Abstract

The United Arab Emirates (UAE) is a league of seven distinct emirates, which jointly make the third biggest economy in the Gulf region. It is the second largest economy in terms of per capita output. The country’s economic growth has averaged roughly 4 percent over the last decade but has wavered from positive to negative due to internal and external forces. In 2008, oil prices increased significantly, only to plunge in 2014 to present time.

Studies show that the volatility of oil prices in the global market has considerable macroeconomic side effects, especially in oil-dependent economies like the UAE. The UAE has started to embrace economic diversification and structural transformation in the wake of the falling oil prices in order to avert the situation. Prior to 2009, the performance of the UAE’s economy was very strong, managing an average yearly GDP growth rate of 5.4 percent.

The high GDP growth rate was principally as a result of the government’s fruitful efforts to diversify the economy. The non-oil GDP was specifically high due to the government plan to stimulate investment. The global economic recession along with declining oil prices and the turmoil in the financial and property markets, especially in Dubai brought an end to the era of high GDP growth rate. The crisis led to a fiscal deficit that the country is still struggling to reduce.

The expansionary fiscal policy still remains the best option under the current exchange rate regime. This is due to its ability to expand the economy by increasing the Gross Domestic Product (GDP) and at the same time enhancing the volume of exports. Besides reverting to the traditional expansionary fiscal policy, the UAE government should diversify the economy based on the distribution of economic outputs and inputs.

Acknowledgements

I would like to recognize everyone who gave any sort of backing to enable me finish this project. Special thanks go to my professor, who guided me through the occasionally grueling process. In particular, I am thankful for his encouragement, readiness to take note, and promptness in response.

Introduction

The United Arab Emirates’ total national output was relied upon to expand by in excess of 3.5% to get to 1.6 trillion Dirhams by the end of 2015 as per the ministry of finance (Sophia, 2015). In an announcement to major media houses, the finance minister Sultan Saeed Al Mansouri stated that the nation’s capacity to keep up a high growth rate demonstrates its monetary productivity and its achievement in the expansion of the economy.

Al Mansouri also stated that the share of the country’s manufacturing division has been increasing and presently stands at around14%. He expects the volume of investment in the country’s industrial segment to grow by more than two digits by 2021. The UAE recorded its most grounded growth a year ago with real GDP up by 4.6% and nominal GDP attaining Dhs 1.47 trillion (Sophia, 2015).

In any case, notwithstanding being the most diversified economy in the Gulf region, worries over low oil prices have washed down the country’s growth prospects (Sophia, 2015). In early 2015, the United Nations monetary and finance agencies cut the UAE’s development estimate owing to the effect of low oil prices on the country’s economy. The International Monetary Fund expected that Abu Dhabi, which is exceedingly reliant on oil proceeds, will witness a 3% growth whereas its non-petroleum industry will grow by 4.6 percent by the end of the year. In the meantime, Dubai’s economy is anticipated to expand by 4.5 % by the end of the year (Sophia, 2015).

The country has enhanced its diversification efforts as of late and this is expected to contribute significantly to the growth of the economy and increase in technological innovation. The country’s administration has additionally stated that it will proceed with some of its huge infrastructural ventures to propel growth (Sabrina, 2014). According to the UAE’s Vice President, Sheik Mohammed, the government has put in place all the necessary plans to expand the non-oil sector in order to increase its contribution to the country’s economy by more than 80% by 2021. This is to be achieved through robust investment in the manufacturing and hospitality industry, air and marine transportation, import and export, and supporting a scope of undertakings and activities hinged on knowledge-based economy (Sophia, 2015).

The country’s stage in the business cycle

The UAE keeps on driving territorial change with an economy that has remained buoyant over the recent past. The nation stands out as one of the most coordinated economies and has seen solid development. For this reason, the UAE continues to be ranked high by both regional and global financial institutions (IMF, 2015). Owing to an interest-driven increment in oil production, the UAE economy was relied upon to grow by 4.5 percent last year. The current volatility in the global market has reduced the expected rate of GDP growth to 3.5 percent. However, Dubai’s GDP has been slightly higher (over 4 percent) (Sabrina, 2014).

The country is in the 4th stage of the business cycle, that is, at the peak phase. This is basically due to two reasons. First, the economy is growing at almost full capacity (between 3.5 to 4.5 percent), and this varies from one emirate to another. Second, the growth of the non-oil sector has remained afloat, driven by development, prominently attributable to capital spending in Abu Dhabi and the ever-growing transport and hospitality industry.

