What is CDS?

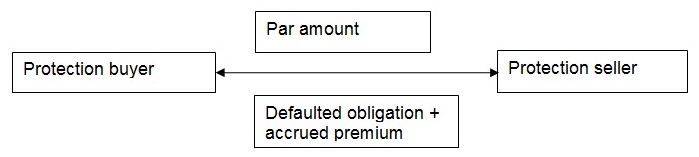

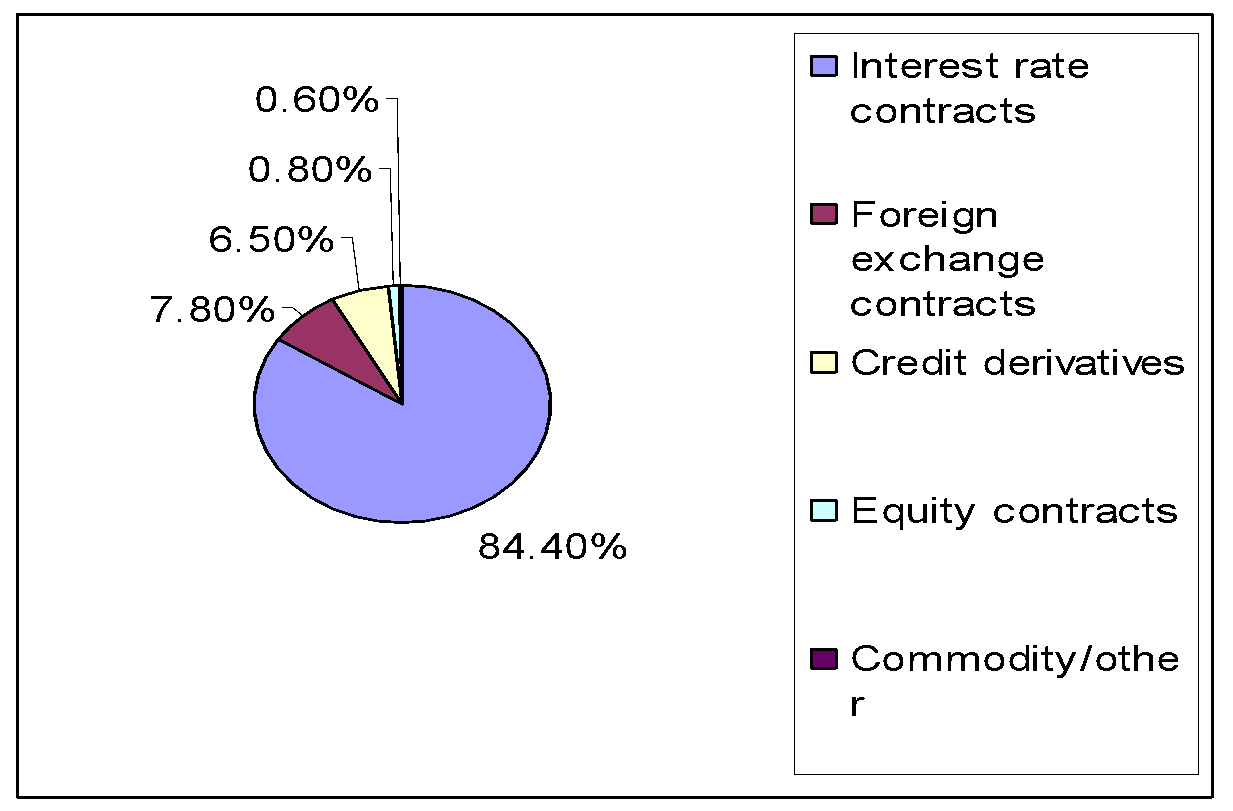

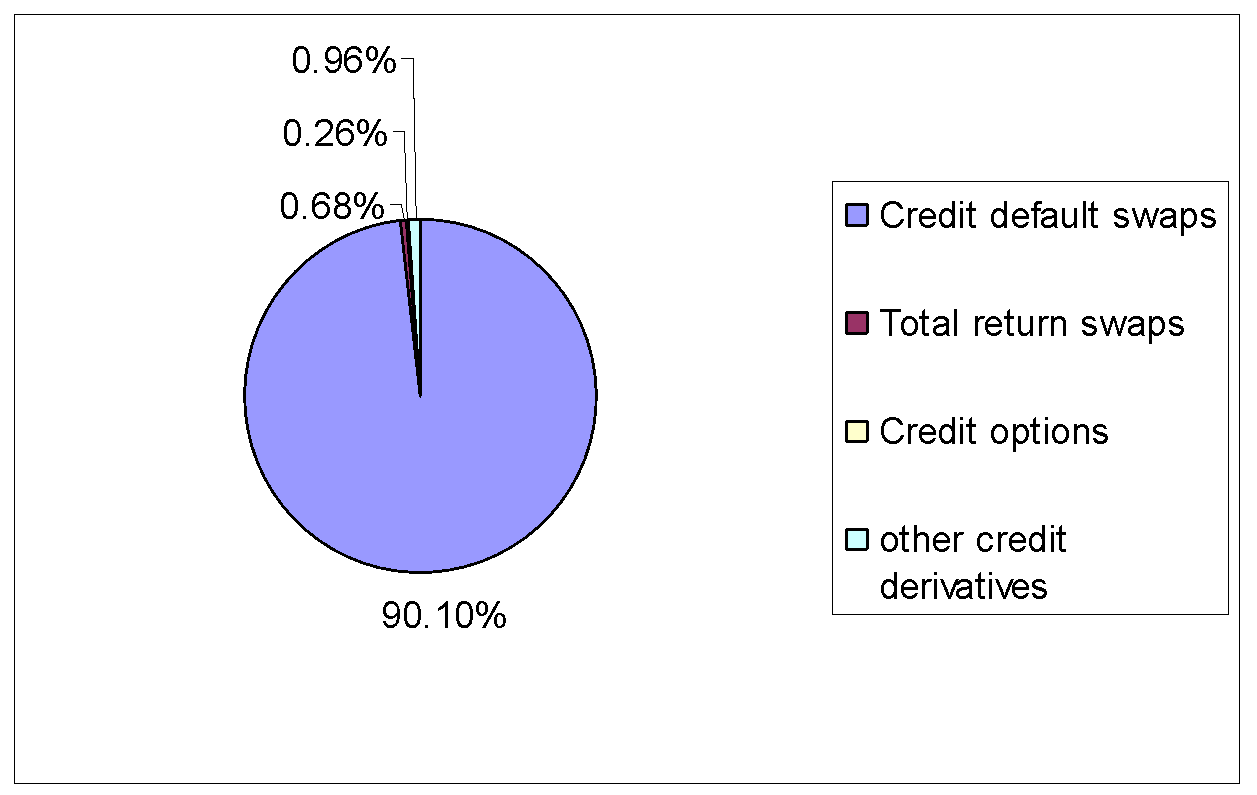

A credit default swap (CDS) is “a contract that provides insurance against the risk of a default by a certain firm,” (Hull, 2006, p. 67). The firm that issues CDS is referred to as the reference entity whereas the default is referred to as a credit event. The person who purchases the insurance gains the right to sell a certain bond issued by the firm for its par value in case the default takes place. A credit event normally necessitates that the buyer pays an ultimate accrual imbursement (Calamos, 2003). Figure 1 shows the cash flow in a credit default swap transaction in case of a credit event. The swap is then resolved by either delivering physically or in form of cash. If the swap necessitates physical delivery, the buyer of the swap will deliver the bonds to the person selling them in return for the bonds’ premium. The cash settlement of the swap is a percentage of the notional principal that is calculated by subtracting the mid-market price from 100 (Hull, 2006). The term notional amount refers to the amount which the parties of the CDS have agreed upon. Notional amounts are of different types (see figure 2) and are good reflections of business activity. Of all credit derivative notionals, CDS make up the greatest portion (see figure 3).

Use of the CDS

