Executive Summary

Saudi Aramco is a state-owned oil-and-gas company in the Kingdom of Saudi Arabia. Its history can be traced back to the time when the kingdom was a young country ruled by the Saud family, considered to be the royal family of Saudi Arabia. The discovery of oil led to the progress and development of the kingdom. Until now, Saudi Arabia is regarded as the richest country when it comes to oil, and in fact, its oil reserve is considered to be the largest in the world. Natural gas is another wealth for the kingdom.

All operations, explorations, and concerns regarding oil and gas within the Kingdom of Saudi Arabia pass through Saudi Aramco. This company is now the lifeblood of the kingdom because it is said to be behind the Saudi economy. At present, the construction industry is again on the rise, and the finances or funds that have resurrected it comes from oil and gas revenues.

It may still come a long way; meaning the oil reserves of Saudi Arabia can still support a thriving economy and the world. The oil reserves of Saudi Arabia will supply the world in the many years ahead. There were doubts as to its capacity to support the world, but now it has come to the attention of industry experts that Saudi Arabia oil is still the industry the world can rely on.

This dissertation is about Saudi Aramco. The story of Saudi Aramco, the oil producer, is the story of Saudi Arabia. Thus, it can be said that when a Researcher talks of Aramco, he/she talks of Saudi Arabia or vice versa.

SWOT and PESTEL analyses are provided. Qualitative analysis and review of the literature were also conducted.

Introduction

Saudi Aramco was originally named the Arabian American Oil Company. In 1933, the government of Saudi Arabia granted a US company, the California Arabian Standard Oil Company, to operate and tap oil in the kingdom. Several big oil companies at that time joined in to form what is now the Saudi Aramco. Oil was discovered at Dhahran, and many discoveries were made later on.

The largest oil fields in the world have been discovered in Saudi Arabia, with Saudi Aramco as the prime organization in fully operating and tapping the vast oil fields. Saudi Aramco is now owned by the government of the Kingdom of Saudi Arabia. This large company is not only oil-producing but has also taken control of refining and marketing of oil to the various parts of the country and the world. It has acquired oil refinery and marketing firms for such purposes. Aramco now employs approximately 51,000 people from 66 different countries. The pool of human resources is composed of geologists, engineers, scientists, and computer specialists who are mostly from Saudi Arabia. (Saudi Aramco, 2011)

On July 1, 1993, Aramco assumed responsibility and control on all state-owned oil refineries in Saudi Arabia. It has been described as a sophisticated organization whose business is producing and processing ‘black gold’. Its control of the vast oil industry was made official through a Royal Decree which put into law the marketing and distribution of oil to the different parts of the country. Previously, it was once held by the Petromin Marketing and Refining but now Aramco has held controlling interests in most refineries in the country. Aramco also holds major interests in international refineries in different parts of the world.

In Saudi Arabia, Aramco takes charge of the distribution and marketing through its many branches. Moreover, Aramco has a supply of a million barrels of oil per day, distributed locally and throughout its subsidiaries in many parts of the world.

Objectives

- To determine the marketing mix that Aramco has introduced in its operations;

- To analyze the strengths, weaknesses, opportunities, and threats (SWOT), and Michael’s Five Forces on Saudi Aramco.

Methodology

The methodology applied in this research is an analysis of the literature and the vast information on Saudi Aramco. Secondary research is conducted on the studies and researches of the company, including the analysis of the SWOT and Porter’s Five Forces, and how the company markets its various petroleum products and the services it offers.

We first focused on organizational theories, globalization, international marketing, and the many concepts of the oil industry. The vast information and data were sourced from the library, online and physical libraries, databases, and websites.

Fraenkel and Wallen (2006, p. 16) stated that “critical researchers should raise several philosophical, linguistic, ethical, and political questions… about all fields of inquiry, ranging from the physical sciences to literature.” Critical research on the literature regarding Saudi Aramco and its petroleum products is an interesting topic for discussion. The emphasis is to provide a critical analysis and then raise issues that may be of benefit to business students. This topic is important for students of business in that it will give them a chance to improve their soft skills as they enter an unpredictable world of intense globalization, where changes and innovations occur every minute, every second of the day.

Literature Review

Saudi Arabia is one of the world’s richest countries when it comes to oil. One of the largest oil companies operating in the country is Saudi Aramco, which is a knowledge-based, global firm, producing and refining oil for the Kingdom of Saudi Arabia. As mentioned in the introduction, Aramco has taken control of the production, refining, marketing, and processing of oil in the country through its many plants, refineries, and merged companies within the country and outside the country.

Saudi Arabia has approximately 5,000-8,700 oil wells, which have been kept secret from the public. The wells produce volumes of oil every day. A paper in 2004 confirmed that Saudi Arabia had a total of 8,700 wells. (Simmons, 2005, p. 102)

These oil wells have the capability of producing millions of barrels per day and provide a reserve for the country in the many years ahead. Petroleum products are the lifeblood of the Saudi economy. This is why the government has taken the lead and acquired controlling interests in the company along with the many refineries and companies in the country.

Saudi Aramco’s operations cover the global oil and gas industry. It spans from the Arabian Gulf to the world. Its business encompasses oil and gas, including processing and refining, and up to distribution. Its area extends up to the territorial waters of Saudi Arabia, encompassing the Arabian Gulf.

Performance of the Saudi Economy

Background

Saudi Aramco started its humble beginnings in 1933 when Saudi Arabia granted the US company, the California Arabian Standard Oil Company, a license to drill or discover oil in the kingdom. This was later joined in by several big oil companies to form the Arabian American Oil Company, now the giant conglomerate Saudi Aramco.

Five years later after the exploration by the Californian company, oil was discovered at Dhahran and soon exportation of oil was commenced to the neighboring Middle East states. The largest oil fields in the world have been discovered in Saudi Arabia and these are now operated and controlled by Saudi Aramco, now fully-owned by the government of the Kingdom of Saudi Arabia.

The discovery of oil in Saudi Arabia in 1933 enriched the government and the Kingdom of Saudi Arabia, allowing its leaders to use the oil revenues to support and finance the country’s development plans. Success in the country’s development was at the hands of the leaders and the people. While before they used to live in mud-brick houses and used animals for transportation, they now lived in buildings and owned cars, and used modern means of transportation. The government pushed for rapid growth and development, built highways, roads, airports, seaports and terminals, public buildings, hospitals, universities, and so on. The miracle in a land that was not even as large as a nation-state in terms of the economy became real because of that one thing known as black gold – oil.

