Introduction

Currently, Saudi Arabia is an important actor of the global economy, which indicates the relevance of its investigation. The paper will reveal trends in the economy of the country and will be organised as follows. Part 1 will show Saudi Arabia’s economic growth, unemployment and inflation. Part 2 will cover the aspects of consumption, investment, government spending and net exports. Part 3 will explore the aspects around oil, gas and petrochemical. Part 4 will be about industrial production and housing; part 5 will investigate forecasts, risks and policy implications. Part 6 will discuss the issues of the impact of COVID-19 on the Saudi economy. Finally, parts 7 and 8 will study G20 and 2030 Vision, respectively.

Measuring the Saudi Arabia Economy

Economic Growth

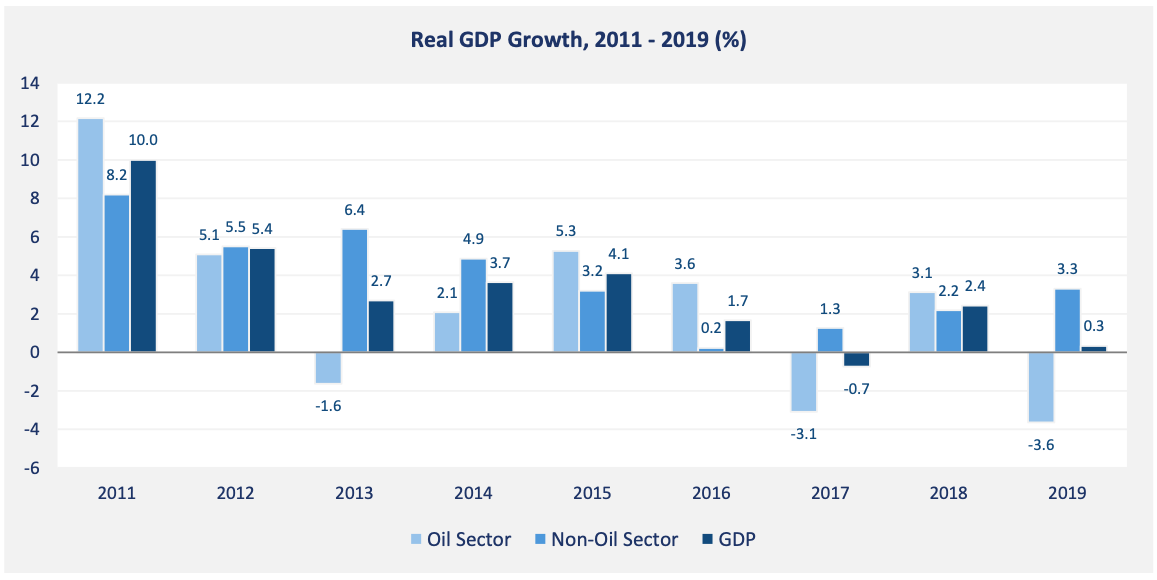

It should be stated that Gross Domestic Product (GDP) of the country demonstrated an annual growth of 0.3% in 2019 while in 2018, the growth was 2.4%. Primarily, this growth arose from retail trade, hospitality market, businesses and transport (General Authority for Statistics, 2019a). Then, in the non-oil sector, economic growth increased by 3.3% – mostly due to the private sector – this indicator was 2.2% in 2018. Moreover, in 2019, economic activities in the oil sector decreased by 3.6%; in 2019, the latter measure was positive – 3.1% (Figure 1). It might mean that Saudi Arabia is on its way to diminishing dependence on oil.

