Introduction

The relationship between capital structure and dividends policy in Saudi companies is often regarded to be one of the most crucial matter for those who are planning to start running business in Saudi Arabia, or for those who are dealing with Saudi companies, and would like to know more on the principles of business activity, accepted in this country.

Context and Background of the Study

The capital structure of the company is often regarded to be the combination of funds, which a company uses for running and financing its activity. A company generally sets the target capital structure, which in fact is the wished (planned) proportion of debt and equity, which should be used for planning and financing the business activity. On the one hand the more debts are used, the higher are the risk levels. However, on the other hand the higher the debt rates the higher are the expected return rates. The fact is that, these principles are central in Saudi business practice, as the dividend policies are built on the principles of achieving the highest interest rates in the business world of this country.

The Purpose and Scope of the Study

The main purpose of this study is to define what the link is between the dividends policy and capital structure of business organizations in Saudi Arabia. The fact is that, a paradox is often challenged, in similar researches: a company should resort to an adequate size of debt funds for maximizing the values of the firm.

The scope of the study will be defined by the initial limits of the financial strategies and the capital structures. Thus, defining the financial strategy and its link to the business performance in the context of dividend policy is the main assignment of this research.

Literature Review

The literature sources, which represent this research sphere, are generally aimed at providing the description of the integrated theory of capital structure and dividend policy in which the financial policy selections are regulated by the same essential factors. Originally these are also defined as the significant ruling schemes, which are claimed to control the actual decisions and choices of any company, made by managers and investors. According to Rakesh (2003): “At one extreme is a very highly levered firm with very little equity. Such a firm puts the maximum control over project choice in the hands of investors. At the other extreme is an all-equity firm that pays no dividends. Such a firm puts maximum control in the hands of the manager. Between these two extremes is a continuum of control allocations determined by different debt-equity ratios and different dividend payout ratios. Higher debt-equity ratios and higher dividend payouts lead to greater investor control.” Koski (1996), in his turn stipulates the notion that in spite of the absence of information problems, which are often faced by dividend policy, control system significantly matters because of the deviation of the expectations and ruling principles implemented by managers and investors. Surely, these divergences often lead to disagreements over the value-maximizing project decisions, which, in its turn, changes the capital structure of the company, as the dividend policy. Jakob and Tongshu (2005) sate the following notion on this matter: “The extent of the potential disagreement depends upon the firm’s prior performance. The manager sets the firm’s dividend policy and capital structure to optimally trade off the value he attaches to being in control of project choice against the decline in stock price from taking control away from investors. We generate testable predictions from the theory and then test them empirically. These tests provide strong support for the theory”

Objectives of the Research

The primary objective is to examine whether stock returns are important factors in firm’s capital structure. Another question is the stock price reaction to dividend announcements, which should be regarded in the context of analyzing the determinants and stability of dividend policy of Saudi companies. In the light of this fact there is strong necessity to provide the clarification of stock price reaction in the context of the changing capital structure its link with the dividend policy, as dividend announcements define the stability of financial market, thus, directing the business activity. Taking these facts into account, it should be stated that if a stock appears to be ex-dividend, the price of the stock should decrease up to the amount of the dividend. Nevertheless, the researches show that the drop is often lesser than the dividend sum. Thus, the key objective of the study will be also to identify the key reasons of this phenomenon, taking into account the differential tax treatment of capital achievements and dividends.

Research methodology

The research based on quantitative analysis for set of listed companies in the kingdom of Saudi Arabia. Research relies on survey and questionnaires with decision-maker and financial analysts who work in or with these companies.

Ethical Considerations

Originally, this research does not touch upon any ethical issues, until the research methodology and the research question has nothing to do with confidential business information and the issues of industrial espionage. Nevertheless, all the necessary data may be achieved by absolutely legal means, thus, there is no necessity to discuss ethical considerations.

Importance and Implication

The importance of the paper is the possibility of estimating risks and dangers in the business world of Saudi Arabia, basing on the knowledge of capital structure and dividend policy: how these two concepts are interconnected, and what role they do play in successful business performance. Business and Financial risk issues, which are implicated in the research may be divided into two components

Business and Financial Risk—the risk associated with a firm can be divided into two groups: the risks which are associated with the type of business, and the risks, which are associated with the company’s financial obligations.