Even though recent data show that non-oil sector has slowed down a little bit, it still remains upbeat. Despite the fact that sharp decline in oil prices is wearing down long-term goals, its impact on the economic activities in the country has been restricted. Furthermore, solid development in the service sector and the expansionary fiscal strategies helped to offset the impact of low oil prices.

The United Arab Emirates GDP Growth rate since 2006

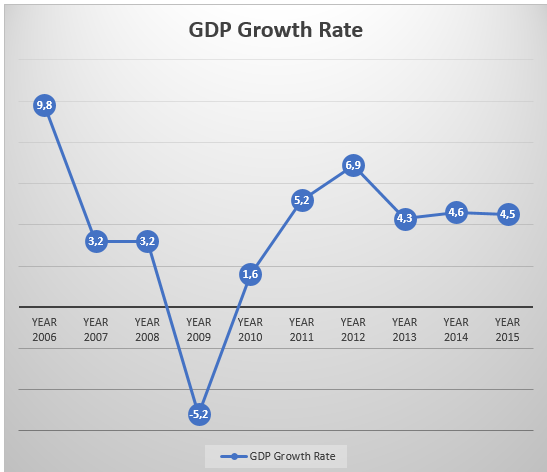

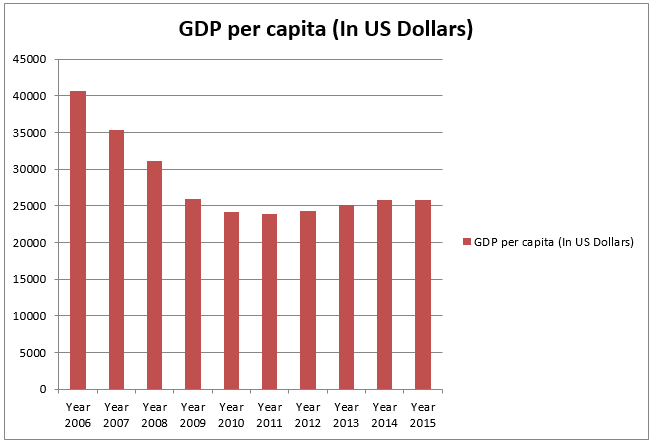

The country’s GDP growth rate has slumped significantly since 2006 predominantly due to drop in oils prices and Dubai debt crisis. The GDP growth rate in 2006 was about 9.8 percent with a GDP per capita of $40689. The GDP growth rate sharply declined to 3.2 percent in the next two consecutive years. The GDP per capita for 2007 and 2008 were $35309.36 and $31670.36 in that order. Nonetheless, the GDP growth rate became worse in 2009 when it fell to -5.2 probably due to the effects of the global recession, lower oil prices and the Dubai financial market crisis, as well as the escalation in the general inflation rate. The GDP per capita stood at $25933.24.

The country made a slow recovery in 2010 with a GDP growth rate of 1.6 percent and GDP per capita of $24699.07. However, in 2011, the situation was completely different. The economy started showing some positive signs with a GDP growth rate of 5.2 percent, which rose to 6.9 percent in the following year. Ever since the GDP growth rate has always ranged between 3.5 to 4.6 percent. At the same time, the GDP per capita has always stood at around $25000.

The effect of low oil prices to the UAE’s economy

Over the last decade, solid GDP growth was bolstered by increased government expenditure, funded by quickly expanding oil proceeds. Therefore, low global oil prices have a considerable impact on the UAE’s economy. Even though UAE is considered among the most diversified and structurally transformed economies in the Gulf region, its economy still relies on oil. With the exclusion of Dubai, most of the emirates are over-reliant on petroleum and natural gas revenue. To be specific, oil revenue accounts for nearly one-third of the UAE’S Gross Domestic Product (Ramwani, 2016).

However, a section of economic experts believes that low oil prices will have a small impact on the country’s economy. This is due to the fact the UAE has amassed a substantial amount of foreign exchange reserves that is able to sustain the current level of expenditure without relying on oil revenue. The situation will become even much better with the government’s current efforts to broaden the economy. The government has been executing a number of strategies aimed at supporting economic diversification, which include changes to reinforce business environment, infrastructural development, increasing access to credit facilities and streamlining the education sector (Gedvilas, 2015).

While the percentage of non-oil GDP has expanded, non-oil exports are still limited. This means the country is still reliant on oil export. The economic volatility caused by dependence on oil proceeds restricts the diversification and transformation process owing to its effect on administration and exchange rates. In addition, UAE relies on oil revenue to fund nearly all of its major project and programs. As a result, the low oil prices substantially affect the implementation of a number of key projects initiated by the government (Ramwani, 2016). The UAE has invested a huge amount of resources to improve its infrastructure.