Saudi Aramco became instrumental in enhancing financial capital in oil and petroleum and the by-products of oil for the government of Saudi Arabia. It acquired controlling interests in some other oil refineries such as the SsangYong Oil Refining Company (or S-Oil Corporation) which was once owned by the Republic of Korea. Aramco has major interests in many oil companies in the neighboring states of the Middle East, UAE, and many other countries. (Saudi Aramco, 2011)

What is remarkable is that this giant state-owned oil company is not only an oil-producing firm, it has also taken control of refining and marketing of oil to the various parts of the country and of the world. It has acquired oil refineries and marketing firms for such purposes. Aramco now employs approximately 51,000 people from 66 different countries. The pool of human resources is composed of geologists, engineers, scientists, and computer specialists who are mostly from Saudi Arabia. (Saudi Aramco, 2011)

A small percentage of the workforce consists of about 8,000 expatriates who come from the United States, Europe, and Asia. (Simmons, 2005, p. 101)

Saudi Aramco’s corporate mission aims for establishing a business unit structure unique in the annals of corporate governance in Saudi Arabia, despite its being a state-owned corporation. It also aims for achieving the best and on what the kingdom can hope for. It has attained many firsts for the Kingdom of Saudi Arabia; the government has no intention to give it up or to privatize it because it sees in the company a strong and formidable force to drive the country into progress and development. Aramco also aims to optimize oil revenues through opportunities offered by its pool of knowledge-rich and expert pool of engineers, scientists, and other professionals. It aims to prepare the company and the workforce to work beyond and look for greater glory in the many years ahead. The company’s joint venture undertakings have been very fruitful, and have offered for the company and the country in general greater opportunities and more revenues. (Saudi Aramco, 2011)

The Stakeholders

Stakeholders of Saudi Aramco include the members of the Saud family and the rulers of the Kingdom of Saudi Arabia. The Royal family reign and inherit the throne not according to the father-son line of succession but through the brother-brother line of succession. Only those children of King Abdul-Aziz can inherit the throne. (Frontline, 2011)

Most of the leaders of Saudi Aramco come from ExxonMobil and the original firms that formed Saudi Aramco. The corporate culture is dominated by American culture. The procedures in the offices and the corporate culture can be traced to the Americans, the pioneers of the original company. Aramco’s rise in the industry was first influenced by the internal and external forces, mostly from the UK- and US-based oil companies called the Seven Sisters. These companies were the original Standard Oil, Exxon, Royal Dutch, Shell, and several others. (The Oxford Business Group, 2007)

SWOT Analysis of Saudi Aramco

Strength

The company’s strength is divided into five major categories, namely: energy, innovation, partnership, performance, and reliability. The organization focuses on the energy, which is the lifeblood of the country’s economy, and energy which drives the company’s workforce. Aramco also focuses on innovation, which refers to changes, creativity, and productivity for the organization’s objectives and improvement of the entire workforce. Innovative solutions are also introduced to many aspects of their business. (Saudi Aramco, 2011)

Aramco does not consider their employees and the entire workforce as a working force but as partners. They do partners with their suppliers, clients, and communities for a wholesome work environment. The work performance of employees and everyone involved in the business count a lot. The organization follows the highest standards of excellence for their workforce in all their areas of operation, including safety and environmental standards, so that their clients and the general public can rely on. (Saudi Aramco, 2011)

The global village is now becoming a reality, and the workforce is composed of diverse cultures. Saudi Aramco realizes the importance of diversity in the workplace. Employees must value the diversity of the organization and accept the multi-ethnicity in the workplace. As Buhler (2001) says, “Heterogenous groups are creative.”

The company encourages its workforce to become creative, to submit their suggestions and ideas to the human resource department, for the improvement and success of the organization. Diversity in the workplace allows the organization to value people; their managers and supervisors are encouraged to get out of the office, talk, and mingle with the members of their teams. Aramco values teamwork and clustering. (Saudi Aramco, 2011)

Creativity spawns new ideas, suggestions, and variations. Employers want employees who are creative because they can positively contribute their ideas and their inner thinking to the team and the organization. Creative employees help formulate the vision and objectives of the organization. Companies evolve, organizations have to change and introduce innovations. And creative people are needed in this kind of scenario. Employees should “think outside the box”. Creative people are productive and work for the fulfillment of the organization’s objectives.

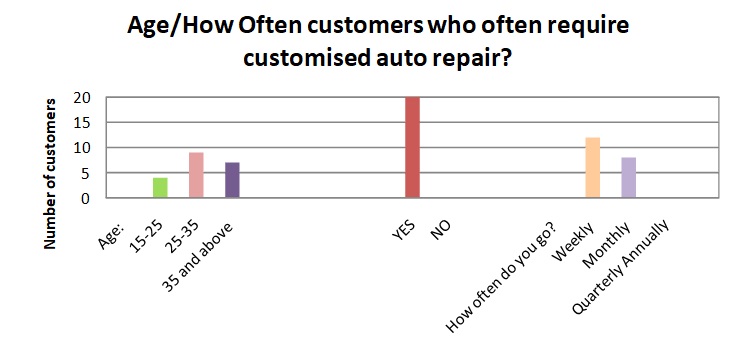

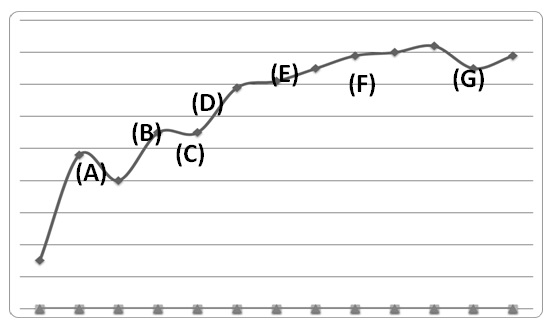

Saudi Aramco’s growth means Saudi Arabia’s major development and improvement in its business cycle. Saudi Arabia’s major business cycle is demonstrated in the graph above. The development and rise of the GDP are attributed to major oil explorations and discoveries. The graph above shows the GDP rise and improvement from 1970 to 2010.

The graph in Figure 1 shows the following data:

- There was an oil boom from 1970 to 1982;

- Another oil bust cycle for the period 1983 to 1987;

- There was a recovery cycle during the period 1988 to 1992;

- But a stagnant cycle occurred during the period 1993 to 1995;

- A restricting cycle occurred in the period 1996 to 2001;

- Another oil boom occurred in 2003 up to 2008;

- Finally, a retrenchment cycle occurred in 2009.

Weakness

The environment is closely in continuous threat by oil companies and refineries in Saudi Arabia. The processing of oil creates a lot of pollutants and chemicals that mix with water. Wastewater treatment and disposal are a problem of the government.