Unemployment

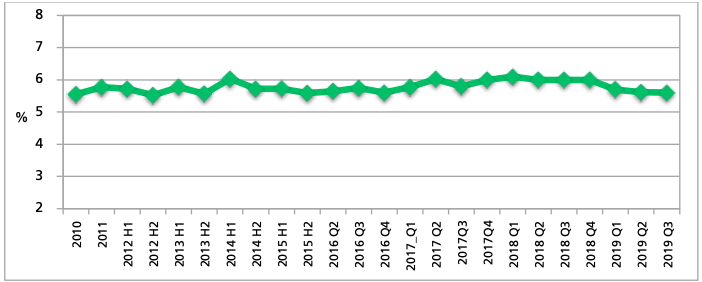

The number of employed persons was 12 927 908 in the third quarter of 2019. Then, the total unemployment rate was 5.5% that is less for 0.5% in comparison with the same period in 2019 – 6% (General Authority for Statistics, 2019b; General Authority for Statistics, 2019c). It is a crucial indicator that reveals the fact that Saudis are becoming more occupied, which stimulates economic development. Nevertheless, it should be noticed that the substantial part of unemployed persons were females and the ones who had a university degree (General Authority for Statistics, 2019b; General Authority for Statistics, 2019c).

Inflation

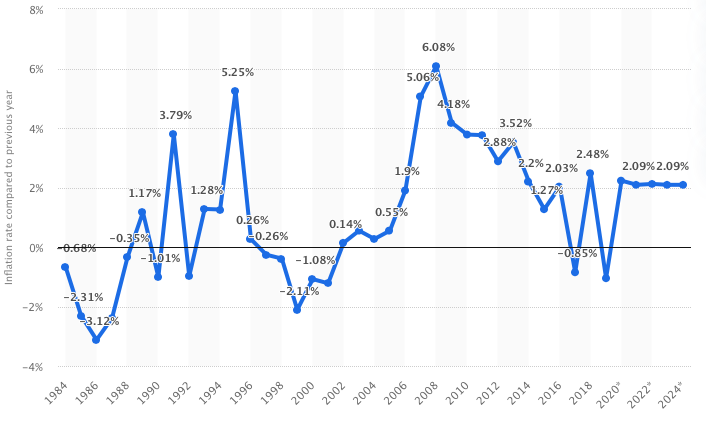

As evident from Figure 3, the inflation rate in 2018 was 2.48%, which might be considered as quite a low percentage. Moreover, in 2019, temporary deflation took place – the inflation rate here was -1.05%. It seems reasonable to state the economy of Saudi Arabia is relatively stable due to increased oil reserves, the growth of GDP and the low unemployment rate. However, deflation is not a constant phenomenon, and it is predicted that the inflation rate will increase by about 3%.

Components of Economic Growth

Consumption

Consumption is a vital factor that shows the ability of the population to buy (or consume) goods and services. It should be noted that consumption rates affect the Gross Domestic Demand to a great extent. In 2019, the growth of the latter indicator was up by 5.3% from 2018 due to more expenditures in “both private consumption and gross capital formation” (General Authority for Statistics, 2019a, p. 2). According to General Authority for Statistics (2019a, p.2), in comparison with 2018, Private Final Consumption Expenditures increased by 3.5% in 2019, and Gross Capital Formation increased by 15.7%; Government Final Consumption Expenditures decreased by 2.3%.

Investment

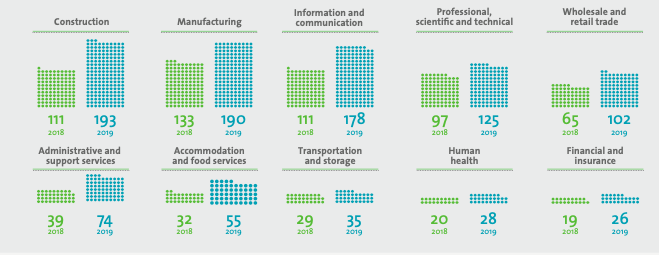

Saudi Arabia is a popular country to invest in – there were $3.5 billion of foreign direct investments (FDI) in 2019; in 2018, this sum was $3.18 billion (Invest Saudi, 2020, p. 1). Hence, in 2019 the increase of FDI inflows was 10.2% in comparison with 2018. Then, 2019 was a record year for the country’s investors – 1131 investor licenses were awarded, which is 54% more than in 2018. Figure 4 shows that the increase of new foreign investor licenses is characteristic of all economic sectors of Saudi Arabia.