Currently, there are six mega infrastructural projects in progress, which is anticipated to cost AED 202 billion. Most of these infrastructures are funded by oil revenues. With the declining oil prices, experts fear it may slow the progress of these projects. However, the UAE government is very optimistic and has assured its citizen and other stakeholders that they will be completed in time. Moreover, the drop in oil prices is likewise influencing the financial sector and a few banks have reduced their lending amid fears of loan defaulters (Ramwani, 2016).

According to Haouas and Heshmati (2014, p. 33), whereas the general feeling within the United Arab Emirates is fairly positive owing to the government’s effort to expand the economy, the drop in oil prices cannot be overlooked. This is due to the significance of the oil and gas industry to the nation’s budget.

They add that, while low oil prices are expected to have a progressive effect on the international economy which ultimately would lead to high foreign domestic investment, the interim effect will possibly lead to the contraction in public expenditure, especially on low-priority projects and non-oil subsidies. Reduced spending eventually leads to slow GDP growth rate as it has been witnessed in the recent past. The country’s GDP growth rate has slowed down from 4.5 percent in 2014 to less than 3.6 percent (Ramwani, 2016).

The right fiscal policy for the UAE

The performance of the UAE’s economy was very strong from 2006 to 2008, attaining an average yearly GDP growth rate of 5.4 percent. The high GDP growth rate was mainly a result of the government’s fruitful efforts to diversify the economy. The non-oil GDP was specifically high due to the government strategy to stimulate investment. The global economic recession along with declining oil prices and the confusion in the financial and property markets, especially in Dubai wrapped up the era of high GDP growth rate (Haouas & Heshmati, 2014, p. 36).

The country’s economy slumped to a GDP growth rate of -5.2 %. The crisis led to an escalation in debt, especially among state enterprises in Dubai that are commonly known as GREs (government-related enterprises). Responding to the crisis, the central government adopted very robust countercyclical financial policies and approved an insurance package for government-related enterprises, which include streamlining debt. As a result, the economy started to recover but at a slow rate (Haouas & Heshmati, 2014, p. 38).

Moving away from a state customary surplus, due to the crisis and the expansionary fiscal policy used, the UAE suffered from a fiscal deficit at the time of the crisis and in the following year. Up to date, the government has not been able to overturn this deficit. However, it has been taking a number of states to minimize this deficit by restricting public expenditure and decreasing government grants and subsidies (Haouas & Heshmati, 2014, p. 38). This begs the question whether the government should continue with the contractionary fiscal policy or revert to the traditional expansionary fiscal policy.

Given the fact that the UAE exchange rate system is presently fixed and hinged on the US dollar combined with the declining oil prices, the expansionary fiscal policy would lead to an increase in Gross Domestic Product (GDP) and enhance the volume of exports. In contrast, the contractionary fiscal policy would reduce the Gross Domestic Product. The expansionary fiscal policy would also lead to competitive devaluation, which subsequently would reduce the value of the local currency and, therefore, increases the aggregate national output.

This, in turn, increases the level of employment, improves the balance of trade, and stabilizes the exchange rate. On the other hand, the contractionary fiscal policy would lead to currency revaluation, which increases the value of the local currency, and subsequently a decrease in aggregate national output. This reduces the rate of employment, deterioration in the balance of trade and the interest rate remains unchanged.

For the above reason, the expansionary fiscal policy still remains the best option for the United Arab Emirates under the current exchange rate regime. A fixed exchange rate does not change. In other words, it is set on a permanent basis. On the other hand, a floating exchange rate can fluctuate anytime. Volatility refers to the intensity at which a given variable adjusts over a specified period of time. Therefore, fixed exchange rates are not volatile because they are permanent. International investors often find it difficult to make sound decisions under a volatile exchange rate system. This is because a volatile exchange system can bring about unexpected gains/losses to investors.

The UAE adopted fixed exchange systems in order to mitigate volatility and attract global investors. The fixed exchange rate system is also preferred because it can ease inflationary tendencies something that the UAE has really struggled against in the last five years (Farouk, 2015, p. 3). Consider the following example. A government may increase public spending due to public demand. An increase in the public expenditure without a corresponding increase in taxes can inflate the budget deficits in the long-term period. When this happens, the government will not be able to borrow extra funds without increasing the interest rate on bonds.