Rules and regulations, including present legislation, should be followed to the letter so that environmental safeguards are fulfilled. Some companies and organizations have been involved and have carried their tasks with the thought of preserving the environment. In doing their projects, they institute measures to safeguard the environment, at the same time conduct total quality management.

Saudi Arabia is one of the richest in the world when it comes to oil, but water is its major problem. It produces wastewater and depends on desalination for potable water. Desalination however is very costly so that the country has to find ways to process water for its drinking population and other industrial needs. Desalination alone costs 6 Saudi riyals for every cubic meter of water. Reused water can then provide a lot of savings for the government and the Saudi people. Moreover, it can help improve and protect the environment or prevent global warming. (Ministry of Economy, Trade, and Industry, 2009)

In the study commissioned by the Ministry of Economy, Trade, and Industry (2009), it was found that in Saudi Arabia, there are five oil refineries, with Saudi Armco as the biggest refinery. The refinery has wastewater treatment plants, which are not found in the same location but are several kilometers apart. Their treatment facilities treat secondary water for the cooling tower, boiler feed water, and so forth. Saudi Aramco takes its water from secondary treated water. Moreover, it uses treated water for industrial purposes. This is one of the major accomplishments of the company in combating environmental abuse and the threat to Saudi Arabia’s dwindling biodiversity. By using treated wastewater, the company has helped in preserving the environment.

The application of wastewater reuse at Saudi Aramco has reduced the cost of industrial water because of the application of excellent technology by experienced Saudi engineers and experts. Regulations and standards for the preservation and protection of the environment, especially on wastewater management and oil and water separation, are being enforced by the Presidency of Meteorology and Environment (PME) Regulations and Standards. (Ministry of Economy, Trade, and Industry, 2009)

Saudi Aramco has environmental programs to help in the fight against climate change and global warming. The above analysis on the weakness of Saudi Aramco can be turned into strength for the company for as long as its present programs of environmental protection, wastewater treatment, and waste disposal are continually improved and imposed by the company.

Opportunity

Saudi Aramco uses technology that allows it to pre-qualify and approve existing projects or soon-to-be projects. Foreign companies can sell directly to the company or through an intermediary or agent. This is an opportunity for Aramco and its suppliers, even small suppliers or companies. The official working days in Saudi Arabia and for Saudi Aramco are from Saturday through Wednesday. English is spoken and considered a business language for most of the business firms in Saudi Arabia. (USA International Business Publications, 2009)

Aramco had become a global and independent conglomerate endowed with highly technical experts in the field of oil exploration and production.

Opportunity is also provided by its strength – the oil and gas are used to power electricity. Saudi Arabia has a capacity of 33.5 GW, and most power plants are powered by gas; there is only one power plant powered by oil.

Threats

The purpose of this section is to discuss whether renewable sources of energy, such as wind power and bio-energy are a threat to the oil industry or Saudi Aramco. From the outset, oil continues to be a primary source of energy within the next decade and beyond. But since there are continuing experimentation and implementation of new forms of energy source, it has come to the attention of some authors and experts in the field whether this is a threat to the production and business of oil.

Renewable Sources of Energy

Oil and gas are fossil fuels that deliver the strength of the company in its competition. The company’s corporate objective points to the maximization of the exploration and sale of hydrocarbon materials such as oil and gas.

The global emphasis on renewable energy such as solar power, bio-energy, and similar other energy sources, can become a threat to Saudi Aramco, assuming that the renewable energy supplies are in great abundance and have penetrated the market as a fuel source.

To examine this new energy source compels this next section of the paper.

Although renewable energy still has a long way to go, its competition to existing oil and gas reserves cannot be undermined. In different parts of Europe, photovoltaic power plants are on the rise. An example is the one in the Czech Republic where solar energy sources are increasing, raising investment from private sectors in photovoltaic facilities. The UK government has responded to the call for more investments for use of renewable energy. In 2009, the government’s Department of Energy and Climate Change (DECC) provided £18million to the UK clean energy sector as support for more projects on clean energy businesses. (Professional Engineering, 2009)

The UK government has full support for the development of technologies, renewable energy sources that include fuel cells, photovoltaic, maritime and wind power, and the so-called smart-grid technology.

In the United States, there has been a move to generate electricity through a rooftop installation of photovoltaic to ensure renewable power sources. Private and public companies aim for “climate neutral” by 2020. (Wilson, 2009, p. 74)

The DESERTEC Project

The concept is to produce clean power from the vast deserts of Saudi Arabia. The DESERTEC project is a huge and long term project that will impact the environment and population of the countries of Europe and around the MENA region (the Middle East and North Africa). It is an ambitious one for the so-called sun-belt countries that involves the construction of Concentrating Solar Power (CSP) plants to make use of solar energy which is an environmentally friendly use of energy. The problem of climate change and global warming due to the overuse of fossil fuel and coal gas emissions will be minimized. (Brix, 2009, p. 2)

According to feasibility studies and assessment of well-known experts, scholars, and scientists, the DESERTEC project is a viable project that will answer the energy and water needs of the population by the year 2050; more specifically it can serve the purpose of saving the earth from destruction of its ozone layer. The world population is expected to increase by about 10 billion by that time, and if electricity and water demands are not programmed by now, there will be insurmountable problems for the people and the deterioration of the environment will exacerbate.

The DESERTEC website says that a few hours the earth receives power from the sun is equivalent to a year it can use for its requirements to run factories, industries, businesses, homes, and offices. The deserts of Africa and Arabia can absorb much heat from the sun using mirrors to heat water to produce steam and convert this into energy. With this technology, solar energy is convertible into High Voltage DC; the technology uses AC converted into Direct Current using gargantuan transformers and components that store electric currents like capacitors. (DESERTEC Foundation, 2011)

The logic behind this is that fossil fuels and coal supplies on earth, particularly those in Saudi Arabia and the Middle East oil wells, will be depleted in the future. There will come a time that resources for these forms of energy source will be diminished. In other words, there must be a way to produce a substitute for fossil fuels and coal, something that is not harmful to the ozone layers and the environment as a whole. Solar energy and other forms of environmentally friendly energy using the wind, tidal waves, hydro, and other similar forms, must be tapped.

The TREC (Trans-Mediterranean Renewable Energy Cooperation) has been continuing its studies which aim to multiply for several times the generation of electricity and desalinated water by solar thermal power plants and then transmitting the power generated through high-voltage direct current (HVDC) transmission lines throughout the Mediterranean region. Power from deserts can be the key to sustainable energy use that can last up to 2050 and beyond, and the earth is ensured of a long life too. It utilizes the tremendous power of the deserts which absorb a vast amount of solar energy. The concept has been acclaimed by scientists and groups, particularly Greenpeace International.