Public Finances

In 2018, there were SAR 906 billion of total revenues in Saudi Arabia; it is predicted that revenues will be SAR 917 billion in 2019, in 2020 – SAR 833 billion (Ministry of Finance, 2020, p. 6). Then, according to the Ministry of Finance (2020), total expenditures were SAR 1079 billion in 2018; in 2019, they will be SAR 1048 billion; in 2020 – SAR 1020 billion (p. 6). Table 1 shows that the budget deficit (GGB)1 is foreseen to increase to -6.4% of GDP by 2020, and it is expected that the GG debt2 will be 26% of GDP.

The primary tool that is aimed to deal with GGB and GG Dept is the Saudi fiscal policy that may be defined as the chosen direction of the government regarding financial affairs. This policy is quite a beneficial instrument as it is “aimed at maintaining fiscal and economic stability and strengthening the resilience of the Saudi economy” (Ministry of Finance, 2020, p. 15). The Ministry of Finance may be considered as the foremost independent fiscal institution – an independent public establishment with a mandate to direct a budgetary policy – in Saudi Arabia that contributes to rational financial decisions.

Table 1. GGB and GG Dept (% of GDP).

Internal and External Trade

It should be stated that in 2018, Saudi Arabia demonstrated a better current account than in 2019 – $70 606 million and $49 842, respectively (Saudi Arabian Monetary Authority, 2020, p. 124). No substantial shifts in the export of goods took place: Saudi Arabia had more oil exports – $231,585 in 2018 and $202,370 in 2019 – than the non-oil ones – $62,280 in 2018 and $58,314 in 2019 (Saudi Arabian Monetary Authority, 2020, p. 124).

Furthermore, Saudi Arabia is a member of the Gulf Cooperation Council (GCC) with five other countries – Kuwait, the United Arab Emirates, Qatar, Bahrain and Oman (Al-Ubaydli and Jones, 2018). Such cooperation alleviates the trade and other affairs between the participants, which contributes to the increased flow of goods, services and human resources (United Arab Emirates: Ministry of Finance, no date).

Oil, Gas and Petrochemicals

Oil

Saudi Arabia’s oil exports were $231.5 million in 2018 – 78.7 % of the total exports (Saudi Arabian Monetary Authority, 2020, p. 124). According to the Saudi Arabian Monetary Authority (2019), such high indicators were attributed to a rise in oil prices in global markets. However, it should be stated that the situation changed in 2019. Oil exports decreased to $202.3 million (Saudi Arabian Monetary Authority, 2020, p. 124), which shows the dependency of oil trading on various economic and political circumstances.

The government recognises that the country’s economy is over-depended on oil exports and contributes to Saudi Arabia’s economic growth to a greater extent than any other factor. Nevertheless, Saudi Arabia develops many projects and policies to overcome this dependency. Due to the latter approach and the world’s gradual shift to environmentally friendly technologies, demand for oil will reduce, so as Saudi Arabia’s oil exports.

Gas

The production of Saudi gas – about 118 billion cubic meters in 2018 (OPEC, 2019) – is still fully used for domestic consumption. However, taking into account the kingdom’s reserves – about 8.5 trillion cubic meters (OPEC, 2019) – the development of export supplies is possible. It should be emphasised that in Saudi Arabia, natural gas is not being exported at all – production volumes are used to satisfy inner needs. However, there has been a number of announcements, according to which Saudi Arabia will move toward the increase of this production. It allows assuming that the possible scenario is the development of the domestic gas market: in this case, Saudi Arabia can reduce the consumption of its own oil, sending more volumes for export.

