Executive summary

Purpose

To determine if the 2008 Global Financial Crisis was a planned or unplanned change based on government and organization reaction, to determine reasons why people and organizations resisted changes that were brought about by GFC and determine if Australian Government reaction to changes brought about by 2008 GFC fitted developmental, transitional or transformational change.

Approach/methodology

The study used a content analysis approach which was delivered through qualitative content analysis. The study used descriptive studies on 2008 GFC to quality and quantify GFC as planned or unplanned change based on organization and governmental reaction to it; identify the reason behind people and organizational resistance towards changes brought by 2008 GFC and level of Australian government fitness

Results

The study determined that the 2008 GFC was a planned change based on organizational reaction and unplanned change based on governmental reactions. The study determined that the 2008 GFC was caused by capital market liberalization and securitization, Credit default Swaps that were not reflected on organizational net leverage. The people and governmental resistance to changes brought about by 2008 GFC were based on government reaction to changes through injection of the economic stimulus package that didn’t translate into economic recovery. The study determined that the Australian government reaction to 2008 GFC fitted developmental change, transitional change, and transformational change

Policy implication

The study was instrumental towards the determination of deficiencies of economic theories and free-market theory in financial stability management. The study provided the basis for the government to develop transformational, developmental, and transitional policies that could result in the regulation of financial markets and incremental stability of financial institutions through sustainable management of liquidity and debt-to-equity ratio.

Introduction

Schermerhorn (2011, p.434) claims in managing organizational change, leaders ought ensure decisions that are made regarding long-term investment products are right and have no likelihood of affecting organization liquidity. Leading organizational change should seek to align business processes with long-term projected goals. Timeliness of decisions impacts on sustainability of a business lifeline and lifecycle. Spreitzer et al (2005) argued that failure of an organization to make competent decisions that could contribute into sustainability of business processes have impact of contributing in potential of an organization to fallback to an exit strategy through mergers and acquisition or close business activities.

The events leading to 2008 GFC through investment in capital market liberalization resulted into increased financial investment in securitization that was not regulated and was not accounted for in organization’s net leverage reports that made it impossible to determine value of real credit risk of a financial organization (Bohn et al, 2005). People and organizations expressed concerns on feasibility of capital market liberalization but organizations shot down people pessimism (Choi, 2000).

Goals and objectives

The aims of this report is to adopt an organizational change management perspective in order to validate if GFC, government and organizational reaction to GFC could have been a planned or unplanned change hence or otherwise determine reasons that made people or organizations to resist change caused by GFC and subsequent economic downturn. The report further investigates if Australian reaction to GFC fitted developmental, transitional or transformational change.

GFC as planned and unplanned change

GFC that began in the US and spread into developed economies qualifies to be a planned change based on organizational reaction and unplanned change based on governmental reaction. Stiglitz (2008a, 2008b, 2008c) claims GFC resulted from capital market liberalization that was perceived as a form of financial market innovation. People efforts to bring down the perceived innovation were “argued against from suppressing the innovation by financial market organizations”. Organizations protected capital market liberalization because securitization was not included into organizational net leverage. However, the organizations didn’t make timely decisions towards reducing opportunities for regulations and long term impact of “anti-trust measures”. Stiglitz (2008b, 2008c) has argued that although capital market liberalization was innovation “it was not in the ways that could have made economy stronger” hence qualifying GFC as a planned change.

The organization didn’t develop standards for securitization and engagement in Credit default swaps since CDS were not reported in net leverage and were unregulated. As a planned change, concerns to manage capital market liberalization were perceived as anti-capitalism and anti-socialism. The perceived “financial innovation” (Stiglitz, 2008a, 2008b, 2008c) resulted into abuse of democratic processes to organizational change which didn’t conform to theory of free markets and real capitalism (Auernheimer, 1974).