Given the rapid expansion of the world’s economies, demand for fossil fuel and construction materials will become severe. Added to this is the water demand. The excessive demand for fossil fuel energy resources will also result in the demise of the ecology of our planet; the effects might be long-lasting and cannot be reversed. Scientists say that this is of immediate concern. The deterioration of our planet’s ecosystem and atmosphere cannot be ignored; if we have to act, the right time is now. Our planet’s ozone layer has been depleted by severe coal gas emissions. Worse is the reality that greenhouse gases have altered meteorological conditions.

The MED-CSP (for Concentrating Solar Power in the Mediterranean Region) study concluded that renewable energy is a must for the economic growth of the region and that the present supply of energy is insufficient. Moreover, renewable energy is not scarce in the region and can supply the countries for a longer period, or up to the specified date 2050, which is crucial in world population (MED CSP 2).

Europe has vast technologies at its disposal, not to mention the knowledge resource, the scientists, and experts in the field, while the MENA region has the potential of a vast amount of solar energy. MENA can export the product of solar energy; it also has vast labor potentials. Capital can be sourced from stakeholders around the world who are interested in solar energy.

The big question here is, is renewable energy a threat to the supply of oil around the planet? Or, is this a threat to Saudi oil?

The big question may not be a question at all. Renewable energy like the one described above, solar energy, and other forms of renewable energy like wind- and bio-energy, are not the same as fossil fuel or energy that comes from petroleum. Scientists contend that oil, no matter what country it comes from, will soon run out, but not renewable energy. The name itself states that it can be renewed. The DESERTEC project and all the other solar energy projects will make use of the vast deserts and solar energy. The sun’s heat will power our earth during the daytime and will return to space at night time in the form of heat radiation. That is why pioneers and promoters of the DESERTEC project are upbeat to proceed and complete the project at a time when our earth is surrendering to the over-use of fossil fuels.

Some say that oil will never run out, technology will continue to find a source for oil and petroleum will be a permanent need for a man. (Simmons, 2006, p. 33)

There are many debates about the oil peak. Saudi Arabia’s oil supply peak record was scheduled in 1980-81, but again it has continued to supply the world with so much coming from its vast oil reserve. Simmons (2006) says that the peaking of oil, which means that its supply has already reached the peak level, has never occurred for Saudi Arabia, which was rumored to be so in the 1980s. This means Saudi Arabia has still vast oil reserves. It was also in the 1980s that the OPEC countries including Venezuela announced that their vast oil reserves had doubled and tripled. There was an additional 300 billion bbls of oil although there was no new oil discovery. This means it was a miracle that oil just poured in.

However, Simmons (2006) commented that he was convinced Saudi Arabia was nearing its peak of oil reserves. Rodgers (2006) argued that the world is producing oil more but consuming oil more than it could find other sources of oil. There have been studies conducted on the past oil reserve growth, including production and demand, the discovered reserves and other reserves yet to be discovered. The analysis provided suggestions that oil production outside the OPEC countries will not meet the demands of oil needs, although oil discoveries have continued. In 1990, there was a discovery of approximately 8 billion barrels of oil annually, but the demand will continue. And while this demand continues, it will pass on the responsibility to the OPEC producing countries, including Saudi Arabia (Rodgers, 2006, p. 34). The debate, therefore, is about flowrate, meaning how the oil supply can meet world demands of oil (Tyler Miller and Spoolman, 2009, p. 370).

The world will continue to need oil no matter if the DESERTEC project and other sources of renewable energy and bio-energy are successful in introducing and supplying energy to the world. The need and introduction of bioenergy and other renewable sources of energy are not a threat to Saudi Aramco and the oil industry. The primary objective of seeking other forms of energy is to reduce or eliminate the threat of climate change, or for environmental preservation.

The introduction and success of bio-energy and other renewable energy into the world economy and diversity is not a threat to oil energy.

Moreover, Saudi Aramco’s product and source of revenue is not just oil but also gas. Gas is another source of revenues and profits for Aramco. Most electric plants in Saudi Arabia are powered by gas.

PESTEL Analysis

PESTEL analysis for Saudi Aramco will be comprised of the political, economic, social, technological, environmental, and legal factors.

Political

Controlling interests are vested in the royal family of Saudi Arabia which is composed of the descendants of the Saud family. As stated in the earlier section, the flow of succession for the royal family is not by way of a father to son but by a brother-brother line of succession. Only the members and descendants of King Abd al-Aziz ibn Saud have the right to the line of succession. (Frontline, 2005)

Saudi Aramco’s rise to global leadership in oil production has been influenced by many factors coming from inside and outside of the country. The world’s oil industry was once controlled by a world cartel composed of companies from the U.S. and the UK. They were once known as the ‘Seven Sisters’ consisting of Standard Oil, or Exxon; then there was also the Royal Dutch Shell; the BP; another company named Standard Oil which later became Mobil; Chevron; Gulf Oil and Texaco. They held the monopoly for some time but some of them have merged. Their leadership and control have been tremendously reduced, amounting to about 10% of the world’s oil and a little reserve. These companies formed a monopoly in the world oil industry. They controlled the prices and the flow of marketing. (Oxford Business Group, 2007, p. 130)

During the time of the ‘Seven Sisters’, market research was not very significant in the other companies’ development. Prices were controlled by a few companies. The ‘Seven Sisters’ which were mostly foreign companies were now replaced by a new set of government-owned companies from other countries led by Saudi Aramco. These companies are government-controlled so that dealing business with them has to pass through government channels or a government to government communication.

Saudi Aramco is not dependent on international oil companies. The so-called upstream sector which was formerly held by United States companies during the twentieth century is under control by Aramco. IOCs provide technical assistance and technology sharing with other member oil companies including Saudi Aramco.

There are still foreign companies doing explorations in the neutral zones within Saudi Arabia, and these are Chevron, the Royal Dutch Shell, and others. The Royal Dutch Shell is into a joint venture with Saudi Aramco to do oil exploration. Sinopec, a Chinese company is also doing some oil explorations within the kingdom along with Aramco and ExxonMobil. (Oxford Business Group, 2009)

Economic

The oil business is capital intensive, so Aramco’s daily business consists of inviting and enticing investors and big oil companies from other countries to join the company and provide more capital. To invest in the oil industry means to invest billions of dollars, without a hundred percent assurance of return of investment (ROI). This is the job of Aramco – to invite oil investors and invest their billions. They will not be competitors but co-partners in the struggle to make Saudi Arabia the haven of oil investors – always.