Petrochemicals

In 2018, the export of petrochemicals was SAR 154,721 million, which is 14 % of all non-oil exports (Saudi Arabian Monetary Authority, 2019, p. 112). It is the biggest share among the other non-oil exports of Saudi Arabia. Hence, the petrochemical industry plays an important role in Saudi Arabia’s economy and may be perceived as quite a perspective object for investments. The officials tend to develop the petrochemical market, fixing such a direction in some crucial documents, such as 2030 Vision.

Sectoral Economic Growth

Industrial Production

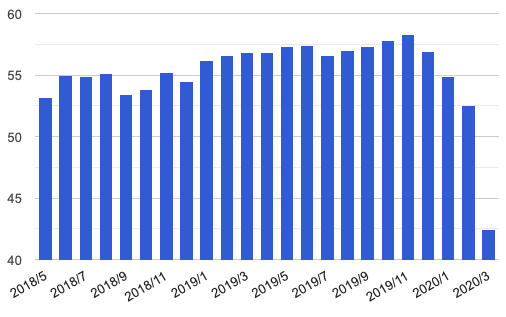

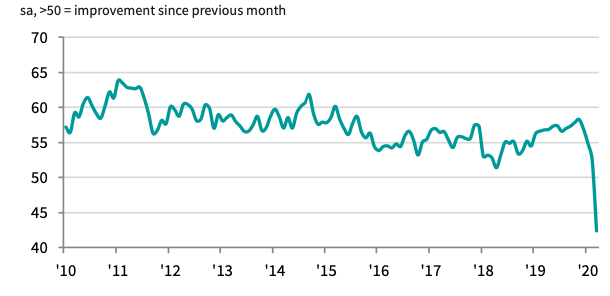

Production for Manufacturing Industries for the fourth quarter in 2019 was 1% lower than during the same period in 2018 (General Authority for Statistics, 2019d, p. 14; General Authority for Statistics, 2018, p.13). Such a little difference cannot be considered crucial; thus, the country is quite stable in the regard above. Then, the average value the manufacturing PMI during the period from May 2018 to March 2020 “was 55.21 index points with a minimum of 42.4 index points in March 2020” (Saudi Arabia: Purchasing, 2020, para. 1).

As evident from Figure 5, PMI for the fourth quarter in 2019 increased to 57,7 from 54,5 in the same period in 2018. According to the latter fact, the economy will demonstrate a growing tendency in further. However, the impact of COVID-19 decreased the PMI to 42,4.

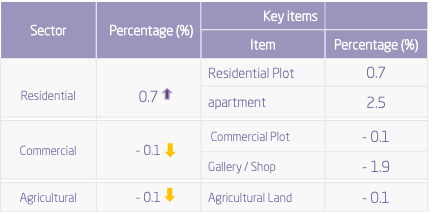

Housing

General Authority for Statistics (2019e) claims that “Real Estate Price Index for Q.4 of 2019, compared to Q.4 of 2018 increase by (0.5%) due to changes that took place in the constituting sectors of the index” (p. 8). As evident from Table 2, such a positive shift happened mostly because of the increase of percentage – 0,7% – in the residential sector index during the compared above periods. Hence, it seems reasonable to assume that housing prices demonstrate a growing tendency, which is one of the primary indicators of sustainable economic development and growth.

In comparison with 2018, it might be supposed that prices were under greater pressure in 2019 when increased transaction volumes in the central cities took place. It indicates that the market may be moving to the lowest point of its cycle. Then, the urban population tends to grow, and there is a mismatch in the supply of housing stock to low and middle-level purchasers. Thus, the affordability of housing appears to be quite a challenging task for Saudi Arabia.

The Sakani affordable housing program and the aspirations to extend the mortgage market are a significant foundation for facilitating pressures in the housing framework (Ministry of Housing, no date). Moreover, “SAMA has established cooperation with the Ministry of Housing with respect to the subsidised housing finance programs” (Saudi Arabian Monetary Authority, 2019, p. 152).

