Definition and Concepts

A cash flow statement represents significant financial declarations for a business or project. It provides information about cash receipts and payments of a venture for a given time frame (Profit, p. 33). The document is crucial for determining a firm’s stability in the business. Cash flow statements help in tracing the various sources of cash such as operations, sales of current and fixed assets, issuance of share capital, and borrowed income. Further, it shows cash outflows, including the purchase of existing and fixed assets, the redemption of debentures, and preference shares, among other expenses (Klammer, p. 200). According to Profit, a cash flow statement contains essential information that provides a basis for evaluating a company’s ability to generate cash and cash equivalents as well as the needs of the venture to utilize such cash flows (p. 34).

The preparation of cash flow statements aims at fulfilling several objectives. For instance, it helps to determine a project’s rate of return. As well, traders use cash flow statements to identify problems with an enterprise’s liquidity. Khan et al. postulate that a business can fail in the event of cash shortages despite being profitable (p. 953). In addition, cash flow statements guide businesses in determining profits as well as evaluating default perils and re-investment needs. Arnold et al. maintain that cash flow should be distinguished from profitability (p. 46).

Fundamental Methodologies and Examples

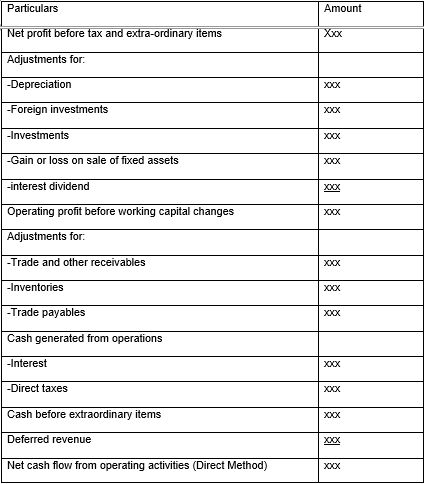

There are three methodologies of preparing cash flow statements, namely, operation, investment, and financing activities. Klammer notes that the operations option entails two approaches, which include the direct and indirect methods (p. 232). Operating activities represent the primary revenue-generating endeavors of an enterprise as well as other businesses that do not involve investments or funding. Operating activities encompass transactions that involve revenue receipts and expenses that affect net income (Khan et al, p. 954). The direct method presents a cash flow statement as an income statement or a profit and loss account determined on a cash basis. In this technique, the difference between cash receipts and cash payments provides the net cash flow. It is noteworthy that the direct method omits non-cash transactions. Items of cash in-flow include receipts from the sale of products, royalties, fees, and commissions, among other revenue(Arnold et al, p. 47). The cash out-flow encompass payments to suppliers of goods or services and employees. Klammernotes that it is necessary to make adjustments for an increase/decrease in both current assets and liabilities to get net cash flows from the operations (see table 1).

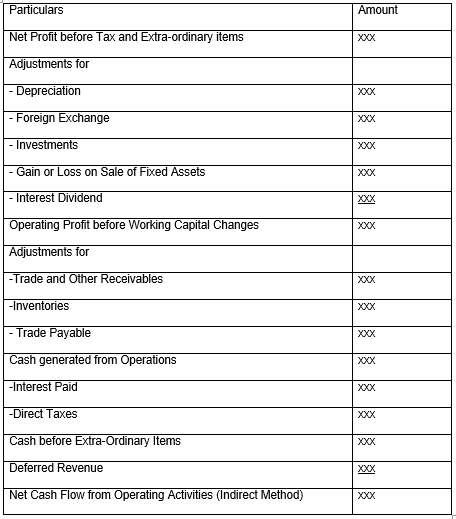

The alternative method uses the net profit/loss for the given time frame as the base (see table 2). However, it is essential to make adjustments for items that influenced the income statement but did not impact the cash. Moreover, the indirect method requires the addition of non-cash and non-operating charges in the revenue declaration to the net earnings (Klammer 245). As well, it mandates subtraction of non-cash and non-operating credits to determine the operating profit before working capital changes. Again, it is mandatory to make adjustments in both current assets and liabilities to establish the remaining cash flow from the firm’s operations (Arnold et al, p. 46).

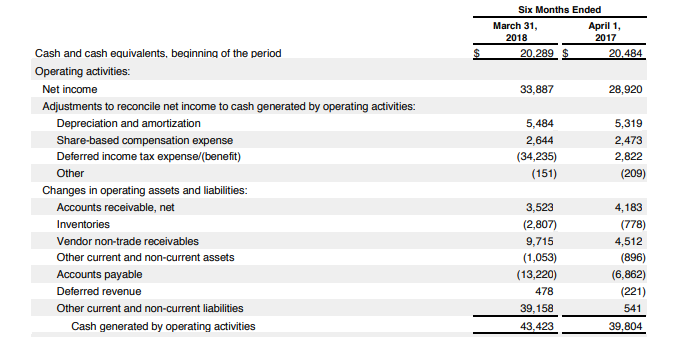

Analysts compare statements from operating activities with an enterprise’s net income to assess the quality of its paychecks. For example, when cash flow is higher than net income, economists give the company’s earnings a higher rating(Profir, p. 38). Contrastingly, low cash flow from operations signals an alarm to investors. An example of a cash flow statement from operations for Apple Inc. between April 1st, 2017, and March 31st, 2018 is shown in table 3.