Saudi Aramco has not only a monopoly of oil production, refining, and marketing in Saudi Arabia but has diversified its products to include agricultural products. Saudi Aramco conducts periodic market research coupled with market intelligence. Market intelligence refers to the broad spectrum of the market. It refers to a lot of topics which may include the organization and its products, prices, macro-environment, competition, and so on. For Saudi Arabia and the local market of oil, market research includes the study on the existing business environment of the country, the price of oil in the local market, the oil companies and the competitors, and the assets of those companies. (Saudi Aramco, 2011)

Aramco committed to mergers and acquisitions. It wants to build more refineries for the kingdom, but at the same time, it is enticing foreign companies to invest more inside Saudi Arabia.

Aramco and Total committed to a $10bn joint venture for a refinery project by 2012 in Jubail. It is expected to produce 400,000 barrels per day. Another joint venture is in the offing between Aramco and ConocoPhillips for an oil refinery at Yanbu that will produce 400,000 barrels per day. The project is estimated to value $12bn and will be completed by 2013. (Oxford Business Group, 2009)

Social

Aramco has created knowledge structures, places, and mechanisms for the creation of knowledge, whether this is through the interaction of employees and managers, and the vast physical structures created by the great wealth from a precious element called oil. Through the networks that the company has created, both locally and internationally, Saudi Aramco has maintained a product-development process unique from the rest of the world’s oil industry. Its wealth of knowledge-based system is a product of marketing intelligence and years of continuous data-basing. It can be challenged but cannot be equaled because it is unique by itself.

Saudi Aramco is a global organization with many subsidiaries in the Middle East and around the world. It operates a network of companies and branches of refining, distribution, and processing of petroleum products. It operates using the latest technology coupled with software and Information Technology. It supplies liquid hydrocarbons which include fuel and feedstock products.

Technological

In the present age of globalization, competitive advantage is more pronounced with the knowledge people possessed, or what is termed, ‘people-embodied knowhow’ (Rodriguez and de Pablos, 2002, p. 174). Tangible assets no longer provide concrete competitive advantages. Firms are focusing on what their people know, and invest much in intellectual capital.

Aramco’s marketing has been revolutionized with the advent of high technology, the internet, and consequently, globalization. Distance is no longer a problem for businesses and organizations because of increased mobility, and organizations are free to locate many screen-based activities wherever they can find the best bargain of skills and productivity. The world is having access to networks that are all interactive. Large networks enable consumers to order and receive what they want to buy – where and when do they want these things to be delivered.

Saudi Aramco’s organizational set up reveals it’s being a global organization. It has many branches in many parts of the world. Being a global organization motivates it to fulfill the processes of globalization. It has to adapt to the changing times, and the application of technological tools for operations and fast-paced communication.

The internet changed the way things are for businesses and organizations. It is seen as a significant contributor to the globalization of economies and markets throughout the world. The internet, the World Wide Web, and globalization are almost synonymous because their functions point to the interconnectedness of computers, and communications have become so easy and accessible wherever and whenever. National borders are ignored or removed from the jurisdiction of the nation-state.

With this technological tool, the rules of business have changed. It is an entirely different ball game, one would comment. Some commentators say that this is now “the death of distance”; meaning distance is not anymore a factor because people can communicate with anyone wherever he/she may be.

Environmental

Where once the oil industry was a threat to the environment because of the pollutants it creates and mixes with the wastewater, Saudi Aramco has helped in the protection of the environment and promoting what has remained of the ecology in Saudi Arabia.

Aramco created a department that promotes environmental protection and sees to it that environmental responsibilities are not left behind. This department is known as the Environment Protection Department which ensures that the organization along with its thousands of departments and employees work within the guidelines of environmental protection and sustainability. The procedures and engineering works within the company follow the performance guidelines for environmental preservation. Some of the guidelines include sanitary codes, environmental assessments before a project is being pushed through, occupational health regulations, and many others. Aramco also manages its wastewater treatment effectively. It produces recycled wastewater and provides desalinated water to the rest of the refineries. (Saudi Aramco – Environment, 2011)

Legal

There are fewer legal constraints for Saudi Aramco considering that the company is state-owned and that legal aspects have been remedied to suit the smooth flow of the company’s operations. There are however complaints and reports from the human rights groups regarding such rights for the citizens of Saudi Arabia. Some are unfounded but some point to the line of succession for the royal family.

Concerning Saudi Aramco, all legal impediments have been controlled because the company is said to be the life-blood of the Saudi economy.

Impact of Saudi Aramco on the External Environment

There are special features of the theories of Industrial Organization (I/O) and Resource-Based View (RBV) models of the strategy included in this discussion. The theory was first formulated by University of London Professor of Economics, Edith Penrose (1959) who said that ‘firms are heterogeneous and there is money to be made from exploiting the differences.’ (Wright et al., 2007, p. 76)

The Resource-Based view model states that the firm is a collection of unique resources. From the experience and constant contact with customers, employees, and competitors, the organization forms a database of information. Each organization is a collection of unique resources and capabilities which can be the basis for a firm’s strategy and its ability to gain competitive advantage. Resources are those acquired by the firm in its long operations and these may include equipment and skills and talents of the employees and managers. They can be classified into physical, human, and organizational capital. The organization can accumulate diverse resources from the environmental forces, including that inside, such as from the employees, and outside (such as from the customers, competitors).

Resources are of different types that enable the firm to implement organizational strategies and help in attaining the organization’s objectives. But individual resources may not be enough. Resources have a greater likelihood of being a source of competitive advantage when they are formed into a capability. Organizational knowledge is one of these resources that present this type. It is original and unique for every company or organization. This kind of resource in an organization cannot be copied or moved.

Saudi Aramco focused on its resources and let it grew into one of the biggest, if not the biggest supplier of capital and resources for the government of the Kingdom of Saudi Arabia. Aramco handles a rather large market that spans from inside Saudi Arabia to the world, all dealing with oil and other petroleum products. The company has also revolutionized the market through the introduction of marketing innovations with the use of technology.

Effects of Globalisation on Saudi Aramco

Globalization has revolutionized businesses and organizations. Companies now are expanding abroad, and have to expand both as an organization and as a business. Businesses have to introduce more new products and services. Competition dictates these companies to be always changing.