Forecasts, Risks and Policy Implications

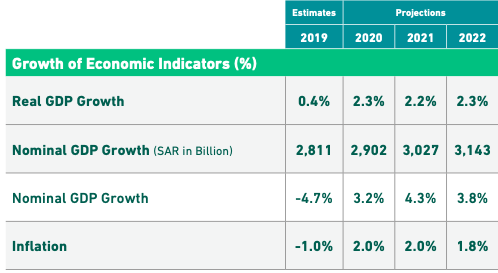

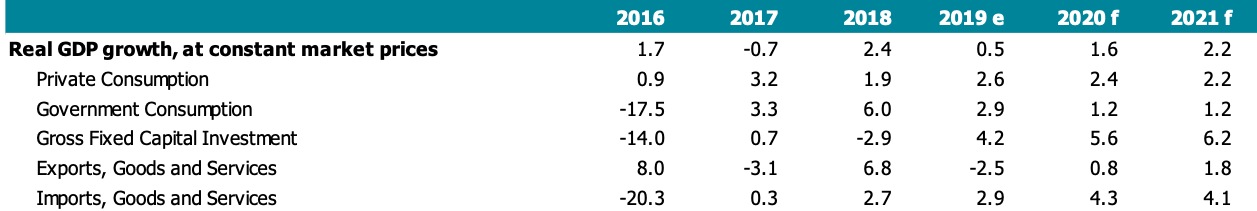

Forecasts

The Ministry of Finance (2020) claims that the real GDP grew at 0,4%, mostly because of “higher-than-expected improvement in real non-oil GDP” (p. 13). Table 3 shows that preliminary estimates point at the real GDP growth of 2.3% in 2020, and 2.2% and 2.3% in 2021 and 2022, respectively. Furthermore, the World Bank also foresees the economic growth of Saudi Arabia, however, with more modest numbers than the country projects (Table 4).

Risks and Policy Implications

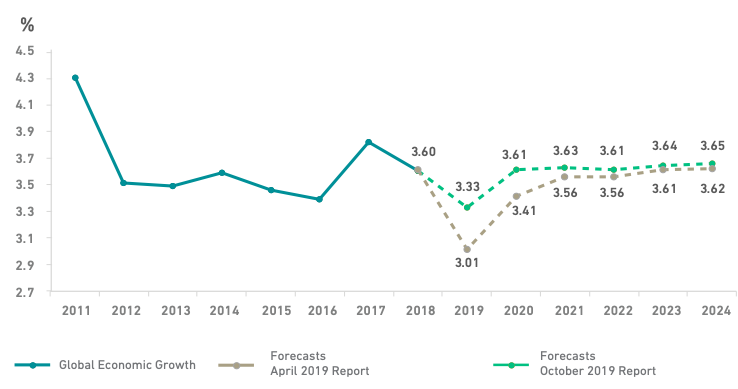

The Ministry of Finance Major states three major financial and economic challenges for Saudi Arabia: global economic slowdown, oil price volatility and low non-oil GDP growth. It is claimed that in light of global economic problems, trade tensions are the most critical risk that “increased volatility of global markets” (Ministry of Finance, 2020, p. 41). The International Monetary Fund (IMF) lowered its estimates of the world’s real GDP to 3.0% and 3.4% for 2019 and 2020, respectively, in October 2019 in comparison with April 2019 predictions (The IMF, 2019a, p. 185; The IMF, 2019b, p. 176; Figure 6).

The government’s goal is to support a rational financial policy to enhance the sustainability of the economy to negative external shifts. Then, “restrictions on oil production and developments in the supply are additional negative indicators” (Ministry of Finance, 2020, p. 42). Saudi Arabia aims to implement policies, according to which it will stimulate non-oil GDP growth and find a balance of oil producers and consumers.