As a result, economic theories for instance the Keynesian theory of macroeconomics claim that the outcome of the planned change had impact of resulting into unfettered financial markets that could not self-regulate or self-correct which demanded regulation (Hicks, 1981). Market fundamentalism as a driver of the GFC fueled subprime crisis through financial instruments for instance securitization. Securitization resulted into a scenario where banks and financial institutions pooled credit facilities like loans into sellable assets (Dell’Ariccia et al, 2008) that further support the claim that GFC was a planned change. This created an environment where the financial institutions began to off-load risky loans into other financial institutions.

The concept to off-load loans was opportunity and financial innovation but it resulted into build-up of inventory and non-performing loans which predisposed liquidity problems. As a unregulated planned change CDS, securitization and capital market liberation didn’t conform to lean principles of production hence predisposing build up of inventory and exposing organizations into decreased operating capital and set pace for liquidity problems. The financial institutions, by virtue of presence of non-performing loans borrowed more money by using non-performing capital as securities that were not regulated or formed part of net leverage which increased credit risk (Traill, 2008).

The borrowing of funds by financial institutions was meant to stabilize securitization, improve operating capital and liquidity. Financial institutions didn’t determine risk profile of savers because they had position to borrow or engage in inter-bank lending to sell off-loaded loans as securities (Krishnamurthy, 2008). Securitization as a core competency and a planned change management exhausted higher markets for investment which resulted into exploitation of riskier markets like subprime markets (Korobkin, 2003).

There was increasing inter-bank security purchases which further created environment for Collaterized Debt obligations (CDO) to spread the financial risks. Emergence of CDO fueled investment banking through buying, selling and trading risks which decreased capabilities for control and management (Dwyer et al, 2010). This created risk exposures and resulted into investment crisis of confidence. This affirmed GFC as a resultant of a planned change (Gould, 2008)

The government reaction qualifies GFC was unplanned change. The government didn’t associate GFC with systemic risk hence use of stimulus packages to turnaround the economy (Gillette, 2009). The economic stimulus didn’t have positive impacts on GFC because the stimulus package was not used to manage systemic risks. Bail out plans resulted into injection of credit into the financial industry which, due to lack of monetary control and management structures, resulted into increasing accumulation of debt-to-equity ratio which provided opportunity for determining hedge funds safety was decreasing. Economic theories claim economic stimulus is meant to stimulate and induce investment and promote consumption hence increasing production and investment (Acharya & Matthew, 2009). However, GFC economic stimulus didn’t contribute into increased production or investment due to crisis of confidence. This goes against Keynesian theory (Mishkin, 2007) because GFC as outcome of planned change could not cope with intervention methods for economic crisis that fit unplanned change.

Reasons people and governments resist change

People and organizations resisted changes caused by GFC due to crisis of confidence in financial instruments (Morris & Hyun, 2008). People were not confident with securitization as a financial innovation. Securitization was not included into net leverage hence no reflection of its performance. Keynesian theory claims that micro-economic actions towards managing economic downturns have capability to contribute into inefficient aggregate macroeconomic outcomes where the economy is predisposed to operate at levels below targeted potential outputs and hence incapacity to sustain a positive growth rate (Hicks, 1981; 1937).

Organizations resist changes because according to classical economic theory for instance Say’s Law, aggregate supply has capacity to create its own aggregate demand which implies a crisis could be self-correcting in the long term. Some of the proposed changes for managing unplanned financial crisis and unplanned economic downturns involve government borrowing, stimulus package to bailout organizations and stimulus packages to stimulate consumption which increases debt on people and organizations as taxpayers. People and organizations could then have resisted changes brought by GFC because this could have meant risk was being transferred into people and organizations as taxpayers (Traill, 2008).

The rationale for bailout stimulated people and organizational resistance to changes created by GFC due to unclear understanding of framework of bailout in order to manage possibilities of perception that the bailout is a form of trickle–down economic which would translate into “treating a patient by giving a massive blood transfusion while there’s internal bleeding” (Dwyer et al, 2010). Resistance would mount because people and organizations would demand use of “polluter pays principle” as applied in environmental conservation hence institutions that were responsible for GFC ought to have carried burden (Acharya & Phillipp, 2009).