A commonly accepted definition of globalization by economists, says Van Der Bly (2005), is that it is the “international economic integration that can be pursued through policies of ‘openness’, the liberalization of trade, investment, and finance, leading to an ‘open economy” (p. 875). Internationalization, liberalization, increased competitiveness – are some of the aspects of globalization.

The exponential growth of the internet in the United States, now being overtaken by the growth in the rest of the world, has led many to question the relationship between a new global network and the future of the sovereignty of the nation-state. In globalization, firms are faced with more challenges and ambiguity but they have to cope and adapt to the social and economic transformations. Inside the organization, structural reforms have changed. The main drivers of globalization are the declining trade and investment barriers as well as advances in communication, transportation, and information technologies.

As Gupta and Becerra (2003) stated, ‘In many industries characterized by rapid technological development and intense competition, superior knowledge, rather than market power and positioning, is the key to long-term success.’

One of the outcomes of the internet and globalization is outsourcing. Outsourcing is delegating some functions of the organization or business to outside organizations or firms whose main business is to provide services or outsourcing functions to these companies. Outsourcing is not new; it is a force in the business transformation that continues to dominate business functions throughout the world. Saudi Aramco outsources some of its functions, including labor-intensive construction. When construction for a particular project starts, the company outsources labor from Asian countries.

We are now in the age of digitization and fast-paced communication. There are major changes in firms, and the setup is different. Top managers and their boards now assume functions different from traditional firms. The structures and functions concerning the roles of top managers and board of directors, the CEO or the Managing Director, and the composition of the Board of Directors are not the same as in the traditional firms. The changes are much more pronounced concerning the scope and the geographical considerations, unlike the organization of proximity.

There is a convergence of employment-related aspects of industries. Mills et al proposed “a theory of the mechanisms of convergence, divergence via path dependence and convergent-divergent”. (Mills and Hofmeister, 2008, p. 570)

Global firms have the whole world as their market field that they can offer a wide array of products and services. Firms keep growing while others downsize, and they can delegate departmental functions, such as marketing, finance, operations, human resource management, and accounting to other firms or organizations which may be found in other countries.

Firms use many different structural forms in dealing with globalization. They can use the horizontal structure because this is made easier with the availability of the internet and Information Technology. It is still possible with the old structure, i.e., the vertical structure where the top echelon of the organization can dictate or take hold of the reins of business even if they are on the other side of the world.

In globalization, some firms centralize control, meaning decisions are made at headquarters. But other firms delegate some important decisions to overseas managers. The relationship between top managers and their boards differs on a global basis, resulting in different structural arrangements among firms.

There are new paradigm shifts in organizations. Convergence is an outcome of globalization. With the interdependence of organizations and countries, functions and resources are converged and focused on a certain point. Advantages and disadvantages are brought out in the open. Furthermore, as a consequence of globalization, there is convergence in political institutions, systems, and global firms.

Saudi Aramco’s Marketing Mix

Market position refers to the relative market share that a firm holds over its competition. Firms that have a large share of a market tend to be the most profitable. However, market share does not necessarily create profitability. Business strategies, such as the marketing of high-quality products, and the provision of good service, result in profitability.

There is an inter-relation on all marketing mix variables. Some of the marketing mix variables associated with pricing decisions are product, distribution, promotion, and price.

Jobber and Lancaster (2003, p. 22) state that “these components are called marketing mix decision variables because a marketing manager decides what type of each component to use and in what amounts. A primary goal of a marketing manager is to create and maintain a marketing mix that satisfies consumers’ needs for a general product type.”

All marketing mix variables could be categorized into just two groups:

- The Offering (product, packaging, service, brand, and price),

- The Methods/Tools (distribution channels, personal selling, advertising, and sales promotion. (Albert Frey, 1961 cited in Smith and Taylor, 2004, p. 7).

The 4Ps which are product, price, place, promotion, and a fifth which is people, is a marketing strategy employed by most firms for competitive advantage. Marketing strategy indicates the specific markets towards which activities are to be targeted and the types of competitive advantages that are to be developed and exploited.

The strategy requires clear objectives and a focus in line with an organization’s corporate goals; the right customers must be targeted more effectively than they are by its competitors, and associated marketing mixes must be developed into marketing programs that successfully implement the marketing strategy.

The attractiveness of marketing opportunities is determined by market factors, such as size and growth rate, as well as competitive, financial, economic, technological, social, ecological, legal, and political factors. (Jobber and Lancaster, 2003, p. 658)

Michael Porter’s Five Forces

Michael Porter’s five forces is a framework used to analyze the opportunities and threats in a business environment. The Five Forces model states that all firms face barriers or obstacles in their struggle for competition and success. These forces are faced within the industry. The firm has to deal with these forces squarely, understand the characteristics that include how they will happen and how they can be solved, and out of these, a business model can be formulated for an edge in the competition. The five forces are categorized as – buyers, suppliers, new entrants, substitutes, and rivalry. These five forces affect each other, and the impact among each other should be the focus of the firms’ strategists. (Hill and Jones, 2008, p. 42)

There are several ways on how to analyze the Five Forces from the forces of how they can limit the industry profits. One example is that some industries can gain more profits than in other industries.

The theory is that when the five forces are weak, the industry is an attraction to the other firms which are gaining profits. Some of the five forces have to perform lower for the firms to gain above-average profits. There is a counter-balance when the five forces are high because there will be low profit in the industry. It is crucial that these five forces are understood so that the firm can develop a strategy to their advantage. The five forces create an environment for the firm in the industry, but the strategists in the firm have to focus their minds on the five forces to gain above-average profits.

Barrier to Entry

This refers to the risk of entry by potential competitors in the industry. An evaluation by this writer states that it is low at present. Potential competitors concerning Saudi Aramco refer to oil companies that are not involving in joint ventures with Aramco but have the potential of joining. There are many oil companies currently being wooed by Aramco to join and invest in Saudi Arabia. As stated earlier, investing in the oil industry requires not just millions but billions of dollars in capital. Therefore these competitors are doing it safely so that they can get their return-of-investment.

Moreover, according to Hill and Jones (2010, p. 43), established companies operating and existing in the industry discourage other companies to enter and join the competition. This is not the case with Saudi Aramco. While it is the established company operating in Saudi Arabia, it has encouraged other investors and oil explorations because it cannot cope with the big demand for oil from customers. There is also great potential for more oil reserves and untapped oil in the remotest areas of Saudi Arabia. However, Aramco is encouraging oil explorations in those remotest areas and not in the established areas where they have explored and considered reserves already.