Limitations of the Study

First of all it should be stated that the research will be essentially restricted with the ethical considerations, as aiming to find out and publish confidential business information may be regarded as the violation of business ethics. Moreover, the limitations are also associated with the research issues, as the factors, which impact the capital structure in the context of dividend policy are numerous, and the aim of the research is to get focused on the most important reasons and factors of possible business changes.

Thesis Chapter

The relationship between capital structure and dividends policy in Saudi companies is the research question which is of great interest for those who are researching the particularities of the business world of Saudi Arabia. Originally, this topic is not deeply researched, nevertheless, the potential of this research is almost unrestricted. It will be important for evaluating the possible business risks, and defining the consequences of these risks for Saudi companies, and for the companies, cooperating with them.

The research will be based on quantitative analysis for set of listed companies in the kingdom of Saudi Arabia, and on surveys and questionnaires with decision-maker and financial analysts who work in or with these companies. Originally, these tools are regarded to be the best in the context of informativity and ethical considerations.

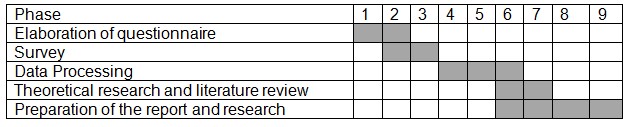

Time Line

The research process will be divided into several stages, each with its different aims. The first stage will be dedicated to the elaboration of the questionnaires and surveys for the managers of the companies. The questionnaire should entail the matters of capital structure and touch upon the matters of the necessary decisions in the sphere of overcoming risks and dangers.

The next stage is the arrangement of surveys with the following processing of collected data.

Terms

- Capital Structure – way a corporation finances its assets through some combination of equity, debt, or hybrid securities.

- Dividend policy – The policy which any company uses for making a decision on how much it will pay out to stakeholders in dividends.

- Financial risks – risks, associated with the financial obligations of the company

- Business risks – risks, in the sphere of business activity, associated with the taken decisions.

References

Athanassakos, G. Fowler, D. (1993) New evidence on the behavior of Canadian stock prices in the days surrounding the Ex-Dividend Day. Quarterly Journal of Business and Economics; 1993; 32, 4; ABI/INFORM Global pg. 26.

Borges, M.R. (2007) The Ex-Dividend Day Stock Price Behavior: The case of Portugal. International Atlantic Economic Society. Vol.36. 15-30.

Jakob, K., Tongshu, M. (2005) Limit Order Adjustment Mechanisms and Ex-Dividend Day Stock Price Behavior, Financial Management; 2005; 34, 3; ABI/INFORM Global pg. 89.

Jensen, Gerald R.; Solberg, Donald P.; Zorn, Thomas S. (1992) Simultaneous Determination of Insider Ownership, Debt, and Dividend Policies, Journal of Financial and Quantitative Analysis; 1992; 27, 2; ABI/INFORM Global pg. 247.

Koch, P.D. Shenoy, C. (1999) The information content of dividend and capital structure policies. Financial Management; 1999; 28, 4; ABI/INFORM Global pg. 16.

Koski, J (1996) A microstructure analysis of ex-dividend stock price behavior before and after the 1984 1986 tax reform Acts. The Journal of Business; 1996; 69, 3; ABI/INFORM Global pg. 313.

Mazur, K. (2007) The Determinants of Capital Structure Choice: Evidence from Polish Companies. International Atlantic Economic Society 2007. Vol. 13:495–514.

Pozdena, R (1987) Tax Policy and Corporate Capital Structure. Economic Review – Federal Reserve Bank of San Francisco; 1987; 4; ABI/INFORM Global pg. 37.

Rakesh B. (2003) Variation in ex day dividend pricing: Myth or reality? Journal of Economics and Finance; 2003; 27, 2; ABI/INFORM Global pg. 190.

Shing-yang Hu; Yun-lan Tseng (2006) Who Wants to Trade Around Ex-Dividend Days? Financial Management; 2006; 35, 4; ABI/INFORM Global pg. 95.

Yong H Kim; Jong C Rhim; Daniel L Friesner (2007) Interrelationships among Capital Structure, Dividends, and Ownership: Evidence from South Korea. Multinational Business Review; 2007; 15, 3; ABI/INFORM Global pg. 25.

Zhang, Y., Farrell, K. (2008) Ex–Dividend Day Price and Volume: The Case of 2003 Dividend Tax Cut. National Tax Journal Vol. LXI, No. 2008.