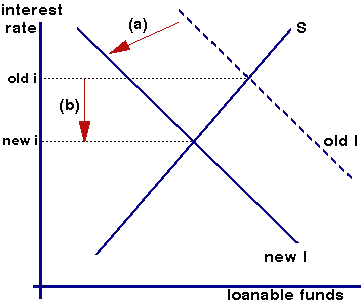

Classical economics claim people and organizations are likely to resist changes predisposed by GFC. In the event a planned fixed investment falls for instance from old I (Old Interest rate) to new I (New Interest rate) (figure 1), it would mean interest rates are likely to fall due to excess supply of loanable funds as it occurred in stimulus packages that were meant to manage GFC impacts (Agazzi, 2010).

Decreased investment would arise due to use of stimulus package towards meeting costs of payment and securitizations and giving more loans. Any excess saving that might result would stimulate drop in interest rate which would result into a condition where saving is equal to investment. Under reduced consumption, investment would fall and hence fall in economic growth that would predispose incapacity to recover from crisis which would also force organizations to resist change created by GFC.

People and organization could resist changes brought about by GFC due to prevalence of uncertainties and instability with regard to financial, currency and commodity markets (Appel, 2009). Organization could react negatively towards capital market liberalization based on past evidences where market liberalization in commodity and financial sector had failed to stabilize economy. As a result, people and organizations exhibit resistance to unregulated financial markets based on past failures and past experiences.

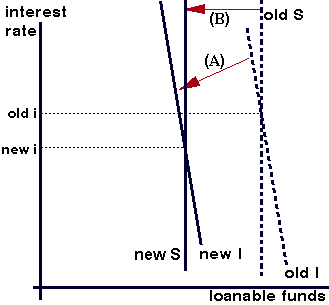

Through use of laissez-faire theory and Keynesian theory, as interest rates fall, savings don’t fall proportionally due to conflict arising from income and influence of substitute products which is also associated with planned fixed investment. However it has been claimed that planned fixed investment affects long term expectations and future expected profitability margins (Acharya et al, 2008). Thus, consumption structure as a function of spending doesn’t rise given fall in interest rates which demonstrate inelastic nature of the demand and supply as driving-vital elements towards achievement of capacity to manage saving-investment gap (Meza & Reyners, 2008).

The possibility of achieving balance could be attained if the interest rate was negative which was not practical with regard to 2008 financial recession hence could cause resistance from people and organization. Negative interest rate could be achieved at New I (new Interest rate) at a point where it intersects the old S (Old supply) curve (figure 2).

Based on Keynesian theory, the fear of loss of capital has higher probability to create environment for people and organization to resist changes caused by GFC. This is because it predisposes liquidity trap which creates environment where interest rates cannot fall if reduction of interest rates was to be applied to stimulate investment and consumption (Schermerhorn et al, 2011). As a result, increasing supply of money increases inflation and could stimulate organizational resistance especially negative impacts of increased money supply with regard to loss of value of bonds

Fitness of Australian government reaction to developmental, transitional and transformational change

The Australian government reaction to GFC fit with needs for developmental, transitional and transformational change.

Government developmental change fit

The Australian government reaction to GFC fits context of developmental change that involves improvement of processes through re-structuring of financial instruments via improvement of skill competencies, adoption of a crisis proof monetary and fiscal policies and adoption of new framework for managing financial industry so that it is independent from external forces (Schermerhorn et al, 2011).

This is based on economic theory where for instance, deficiencies of regulation results into internal markets that cannot self regulate. Through developmental change management, Australia government stopped reliance on market fundamentalism, capital market liberalization and securitization. Australian government adopted efficient market model that ensures adoption of relevant economic theories that could support financial management, adoption of reliable financial statistical analysis to inform decision making and capability to utilize financial probability management to effect financial industry management which would reduce opportunities for engaging in risky behavior of rewarding or promoting financial crisis in the long term (Schermerhorn et al, 2011).