Therefore, the government will be compelled to print more money in order to finance the budget shortfall. There are several consequences associated with this action. For example, the interest rates will fall in the short-term and the demand for foreign deposits will increase. In addition, the supply of domestic currency on the money market will increase. If this happens in a floating exchange system, the domestic currency will deflate in relation to other currencies. An increase in the money supply will result in inflation. However, the inflationary tendency can be mitigated by adopting a fixed exchange rate.

The devaluation of local currency as a result of adopting the expansionary fiscal policy will increase the cost of imported products and, therefore, discourage imports.

On the other hand, locally produced goods will be somewhat less expensive to foreigners. This means that the volume of export will increase. Consequently, the current account deficit is likely to decrease. At the moment, the country exports over AED 140 billion and imports in excess of AED 511 billion. The UAE’s main trading partner is India. Other major trading partners are China, U.S., and the GCC member states (except Saudi Arabia) (Farouk, 2015, p. 5).

The country exports over AED 140 billion and imports in excess of AED 511 billion. UAE imports from India is worth AED 30 billion and exports around AED 20 billion, whereas its imports from China is worth around AED 50 billion and exports stand at AED 4 billion. The imports from Japan is worth AED 85 billion while exports stand at around AED1 billion. The imports from other Asian partners stand at AED 22 billion, whereas exports are worth about AED 2 billion.

The country’s major Western partners include U.S. Italy, Germany, Switzerland and France. The country mainly exports crude oil to these countries. As a result, the imports are more than exports (Farouk, 2015, p. 6). Hence, the expansionary fiscal policy will help the country in improving its balance of trade and its diversification efforts by expanding exports.

Besides reverting to the traditional expansionary fiscal policy, the UAE government should diversify the economy based on the distribution of economic outputs and inputs. Depending on the measure taken, the public and private stakeholders should mainly focus on productive sectors that can sustain long-term growth, as well as invest in research and technology. The diversification and transformation process must also foster the growth of peripheral sectors.

Last but not least, the policymakers should persistently and reliably upgrade the profitability and intensity levels of the monetary base by drawing on assets and making vital interests in divisions, businesses, furthermore, esteem chains where there is an upper hand and where there is business sector opportunity and development potential. This exertion can include improving human capital, expanding education and importing expatriates as required; enhancing money related capital by growing new financing plans and instruments; improving the exploitation and utilization of natural resources and; upgrading innovation and learning with the point of enhancing novelty.

Conclusion

Even though UAE is regarded as one of the most dynamic economies, the declining oil prices will considerably affect its expenditure in infrastructural development and expansion of the public sector jobs in the long-term. For this reason, necessary measures need to be taken to avert the situation. At the moment, the country still has enough foreign exchange reserves that are able to sustain the current level of expenditure without relying on oil revenue.

However, the issue of declining oil prices should not be taken for granted given the fact that oil revenue accounts for nearly one-third of the UAE’S gross domestic product. In addition, most of the major infrastructural projects in the country are funded by oil proceeds. The country is still grappling with the fiscal deficit that was caused by the global financial recession, Dubai debt crisis, and low oil prices.

As a result, the UAE requires a strong monetary and fiscal policy that will help it to bridge the deficit and grow its robust economy. The expansionary fiscal policy remains the best option under the current exchange rate regime due to its ability expand the economy by increasing the Gross Domestic Product (GDP) at the same time enhancing the volume of exports. Other measures that should be considered include assessing and evaluating economic diversity when formulating policies. Depending on the measure taken, the public and private stakeholders should mainly pay attention to productive sectors that can sustain long-term growth.

References

- Farouk, H. (2015). United Arab Emirates Economic Overview 2015. Dubai, UAE: Grant Thorton.

- Gedvilas, J. (2015). Why the United Arab Emirates Refuse to Panic over the Falling Global Oil Prices?. Web.

- Haouas, I., & Heshmati, A. (2014). Can the UAE Avoid the Oil Curse by Economic Diversification? Abu Dhabi, UAE: Abu Dhabi University.

- IMF. (2015). United Arab Emirates: Selected Macroeconomic Indicators, 2012-20. Washington, D.C.: International Monetary Fund.

- Ramwani, K. (2016). Analyzing the Impact of the Declining Oil Prices on the Key Sectors of the UAE Economy. Web.

- Sabrina, A. (2014). Economic Profile of the United Arab Emirates. Web.

- Sophia, M. (2015). The growth in the economy has been attributed to the country’s diversification efforts. Web.

- Trading Economics. (2016). United Arab Emirates GDP Growth Rate 2000-2016. Web.