Background

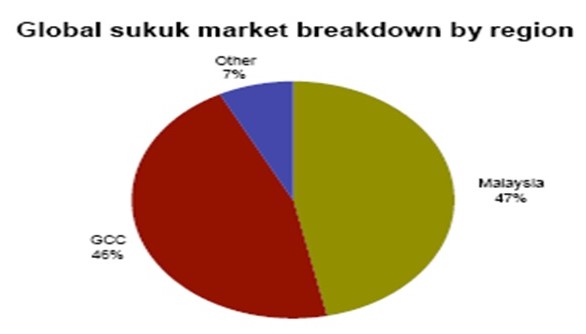

Sukuk (plural of sak) are Sharia-compliant bonds. Shariah laws are Muslim laws mostly effective in Muslim states. The belief is that no one should trade in money but rather in goods and services (Jadwa Investment 1). As such, interests earned in the case of bonds are prohibited in the Sukuk. The Sukuk transaction involves the ownership of certain assets which generate returns as opposed to being a pure financial debt. However, in many other related aspects, the two instruments are very similar. The Sukuk is constantly gaining popularity among governments and companies in recent years. It is being seen as a better alternative to the bond and more importantly, it offers avenues for access to credit for people of the Muslim faith. The comfort of investors has drastically risen due to the fact that it is possible to identify tangible ownership in the case of the Sukuk, as opposed to the bond. This has continually grown the wealth of the Muslim world. Internationally, the confidence in the Sukuk cannot be overrated. Credit ratings are high among agencies, reinforcing investors’ confidence. Countries like Malaysia whose economic performance is impressive lead the park in the issuance of Sukuk with about 47 percent of global Sukuk issuance by market value. The second is the GCC, accounting for about 46 percent.

Countries like Sri Lanka, Singapore, Canada, Thailand, the UK, the United States, and Russia have registered impressive responses to the Sukuk. Recently, the second largest bank in Russia, VTB, indicated that it intends to start offering a Sukuk product. Seeing that Sukuk has gained prominence worldwide, this is an indication of the popularity of Islamic banking. In addition, it is also an indication that foreign issuers are ready and willing to place their liquid investment within the GCC. Conventional banks are also embracing the idea of Sukuk in a bid to cash in on this popularity. There are six major contracts that define Sukuk, as described below.

- Ijara: The party to be financed identifies the property suitable for purchase and agrees on the purchase price with the seller. Then, you approach the third party to buy the property with the same price agreed with the seller, and the third party leases it to you with a monthly payment until you own the property.

- Mudaraba: This entails a contract that is usually reached by a fund manager and an investor. In this case, the role of an investor is to provide the fund manager with capital to manage it on their behalf. Upon a realization of a profit, the two parties share it based on their terms of the agreement.

- Musharaka: An agreement between two parties (partnership). Both parties provide capital and both can actively manage it. Then, profits and losses are shared between them in an agreed ratio.

- Murabaha: This is where a third party buys a property and the investor (buyer) comes in to buy the property at an agreed price and decides on a monthly payment made by investors to a third party until the investor owns the property.

- Istisina: First attention between a bank and a customer to purchase a commodity that has to be manufactured by the third party then istisina contract comes in between bank and third-party stated that it will deliver it to the customer at a certain time with specific price and the investor buys agreed payments to the bank.

- Istithmar: An agreement between an investor and a party to buy(investor) underlying assets(party) like Sukuk that has long or short maturity whereby it going to create profit at maturity (HSBC Saudi 3).

