Introduction

The US automobile industry currently is going through a slump. The sales figures dropped by 13 percent in 2008 from the sales of automobiles in the same time last year (Isidore, 2008). Experts have attributed this decline in demand and supply in the auto market as an effect of the spiraling of global oil prices and the recession that the economy presently faces. The changes in demand and supply and the growth of the industry are thus affected by external conditions. This paper is dedicated to understand the causes that affect the US demand for automobiles in US: how the industry is affected by a shift in supply or demand of the autos, how elasticity of supply and demand of automobiles, the positive and negative externalities the auto industry produces, if there are wage inequalities in the industry and how it can be measured, and if monetary or fiscal policy affect the auto industry. In summary, this report tries to understand the underlying microeconomic and macroeconomic conditions that affect the automobile industry in the US.

Change in demand and Supply

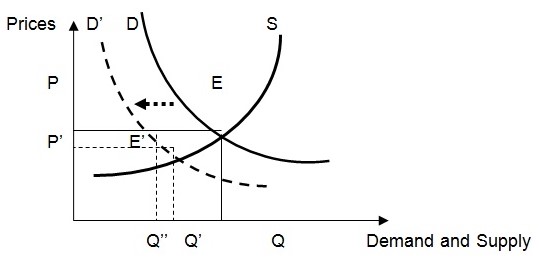

First analyzing the microeconomic affects we see what would happen to the industry if the demand or supply changes. We consider the current sate in the US automobile market when there has been a decline on consumer demand for cars, even when the prices of cars are same. This decline in demand will lead to an inward shift of the equilibrium price and quantity demanded. So in order to retain equilibrium situation, the manufacturers i.e. the suppliers of the product have to reduce their production and supply of the product. This has been demonstrated in figure 1, which shows that due to a decline in demand of automobile the demand curve shifted to the left which indicated that the overall demand changed to change in exogenous factors determining the demand for the product which were otherwise taken constant in the demand-supply analysis.

As figure 1 shows that due to the change in the constant determinants of demand in the US automobile market the demand for automobile shifted to the left, from D to D’. As the demand curve shifts leftward, there is a gap in demand and supply of the good. There arises an excess of supply to demand. As supply increases there are more cars available in the market, which drives down the prices of the good. At price P quantity demanded by customers according to D’ is Q’’. But this quantity is supplied by the manufacturers at a lesser price. This leads to price adjustment in the market and a left-ward shift in the demand curve and the supply of SUVs and trucks remaining same, the equilibrium point shifts from E to E’. The quantity demanded as well as the price of the product declines. If the market did not adjust to the change in demand and the price would have remained same, then there would be an excess of supply of cars. The market demand curve for automobile shifts left due to ride in oil prices, availability if a cheaper alternative in terms of fuel-efficient car prices, and customer expectation of a looming economic recession in the US. This causes the equilibrium price to rise and the equilibrium quantity to fall. The market price has to fall to eliminate a potential surplus at the initial price P.

Thus, we may conclude that due to changes in the non-price determinants of cars, the US auto market experienced a slump in auto demand. The reasons points at a decline in the prices of cars, but further research is required in order to determine the extent to which the prices are expected to fall.

Change in Exogenous Factors

Hence the above analysis shows that a decline in demand of automobile are due to three reasons have been posed by the manufacturers of automobiles as the possible causes for change in automobile demand: oil prices, fuel-efficient car prices, and looming economic recession in the US. Oil being a complementary good to cars, the increase in price of oil will lead to a decline in the demand for cars. Hence, fuel efficient substitutes of American automobiles are a cheaper alternative. As the price of the complementary good of automobiles increased, automobiles became dearer. Moreover, customers expect adverse economic conditions due to the fear of an expecting recession in the US. These three non-price determinants of the demand for automobile altered and lead to a decline in the demand for the products. This decline in demand led to a decline in demand for the product. This can be found from the following analysis of the three determinants.

- With an increase in oil prices, the demand for automobile fell. Oil being a complementary good, an increase in the price of oil led to a decline in demand for oil. As less oil was available for the running the car and oil itself became costlier, the demand for cars also fell.