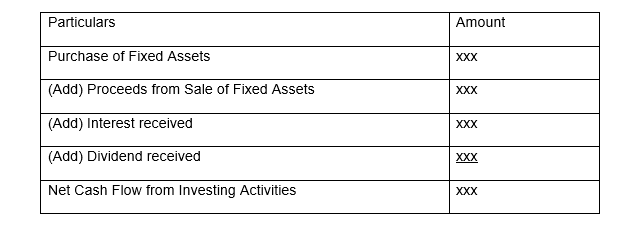

Further, a firm can analyze cash flows using investment activities, which involve acquisitions and sales of long-term assets. Investing activities comprise firms’ transactions and events that entail the purchase of long-term productive assets that are not meant for resales such as land, equipment, and machinery. Items from cash inflows from investing activities include cash receipts from the sale of fixed assets, including intangibles, shares, and warrants (Klammer 270). Further, repayments of overdrafts and loans given to third parties form part of cash inflows for investing activities. In addition, cash earnings and expenditures that associate with future, option, swap, and forward contracts fall in the category of investing activities. According to Arnold et al., items of cash outflows from investing activities include payments made in the acquisition of fixed assets and expenses on capitalized research and development expenditures (48). Likewise, cash outflows comprise payments made to obtain shares, permits, debt instruments of other companies, interests in joint ventures, cash upfronts, and lendsmade to third parties (see table 4).

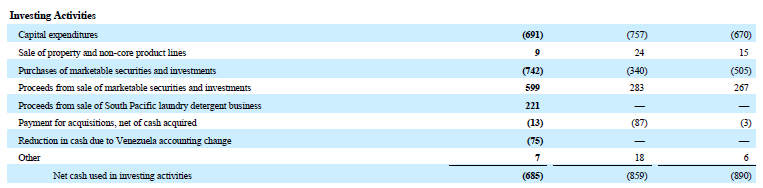

Table 5 shows an example of a cash flow statement from investment activities for Colgate in 2015. The company’s cash flow from investments amounted to $685 million in 2015 and $859 million the previous year. Moreover, the table estimates that Colgate’s principal capital reached $691 million in 2015 while it amounted to $757 million in 2014. The company obtained $599 million as earnings from the disposal of vendible securities and reserves (Klammer, p. 270).

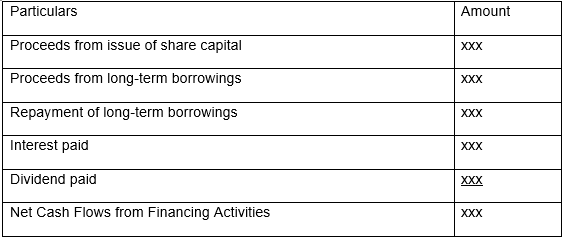

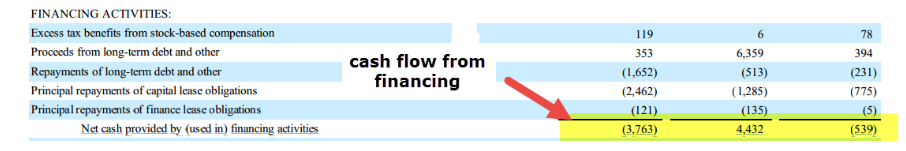

Additionally, cash flows can be analyzed from the funding activities of an enterprise. Such activities cause changes in the scope and structure of a firm’s capital and debt (Klammer 280). Items of cash inflows from financing activities comprise proceeds from issued shares, bonds, debentures, loan notes, and other temporary borrowings. Particulars of cash outflows for this method include cash repayments of borrowed funds and dividends (Arnold et al, p. 52). Preparation of cash flow statement from financing activities is shown below in Table 6. Furthermore, an example of cash flow analysis from financing activities for Amazon is shown in table 7.

For instance, cash flows for Amazon in 2014 involved repayments of long-term debt, capital, and finance lease obligations (see table 7). The proceeds from long-term financing remained consistently high. The information indicates that Amazon borrowed long-term debt continually. Likewise, repayments for long-term funding display massive cash outflow, which shows that the company paid long-term debt extensively in 2014. This information is crucial for investors to explore whether Amazonfinanced its debt by taking additional loans.

Works Cited

- Arnold, Allen G., et al. “Toward Effective Use of the Statement of Cash Flows.” Journal of Business & Behavioral Sciences, vol. 30, no. 2,2018, p. 46-54.

- Khan, Usman A, et al. “A Critical Analysis of the Internal and External Environment of Apple Inc.” International Journal of Economics, Commerce, and Management, vol. 3, no.6, 2015, pp. 955-961.

- Klammer, Tom. Statement of Cash Flows. 6th ed., John Wiley & Sons, 2018.

- Profir Ludmila. “Analysis of Financial Performance Based on the Relationship between Investments and Cash-Flow.” Management Intercultural, vol. 1, no. 40, 2018, pp. 33-48.