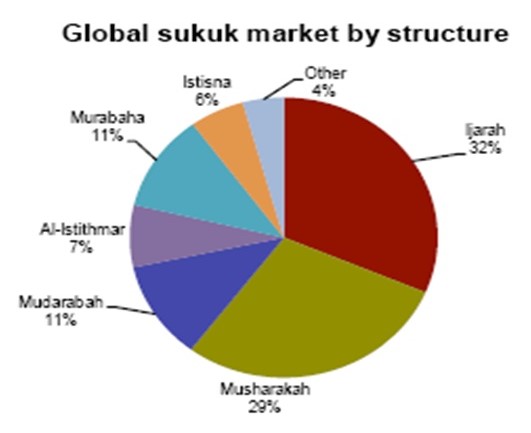

Ijara is the most popular Sukuk. It accounts for over 32 percent of all the Sukuk issued worldwide. Musharaka and Mudaraba then follow. In Saudi Arabia, the market for sukuk is mainly focused on the Istithmar. Shariah boards have the responsibility of determining what transaction structures fulfil Shariah laws as there are no universally agreed standards. Some nations have a conservative model in the application of the Shariah law, while others are more liberal resulting in inconsistencies on what is and what is not Shariah complaint. Saudi Arabia seems to be the most conservative nation. The country considers most Ijara structures prevalent in other countries as being non-compliant to the requirements of Shariah laws. Such absence of commonly agreed terms is a challenge to the growth of Sukuk.

Recent trends in Sukuk and bond issuance

In recent years, the Islamic finance sector has been experiencing significant exposure in the form of securities and bonds. Islamic securities, also known as Sukuk, have gained popularity. Governments have found in Sukuks a means to raise enough money needed to finance projects. In addition, companies are now relying on corporate Sukuks as a way of funding. The issuing of Sukuk started in 2000, when three Sukuks were issued, all valued at $336 million. By 2006, the number of Sukuks issued had increased to 77 and their valued was at the time estimated to have been over US$ 27 billion. At the international level, the capital markets have also introduced Sukuks to assist them raise the necessary finances for their growth. By adopting islamically acceptable structures, the capital markets have realized that Sukuks are in fact an important method for raising finances.

The Kingdom of Saudi Arabia introduced sukuks for the first time in 2006, but their real impact fully began in 2008. Since then, the sukuk have had a great impact on the Saudi Arabia market. This is in addition to enhancing economic and industrial development. Until now, commodity and consumer finance have been the main concern of Saudi Arabia’s Islamic finance industry. However, the petrochemicals, gas, oil, real estate and manufacturing sectors are now the beneficiaries of Islamic financing in Saudi Arabia. Various forms of finances are used to provide liquidity to these sectors, and they include sukuk, equity financing and trade finance, amongst others. The introduction of sukuk has resulted in a massive growth of the bond market in Saudi Arabia. According to estimates, sukuks now cover 81 percent of entire bonds that Saudi Arabia issues.

Sukuk and bond market in Saudi Arabia

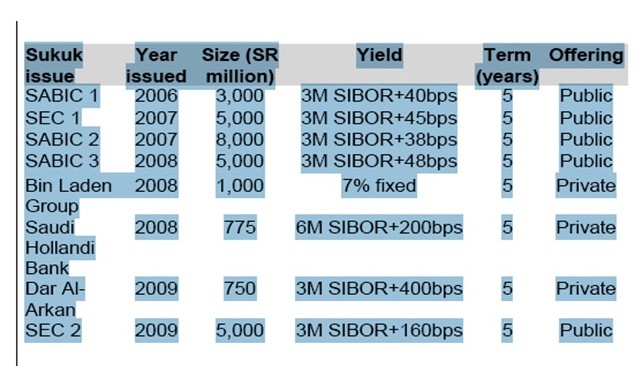

The Saudi sukuk market is still new, with only five publicly listed sukuk issued by two companies, Sabic and SEC. In addition, Saudi Hollandi Bank, Dar AlArkanand the Bin Laden group has privately placed sukuk. An over-the-counter market was launched in August 2006 with the first listing a Sabic sukuk. Under this system trades are negotiated off the exchange and there is no system to match buy and sell orders. Most trades were done through the treasury departments of local banks. For the whole of 2008, there were only 85 trades executed with a value of SR1.3 billion, compared to 52 million share transactions worth SR2 trillion over the same period.

