Financing: OC Builder Opts for Interest-Free, Equity-Based Islamic Loans.” Orange County Business Journal (2000): 26.

- Ismail, Sufyan. Why Islam has prohibited interest and Islamic alternatives for financing. Booklet by Ethical Ltd.

- Khan, Aamir Hameed. “Islamic Financial System and Current Crisis.” 2008: p. 1-3.

- Kuran, Timur. “The Scale of Entrepreneurship in Middle Eastern History: Inhibitive Roles of Islamic Institutions.” Department of Economics, Duke University. 2007.

- Kutub, Muhammed. Islam: The Misunderstood Religion. 2001

- Mohamed, Musbri. “Introduction to Islamic Financial System.” PowerPoint presentation for Pursuing MBL.

- Pakistan. Supreme Court of Pakistan. Justice Muhammad Taqi Usmani. The Text of the Historic Judgment on Interest. Pakistan: Supreme Court, 2000.

- Walsh, Christine. “Ethics: Inherent In Islamic Finance Through Shari’a Law; Resisted in American Business Despite Sarbanes-Oxley” Journal of Corporate & Financial Law: p. 753 – 777.

- Wills, Zachary. & Chip Brewer. “Overview of Islamic Finance.” Grail Research. 2007.

- Wiseman, Paul. “Islamic loans turn profit for banks in USA.” USA Today, 2008: Section Money, p. 06b.