Introduction

Discussion

Economic theory points out that one significant factor describing differences in interest rates on different securities may be a variance in the time duration before securities mature. The term structure of interest rates can be explained as a relationship between the terms of securities and their market rates of interests. Economists utilize a diagram referred to as a yield curve to show the term structure of interest rates on securities of a particular type at a particular period (Cukierman, 1973, p. 570). This paper focuses on the theories that explain the term structure of interest rates and the importance of the term structure of interest rates.

The Yield Curve

The Structure Theories

Yield curve allows for abstraction of irrelevant factors and focuses on factors relevant to portfolios’ interest rates risk. It presents graphical approximation of the term structure of interest rates as a functional relationship between maturates of debt instruments differing only in time duration to maturity, and its yield to maturity. The shape of the term structure might change dramatically as time goes by (Jarion, 2009, p, 121). These changes will cause great interest rate risk. Possible factors which may influence the shape of the term structure include: market expectations concerning future direction of interest rates; presence of liquidity premiums in debt instruments’ expected returns; and market inefficiency (Kennedy, 2000, p. 87).

Expectations Theory

The expectations theory of the term structure of interest rates explains that the yields on financial assets of different maturities are primarily related to market expectations of future yields. The main factor of influence over this link is the expectations of future interest rates, where future changes affect current structure. A stable yield curve puts lenders and borrowers at equilibrium at current pattern of interest rates. The gains from long-term loans must equal the average of the series of short-term loans (Campbell, 1999, p.212).

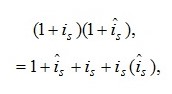

Suppose long-term is for two years. This is expressed in the form of:

Where![]() represents long-run interest rate. If the interest rate is low, then it is possible to ignore the power term. A short-term loan is for one year. Lenders lend for one year, they then renew at the expected one-year rate by comparing this with what they would have earned by lending at today’s rate over a two years term, that is

represents long-run interest rate. If the interest rate is low, then it is possible to ignore the power term. A short-term loan is for one year. Lenders lend for one year, they then renew at the expected one-year rate by comparing this with what they would have earned by lending at today’s rate over a two years term, that is

The result is the average long-term rate of interest, where the future plays a role through expectation related to the course of the short-run rate of interest. The link between the rates on various assets vary in their term to maturity which is referred to as the term structure of interest rates (Chance, 2008, p. 64).

Segmented Markets Theory

Based on segmented market theory, the term structures are represented by different markets that are separated. The demand and supply for a particular bond determine the interest rate and the expected return do not influence any other assets. These markets are segmented and do not substitute one another. This is a contrasts expectations theory, where bonds of differing maturities are substitutes and influence each other (Mishkin, 2010, p. 124).

The reason for this assumption is based on the investors’ preference to invest in one particular level of maturity. This is because they desire to hold for a specific period with a certain return and risk. Some investors have a short-holding period to minimize the interest-risk. This clarifies why the demand for long-term bonds is lower than short-term ones. Hence, the lower prices but higher interest rates. In other words, the rise in interest rates on different yearly bonds cannot affect each and their maturity. This speculation, however, fails to explain why interest rates on bonds of different maturities have a tendency to move in the same direction (Duffee, 200, p 190).

The Preferred Habitat Theory

The theory of the term structure expresses the interest rate on a long-term bond as equal to the average of short-term interest expected over the life of the asset, plus a risk premium which is determined by demand and supply conditions. Bonds of different maturities are imperfect substitutes, because savers have preferences for particular periods, that is, the preferred habitat. Savers prefer bonds of a particular maturity, but they are willing to consider other bonds if an expected return is high. If the preferred habitat is short-term bonds over long-term bonds, investors are willing to hold them even though there is a lower expected return. Clearly, investors must be paid a risk premium to induce them to hold long-term bonds (Cukierman, 1973, p. 563).