Recognizing the need to enhance the debt capital market, on June 13 the Capital Market Authority and Tadawul launched a new platform for sukuk trading. This new platform is an order driven market which means that all traders publicly post their orders and the best buy and sell orders are automatically matched. Automation brings major improvements in the speed and cost of trading and greatly enhances transparency and the process of price discovery. The only disadvantage of an electronic order driven system is its inability to execute large trades. In the absence of market makers, investors who intends to trade large blocks of shares may be forced to accept a less advantageous price. Normally, blocks are traded off exchange to avoid that risk. The main order types are limit orders (with specified bid price) and market orders (buy or sell at the prevailing bid or ask price). The new sukuk system only allows limit orders. Best priced orders are processed first and in the event that there is more than one order at the best price, the one received earliest is prioritized. Clearing and settlement occur two days after the transaction. The new platform consists of four phases, which are the same as those for trades in equity through the Tadawul. Namely:

- Pre-open: Market: 11:15 to 11:30: An order book is built through the accumulation of buy and sell orders, no trade matching occurs at this point.

- Continuous trading market: 11:30 to 3:30: Orders are matched and best buy and sell orders are displayed.

- Pre-close: Market: 3:30 to 4:30: At this phase, no price or quantity modification is possible, although previously entered orders can be deleted.

- Market close: 4:30 to 11:15 next trading day: Market is closed, no action can be performed

Sukuk vs. Eurobonds

Sukuk have a lot of similarity to conventional Eurobonds. For example, like Eurobonds, sukuk either assume the form of a security tool capable of giving the holder a level of return that is predictable, in this case, floating or fixed.However, one distinguishing feature between sukuk and Eurobonds is that the levels of trading of the sukuk are less in comparison with those of the Eurobonds. On the other hand, both Eurobonds and sukuk are rated by rating agencies that are recognized globally.

Both the Eurobond and the Sukuk are financial instruments used to borrow pooled resources to governments and business institutions. The Eurobond enables investors in Europe to invest in a bond which is not dominated by the dollar. The basic way of issuing the bond is through discounts and premiums. The bond is sold to investors at a discount and redeemed by the issuer at a par value. The income gained by the investor is in the form of a percentage of the principal sum. More importantly, the issuer is at greater liberty in dealing with the funds resulting from the bond issue. The liability towards repaying the bonds is predetermined.

The Sukuk on the other hand is a Shariah compliant bond. The basic Shariah laws prohibit the trading in money and earning of interests. The bond thus is configured to ensure that this does not occur. Shariah law only allows for profiteering through trading in goods and services. To this effect, the holder’s funds are used to acquire certain rights over the assets belonging to the issuer. During the period of the bond the assets are utilized in generating returns. These returns are shared between the issuer and the Sukuk holders on a predetermined rate.

Saudi Electricity Company (SEC): Sukuk Expiring 2027

The Sukuk was issued in 15th of July 2007 and lasts for a period of 20 years up to July 2027. It was issued at par, without discount or premium. It was issued by SEC, a joint stock company incorporated in Saudi Arabia. The Sukuk offers returns on a quarterly basis referred to as the Periodic Distribution Amount (PDA) to the holders of the Sukuk. The PDA is calculated using a benchmark rate and a margin which is in the form of annual percentages on the face value of the Sukuk at the end of the distribution period. The SEC which is the Issuer purchases the Sukuk from holders at a predetermined purchase price which decreases as time elapses. The periodic distribution dates fall on 15th July in the years 2012, 2017 and 2022. This means that payment for incomes earned through the Sukuk is done on a quarterly basis but reduction of the principal amounts held by subscribers are made after every five years.

Under the Sukuk Assets Transfer Agreement the issuer will transfer certain custodian rights and entitlements to assets to the Sukuk holders Agent for the period of 20 years. This means that holders of the Sukuk actually buy rights over tangible assets belonging to the Issuer for the period of lending. The custodian holds the Sukuk assets on behalf of the holders on a prorata basis in relation to the face value held (Saudi Electricity Company 5).

It is these assets which when utilized give returns which are shared among the holders through the periodic distribution amounts already set. The returns are expected to at least cover the PDA. The income from the assets exceeding the PDA is held by the SEC and can be invested by the SEC on its own account and are payable subject to conditions.

Investing in the Sukuk involves taking a risk just like in any other investment. The risk factors prevalent in the sukuk can be categorized in to three categories namely: factors relating to SEC’s Business: factors relating to the sukuk and factors relating to the Sukuk assets.