Use of efficient market model has capability to ensure prices reflect market information and trends in consumption which would add value to inflation targeting and management. As a result, developmental change has capacity to divert attention from inflation into structures for building financial stability. Thus Australian government control of inflation was important ingredient towards adoption and implementation of sound economic theories. This made it possible to ensure stimulus packages didn’t go to fund bonus payment and dividends at the expense of financial institution capitalization (Krishnamurthy, 2008).

Australian government implemented need for raising of capital reserve requirement s for the banking industry and reduction of leverage that had been employed by the financial sector. The move included measures meant to address financial market stability through self regulation and self rating which ensured transparency for instance in hedge funds and relevant financial schemes. The developmental change was evident through introduction of currency exchange tax which had impact of managing threats of currency speculations and financial volatility.

Australian government transitional change fitness

The Australian reaction to the GFC satisfied the transitional change towards financial crisis management (Appel, 2009). The Australian government developed structures for protecting her export revenue through trade and investment with neighboring states as opposed to reliance on developed economies like United States, which was vital towards insulating the nation against future financial crisis that might emerge from the developed economies (Stewart & Kringas, 2003). This form of integration was based on diversification and capabilities to manage debt-to-equity ratio and manage risks of globalization which was in the past perceived to be a form of risk diffusion. Australia government developed a transitional change via development of bankruptcy code which would facilitate sovereign debt restructuring (Acharya & Matthew, 2009).

The transitional change was meant towards achievement of capital adequacy requirements through capabilities to attain counter-cyclical and pro-cyclical balance hence reducing access to credit even in good economic times. This was further supported by adoption and implementation of stricter tax regulations and financial standards on private equity funds. The transitional measures were meant to manage predisposing factors to GFC for instance financial system breakdown which is economically oriented, environmental structures with regard to policies on global warming; cultural tolerance of financial system sustainability through management of cultural financial intolerance and incapacities brought about by western cultural compliance for instance Breton wood institutions for example the IMF and world Bank and management of political influence on financial instruments with regard to managing democratic deficits and threats of free market economy based on free market principles.

Australian government transformational change fitness

The Australian government reaction to GFC was in line with transformational change that ensured non-reliance on financial market liberalization as financial innovation of managing risks through creation of risks. Australia government in implementing transformation change didn’t follow economic theories for managing financial crisis through increased borrowing, and increased infrastructure but instead adopted policies towards efficient stabilization of interest rates and tax strategies towards managing reserves and stopped use of borrowing to service capital deficits which could have increased debt at taxpayers expense (Acharya & Phillip, 2009).

This further helped to restore investment confidence and managed crisis of confidence that were evident in developed economies like the USA. Stopping borrowing was implemented because borrowing funds during periods of crisis increases risks which affect growth during debt payback when economic is at recovery stage.

Australian government didn’t reduce taxes because this could have decreased government revenue when the Australian government needed to stabilize and strengthen her revenue. Decreased revenue from tasks would have increased secondary risks in health sector and education (Appel, 2009). The financial crisis management through transformational change ensured less investment in infrastructure which further created opportunity to protect revenues. However, Australian government implemented regulation of financial institutions in order to balance free market principles and democratic influence (Meza et al, 2008).

This made it possible for the Australian government to manage and guide its development and progress. Australian government further implemented need for repayment of debts. Tax increase was favored to reduce borrowing. The transformational change was implemented in the banking industry through enhanced technological learning, neighborhood state economic integration and management of commodity prices to stabilize consumption structure.

Conclusion

The study determined that GFC was a planned change based on organizational reaction and unplanned change based on governmental reaction. As organizational planned change, GFC resulted from investment in capital market liberalization through securitization, credit default swaps that were not reflected in net leverage due to lack of regulations and predisposed decreased liquidity. This resulted into organizational use of government economic stimulus to pay credit, dividend and provide credit by servicing securities.

The study identified reasons that made people and organizations to react to changes that were created by GFC. The study further determined that Australian government reaction to GFC fitted transitional, developmental and transformational change and that organization and governments were oriented towards adopting and implementing transformational change that combines developmental and transitional change initiatives.

Works cited

Acharya, Viral V., and Matthew Richardson, eds. (2009), Restoring Financial Stability: How to Repair a Failed System, New York University Stern School of Business/John Wiley & Sons.