Preferred Habitat Theory uses expectations approach by including a risk premium to the equation, with a slight change in notation from expression, that is

![]()

Where![]() represents the risk term premium for n-periods on bonds at time. The equation is the average of short-term interests plus the risk premium, which is equal to the interest rate on long-term bonds.

represents the risk term premium for n-periods on bonds at time. The equation is the average of short-term interests plus the risk premium, which is equal to the interest rate on long-term bonds.

The Liquidity Premium Speculation Theory

This theory applies expectations hypothesis by suggesting a positive liquidity premium that must be provided to investors to purchase long-term bonds in compensation for the interest rate risk. Investors expect short-term interest rates to rise to some established norm when they are too low, so that the average of future rates will be relatively higher than the current ones. With additional positive premiums, long-term rates will be substantially above current short-term rates, and the yield curve will become steep as well as upward sloping. Equally, if short-term rates are high, then agents will expect them to fall. Long-term rates will drop below short-term rates because the average of future short-term rates will be decidedly far below current rates, despite the positive premiums; the yield curve will be downward sloping (Duffee 2002, p. 200).

Finally, all three theories can be placed into one formulation. This can be expressed as;:

![]()

This expression combines benefits of all three theories and covers their respective drawbacks (Jorion, 2009, p. 36).

Importance of the Term Structure of Interest Rates to Economists

There is a number of reasons why economists are keen on the term structure of interest rates. The first reason is that since it s easy to observe the actual term structure of interest rates, the accuracy of forecasts of some theories related to the issue can be done or evaluated rather easy. The term structure theories are based on principles and suggestions that can be easily applied to different branches of economic theory. If such principles are found important in describing the term structure, they might also prove importantce in contexts in which their relevance is less easy to evaluate (Mishkin, 2010, p. 56).

According to Pilbeam (2010), the second reason is that the term structures theories can be helpful when explaining how changes in the short-term rates influence on the long-term ones. Examples include; role of financial intermediaries and pricing of claims to physical assets rates, rates on securities with relatively short terms, and effects on the levels of long term interest rates (Duffee 2000, p. 189). Theories of the term structure may assist describe methods by which monetary policy affect theses economic decisions.

The third reason is that it may provide information regarding participant’s expectations in financial markets. These expectations are important for forecasters and policy makers. Market participants’ belief of what may occur in future impacts current decisions. In turn, these decisions assist determine what actually happens in future. Understanding of market participants’ expectations is necessary to predicting future events of determining the effects of different policies.

Conclusion

In conclusion, the term structure is built on three theories which are; “the expectation theory, liquidity preference theory and market segmentation theory”. Chance (2008, p,111) explains that even though these theories form a good basis for the study of term structure of interest rates the approach is traditional. This explanation proves that the understanding of the “term structure” needs to be built on a more solid foundation which calls for more research and studies. Chance (2008, p. 112) argues that from his own analysis, he noted that the theories are deficient. From this arguments and explanations, it is evident that the term structure is not a sufficient tool in the analysis of financial markets. The arguments also prove that the term structure is an important tool in the financial market.

References

Campbell, J., 1999, Assets prices, consumption, and the business cycle, in J.B. Taylor and M. Woodford: Handbook of Microeconomics, Amsterdam, Long Pages.

Chance, D., 2008, Essays in derivatives: risk-transfer tools and topics made easy, , New Jersey, John Wiley & sons

Cukierman, B., 1973, ‘The term-structure of interest rates and expectations of price increase and devaluation’. The Journal of Finance Vol. 28, No. 3, 567-575.

Duffee, G.,. 2002, ‘Term premier and interest rate forecast in affine models’. The journal of Finance, 53(1) 187-218.

Jorion, P., 2009, Financial risk manager handbook, John Wiley and Sons, New Jersey.

Kennedy, P., 2000, Microeconomics essentials: Understanding economics in the news, Massachusetts, MIT Press.

Mishkin, F., 2010, The economics of money, banking, and financial markets, 9th edition, New York, Addison-Wesley.

Pilbeam, K., 2010, Finance and Financial Markets, Second Edition, Basingstoke, Palgrave.