Under the SEC business, there are possibilities of the firms power generation plants experiencing unforeseen failures or may not operate as planned. The due to the nature of power generation, there are significant operational risks such as inefficient operations, high costs of maintenance and liabilities to third parties. Secondly, there are probabilities that projects under construction by the SEC may not commence in and run according to schedule and within the budget and in accordance to specifications. It is also possible that the new plants being developed using the funds raised by the Sukuk do not operate at their expected levels of output due to issues of design and specifications. Occurrence of such failures can reduce the returns for the firm as the company has a policy to only accept new plants from contractors if they reach the specified output and efficiency levels.

In addition, all the fuel required by the SEC is supplied by only one supplier. Oil is an important input in the generation of power. The presence of only one supplier increases risks in operations. It is however notable that the supplier is highly reliable having supplied oil to the firm since formation. There are also risks emerging from excess demand during peak times (Saudi Electricity Company 6).

Factors relating to the Sukuk range from the laws that govern such financial transactions, jurisdiction and enforceability. The Kingdom of Arabia applies Shariah law and the Sukuk is based on these laws. There may be disputes to the compliance of the said Sukuk to the Shariah laws whose outcome may affect holders adversely. Also, failure to receive dues from custodian is not on the SEC or custodian so long as due diligence is adhered to.

Saudi Basic Industries Corporation Sukuk Expiring 2027

The Sukuk was issued at par without discount or premium. It expires on 2027. It also has a fifth year date (Zawya Research 2). The PDA is to be paid on a predetermined rate on the 15th of every January, April, July and October to the holders of the Sukuk. The PDA is also calculated using the benchmark rate plus a margin. The sukuk is subject to a declaration of agency where the custodian will hold some rights over Sukuk holder’s assets on behalf of the holders. Holding the Sukuk thus implies having some rights over the certain assets of the issuer (Saudi Basic Industries Corporation Par4).

The risks in investing in the Sukuk are several. There are those based on the performance of the Sabic Group and its affiliates. This result from the fact that the firm is a holding company hence it relies on the performance of its subsidiaries for profits. There are also operating risks from the firm’s affiliates. Equipment and machinery spread around the affiliates have the possibility of failure (SABIC Sukuk 6).

In addition, there are other Sukuk issues made by the same firm previously as well as other different asset- backed securities. Again debt financing holds inherent risks as it cannot be repaid using proceeds from capital transactions. Moreover, there are planned acquisitions which present further risks by engaging new partners and entering new projects where not much experience is available. The international markets within which the firm operates is also highly competitive presenting significant risks in the market for the firm.

Summary of differences

Calculation and payment

The returns for the Sukuk are based on a predetermined sharing model which is prepared taking to consideration the ability of the assets to give returns. A benchmark rate of return is universally agreed among the issuers of Sukuk. A margin of profit for contribution made to the profits generated through mutual agreements between the issuer and the Sukuk holder. Payment of these returns is done on a quarterly basis. The principal amount for each holder is however paid back on agreed periods usually five years for long-term Sukuks. This effectively reduces the obligation for sharing returns through reduction in the assets held. Bonds on the other hand are issued at a discount. An example is where a face value of 100 is issued at 95. The implication of these is that a return of five is guaranteed at the end period of the bond. Payment for returns got from bonds can be done periodically such as quarterly just like the Sukuk.

The following are calculated results for the Sabic sukuk

The role of Sukuk and bond market in Saudi Arabia economy

Many industry players in the economy of Saudi Arabia have by now recognized the potential and meaning of Islamic financing, specifically the issuing of sukuk. However, it has been expected that in a few years time, an increasingly number of organizations in the kingdom shall have sukuk as a solution to their working capital, expansion plans, and refinancing pf existing debts. Saudi Arabia has so far witnesses a few sign and major deals, thanks to Islamic financing. A notable financing transaction is the one that was issued in July 2009 by SABIC, at a market value of SR 3 billion. This particular sukuk issue was special in that it was the first sukuk to have ever been issued publicly, in Saudi Arabia. Furthermore, it was the first one under the newly established Capital Markets Law. In 2009, SABIC, an organization involved in Islamic financing, managed to access the market valued at SR 7.5 billion by way of issuing such sukuk as murabaha. It is an indicator to the potential that the market for Islamic finance holds not just in Saudi Arabia, but also globally. In 2006, the Kingdom in combination with the Bahrain-based Investment Bank, helped issue a sukuk that was valued at $ 23 million (Kamal and Al Sudairy 8). By today’s standard, this might look like a sukuk of modest value, but nonetheless, it help in setting a strong basis for the issuance of sukuk of significant value. In addition, the sukuk also helped attract foreign investors, who are now able to directly access assets in the real estate market, in Saudi Arabia. Although the situation for Saudi’s industrialization are shining moving on to the future, nevertheless, there is a need for Islamic banks issuing bonds and sukuk in the kingdom to become increasingly practical while educating and marketing their products to organizations regarding their capability, efficacy, structures, and profitability.