Acharya, Viral V., and Philipp Schnabl (2009), Securitization without Risk Transfer: The Anatomy of Hidden Bank Debt. Working Paper, New York University Stern School of Business.

Acharya, Viral V., Douglas Gale, and Tanju Yorulmazer, (2008), Rollover Risk and Market Freezes, Working Paper, New York University Stern School of Business.

Agazzi, Isolda (2010) Markets Can’t Self-Regulate; State Should Step In – UNCTAD, Inter Press Service. Web.

Appel, Adrianne (2009) Economy-US: Trillions to Banks as Taxpayers Left in the Dark, Inter Press Service. Web.

Auernheimer, Leonardo, (1974) The Honest Government’s Guide to the Revenue From the Creation of Money, Journal of Political Economy, Vol. 82, No. 3, pp. 598-606.

Bohn, Jeff, Arora Navneet and Korablev Irina, (2005) Power and Level Validation of the EDF Credit Measure in the US Market.

Choi, Stephen J. (2000) Regulating Investors Not Issuers: A Market-Based Proposal, 88 California Law Review, 280.

Dell’Ariccia, Giovanni, Deniz Igan, and Luc Laeven (2008). Credit Booms and Lending Standards: Evidence from the Subprime Mortgage Market.” Working paper, International Monetary Fund.

Dwyer, Douglas, Zan Li, Shisheng Qu, Russell Heather and Zhang Jing, (2010) CDS-implied EDF™ Credit Measures and Fair-value Spreads”.

Gillette, Clayton P. (2009) Standard Form Contracts, NYU Law and Economics Working Papers No 181.

Gould, Bryan (2008) who voted for the markets? The economic crisis makes it plain: we surrendered power to wealthy elites and fatally undermined democracy, The Guardian.

Hicks, J. R. (1937), Mr. Keynes and the Classics – A Suggested Interpretation”, Econometrica, v. 5: 147-159.

Hicks, John (1981), IS-LM: An Explanation, Journal of Post Keynesian Economics, v. 3: 139-155.

Korobkin, Russell B. (2003) Bounded Rationality, Standard Form Contracts, and Unconscionability, 70 University of Chicago Law Review 1203.

Krishnamurthy, Arvind. (2008). The Financial Meltdown: Data and Diagnoses, Working paper, Northwestern University.

Meza, David de Bernd Irlenbusch and Diane Reyniers, (2008) Financial Capability: A Behavioural Economics Perspective” FSA Consumer Research 69, p.15.

Mishkin, Frederic S. (2007). Inflation Dynamics, International Finance 10(3): 317-334.

Morris, Stephen and Hyun Song Shin. (2008). Financial Regulation in a System Context Brookings Papers on Economic Activity: 229-274.

Schermerhorn J, Davidson P, Poole D, Simon A, Woods, P & Chau So Ling (2011), Management Foundations and Applications, 1st Asia Pacific Edition, John Wiley & Sons Australia Ltd.

Spreitzer, G.M., Perttula, K.H. & Xin, K. (2005). Traditionality matters: an examination of the effectiveness of transformational leadership in the United States and Taiwan, Journal of Organizational Behavior, 26, pp.205-227.

Stewart, J. and Kringas, P. (2003) Change Management – Strategy and Values in Six Agencies from the Australian Public Service: in Public Administration Review, v. 63 n. 6 (2003): pp. 675-688.

Stiglitz, Joseph (2008a) Good day for democracy; now Congress must draw up a proposal in which costs are borne by those who created the problem. The Guardian. Web.

Stiglitz, Joseph (2008b) A crisis of confidence. The Guardian. Web.

Stiglitz, Joseph (2008c) Let’s throw away the rule book. Bretton Woods II must establish economic doctrines that work in emerging economies as well as in capitalism’s heartland, The Guardian. Web.

Traill, R.R. (2008). Problems with Economic Rationalism – Psychology, Green-issues, and Jobs, Melbourne: Ondwelle.