CDS are used to offer an efficient means of setting a price on pure credit because they measure the credit risk of a particular reference entity or reference asset. Asset swaps are well-developed in the market and are utilized both to modify the cash flow constitution of a corporate bond and to cushion against the interest rate risk of an investment in such a bond. Because asset swaps are priced at a spread over interbank risk, the asset swap spread is a representation of the credit risk of the asset swap name (Fabozzi, 2003).

CDS Market

The credit default swap market is approximately $43 trillion out of which the US CDS market takes up about $15.5 trillion. The CDS market offers a way of hauling out mispriced alternatives entrenched in low-grade convertibles or to provide protection of the hedge against credit spread increase. Because the theoretical value can be more easily obtained by using an asset swap, the efficiency of the convertible market is likely to be enhanced (Rajan, McDermott & Roy, 2007). The arbitrageur of a convertible can use the swap market to haul out cheap equity alternatives from mispriced investment-grade convertibles due to the potential demand for investment-grade companies’ credit by the fixed-income group. The swap convertible market is particularly vigorous in Europe because of the under-developed corporate bond market as well as the comparatively higher percentage of investment-grade convertible debt. In Japan, there is also an active convertible swap market which is as a result of a high number of out of order convertible issues and the opportunity to obtain cheap equity alternatives entrenched in these collaterals.