Pricing and valuation of Sukuk and bond

The global economic crisis has also affected the sukuk issuing in Saudi Arabia. Just like in other countries as far as financial assets and risk are concerned. On the other hand, the fact that initial public offerings (IPOs) are now less attractive, in addition to banks having to become easier regarding their policies on lending means that companies have no choice but to seek out for other funding options. This is how sukuk comes in. However, a number of companies have far realized funds by issuing sukuk since September 2008. The new sukuk is characterized by a pricing strategy that has high rate of aversion to risk within the bond market. In June 2009, the SEC (Saudi Electricity Company) issued sukuk and the expectation was that it would realize 160 basis points above the existing inter-bank rates in Saudi Arabia (SIBOR). This is in comparison with simple 45 basis points realized by the sukuk that was issued at a similar period in July 2007. The premiums for sukuk were quite high from late 2008 to earlier this year (2009). As a result, such banks as Saudi’s Holland Bank were the beneficiaries of these high premiums. Even then, the observable trend amongst sukuk buyers is an tendency towards corporations that enjoys large government ownership, due to the ensuing supportive of the investors about their investment.

Challenges and hurdles for launching Sukuk and bond in Saudi Arabia Market

Various challenges characterize the launching of sukuk and bond in Saudi Arabia.

- a lack of breadth: At the moment, only SEC and Sabic are sukuk listed. The two issuers are characterized by massive government ownership. The assumption therefore is that the support from the government could translate into trading at low spreads.

- lacks liquidity: As a result, market participants cannot work with ease and efficiency. A majority of the investors needs a premium when they decide to invest in instruments that are illiquid. In fact, the returns that the two listed sukuk provided the nature of sukuk are not able to pay back soon so issue of illiquidity.

- The human resource in the sukuk market also lacks in experience: At the moment, individuals with such a combination of knowledge are very few in Saudi Arabia. Moreover, not many investors are familiar with the sukuk product. This is because the sukuk market in Saudi Arabia is quite new and underdeveloped.

Therefore, for the average investor in Saudi Arabia, understanding of the instruments of fixed income and sukuk are strange subjects. For this reason many Saudi have less invest in sukuk with a lot of caution. Furthermore, the minimum order size that an investor can trade in is worth SR 10,000 and this too has played a role in discouraging the small investors that are willing but lacks in finances.

Conclusion

The sukuk market in Saudi Arabia is approaching its maturity stage, thanks to the interest shown by both investors and issuers. This is a confirmation that sukuk are a viable choice for companies to medium-term investments and savings. Nonetheless, there are various challenges that face the sukuk and bond market in Saudi Arabia. Seeing that only two companies are sukuk listed in Saudi Arabia, this has resulted in a lack of breath in the sukuk market. Accordingly, it is important to seek for diversification in the form of various sukuk regarding sector representation and risk profile. In addition, the nature of the sukuk market demands for individuals who have a wide knowledge in law and finances. As a result, it is important to offer sufficient training to such individuals to increase their capability to handle the issuance of sukuk market.

Works cited

HSBC Saudi. Saudi Electricity Company is Offering Sukuk expiring 2029. Web.

Jadwa Investment. The Saudi Sukuk Market. 2009. Web.

Kamal, Hissam, and Al Sudairy, Sheikha. SABIC Sukuk: The Debut Sukuk in Saudi Arabia. Deals of the Year 2006 Handbook. Web.

SABIC. Saudi Basic Industries Corporation. 2009.

Zawya Research. Saudi Electricity Company is Offering Sukuk expiring 2027. Web.