Introduction

The Chinese banking system has grown from the centered model to the current vital conduit for the financial system to the macroeconomy. China has been practicing a fixed exchange rate financial system. However, in the recent past, this has been replaced by the floating financial system which has ensured steady appreciation of the Yuan currency in its banking systems. The stability in Yuan has placed China in the strong business zone that was once a preserve of Australia and other first world giants. With the itching economic climate, stable Yuan currency has positively affected people across the spheres of the Chinese economy. As part of the contagion gain, Yuan’s stability has strengthened the stimulus gains of Chinese banks due to the presence of hundreds of millions of hot money. Thus, this analytical treatise attempts to explicitly report on the Chinese banking system in relation to profitability, assets, equity and performance ratios.

The Chinese Banking System

Many banks in China are becoming victims of the unpredictable currency exchange rate. A good percentage of Yuan risk in the Chinese banking industry can be attributed to CDS markets which are spreading at an alarming rate (Kymal 2007). Thus, insignificant diversification is prominent for meaningful investments in Chinese territory. Reflectively, the effects of the swings in Yuan currency don’t spare bystanders in the banking industry. Rather, it results in weak growth at the micro level but is capable of supporting policy implementation in the Chinese banking business.

Chinese banks were least affected by the great depression of 2010. This enabled its banking system to be on top of the competition in terms of profitability. The strong brand name in its banking system has been built for over six decades. The strength of the Chinese banking system is the wide range of products and services they offer. Diversification is a source of financial strength for the banking system because if one product does not perform as expected in the market, revenue from other products will cushion the banks’ finances (Hunt and Terry 2011). Thirdly, the Chinese banking system has extensive and well-built distribution networks within the expansive Chinese territory. Further, the banks make use of the latest technology in the financial management market to ensure efficiency in operation costs. Finally, the Chinese banks have good business relations with the host countries. This creates an ideal environment for their operations (Hunt and Terry 2011). A major weakness in the Chinese banking industry is that the markets are concentrated in China.

Analysis of performance over past five years

The main commercial banks in China are the Bank of China, Agricultural Bank of China, and China Construction Bank. The financial analysis is carried out from a debt provider and a shareholder’s point of view (Hunt and Terry 2011). The shareholders if mostly concerned with the profitability and returns of their investment while a debt provider is mostly concerned with the leverage of the banks. The banks focus on maintaining an organic growth of returns of over 20%. The growth is achievable because there is a potential for growth in the Chinese market. After all, the infrastructure in Chinese is quite dilapidated and there is a need to replace or repair. Besides, the target markets are recovering from the period of recession. Therefore, there is a possibility of achieving a growth of 20%. Also, in 2011 and 2012, the Chinese banking industry has recorded growth in performance which is likely to continue for a few more years. The Chinese banking industry is experiencing a phase of growth in operation. The forecasts for operating income are based on the assumption that the operating income grows at 10% annually in the first year, 15% in the second year and 20% in the third year. This rate portrays organic growth.

Revenue growth in the Chinese banking industry has remained stable over the years. The growth is conservative and achievable due to the expansion of the Chinese market. Cash flow has also grown over the years. This implied that the interest expense declined thus, improving the cash flow (Hunt and Terry 2011). The increase in cash flow has risen from an increase in revenue and operating profit. The funding needs of the banking industry in China are based on the assumption that debt funding will go down by 5% every year to 967.61 Yuan in 2015. Equity funding will remain constant throughout the forecast. The funding mix will enable the banking industry to achieve a total debt to equity ratio of 2.0 by 2015 from 2.32 in 2012.

The treasury department is mandated to “monitor liquidity, currency, credit, and financial risks” (Kymal 2007, p. 24) of the banks in China. Further, the department “manages and monitors the banks’ financial risks and internal and external funding requirements in support of the banking industry corporate objectives” (Kymal 2007, p. 34). Most of the banks in China do not trade in financial instruments same as commercial banks in Australia. However, their performances within the last three years have been better as a result of their ever-expanding economy. The financial aim of the Chinese banks is to reduce leverage, increase cash flow, and increase revenue (RBA 2012). In monitoring liquidity, currency, credit and financial risks, the treasury department of China ensure that the banks have adequate liquidity. In terms of liquidity, the Australian commercial banks are more stable.

Difference between commercial banking in China and Australia

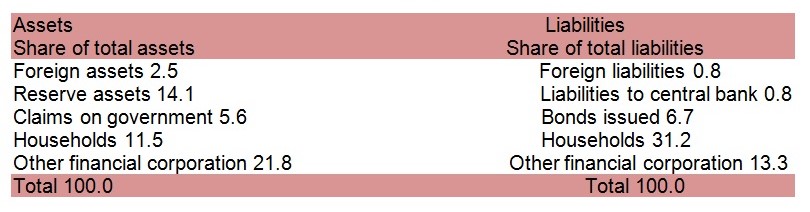

Commercial banking in China is heavily controlled by the government. The state owns the four largest banks in the country. The commercial banking sector is divided into five groups. The table below summarizes the statistics of commercial banks in China.

The table below summarizes the statistics for Australian Commercial Banks.

Based on the statistics above, total deposits for China commercial banks are greater than in Australia. Further, total loans and advances for China banks are greater than in Australia. Based on these two attributes, it is evident that commercial banks in China have better performance than banks in Australia.

Conclusion

Conclusively, the performance of the Chinese banking sector has experienced stable profitability and ratios over the last five years. Despite the financial meltdown of 2010, the banks survived the financial crisis due to diversity in business models, balanced equity and debt ratio, and efficiency in operation.

Reference

Hunt, B., and Terry, C 2011, Financial Institutions and Markets, Cengage, Alabama.

Kymal, C 2007, Conducting effective process-based audits: A handbook for ISO/TS 16949, Paton Professional, United States of America.

RBA 2012, Financial Stability Review, Web.