The barrier to entry in the Saudi oil industry could be measured coming from Saudi Aramco. Competitors can only come in through a joint venture with Aramco, or they have to pass through some regulations that necessitate the approval of Aramco. This makes it difficult for the new entrants. Aramco can impose a costly entry for its competitors. But the higher the entry cost, the greater is the barrier.

Another is the economies of scale, a factor in the barrier to entry. As Saudi Aramco expands to produce more oil and to maximize its output, costs for the company may fall. Economies of scale can result in 1.) cost reductions in the oil output; 2.) discounts or reduced prices by Aramco on bulk purchases to ensure customer loyalty; 3.) allowing fixed production costs for oil instead of large volume sales; 4.) the savings incurred by Aramco.

The absolute cost advantage provides another barrier to new entrants. This pertains to the lower cost in the structures of the existing company. (Hill and Jones, 2010, p. 44)

The market for Saudi Arabia is considered laissez-faire because there is no restriction. The government of the kingdom is allowing investors and industry players to take their hold in the different sectors of the industry. There are however laws that govern the conduct of joint ventures between firms, or between local firms and foreign companies. But these laws help in the setting up of industrial facilities and the processes and operations of joint ventures. Awards of independent power projects are issued to contractors if the projects pass through the planning process by Saudi Aramco. The contract is a build-own-transfer method on equipment, parts, and supplies which are bought from abroad. Saudi Aramco also issues contracts on an engineering-procurement-construction basis, and these contracts are issued only to the lowest pre-qualified bidder.

The regulation for product standards issued by the government of the kingdom is the Saudi Arabian Standards Organization (SASO) which has recently adopted the ISO 9000 standards. This is also an accreditation body for quality standards in Saudi Arabia. SASO has formulated the Conformity Certification Program (ICCP) that applies quality standards to 66 different products.

A new law issued by the Kingdom concerns foreign investments in Saudi Arabia. This law provides for the same treatment for local and foreign investors on subjects of incentives and privileges, including guarantees and exemptions. A government agency created for this purpose is the Saudi Arabian General Investment Authority (SAGA), which is charged to issue a license for foreign capital investment. (USA International Business Publications, 2009)

Buyer Power

As stated earlier, Saudi Aramco has invited investors into the Saudi Arabia investment climate to help in the tapping of the vast oil resources in the country. Aramco is the lead organization when it comes to exploiting the country’s oil resources. But buyers are coming in and eyeing their guns in the upstream hydrocarbons industry. There is still great opportunity in venturing for the non-associated gas which can be found in the remotest areas of Saudi Arabia, and which needs a joint venture undertaking for Saudi Aramco and international companies. An estimated gas reserve of 40% for the next ten years is expected to be tapped and produced with the consortium exploration by Rub Al Khali, also known as Empty Quarter. The merging of Saudi Aramco and Shell is known as the South Rub Al Khali Company.

The theory formulated by Porter is that if buyer power is high, then profit is low. This does not mean there are no profits for entrants from other firms in the industry, particularly foreign firms. What the firms should do is to focus and understand the buyer power of Porter’s five forces, and they can gain profits by entering into the Saudi oil industry. Saudi Aramco is the way to the Saudi oil investment. There is no way that a foreign firm can enter the industry without having a joint venture with Aramco.

The Intensity of Rivalry within Saudi Arabia

The intensity of rivalry in the oil business in Saudi Arabia is at a low level.

The refining business in Saudi Arabia, which is being spearheaded by Aramco, is also a product of several joint ventures between Aramco and international firms. Recently, there have been new refinery projects which can be attributed to the so-called “global tightness in refining throughput and high refining margins” (Oxford Business Group, 2008).

Saudi Aramco is not only big in Saudi Arabia, it is the world’s largest when it comes to oil production and is a product of good fortune, coupled with tact, patience, and power by its founders and leaders. Buyer power may be strong in this part of the Saudi oil industry because of Saudi Aramco. The company has gained a monopoly in all aspects of oil production, refining, and distribution.

A determinant factor in the intensity of rivalry is the level of demand. More customers may come in and demand products. The situation may therefore put the level of competition to moderation since companies can have a wider scope to compete. It will also reduce rivalries because companies can have more customers to sell their products. In the case of Saudi Aramco, there has been a growing demand for its products, oil and gas, and other by-products. More profits can be gained in this situation. The intensity of rivalry in Saudi Arabia is low; thus oil companies can come in and have profits. There will be low profits if the oil demand is low as there will be intense competition between Aramco and its competitors.

Threat or Closeness of Substitutes

One determinant factor for the threat of substitutes is switching costs which arise when there is more time, energy, and sources required to switch products, for instance from the existing company to another company, which is the new entrant. Switching costs can force the customer to stick to the existing company, even if the new entrant offers much lower prices for the product.

The threat of substitutes for oil in Saudi Arabia is low; thus new entrants can have more profits. Moreover, they should also take into consideration that Saudi Aramco aims for more entrants into the Saudi industry. Therefore, it will not do any good if they encourage higher switching costs in the industry.

Supplier Power

Supplier power is low in the kingdom as this is only dominated by Saudi Aramco. But when it comes to supplies for construction, it can be considered high. However, this is not the concern of this paper (construction).

As a whole, the government does not impose restrictions and impediments because it encourages investments in the kingdom. There are no restrictions or impediments on the import of machinery and equipment for construction projects and refineries. Some regular duty tariff is applied which is just five percent ad valorem. Power generation equipment is imposed some custom duty, but there is an exemption to this when the end-user issues a certification of approval to the supplier or contractor. Another preferential treatment is issued to suppliers of gas turbines and parts and other necessary parts because these materials are a necessity inside the kingdom. (USA International Business Publications, 2009).

Conclusions/Recommendations

The history of Saudi Aramco is the history of Saudi Arabia. This oil company is now owned by the government and is considered the life-blood of the kingdom’s economy. Without Saudi Aramco, the country will not have life.

Saudi Arabia is the richest when it comes to oil, and Saudi Aramco is also the largest and the richest in the Middle East. Aramco has taken charge of all jobs involving oil exploration, refining, distribution and marketing, and maximizing oil output including revenues derived from other products coming from oil.

While it is in charge of optimizing oil revenues and other related businesses involving oil, Aramco can be a barrier to new entrants to the oil industry in Saudi Arabia. This is attributed to the fact that a competitor can enter the Saudi oil industry only through Saudi Aramco, as explained in Porter’s Five Forces in the preceding section.

The position of Saudi Aramco, vis-à-vis its role in the Saudi Arabia oil industry, make it a strength and a weakness; strength because it has helped the country rise to its present ‘glory’. Where before Saudis were just living in tents, now they are residents of push residential houses and condominiums. They ride in cars and air-conditioned buses where once they just rode on the backs of camels and other animals. Saudi Aramco was the financial capital of Saudi Arabia.

