Measurement is a significant part of performance improvement in all types of companies because it allows tracking progress on strategy implementation. True Coop Community Bank’s current strategy is to balance profits and growth, provide high-quality service, and acquire a larger customer base. The application of this strategy requires linking it with operational outcomes. The balanced scorecard is a system for strategic planning and management that helps to communicate business objectives across the company, align daily work with long-term strategic goals, and measure the company’s progress over time. The measures included in the balanced scorecard target various areas of business functioning, thus ensuring a comprehensive view of performance.

To categorize the measures into the four BSC perspectives, it is crucial to understand the relationship between different outcomes. Table 1 shows the measures used by True Coop Community Bank, divided into four perspectives: financial, customer, internal business, and learning and growth. Financial measures to be used for True Coop Community Bank are outstanding loan balances, deposit balances, and non-interest income.

These measures represent the financial performance of the bank because they reflect its profitability and stability. For example, a growth in deposit balances means that more customers choose to trust the bank with their funds, whereas outstanding loan balances are essential for interest-related income. Non-interest income growth is also crucial to TCCB because it represents the income learned from service fees and the bank’s products. Growing non-interest income would mean that the company is moving in the right direction with its current strategy. Thus, each of the three financial measures aligns with the bank’s strategy since they reflect profits and resources that could impact earnings in the future.

Table 1. BSC Perspectives and Measures.

With regard to customer measures, TCCB can utilize a variety of indicators as part of the BSC. These include the number of products per customer, the number of new customers, new loans created, new accounts, customer satisfaction, and customer retention. Each of these measures contributes to TCCB’s strategy implementation in terms of increasing customer base and providing high-quality service. The number of products per customer, customer satisfaction, and customer retention show whether or not customers see value in being clients of TCCB, and ensuring high performance in these aspects helps to improve the customer base. Measures relating to new customers, such as the number of new customers, new loans created, and new accounts, reflect the attractiveness of the bank to new clients and its growth in the market.

Internal business measures can be seen as facilitators that help companies to achieve the target financial and customer indicators. In the present case, relevant internal measures include processes that contribute to customer retention and new customer acquisition, as well as to the utilization of TCCB’s products by customers. Thus, sales calls to potential customers, thank-you calls or cards to customers, new product introductions, cross-sells, and referrals. Sales calls to potential customers and new product introductions can attract new clients to the bank, whereas thank-you calls and cards help to form lasting relationships and retain them. Cross-sells and referrals, in turn, relate to the utilization of the bank’s services. Thus, these internal business measures relate to the strategy by influencing customer indicators.

Finally, learning and growth activities facilitate excellence in internal business activities and allow growing indicators from the previous group. Here, employee training hours are crucial to provide excellent service and increase product utilization by customers. Employee turnover is also essential since it affects employees’ level of experience with the bank and its products. Finally, employee satisfaction makes employees more motivated and committed to achieving internal business goals. In this way, there are evident links between the BSC measures and TCCB’s strategy, as well as between different categories of measures.

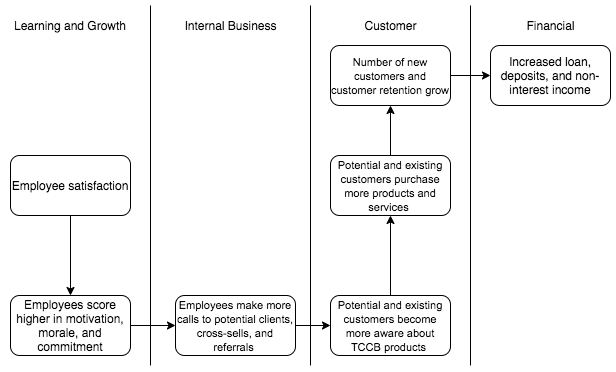

Cause-and-effect chains help to present these relationships in an easy-to-understand form. Figure 1 shows how employee satisfaction impacts TCCB’s financial results. When employee satisfaction grows, employees score higher on motivation, morale, and commitment. This makes them more active in their daily work, thus increasing the number of sales calls, cross-sells, and referrals. As a result, potential and existing customers become more aware of TCCB products and services and purchase more of them, thus growing the number of new customers and customer retention rate. Both of these customer indicators contribute to deposit balances, non-interest income, and outstanding loan balances.

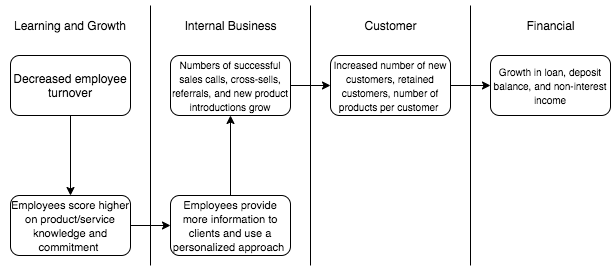

Figure 2 shows how these financial indicators are connected to employee turnover. When turnover is low, employees have better product and service knowledge and commitment. This means that they can provide more information to clients and suggest products fitting clients’ needs, thus using a personalized approach. The number of successful sales calls, cross-sells, referrals, and new product introductions grows, increasing the number of new customers, retained customers, and products per customer. Therefore, loan, deposit balance, and non-interest income grow.

Overall, the balanced scorecard offers a helpful method for tracking performance and progress over time. Since the measures are aligned with company strategy, managers can relate daily performance management activities to long-term growth and success. Understanding the relationships between different BSC categories and measures helps to anticipate the effect of various improvement efforts and prioritize the tasks and activities that contribute to the company’s strategy. In TCCB’s case, the balanced scorecard would be useful in balancing various strategic objectives and integrating them in performance measurement and management activities.