- Fuel-efficient cars are a cheaper alternative to gas guzzling automobile (Isidore, 2008). Hence being a cheaper substitute the customers shifted their demand towards this product and by assumptions customers take rational decision and are influenced by price changes.

- The US economy is feared to undergo a recessionary phase. This adverse expectation regarding the market has dampened the demand for cars in the country, as people are more eager to save and reap interest on their money rather than spend them on consumer durables.

Elasticity of Demand

Research has shown that elasticity of automobiles increases positively with the life of the vehicles (Moral & Jaumandreu, 2007). So as the car grows older, the demand for the product in the market reduces. In case of the US automobile industry, the demand for US made cars declined considerably as the market demand for Japanese and European made cars increased. The increase in demand for Japanese or European make cars was better attributes like “price, size, power, operating cost, transmission type, reliability, and body type” (Train & Winston, 2007, p. 6). Hence, in demand for car it is not only the price but also other factors that act as exogenous factors in deciding the demand for car. Other exogenous factors that affect the demand are availability of car loan (Attanasio, Goldberg, & Kyriazidou, 2008). Research has shown that both elasticities i.e. price and income elasticity of cars vary with changes in household income, and with interest rate and income elasticity of car loans available from banks (Attanasio, Goldberg, & Kyriazidou, 2008). Hence, car loans also affect the elasticity of demand for cars as because most customers purchase cars with an auto loan.

Research further indicated that price elasticity of US automobiles are so high that U.S. manufacturers were compelled to reduce the price of vehicles in the domestic market in 2000 so that they could achieve the same market share in 2000 that they had in 1990 (Train & Winston). The research also showed that the prices had to fall be 50 percent in order to attain the same market share (Train & Winston). Cross price, elasticity also affected the US automobile industry as the demand for car of US manufacturers fell with the price decline in the European and Japanese vehicles. Further, car demand in the US industry is not only driven by price alone. They are also affected by factors like technology and design (Train & Winston). Thus, these are the exogenous factors that affect the demand for automobiles in the industry.

Externalities

Largely the externalities that can be associated with the automobile industry are largely negative. First, there are concerns over oil. With global oil prices spiraling and the consumption of oil increasing every day with increased use of cars, and with the presence of continuous instability in the Middle East, it is important to check on the usage of this precious natural resource. Second, car emission is in the form of carbon which raises the concern of greenhouse effect. As scientists have confirmed that global warming is occurring, it is important to put a check on the carbon that is emitted by cars (Parry, Walls, & Harrington, 2006). Third, with increased sale of automobiles, roads are becoming more and more congested. Lack of roads and increased paucity of available land for further construction of roads are a major concern for the authorities as the percentage of traffic congestion are increasing exponentially. Fourth, the taxation imposed on road travel to compensate for road and transportation projects are increasingly becoming inadequate and require increased assistance from the state and local level by referenda tying.

Wage Inequality

The last two decades has witnessed an increase in the output per worker in the US economy by significant level. Even then, blue collar workers have seen a modest increase in take-home pay while the Americans at the upper echelon of the income pyramid have earned increasing salaries. A large group links this increasing inequality to the expansion of US trade, particularly with low-wage developing countries like India and China. The US automobile industry too has seen an increased dependence on globalization as more and more US automobile manufacturers have adopted fragmented outsourcing policy to reduce their cost of production. Other reasons which contribute to the increasing inequality are real wage growth and increased earnings inequality (Lawrence, 2008). For calculating the inequality of income Lawrence first deconstructs the empirical gap between real blue-collar wages and labor productivity growth over 25 years and calculates statistically the percentage of the gap attributable to measurement issues and how much the wages would be if the inequality is kept constant at a particular level. According to Lawrence wage inequality in US, industries are not primarily due to international trade as popular belief is. He demonstrates that US imports goods which are “sophisticated” and are produced in the United States through automated procedures. But in case of automobile industry, this is not applicable as US automakers like GM have their manufacturing plants in countries like Poland. So the industry outsources its operations at the cost of domestic labor which has declined the wages in the domestic industry.