On its website, the company stresses its adherence to corporate strength through energy, innovation, partnership, performance, and reliability. These five corporate ‘virtues’ are said to be the working background of the people and the working force of Aramco, who are considered knowledge-based.

Aramco also practices human resource strategies that are unique in the sense that the country is not yet considered a democracy.

One of the greatest jobs that it can offer for Saudi Arabia is to entice more investors and take some back steps by sacrificing ‘corporate pride’ to pave the way for more new entrants into the Saudi oil business.

Saudi Aramco’s thrust in environmental preservation to minimize climate change and global warming is a commendable move on the part of the organization.

One of its positive moves is the oil treatment plant which treats wastewater for eventual reuse in factories and industries and even in homes. As discussed in the literature, Saudi Arabia depends on desalination for potable water. Desalination is costly for the government, and so wastewater treatment is one of the options. Reused water has provided savings for Aramco and the government.

Saudi Aramco seems like a government agency for the Kingdom of Saudi Arabia because of the function that it has assumed ever since its inception as an oil company in 1933.

The SWOT analysis of Saudi Aramco can be summarized and concluded in the following manner:

- Saudi Aramco is a strength and a weakness itself. It cannot go on and proceed to be greater and richer by continuing what it has started. This is so because, in the age of globalization, liberalization is a by-product of the new age of the Internet, Information Technology, and globalization in general. Should the government decide to liberalize Aramco, Saudi Arabia will be greater and richer, and its role in the Middle East will be bigger.

- Saudi Aramco is the symbol of the oil industry in Saudi Arabia, and as such the oil industry cannot exist with Aramco. A greater and bigger plan can be devised for a bigger move for the Kingdom o Saudi Arabia. Should Aramco privatize? Well, of course, it is not the concern of this paper. But history tells that liberalization is the key to the success of any government.

The oil industry is capital intensive, therefore Saudi Aramco needs more capital and financial support from international oil companies. Aramco has to devise more plans to attract investors. The features of Porter’s Five Forces can tell us that Aramco can become a barrier to entry because of its role in the Saudi Arabia oil industry. But this can be ironed out with the sidetracking of some of the existing laws and procedures just to gain the sympathies and trusts of the international investors.

References

Avasarikar, D. P. and Chordiya, S. B., 2007. Marketing research. India: Nirali Prakashan.

Brix, P. 2009. DESERTEC – European strategic aspects: seminar paper. Norderstedt, Germany: GRIN Verlag.

Buhler, P., 2001. The growing importance of soft skills in the workplace. Supervision [e-journal], Available through: City University London.

DESERTEC-EUMENA CONCEPT. DESERTEC Foundation. Clean Power From Deserts: The DESERTEC for Energy, Water and Climate Security. Web.

DESERTEC Foundation. 2011. The DESERTEC concept. Web.

Frontline, 2005. House of Saud: a view of the modern Saudi dynasty. Web.

Gupta, A. K. and Becerra, M., 2003. Impact of strategic context and inter-unit trust on knowledge flows within the multinational corporation. In B. McKern (Ed.), Managing the Global Network Corporation. New York: Routledge.

Hill, C. and Jones, G. 2008. Strategic management: an integrated approach. United States of America: South-Western Cengage Learning.

Jobber, D. and Lancaster, G., 2003. Selling and sales management, 6th edition. London: Prentice-Hall.

Lancaster, G. and Reynolds, P., 2002. Marketing made simple. Great Britain: Butterworth-Heinemann Publications.

Mills, M. et al., 2008. Converging divergences?: An international comparison of the impact of globalization on industrial relations and employment careers. International Sociology 2008, Web.

Ministry of Economy, Trade and Industry, 2009. The study on wastewater treatment and water reuse in Saudi-Aramco, Saudi Arabia. Japan External Trade Organization (JETRO) Water Re-use Promotion Center Sumitomo Corporation, Mitsubishi Heavy Industries, LTD.

Oxford Business Group, 2007. The report: emerging Saudi Arabia 2007. Saudi Arabia: Oxford Business Group.

Oxford Business Group, 2008. The report: Saudi Arabia 2008. Saudi Arabia: Oxford Business Group.

Oxford Business Group, 2010. The report: Saudi Arabia 2010. Saudi Arabia: Oxford Business Group.

Professional Engineering, 2009. Carbon trust pumps £18m into cash-strapped start-ups.

Rodgers, M., 2006. Recent trends in exploration results and the implication for future petroleum liquids supply. In J. Zuchetto, Ed., National Research Council (U.S.), Trends in oil supply and demand, potential for peaking of conventional oil production, and possible mitigation options: a summary report of the workshop, p. 33. Washington, DC: National Academies Press.

Rodriguez, J. and de Pablos, P. O., 2002. Strategic human resource management: an organisational learning perspective. International Journal of Human Resources Development and Management, Vol. 2, Numbers 3-4/2002, pp. 175-6.

Saudi Aramco. 2011. Company’s story. Web.

Simmons, M. 2005. Twilight in the desert: the coming Saudi oil sock and the world economy. Hoboken, New Jersey: John Wiley & Sons, Inc.

Simmons, M., 2006. Questions regarding Saudi Arabian petroleum supplies. In J. Zuchetto, Ed., National Research Council (U.S.), Trends in oil supply and demand, potential for peaking of conventional oil production, and possible mitigation options: a summary report of the workshop, p. 33. Washington, DC: National Academies Press.

Smith, P. R. and Taylor, J. 2004. Marketing Communications: An Integrated Approach 4th Ed. United Kingdom: Kogan Page Limited.

Tyler Miller, G. and Spoolman, S. 2009. Living in the environment: connections, and solutions. United States of America: Cengage Learning.

USA International Business Publications, 2009. Saudi Arabia investment and business guide: volume 1 strategic, practical information, selected opportunities. Washington DC: International Business Publications.

Van Der Bly, M. C., 2005. Globalization: a triumph of ambiguity. Current Sociology, 53 (875). Web.

Wilson, M., 2009. Energy alternatives abound at REI. Chain Store Age [e-journal], Available through: City University London.

Wrenn, W. B. Stevens, R. and Loudon, D. 2002. Marketing research: text and cases. New York: The Haworth Press, Inc.

Wright, P. et al. 2007. Human resources and the resource-based view of the firm. In: R. Schuler and S. Jackson (Eds.), Strategic Human Resource Management, p. 76. UK: Blackwell Publishers Ltd.