Impact of COVID-19 on the Saudi Economic

COVID-19 has influenced Saudi Arabia’s economy to a great extent in each sector. Currently, the country’s “PMI [is] at its lowest since the survey began in August 2009” (IHS Markit, 2020, p. 1). It means that all opportunities and capabilities for development and growth are hindered. According to HIS Markit (2020), the lower economic activity takes place due to “business closures and delays to projects amid the global public health crisis” (p. 1). Figure 7 shows the drastic fall of PMI, which indicates a plethora of upcoming difficulties of various characters.

G20

In 2020, Saudi Arabia is taking the presidency of the G20, which means that the country has developed a theme for the year that is pivotal to global discussions. Saudi Arabia proposed the following idea: Realising opportunities of the 21st century for all (Presidency agenda, no date). The country emphasises the importance of creating conditions in which all people can live, fostering collective efforts to protect humanity’s commons and adopting strategies to implement innovations. The taking of such a responsibility enhancing Saudis’ reputation and might lure many recourses to come into the country.

Vision 2030

Vision 2030 is a program aimed at restructuring the country’s economy, which will reduce its historically high dependence on oil due to changes in the Kingdom’s income sources (Vision 2030, no date). First, the program provides for an increase in non-oil revenues by increasing fees and tariffs for utilities, gradually expanding the tax base. Second, the authorities want to cut spending by lowering subsidies, reviewing massive state investment programs and cutting spending on arms purchases abroad. Third, the government intends to diversify the assets of its national wealth and, in the process, increase current investment income.

Conclusion

In conclusion, it seems reasonable to state that Saudi Arabia has chosen the way of economic development with an accent on sustainable and progressive policies and approaches. The above statistics demonstrate that the country tends to show quite significant indicators of economic growth. Then, the government proposes and implicates a large number of projects and initiatives of various characters. The above assumptions are evident from the provided numbers that compare periods in 2018 and 2019. The country is gaining a strong international reputation by its activity in such organisations as G20.

However, there are some substantial factors that hinder the smooth and coherent development of Saudi Arabia. First, it is the country’s over-dependency on oil – its economic growth is mostly based on the exports of this good. Second, it is the global economic slowdown that negatively affects all the countries. Third, it is COVID-19 that made most of Saudi Arabia’s economic activities stop and drop its PMI to the lowest point since 2009.

Reference List

Al-Ubaydli, O. and Jones, E. (2018) GCC economic integration: opportunities and challenges. Web.

General Authority for Statistics (2018) Industrial production index (IPI), 2018, 4th. Quarter. Web.

General Authority for Statistics (2019a) Gross domestic product 2019. Web.

General Authority for Statistics (2019b) Labour market, third quarter 2019. Web.

General Authority for Statistics (2019c) Labour market, third quarter 2018. Web.

General Authority for Statistics (2019d) Industrial production index (IPI), 2019, 4th. Quarter. Web.

General Authority for Statistics (2019e) Real estate price index, fourth quarter 2019. Web.

IHS Markit (2020) IHS Markit Saudi Arabia PMI. Web.

Invest Saudi (2020) Investment highlights. Web.

Ministry of Finance (2020) Budget statement: Fiscal year 2020. Web.

Ministry of Housing (no date) Sakani. Web.

OPEC (2019) Natural gas. Web.

Plecher, H. (2019) Inflation rate in Saudi Arabia from 1984 to 2024. Web.

Presidency agenda (no date) Web.

Saudi Arabia: Purchasing Managers Index (PMI), manufacturing. (2020). Web.

Saudi Arabian Monetary Authority (2019) 55th annual report. Web.

Saudi Arabian Monetary Authority (2020) Monthly bulletin February 2020. Web.

The IMF (2019a) World economic outlook. Web.

The IMF (2019b) World economic outlook. Web.

The World Bank (2019) Saudi Arabia: recent developments. Web.

United Arab Emirates: Ministry of Finance (no date) GCC economic integration. Web.

Vision 2030 (no date). Web.

Footnotes

- Budget deficit is the excess of budget expenditures over its revenues.

- GG Dept it is the state’s expenditures on the payment of income to creditors and the repayment of obligations that have come due.