Apart from globalization, the other reasons that are responsible for wage inequality in automobile industry in US are low labor income, low labor bargaining power, and offshoring. First, Lawrence (2008) showed that wage inequality follow as cyclical pattern as his study found that the low income share of blue labors in 2006 was same as that in 1997. Second, the labor’s bargaining power could be considerably reduced with the increased trend of offshoring which increased the inequality. Third, US multinationals who offshored their core functions abroad, failed to fetch increasing profits, which remained fairly constant over the last two decades, this adversely affected the earnings of the labors in the country and hence the increasing inequality (Lawrence, 2008). Other reasons for wage inequality in the automobile industry are changes in technological know-how, institutional developments such as deregulation in the financial sector, amendments in the corporate governance practices in the country, and the rise of the asset market (Lawrence).

Monetary and Fiscal Policy

The Federal Reserve keeps a watch on the swings in the automotive industry closely as it is a strong affecter of the domestic economy. The monetary policies and fiscal policy affects the automobile industry greatly. For instance if there is a tax cut in the sale of cars, automobile swill be cheaper and will thus increase the demand and thus the consumption of cars. And if the bank rates were lowered, this would signify that car loans will become cheaper and hence cars will become cheaper.

NAFTA agreement between US and Mexico has boosted the automobile industry as it has opened the avenue for the industry to outsource its auto parts industry to Mexico as it would provide cheaper auto imports from Mexico or would provide opportunity for the US auto companies to relocate to Mexico (National Research Council, 1982). But others argue that this avenue for outsourcing would coma at the cost of US employment as the Mexican auto assembly plants had high quality workers at low wages.

The monetary policy in US aims at keeping a check on inflation, and so increased the interest rates that bank could lend at and this would increase car loans and increase car prices. In other words, an increase in the Fed rate followed by an increase in oil prices to control inflation resulted in the decline of demand for cars and hence led to a decline in the growth of the industry (Rudebusch, 2000). This has sufficiently aided the US automotive industry. Further, the monetary policy of the Federal Bank has been expansionary since 1980s (Boivin & Giannoni, 2006). The Fed has cut the bank rates, continuously giving indication to the industry to undertake greater amount of investment and ensuring enough liquidity in the market. Moreover, the monetary policy has increased the bank rates to lend abroad higher. This will increase the avenues for domestic automobile industry to take greater advantage of the country’s financial resources. Hence, both the fiscal and the monetary policy have helped the US automobile industry to a path of growth.

Conclusion

The US automobile industry has been analyzed from both the perspective of macro and micro economy. The analysis shows that there are shifts in demand and supply of the auto industry currently and the exogenous reasons which affect this shift are stated. Further, we also see how elasticity of automobiles affects the industry. We also discuss the externalities of the auto industry which turns out to be mostly negative in nature like pollution. Further we see that the increasing wage inequality in the US auto industry and the reasons why it is occurring. In the end, we discuss the affects that monetary and fiscal policy has on the automobile industry.

Works Cited

Attanasio, O. P., Goldberg, P. K., & Kyriazidou, E. (2008). Credit Constraints in the Market for Consumer Durables: Evidence from Micro Data of Car Loans. International Economic Review Vol. 49 no. 2 , 401 – 436.

Boivin, J., & Giannoni, M. P. (2006). Has Monetary Policy Become More Effective? The Review of Economics and Statistics vol. 88 no. 3 , 445-462.

Isidore, C. (2008). CNN Money. Web.

Lawrence, R. Z. (2008). Blue-Collar Blues: Is Trade to Blame for Rising US Income Inequality? Washington DC: Policy Analyses in International Economics.

Moral, M. J., & Jaumandreu, J. (2007). Automobile demand, model cycle and age effects. Spanish Economic Review 9 , 193–218.

National Research Council. (1982). The Competitive Status of the U.S. Auto Industry: A Study of the Influences of Technology in Determining International Industrial Competitive. National Academies Press.

Parry, I. W., Walls, M., & Harrington, W. (2006). Automobile Externalities and Policies. Washington DC: Discussion Paper, Resources for the Future.

Rudebusch, G. D. (2000). Structural change and monetery policy. San Francisco: Economic Review – Federal Reserve Bank of San Francisco.

Train, K. E., & Winston, C. (2007). Vehicle Choice Behavior and the Declining Market Share of U.S. Automakers. International Economic Review Vol. 48 no. 4 , 1469 – 1496.