On the other hand, the U.S. swap market is rather inactive due to the nation’s more developed corporate bond market as well as the largely lower quality of the available convertible credits. Between 1999 and 2000, the U.S. swap market showed a high activity level after issuance declined in the corporate paper market. In reaction to the wave of activity, short-dated convertibles of high premium and zero coupons were issued and swapped through the corporate paper market spreads. The high quality and large size of issue facilitated the boost in demand for this security in the commercial paper markets, in addition to the lower periods that originated from the recurrent and short-dated zero-coupon convertibles.

The swap market provides the convertible arbitrageur with a chance of selling the fixed-income proportion of the convertible and maintaining the cheap equity alternative. The equity alternative constituent is later hedged with stock thereby offering a lucrative neutral hedge chance. As a matter of fact, the short interest rebate declines and may totally cover the complete dollar investment in the equity alternative stub (Calamos, 2003).

Pricing model

The pricing models of CDS can be categorized into two: structural models and reduced form models. Structural models are characterized by modeling the firm’s value so as to give the probability of a firm default. The foundation of the structural model approach is the Black-Scholes-Merton option pricing framework. In this model, the default event is presumed to take place when the company’s assets are lower than the book value of the debt. The model has two main features: default events take place as expected when a firm lacks sufficient assets to clear its debts; and a firm’s assets change arbitrarily (Choudhry, 2004). Reduced form models on the other hand are a type of no-arbitrage model. Thus, the pricing of CDS using these models is consistent with the market information about the credit-risky bonds exchanged in the market. These models permit the separation of the default process from the asset value, and are utilized more commonly to price credit derivatives (Chorafas, 2008)

Benefit of CDS

Credit default swaps have several applications and are used widely in flow trading of single reference name credit risks, or in trading a basket of reference obligations in portfolio swap form (Anson & Chen, 2004). CDS are also utilized in structured products, in several combinations and their elasticity is the reason behind the growth and wide use of the synthetic collateralized debt obligation and other mixtures of credit products. Relative to the cash market bonds and loans, CDS separate and move credit risk. This implies that their value is a reflection of only the credit quality of the reference entity (Choudhry, 2006). The protection seller, who is also the investor, gains a return that is associated only with the credit quality of the reference entity.

Risk of CDS

The greatest risk of a credit default swap is restructuring (Gregoriou & Ali, 2008). Restructuring refers to the alteration of the terms and conditions of the obligation so that the new terms and conditions become less attractive to the debt holder than the initial ones. Terms that can be altered include: a fall in the rate of interest, a fall in the principal amount, a reorganization of the principal repayment schedule (for instance, increasing the length of the maturity of the obligation, or postponing the interest payment), and changing the rank of superiority of the obligation in the debt structure of the reference entity. Restructuring is the most contentious credit event that is incorporated into a credit swap (Anson & Chen, 2004). This is because a protection buyer gains from the addition of a restructuring as a credit event and believes that getting rid of restructuring as a credit event will wear away its credit protection. On the other hand, the protection seller would desire not to incorporate restructuring because even habitual alterations to obligations that take place in lending arrangements would set off a payment to the protection buyer (Fabozzi & Anson, 2007).

Reference List

Anson, M.J., & Chen, R. (2004). Credit derivatives: instruments, applications and pricing. Hoboken, NJ: John Wiley & Sons, Inc.

Calamos, N. (2003). Convertible arbitrage: insights and techniques for successful hedging. Hoboken, NJ: John Wiley & Sons, Inc.

Chorafas, D. (2008). Introduction to derivative financial instruments: options, futures, forwards, swaps and hedging. New York: McGraw-Hill.

Choudhry, M. (2004). An introduction to credit derivatives. Burlington, MA: Elsevier Butterworth-Heinemann.

Choudhry, M. (2006). The credit default swap basis. New York: KBC Financial Products.

Comptroller of the Currency Administrator of National Banks. (2009). OCC’s quarterly report on Bank Trading and Derivatives Activities Q4 ’09. Washington, D.C.: Comptroller of the Currency Administrator of National Banks.

Fabozzi, F.J. (2003). Professional perspectives on fixed income portfolio management, volume 4. Hoboken, NJ: John Wiley & Sons, Inc.

Fabozzi, F.J., & Anson, M.J. (2007). Fixed income analysis. Hoboken, NJ: John Wiley & Sons, Inc.

Gregoriou, G.N., & Ali, P.U. (2008). The credit derivatives handbook: global perspectives, innovations and market drivers. New York: McGraw-Hill.

Hull, J. (2006). Options, futures, and other derivatives. Hong Kong: Pearson Education Asia Limited.

Rajan, A., McDermott, G., & Roy, R. (2007). The structured credit handbook. Hoboken, NJ: John Wiley & Sons, Inc.